User Reviews

More

User comment

6

CommentsWrite a review

2024-07-10 18:20

2024-07-10 18:20

2024-06-28 14:27

2024-06-28 14:27

Score

5-10 years

5-10 yearsRegulated in South Africa

Derivatives Trading License (EP)

MT5 Full License

High potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index3.60

Business Index6.91

Risk Management Index0.00

Software Index9.61

License Index0.00

Single Core

1G

40G

More

Company Name

RCG MARKETS (PTY) LTD

Company Abbreviation

RCG Markets

Platform registered country and region

South Africa

Company website

X

YouTube

+27 (67) 589 3585

Company summary

Pyramid scheme complaint

Expose

| RCG MARKETS Review Summary in 10 Points | |

| Founded | 2018 |

| Headquarters | South Africa |

| Regulation | FSCA (exceeded) |

| Market Instruments | forex, indices, shares, commodities and energies |

| Demo Account | N/A |

| Leverage | 1:2000 |

| EUR/USD Spread | 1.5 pips |

| Trading Platforms | MT4 |

| Minimum deposit | R50 |

| Customer Support | Live chat, phone, WhatsApp, email |

RCG MARKETS is an intermediary financial service provider established in 2018. RCG Markets direct market access for the execution of trades for various CFD's and FX for individuals (retail traders/speculators), professional money managers (Hedge Fund Managers) and Corporates (Investment Firms. It says to be licensed and authorized by South Africa Financial Sector Conduct Authority (FSCA: FSP49769), but it is exceeded, which means the broker is not legally regulated by popular regulatory agencies.

RCG MARKETS offers a wide range of tradable instruments and access to industry-standard MT4 trading platform. RCG MARKETS also provides competitive spreads and commissions. However, the broker has limited regulatory oversight and may not be the best option for traders who prioritize a high level of regulation.

| Pros | Cons |

| • Multiple account types | • Lack of regulatory oversight |

| • Wide range of tradable assets | • Limited research and educational resources |

| • Advanced MT4 trading platform | • Limited trading tools and indicators |

| • Competitive spreads and commissions | • Limited social trading options |

Note: The lack of regulatory oversight may be a significant concern for some traders, as it may indicate a higher level of risk. It is important to thoroughly research and assess any potential risks before trading with RCG MARKETS.

It is difficult to say for certain whether RCG MARKETS is safe or a scam based solely on the fact that its FSCA license is exceeded. However, it is certainly a cause for concern and indicates that the broker may not be operating in compliance with regulatory requirements.

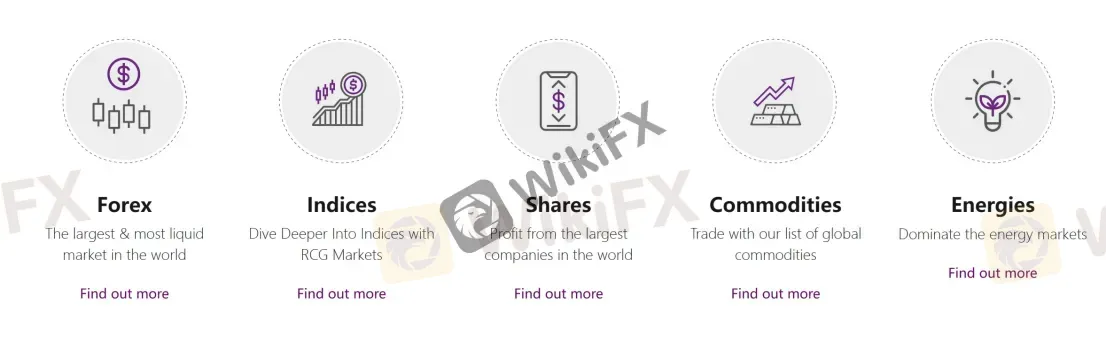

RCG MARKETS offers trading in a variety of financial instruments such as major and minor currency pairs, stock indices, individual stocks, commodities such as gold and oil, and energies such as natural gas.

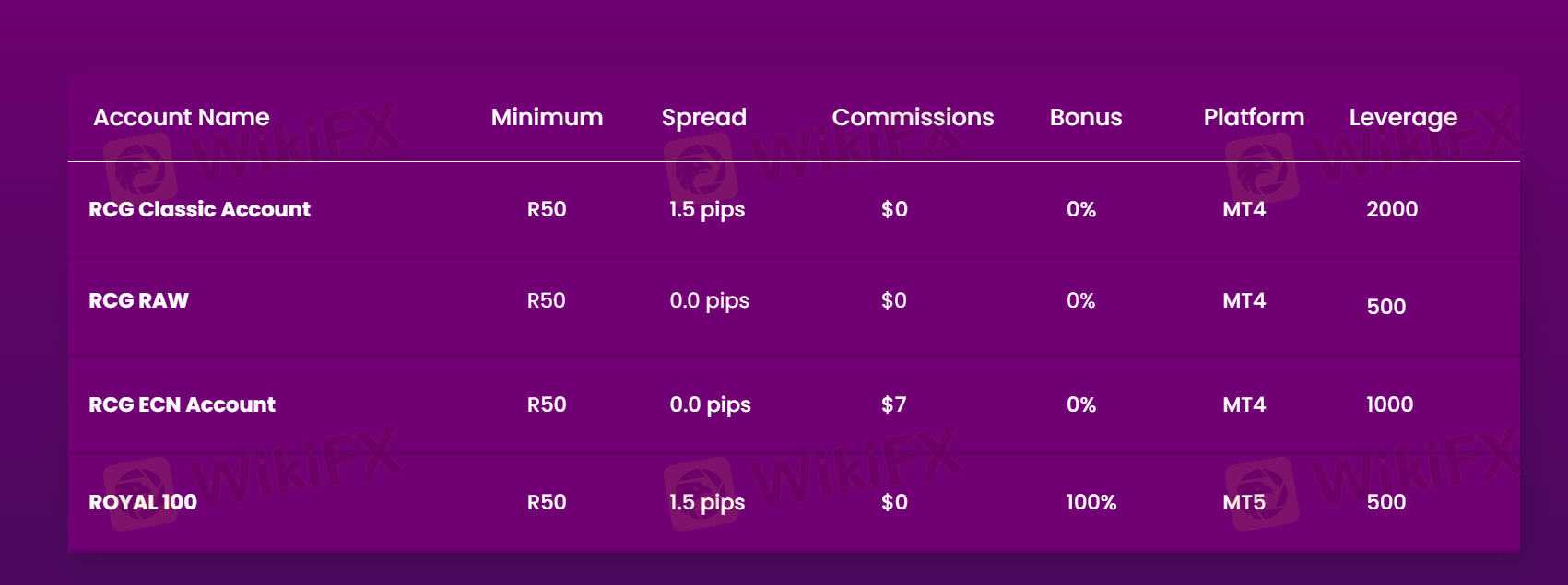

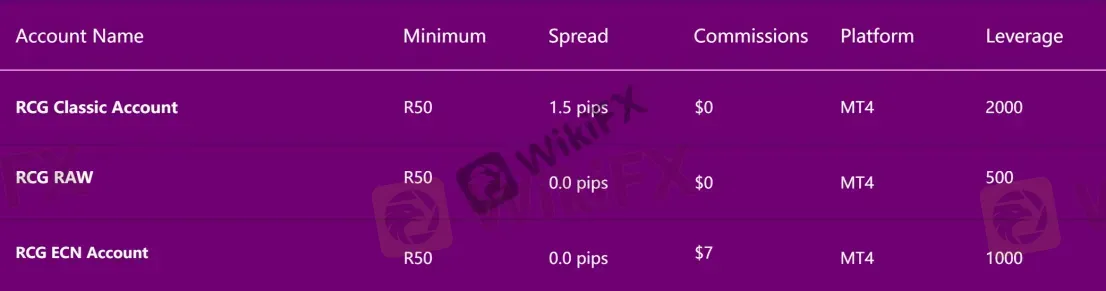

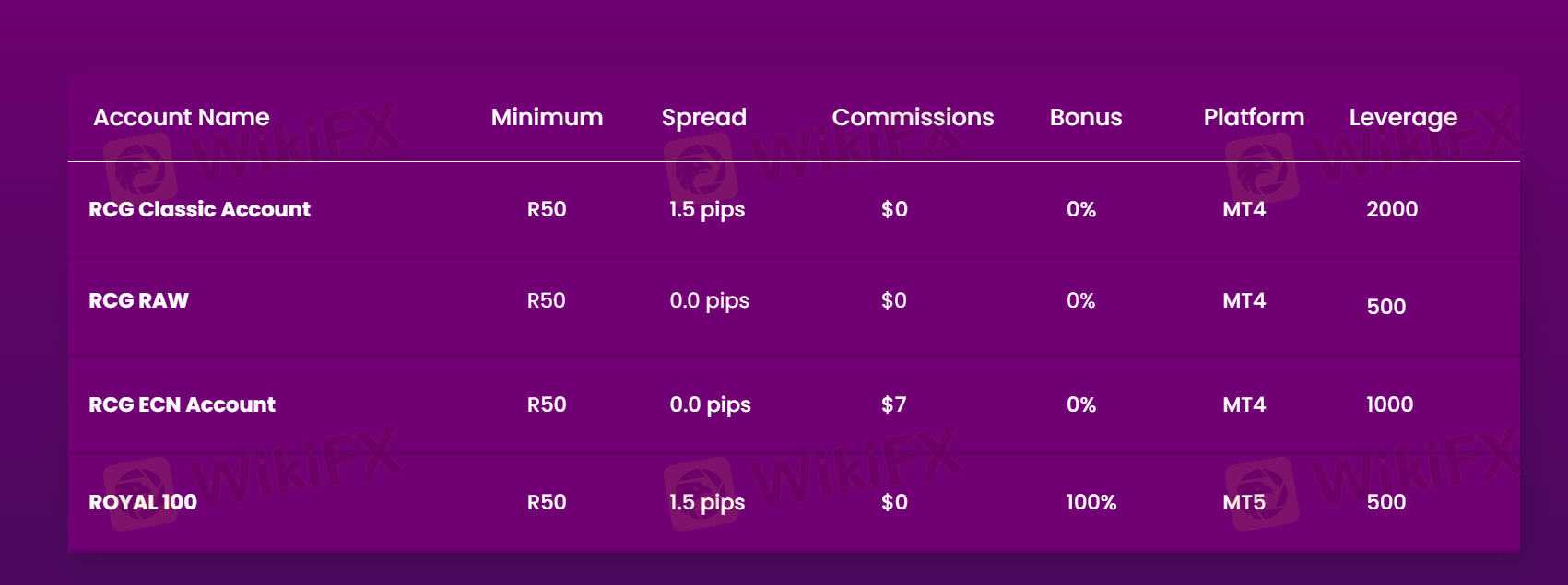

RCG MARKETS offers three types of trading accounts: RCG Classic, RCG RAW, and RCG ECN accounts.

The RCG Classic account is a commission-free account that offers spreads from 1.5 pips.

The RCG RAW account is a commission-free account that offers raw spreads starting from 0.0 pips.

The RCG ECN account is a commission-based account that offers raw spreads starting from 0.0 pips and commission of $7.

All three account types have a minimum deposit requirement of R50.

The maximum leverage offered by RCG MARKETS varies depending on the type of account. 1:2000 for RCG Classic accounts, 1:500 for RCG RAW accounts and 1:1000 for RCG ECN accounts. It is important to note that leverage can increase both potential profits and losses, so traders should use caution when trading with leverage.

RCG Classic accounts have a spread of 1.5 pips, while RCG RAW and RCG ECN accounts have 0.0 pips for the EUR/USD currency pair. In terms of commissions, RCG Classic and RCG RAW accounts have no commission, while RCG ECN accounts have a commission of $7 per round turn lot. It's worth noting that spreads and commissions can vary depending on the specific account type, trading instrument, and market conditions.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| RCG MARKETS | 1.5 pips (RCG Classic), 0.0 pips (RCG RAW and RCG ECN) | No commission (RCG Classic and RCG RAW), $7 per lot (RCG ECN) |

| Interactive Brokers | 0.1-0.3 pips | Commission-based |

| TD Ameritrade | 0.9-1.3 pips | No |

| ETRADE | 1.2-1.6 pips | No |

| IG | 0.6-0.8 pips | No |

| Saxo Bank | 0.6-0.9 pips | No |

Note that spreads and commissions can vary depending on market conditions, account type, and other factors. It's always best to check with the broker directly for the most up-to-date information.

RCG MARKETS provides the popular MetaTrader4 (MT4) trading platform to its clients. MT4 is a widely used trading platform in the forex industry and offers advanced charting capabilities, a range of technical indicators, and the ability to automate trades through expert advisors (EAs). The platform is available for desktop and mobile devices and allows for seamless trading across multiple accounts.

See the trading platform comparison table below:

| Broker | Trading Platform(s) |

| RCG MARKETS | MetaTrader4 |

| Interactive Brokers | Trader Workstation, IBKR Mobile, IBKR WebTrader, |

| TD Ameritrade | thinkorswim, TD Ameritrade |

| ETRADE | Power ETRADE |

| IG | IG Trading Platform, MetaTrader4 |

| Saxo Bank | SaxoTraderPRO, SaxoTraderGO, SaxoInvestor |

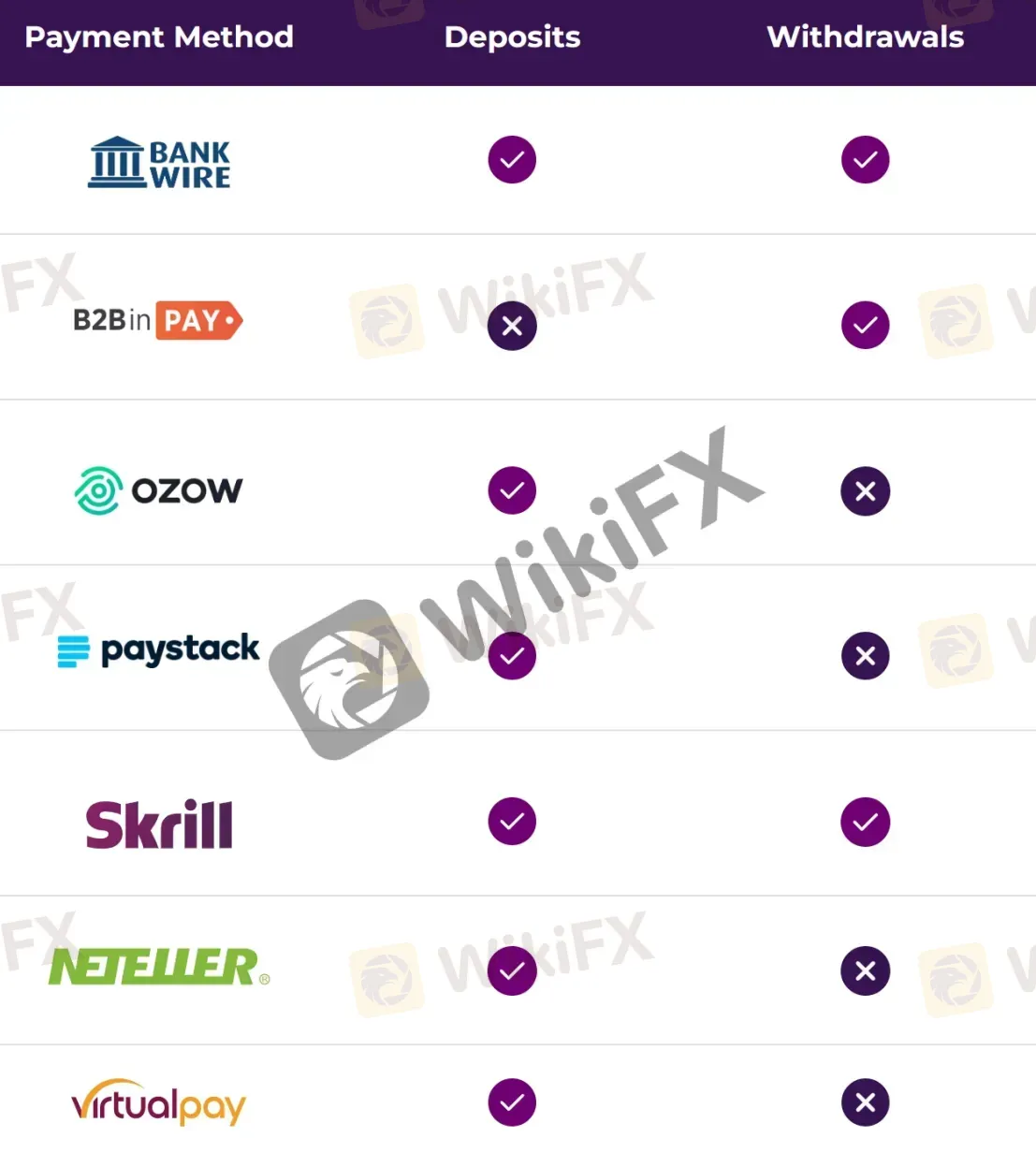

RCG MARKETS accepts deposits and withdrawals through various methods, including Bank Wire, B2B in PAY, OZOW, paystack, Skrill, Neteller and Virtualpay. The specific options available may depend on the client's country of residence.

The minimum deposit requirement for all account types is R50.

| RCG MARKETS | Most other | |

| Minimum Deposit | R50 | $100 |

The process for withdrawing funds from RCG MARKETS may vary depending on the specific account and payment method used for deposit. Generally, the steps for withdrawal are as follows:

Step 1: Log in to your RCG MARKETS account.

Step 2: Navigate to the “Withdrawal” section.

Step 3: Choose the withdrawal method you prefer, such as bank transfer or e-wallet.

Step 4: Enter the amount you wish to withdraw.

Step 5: Provide any necessary information, such as bank account details or e-wallet ID.

Step 6: Confirm the withdrawal request.

It is important to note that RCG MARKETS may have withdrawal fees or minimum withdrawal amounts, which may vary depending on the payment method used. It is recommended to check with RCG MARKETS or review the terms and conditions for more information on specific withdrawal procedures and fees.

RCG MARKETS had a customer service team available via phone, WhatsApp and email during business hours. They also had a live chat option on their website, which allowed for quick and easy communication with a representative. You can also send messages online to get in touch, and follow them on some social networks such as Facebook and Instagram.

To sum up, RCG MARKETS is a broker that offers a wide range of trading instruments, competitive trading conditions, and several account types and payment options. Their MT4 platform is a popular choice among traders. However, it is important to note that their FSCA license has been exceeded, which may raise concerns about their regulatory compliance.

Additionally, RCG MARKETS may not be the best choice for traders who are looking for comprehensive educational resources to support their trading activities.

| Q 1: | Is RCG MARKETS regulated? |

| A 1: | No. It has been verified that RCG MARKETS currently has no valid regulation. |

| Q 2: | Does RCG MARKETS offer the industry-standard MT4 & MT5? |

| A 2: | Yes. RCG MARKETS supports MT4. |

| Q 3: | What is the minimum deposit for RCG MARKETS? |

| A 3: | The minimum initial deposit to open an account is R50. |

RCG Markets holds a valid FSCA license. Reports show withdrawal rejections & stop‑loss issues. Traders urged to verify details and exercise caution.

WikiFX

WikiFX

Lured into trading by RCG Markets with fake bonus schemes? Are manipulated and widened spreads draining your capital? Do you have to wait endlessly to receive withdrawals? These are obvious signs of a potential scam that may hit you. Many forex traders face these issues when trading through RCG Markets. Their frustration over these incidents has become evident on several broker review platforms. We scanned their reviews and presented some of them in this article. Take a look.

WikiFX

WikiFX

In today’s article, WikiFX will be taking you on an in-depth review of RCG Markets, which is a relatively new Forex broker within the industry that was established in 2018.

WikiFX

WikiFX

RCG Markets and FBK Markets are both forex brokers running businesses in South Africa. What is the secret behind the two?

WikiFX

WikiFX

More

User comment

6

CommentsWrite a review

2024-07-10 18:20

2024-07-10 18:20

2024-06-28 14:27

2024-06-28 14:27