User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.46

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Danger

Danger

Danger

Note: AshfordInvestments' official website: https://www.ashfordinvestments.com/ is currently inaccessible normally.

| AshfordInvestments Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Bulgaria |

| Regulation | No regulation |

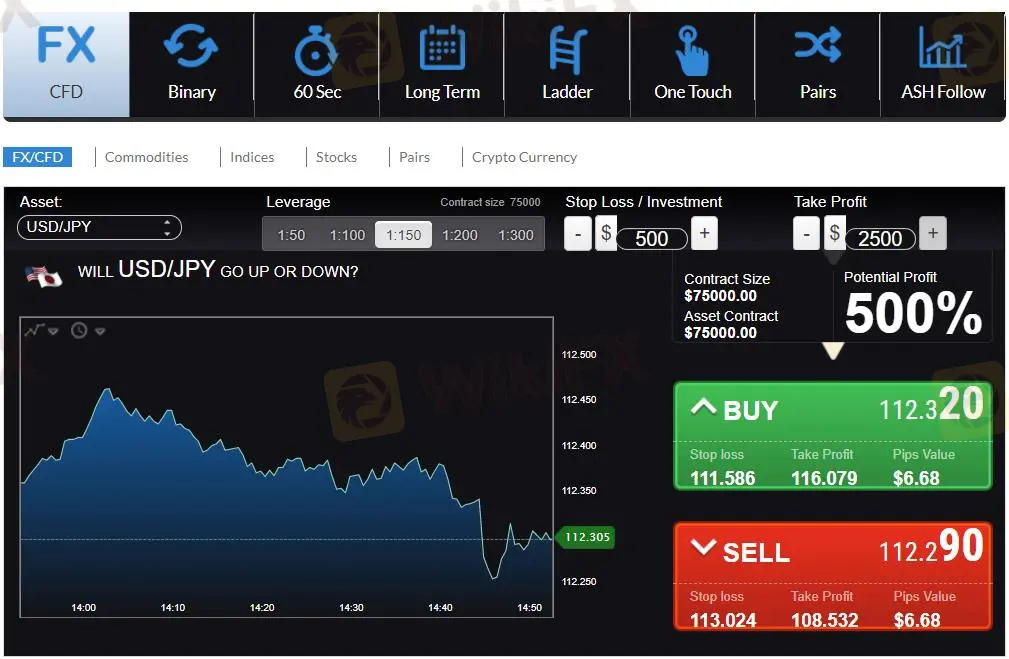

| Market Instruments | Forex, CFDs, binary options |

| Demo Account | ❌ |

| Spread | / |

| Leverage | 1:300 |

| Minimum Deposit | $250 |

| Trading Platform | SpotOption |

| Customer Support | Live chat, email: support@ashfordinvestments.com |

| Tel: +442038689102 | |

| Address: Bulv. Gen. Totleben 52-55, Sofia 1606, Bulgaria | |

AshfordInvestments is a binary options brokerage company who initially founded in 2015 and resumed operation in 2017. The company is owned by Teres Media BG Limited in Bulgaria. It mainly offers forex, CFDS and binary options trading, involving assets include currency pairs, commodities, stocks, indices and cryptocurrencies. The company offers 5 tiered accounts with minimum deposit from $250, and a rebate bonus of up to 87%.

However, the broker currently does not maintain functional website. And the absence of regulation further exacerbates its credibility and reliability. What's worse, both ASIC and MAS released warning alerts on this company about possible scam. So staying away from such a brokerage is a wise choice.

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of AshfordInvestments, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

Unavailable website: AshfordInvestments' website cannot be opened currently, which indicates possibility of cease of operation.

Regulatory concerns: The broker operates with no valid regulation currently, meanig that it might not comply to financial rules and customer protection. This heightens trading risks with them.

Limited transparency on trading conditions: The broker does not disclose necessary info on trading conditions such as spreads, commissions, etc.

High minimum deposit: Though offering 5 tiered accounts, AshfordInvestments sets a high barrier of entry point at $250, which is not friendly to beginners and retail investors who want to start small for testing first.

Limited payment methods: AshfordInvestments only accepts payment by wire transfer and mastercards, limiting flexibility and options for traders to fund their accounts.

AshfordInvestments offers a wide range of market instruments, including binary options (Call/Put, 60 seconds, Long Term, One Touch, Ladder, and Pairs), as well as FX/CFD trading. Traders can access a variety of assets such as currencies, commodities, indices, stocks, and cryptocurrencies, providing opportunities for both short-term and long-term trading strategies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Binary Options | ✔ |

| Bonds | ❌ |

| ETFs | ❌ |

AshfordInvestments five account packages—Bronze, Silver, Gold, Platinum, and Diamond— each with increasing deposit requirements and benefits. The Bronze account requires a minimum deposit of $250 with up to 82% ROI, while the Diamond account requires an initial deposit of $50,000 and offers a return of up to 87%.

As you progress through the tiers, you unlock more advanced features such as welcome bonuses, personalized support, educational resources, trading signals, and faster withdrawal processing.

| Account Type | Initial Deposit | Max ROI | Additional Benefits |

| Bronze | $250 | Up to 82% | - |

| Silver | $2,000 | 50% welcome bonus, personal broker meetings | |

| Gold | $10,000 | Access to webinars, daily signals | |

| Platinum | $25,000 | Up to 87% | 100% welcome bonus, SMS signals, senior analyst sessions |

| Diamond | $50,000 | Premium platform, faster withdrawals |

AshfordInvestments offers leverage up to 1:300. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

AshfordInvestments is said to offer a web-based trading platform called “SpotOption”, which is widely used by binary brokers.

AshfordInvestments only accepts payments by wire transfers and Mastercard. Traders who want more modern or popular funding methods will find this disappointing.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment