User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.01

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Key Information | Details |

| Company Name | Bobvinvestments |

| Years of Establishment | Less than 1 year |

| Headquarters | United Kingdom |

| Regulation | Unregulated |

| Tradable Assets | N/A |

| Account Types | Standard, Premiere, Pro |

| Minimum Deposit | £200 |

| Leverage | Up to 1:500 |

| Spread | From 0.1 |

| Deposit/Withdrawal Methods | N/A |

| Trading Platforms | N/A |

| Customer Support Options |

Bobvinvestments is a recently established broker firm based in the United Kingdom. They offer three account types: Standard, Premiere, and Pro, with varying minimum deposit requirements. The lowest of the minimum deposits is £200 while the highest possible leverage is 1:500 and the spread is from 0.1 pips.

The company operates without regulation. While specific details about tradable assets, office locations, deposit/withdrawal methods, and trading platforms are not available, Bobvinvestments provides customer support through email. Educational content and bonus offerings are not mentioned in the provided information.

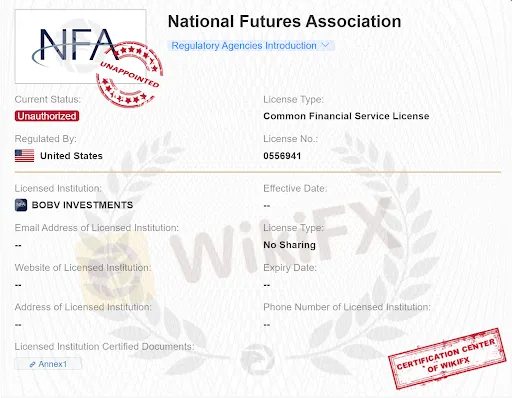

Bobvinvestments is an unauthorized broker, lacking the necessary authorization from the National Futures Association (NFA) to provide financial services. The regulatory authority responsible for overseeing Bobvinvestments is the United States. However, details such as the effective date, expiry date, address, phone number, email address of the licensed institution, and website of the licensed institution are not provided.

The unauthorized status of Bobvinvestments with the National Futures Association (NFA) means that they do not possess the required license to operate as a regulated financial service provider.

It is important to note that dealing with an unregulated broker like Bobvinvestments increases the risk of potential fraud and financial misconduct. Without the oversight and consumer protection measures provided by regulatory bodies, there is a high likelihood of falling victim to deceptive practices and fraud.

Bobvinvestments offers three account types: Standard, Premiere, and Pro. One potential advantage is the availability of different account options, allowing traders to choose based on their individual needs and investment capabilities. The maximum leverage ratio of 1:500 provided by Bobvinvestments may attract those seeking higher leverage for their trades.

One of the significant drawbacks of Bobvinvestments is its unregulated status. As an unregulated broker, the company operates without the oversight and consumer protection measures provided by regulatory authorities. This lack of regulation exposes traders to a higher level of risk, as there are no guarantees regarding fund protection, adherence to industry standards, or resolution mechanisms in case of disputes. Additionally, the absence of specific information about the company's regulatory compliance, deposit/withdrawal methods, and trading platforms limits transparency and leaves potential clients with incomplete information for making informed decisions. Lastly, the Bobvinvestments website is inaccessible, preventing customers from accessing new information about financial updates.

| Pros | Cons |

| Account Variety | Unregulated |

| High Leverage | Lack of Financial Information |

| Inaccessible Website |

The Bobvinvestments website is currently down and unarchived, resulting in the unavailability of any information about their account types, minimum deposit requirements, leverage ratios, spreads, deposit/withdrawal methods, and trading platforms, other than archived information on aggregate websites. This lack of accessible information significantly hampers the clarity and transparency of the company's services. Potential clients are unable to obtain the necessary details to assess the suitability of the offered account types, the financial commitment required, the level of risk involved, and the available trading tools.

The absence of crucial information regarding deposit and withdrawal methods, as well as the supported trading platforms, not only obstructs transparency but also casts doubt on the reliability and functionality of the company's services. The unavailability of the website and the resulting lack of information hinder Bobvinvestments' ability to establish a trustworthy image and may raise concerns among potential clients about the company's reliability and professionalism.

Bobvinvestments provides three account types, Standard Account, Premiere Account, and Pro Account. Specifics are as follows:

Standard Account: The Standard account offered by Bobvinvestments provides traders with a basic option to engage in financial activities. With a minimum deposit requirement of £200, this account type allows traders to access the markets with a maximum leverage ratio of 1:500. The account features a minimum spread of 0.1, supporting the execution of trades as small as 0.01 lots. It also allows the use of supported Expert Advisors (EAs) for automated trading. However, specific details about the tradable assets, deposit/withdrawal methods, and trading platforms are not provided.

Premiere Account: Bobvinvestments offers the Premiere account, targeting traders looking for a higher level of trading capabilities. This account requires a minimum deposit of £5,000, providing traders with potential advantages in terms of account features. Similar to the Standard account, the Premiere account offers a maximum leverage ratio of 1:500 and a minimum spread of 0.1. It also supports the use of Expert Advisors (EAs) for automated trading. However, additional information regarding tradable assets, deposit/withdrawal methods, and trading platforms is not provided.

Pro Account: Designed for experienced and high-volume traders, the Pro account requires a substantial minimum deposit of £50,000. With this account type, traders gain access to potentially enhanced features and benefits. However, specific details about the tradable assets, minimum position sizes, deposit/withdrawal methods, trading platforms, and commission structure are not provided.

Here is a table summarizing the account using the available information:

| Account Type | Minimum Deposit | Maximum Leverage | Minimum Spread | Supported EA |

| Standard | £200 | 1:500 | 0.1 | Yes |

| Premiere | £5,000 | 1:500 | 0.1 | Yes |

| Pro | £50,000 | 1:500 | 0.1 | Yes |

Bobvinvestments offers different minimum deposit rates depending on the chosen account type. The Standard account requires a minimum deposit of £200, while the Premiere account has a higher minimum deposit requirement of £5,000. For traders looking for more advanced features, the Pro account demands a substantial minimum deposit of £50,000. These varying deposit rates allow traders to select an account type that aligns with their investment capabilities and trading preferences. It is important to note that the provided information focuses solely on the minimum deposit amounts and does not include details about other account features or associated benefits.

Bobvinvestments offers a maximum leverage ratio of 1:500 across all of its account types, as per the available information. This leverage allows traders to potentially amplify their trading positions relative to their account balance. It is important to note that trading with leverage involves significant risk, as gains and losses are magnified.

Here is a comparison table of the maximum leverage ratios offered by Bobvinvestments, FXPro, IC Markets, FBS, and Exness:

| Market Instrument | Bobvinvestments | FXPro | IC Markets | FBS | Exness |

| Forex | 1:500 | 1:500 | 1:500 | 1:3000 | 1:2000 |

Bobvinvestments offers a minimum spread of 0.1. The spread represents the difference between the bid and ask prices of a financial instrument and is an important factor to consider in trading. A lower spread generally indicates a tighter pricing structure and can potentially reduce trading costs for traders. However, without specific details on the spread across different instruments or market conditions, it is difficult to provide a comprehensive analysis of Bobvinvestments' spread offerings.

The only channel of customer support for contacting Bobvinvestments is email, customers can reach out to them at the email address Info@tgfxprime.com. This support option allows users to send inquiries or concerns and receive responses via email communication.

Depending solely on one customer support channel limits accessibility for customers as some people may prefer or only have access to different methods of communication, such as phone calls or live chat which could lead to the company alienating customers. Furthermore, if the single support channel experiences technical issues or downtime, the company's ability to assist customers is severely hindered. This could result in missed opportunities to resolve problems promptly and provide satisfactory solutions.

In conclusion, Bobvinvestments is an unregulated brokerage that offers three account types: Standard, Premiere, and Pro, each with varying minimum deposit requirements. While the maximum leverage ratio of 1:500 may appeal to traders seeking higher leverage, the lack of comprehensive information about tradable assets, spreads, deposit/withdrawal methods, and trading platforms limits the transparency and evaluation of their services. Additionally, operating without regulation raises concerns about the company's compliance with industry standards and client fund protection.

The unavailability of the Bobvinvestments website further adds to the limited access to crucial information. This lack of accessibility and detailed descriptions of account types and features make it challenging for potential clients to make informed decisions about their investments.

Q: What types of accounts does Bobvinvestments offer?

A: Bobvinvestments offers Standard, Premiere, and Pro accounts with varying features and minimum deposit requirements.

Q: Is Bobvinvestments regulated?

A: No, Bobvinvestments operates without regulation, which raises concerns about compliance and client protection.

Q: What is the maximum leverage ratio offered by Bobvinvestments?

A: Bobvinvestments offers a maximum leverage ratio of 1:500 across its account types.

Q: What is the minimum deposit requirement for the Standard account?

A: The minimum deposit for the Standard account is £200.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment