User Reviews

More

User comment

4

CommentsWrite a review

2023-02-17 11:29

2023-02-17 11:29 2023-01-03 11:45

2023-01-03 11:45

Score

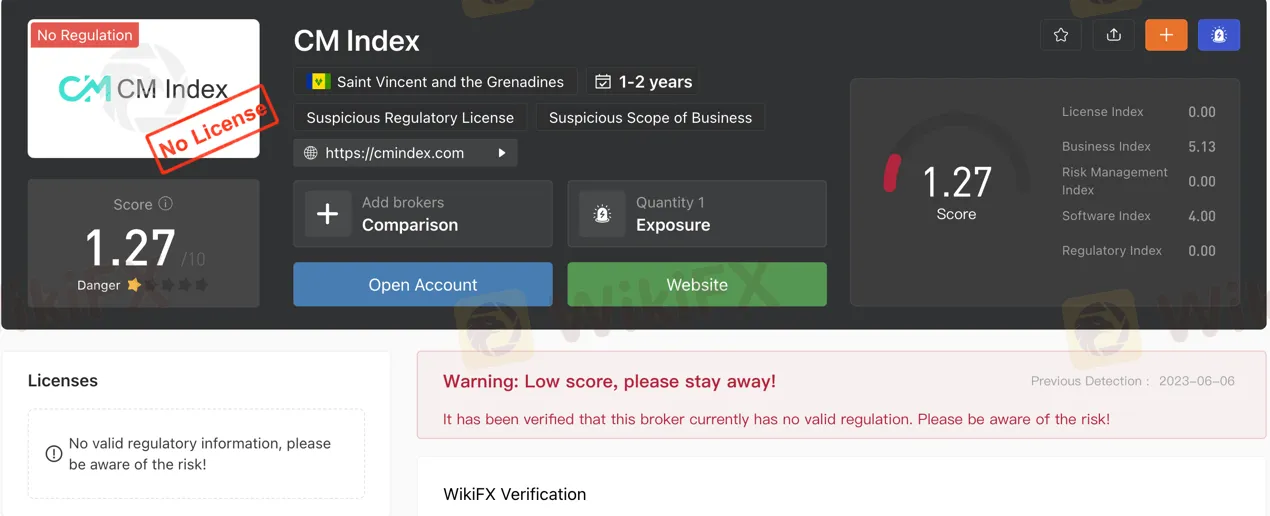

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index6.67

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

CM Index LTD

Company Abbreviation

CM Index

Platform registered country and region

Saint Vincent and the Grenadines

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Aspects | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded year | 1-2 years |

| Company Name | CM Index LTD |

| Regulation | No Regulation |

| Minimum Deposit | $15 (Deposit Bonus and Leverage accounts), $100 (ECN Raw account) |

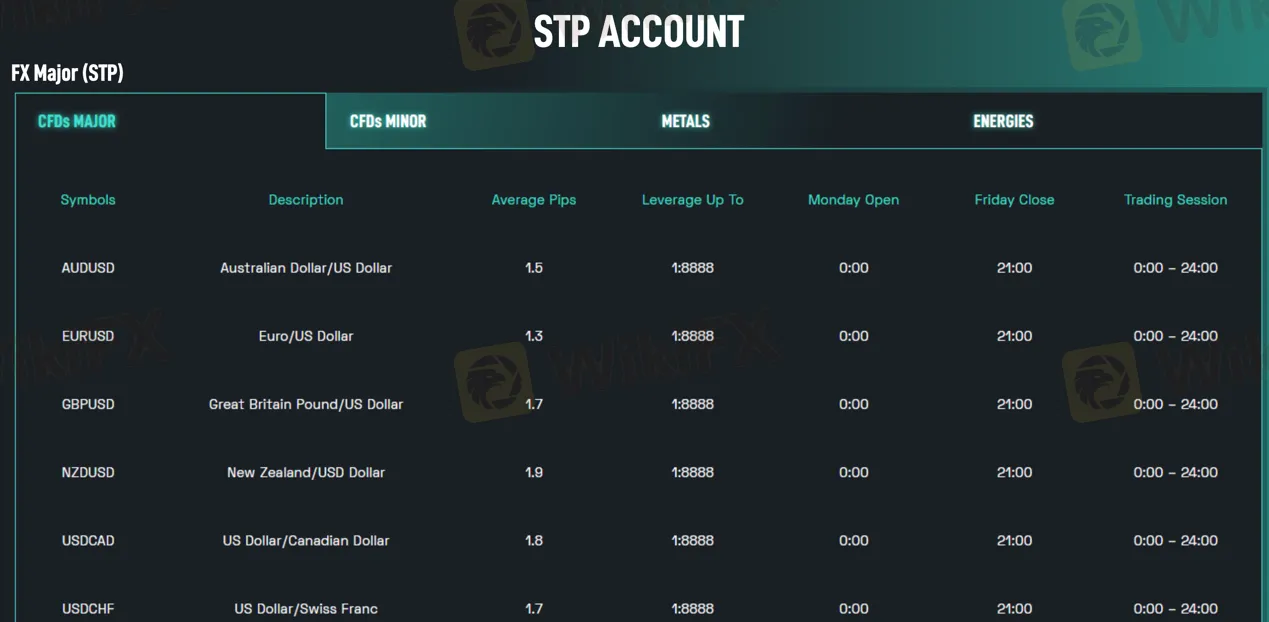

| Maximum Leverage | 1:500 (Deposit Bonus account), 1:8888 (Leverage account), 1:200 (ECN Raw account) |

| Spreads | From 1.0 pips (Deposit Bonus and Leverage accounts), 0.1 pips (ECN Raw account) |

| Trading Platforms | MetaTrader 4 (MT4) desktop and mobile, cTrader desktop |

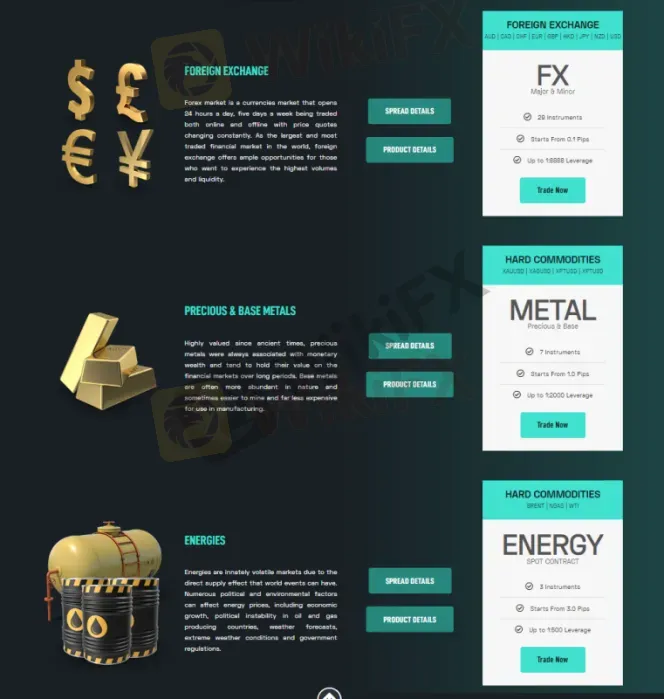

| Tradable assets | Forex, Precious & Base Metals, Energies |

| Account Types | Deposit Bonus Account, Leverage Account, ECN Raw Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Email (support@cmindex.com) |

| Payment Methods | Wire transfers, local depositors, online bank transfers, cryptocurrency (such as Litecoin, Bitcoin, Ethereum), and credit/debit cards (temporary closed) |

| Educational Tools | Marketing materials, educational resources |

The CM Index is a broker or financial institution that, based on the information provided, does not have any valid regulation. Regulation in the financial industry is typically imposed by governmental or non-governmental authorities to ensure that financial institutions operate within certain guidelines and adhere to specific standards. These regulations are designed to protect investors and maintain the stability and integrity of the financial markets.

CM Index offers access to various financial markets, including the forex market, precious and base metals, and energy markets. The forex market is the largest financial market globally, providing opportunities to profit from fluctuations in exchange rates between currencies. Trading in precious and base metals allows investors to hedge against inflation and economic uncertainty. Energy markets, including oil and natural gas, offer opportunities to profit from price fluctuations influenced by supply and demand dynamics and geopolitical events.

The broker provides three live trading account types: Deposit Bonus, Leverage, and ECN Raw. Each account type has its own features and requirements, catering to different trading preferences and strategies. The Deposit Bonus account offers a 50% deposit bonus, while the Leverage account provides high leverage of 1:8888. The ECN Raw account offers zero spreads starting from 0.1 pips.

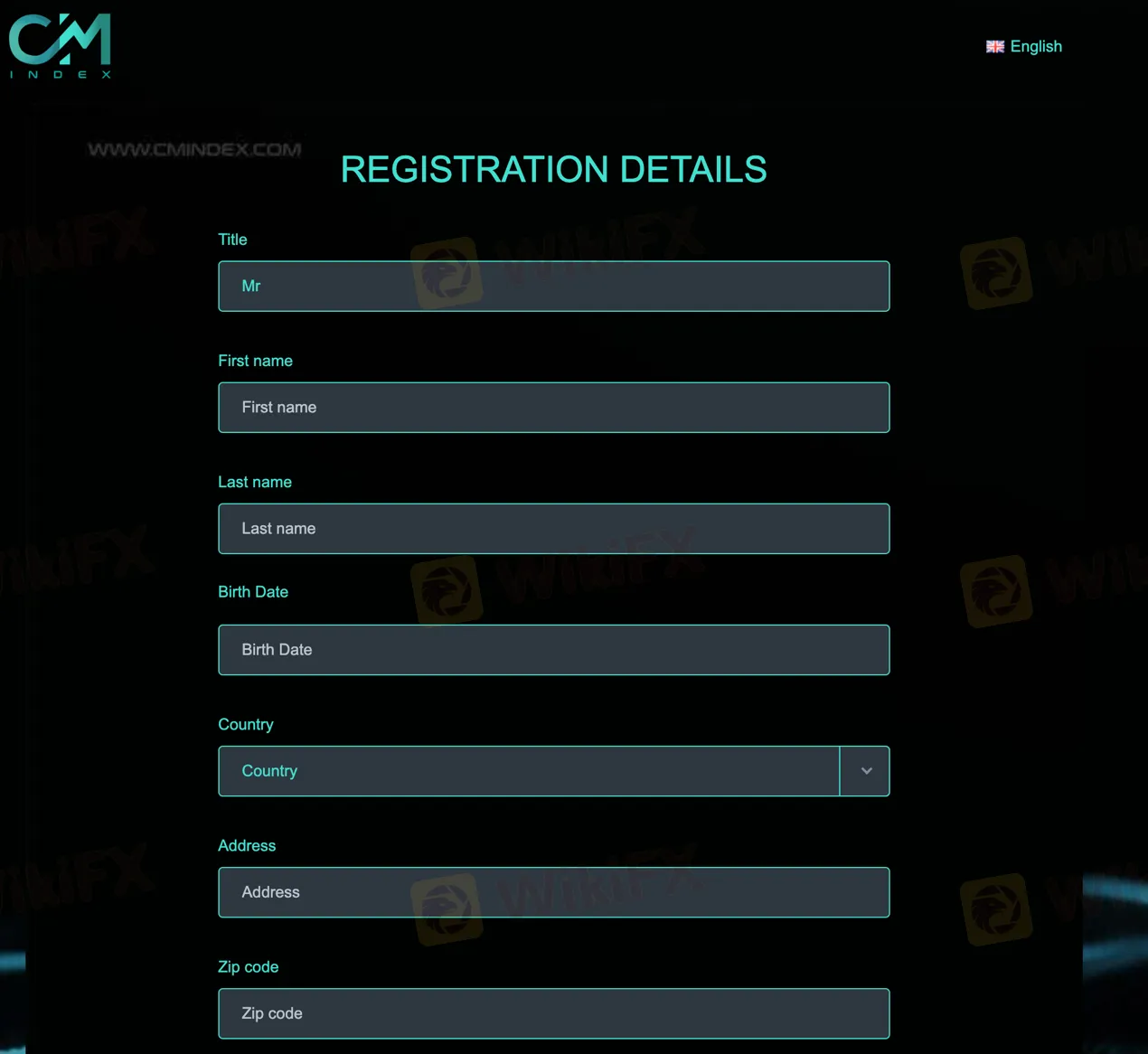

To open an account with CM Index, potential clients need to visit the broker's website, complete a registration form, choose an account type, agree to the terms and conditions, and submit verification documents. Account funding can be done through various deposit and withdrawal options, including bank transfers, credit/debit cards, and e-wallets.

CM Index utilizes the MetaTrader 4 (MT4) platform for desktop and mobile devices, as well as the cTrader platform. These platforms offer advanced trading tools, features, and customization options to enhance the trading experience. The broker also provides educational resources and marketing materials to support traders' knowledge and attract new clients.

Overall, it is important for investors to be aware that CM Index lacks valid regulation, which may entail potential risks. Thorough research and understanding of the broker's terms, conditions, and services are essential before engaging in any trading activities.

The following is a compilation of pros and cons associated with trading through the MetaTrader 4 platform. MetaTrader 4 offers a wide range of benefits, including diverse deposit and withdrawal options, instant processing for certain methods, availability of local depositor options, higher transaction limits, and acceptance of credit/debit cards. Additionally, it provides stability, reliability, and access to various trading tools, indicators, and educational resources. However, there are drawbacks to consider, such as longer processing times for international wire transfers, temporary closures or restrictions on certain deposit methods, higher fees for specific transactions, and potential technical issues or platform downtime. Traders may also face limited customer support, regulatory and compliance risks, and restrictions on market access or trading instruments. It is crucial to weigh these pros and cons when deciding whether to utilize the MetaTrader 4 platform for trading activities.

| Pros | Cons |

| Wide range of deposit and withdrawal options | Longer processing times for international wire transfers |

| Instant processing for certain deposit methods | Temporary closure or restrictions on certain deposit methods |

| Availability of local depositor options | Higher minimum per transaction amount for international wire transfers and cryptocurrency deposits |

| Higher maximum transaction limits | Limited availability of certain deposit and withdrawal options based on regions |

| Acceptance of credit/debit cards | Higher fees for certain deposit and withdrawal methods |

| Stability and reliability of MetaTrader 4 | Lack of transparency in pricing and execution |

| Access to a wide range of trading tools and indicators | Potential technical issues or platform downtime |

| Mobile platform availability for trading on the go | Limited customer support outside of regular business hours |

| Wide range of educational resources and marketing materials | Lack of integration with certain third-party platforms or plugins |

The CM Index is a broker or financial institution that, based on the information provided, does not have any valid regulation. Regulation in the financial industry is typically imposed by governmental or non-governmental authorities to ensure that financial institutions operate within certain guidelines and adhere to specific standards. These regulations are designed to protect investors and maintain the stability and integrity of the financial markets.

CM Index advertises that it mainly offers three different asset classes in financial markets, including forex, precious & base metals and energies.

Forex: CM Index provides access to the forex market, allowing clients to trade a wide range of currency pairs. Forex trading involves the buying and selling of currencies, and it is the largest financial market globally, with high liquidity and trading volume. This market offers the opportunity to profit from fluctuations in exchange rates between different currencies.

Precious & Base Metals: CM Index offers trading in precious and base metals such as gold, silver, platinum, copper, and others. These metals are often seen as safe-haven assets and can act as a hedge against inflation or economic uncertainty. Trading in metals allows investors to speculate on the price movements of these commodities.

Energies: CM Index also provides trading opportunities in energy markets, including oil and natural gas. Energy commodities play a crucial role in global economies, and their prices can be influenced by various factors such as supply and demand dynamics, geopolitical events, and weather conditions. Trading energy products allows investors to take advantage of price fluctuations in these markets.

CM Index offers three different live trading accounts: Deposit Bonus, Leverage, and ECN Raw. Each account type has its own features and requirements, catering to different trading preferences and strategies.

Deposit Bonus Account (BONUS STP):

The Deposit Bonus account requires a minimum initial deposit of $15. It offers a maximum leverage of 1:500 and the spreads start from 1.0 pips. One of the notable features of this account is the 50% deposit bonus, which can potentially boost the account's equity. It also supports floating and margin trading, allowing traders to manage their positions effectively. Expert Advisors are allowed on this account, enabling automated trading strategies.

Leverage Account (LEVERAGE STP):

The Leverage account also has a minimum initial deposit requirement of $15. It offers a high maximum leverage of 1:8888, providing traders with significant trading power. The spreads start from 1.0 pips. Similar to the Deposit Bonus account, this account type supports floating and margin trading. It also allows the use of Expert Advisors.

ECN Raw Account (RAW ECN):

The ECN Raw account has a higher minimum initial deposit requirement of $100. However, it provides traders with the advantage of zero spreads, starting from 0.1 pips. This account type is suitable for those who prefer tighter spreads and direct market access. It allows the use of Expert Advisors as well, offering automated trading capabilities. The maximum leverage for the ECN Raw account is 1:200.

| Pros | Cons |

| Multiple account types for diverse preferences | Higher minimum initial deposit for ECN Raw account |

| Lower minimum initial deposits for some accounts | Excessively high leverage in Leverage account (1:8888) |

| High leverage options for increased trading power | Wider spreads in Deposit Bonus and Leverage accounts |

| 0.1 spreads in ECN Raw account | Importance of reviewing terms and conditions thoroughly |

| Expert Advisors only available for the Raw ECN Account |

To open an account with CM Index, you can follow the steps outlined below:

Visit the CM Index website: Go to the official CM Index website using your web browser.

Click on the “Register” button: Look for the button on the homepage or in the top navigation menu that allows you to start the account opening process.

3. Fill out the registration form: You will be directed to a registration form where you need to provide personal information such as your name, email address, phone number, and country of residence. Make sure to provide accurate and up-to-date information.

4. Choose an account type: CM Index offers different account types, such as Deposit Bonus, Leverage, and ECN Raw. Select the account type that suits your trading preferences and objectives.

5. Agree to the terms and conditions: Read and understand the terms and conditions presented by CM Index. If you agree to them, check the box or provide your electronic signature to indicate your acceptance.

6. Submit verification documents: As part of the account opening process, you may be required to submit certain documents for verification purposes. These documents typically include proof of identity (e.g., passport or ID card) and proof of address (e.g., utility bill or bank statement). Follow the instructions provided by CM Index to submit the necessary documents.

7. Fund your account: Once your account is verified and approved, you can proceed to fund your account. CM Index usually specifies the minimum deposit amount required for each account type. Choose a suitable payment method provided by CM Index, such as bank transfer, credit/debit card, or e-wallets, to deposit funds into your trading account.

8. Start trading: After your account is funded, you can log in to the trading platform provided by CM Index using the login credentials provided to you. Explore the available trading instruments, set up your trading preferences, and start executing trades based on your trading strategy.

Traders holding different account types can enjoy different maximum leverage ratios. Clients on the Deposit Bonus account can experience leverage of 1:500, while the Leverage account can enjoy the maximum leverage of 1:8888 and the ECN Raw account has a leverage of 1:200. Inexperienced traders are advised not to use too much leverage since leverage magnifies gains and losses.

CM Index claims that different accounts have different spreads and commissions. In particular, the spread on the Deposit Bonus and Leverage accounts is as low as 1.0 pips, while the clients on the ECN Raw account can enjoy the minimum spreads of 0.1 pips. As for commissions, the Deposit Bonus and Leverage accounts have no commission while the ECN Raw account will be charged a commission of $7 per lot.

CM Index offers different spreads and commissions for its various trading accounts. The Deposit Bonus and Leverage accounts have spreads as low as 1.0 pips, indicating the difference between the buying and selling prices of the trading instruments. On the other hand, the ECN Raw account boasts minimum spreads of 0.1 pips.

In terms of commissions, the Deposit Bonus and Leverage accounts do not charge any commissions per lot traded. This means that traders using these account types can focus solely on the spreads without incurring additional transaction costs. However, the ECN Raw account does have a commission of $7 per lot, which is a fee charged for each trade executed.

CM Index offers traders the opportunity to engage in forex and CFD trading through its trading platform options. With the availability of MetaTrader 4 (MT4) for desktop and mobile devices, as well as the cTrader platform, traders can access a variety of sophisticated tools and features to enhance their trading experience.

MetaTrader 4 Desktop: CM Index offers the popular MetaTrader 4 (MT4) trading platform for desktop, compatible with both Mac OS and Windows operating systems. MT4 is widely praised by forex traders for its stability and reliability. It provides a range of sophisticated trading tools, including Expert Advisors, Algo trading, Complex indicators, and Strategy testers. Traders can also access a vast marketplace with over 10,000 trading apps available to enhance their trading performance.

2. MetaTrader 4 Mobile: CM Index also provides the MT4 mobile platform, which is available for iOS and Android devices. Traders can download the MT4 app from the App Store or Play Store. The mobile platform allows traders to access their accounts and trade from anywhere at any time. It offers essential features such as one-click trading, advanced analytical tools, multiple chart timeframes, and automated execution.

3. cTrader Desktop Platform: In addition to MT4, CM Index offers the cTrader platform for desktop. cTrader provides an innovative trading experience with advanced features, including detachable and resizable charts, multiple screen support, customizable charting tools, level II pricing, fast execution, and a wide range of technical indicators. Traders can access various markets and enjoy a comprehensive charting and trading experience.

| Pros | Cons |

| Stability and reliability of MetaTrader 4 | Limited information on cTrader platform |

| Access to a wide range of trading tools and indicators | Lack of information on additional platform features |

| Mobile platform availability for trading on the go | No details on order execution and trading conditions |

| User-friendly interface and customizable charts | Insufficient information on platform security measures |

| Ability to automate trading with Expert Advisors | Limited information on customer support availability |

CM Index provides a range of trading tools to enhance the trading experience for its clients. These tools are designed to offer advanced trading capabilities, educational resources, marketing materials, and trading options. Here is a brief description of the trading tools offered by CM Index:

Marketing Materials: CM Index provides various marketing materials, including banners and websites, to help partners attract and promote new clients effectively. These materials are designed to boost results and provide up-to-date information about the products and services offered.

2. Educational Resources: Traders can benefit from educational resources such as videos, tutorials, and seminars. These resources cover topics ranging from basic trading knowledge to advanced strategies, allowing clients to enhance their trading skills and knowledge of financial markets.

The trading hours at CM Index vary depending on regions and seasons. For example, in Asia, the trading hours during the summer are from 24:00 to 08:00, and during the winter, they are from 00:00 to 09:00. The active currencies during these hours in Asia are JPY (Japanese Yen) and HKD (Hong Kong Dollar).

In the United Kingdom and Europe, the trading hours are from 07:00 to 16:00 in London and Frankfurt during the summer, and from 08:00 to 17:00 during the winter. The active currencies during these hours include CHF (Swiss Franc), EUR (Euro), and GBP (British Pound).

In America, the trading hours are from 12:00 to 21:00 in New York and Chicago during the summer, and from 13:00 to 22:00 during the winter. The active currencies during these hours are CAD (Canadian Dollar) and USD (United States Dollar).

In the Pacific region, specifically in Sydney, the trading hours are from 21:00 to 06:00 during the summer, and from 22:00 to 07:00 during the winter. The active currencies during these hours are AUD (Australian Dollar) and NZD (New Zealand Dollar).

CM Index says to work with numerous means of deposit and withdrawal choices, consisting of international wire, local depositor, online bank transfer, Neteller, Skrill, cryptocurrency (Litecoin, Bitcoin, Ethereum, etc.), credit/debit cards (Visa, MasterCard).

The minimum per transaction is $1,000 for international wire, $100 for cryptocurrency, $10 for the local depositor, and others are all $15. Maximum per transaction is $100,000 for local depositor; $10,000 for international wire and cryptocurrency; $500 for credit/debit cards; while others are $2,000.

As for the processing time of deposit and withdrawal requests, international wire deposits require 1-7 business days to process; local depositor and cryptocurrency deposits take up to 1 hour while other deposits can be processed instantly. International wire and credit/debit card withdrawals require 1-7 business days to process while the left withdrawals take up to 24 hours.

| Pros | Cons |

| Acceptance of credit/debit cards | Longer processing times for international wire transfers |

| Instant processing for certain deposit methods | Temporary closure or restrictions on certain deposit methods |

| Availability of local depositor options | Higher minimum per transaction amount for international wire transfers and cryptocurrency deposits |

| Higher maximum transaction limits for international wire transfers and local depositors | Limited availability of certain deposit and withdrawal options based on regions |

CM Index claims to provide bonuses and fee-free transactions to its clients. They advertise a deposit bonus ranging from 50% to 100%, which means that clients can potentially receive additional funds in their trading accounts based on the amount they deposit. However, it is important to note that the terms and conditions regarding the eligibility and withdrawal requirements of these bonuses are not specified in the provided information.

Regarding fees, CM Index states that they offer 0% fee transactions. This suggests that clients may not incur any additional charges or commissions for their trades. However, it is advisable to thoroughly review the broker's fee structure, as there may be other fees or charges associated with certain services or account activities that are not explicitly mentioned.

CM Index provides customer support through various channels. Users can reach out to their customer support team via telephone at +212646052656, email at support@gmail.com, live chat on their website, or by sending messages online. Additionally, CM Index maintains a presence on social media platforms such as Twitter, Facebook, Instagram, YouTube, Telegram, and LinkedIn.

The broker offers an online contact form for users to submit their inquiries or issues. CM Index emphasizes excellent service and a user-friendly experience. They claim to have a comprehensive Help Center page dedicated to providing clear guidance and answering questions within a matter of minutes. In case users cannot find the desired answer on the Help Center page, they can contact CM Index through a ticket system, email, or live chat.

In conclusion, CM Index presents itself as a broker offering trading services in forex, precious metals, and energies. However, the lack of valid regulation raises concerns about the credibility and security of the platform. While CM Index provides multiple account types, deposit bonuses, and high leverage options, the excessively high leverage in one account type and potential volatility in forex and metals markets pose risks for traders. The platform offers popular trading platforms like MetaTrader 4 but lacks comprehensive information about certain features and platform security. While the availability of marketing materials and educational resources is highlighted as a positive aspect, there is variability in their availability. Additionally, the limited details on customer support and the absence of clear terms and conditions regarding bonuses and withdrawals are noteworthy disadvantages. Traders should exercise caution and carefully consider the potential risks associated with CM Index before engaging in any trading activities.

Q: Is CM Index a regulated broker?

A: Based on the information provided, CM Index does not have any valid regulation. It is important to be aware of the risks associated with trading with an unregulated broker.

Q: What market instruments are available for trading with CM Index?

A: CM Index offers trading in forex, precious and base metals, and energies. These instruments allow investors to participate in the global currency exchange market, trade in metals like gold and silver, and take advantage of price fluctuations in energy markets.

Q: What types of live trading accounts does CM Index offer?

A: CM Index offers three different live trading accounts: Deposit Bonus Account, Leverage Account, and ECN Raw Account. Each account type has its own features and requirements, catering to different trading preferences and strategies.

Q: How can I open an account with CM Index?

A: To open an account with CM Index, you can visit their official website and click on the “Register” button. Fill out the registration form, choose an account type, agree to the terms and conditions, submit verification documents if required, fund your account, and start trading.

Q: What leverage ratios does CM Index offer?

A: CM Index offers different maximum leverage ratios based on the account types. The Deposit Bonus Account has a maximum leverage of 1:500, the Leverage Account has a maximum leverage of 1:8888, and the ECN Raw Account has a maximum leverage of 1:200.

Q: What are the spreads and commissions with CM Index?

A: The Deposit Bonus and Leverage accounts have spreads as low as 1.0 pips, while the ECN Raw account boasts minimum spreads of 0.1 pips. The Deposit Bonus and Leverage accounts do not charge any commissions per lot traded, but the ECN Raw account has a commission of $7 per lot.

Q: What deposit and withdrawal options are available with CM Index?

A: Wire transfers, local depositors, online bank transfers, cryptocurrency (such as Litecoin, Bitcoin, Ethereum), and credit/debit cards (temporary closed)

Q: What trading platforms are offered by CM Index?

A: CM Index offers the MetaTrader 4 (MT4) trading platform for desktop and mobile devices, as well as the cTrader platform for desktop. These platforms provide traders with a range of tools and features to enhance their trading experience.

Q: What trading tools are provided by CM Index?

A: CM Index provides trading tools such as marketing materials, educational resources, and low latency connectivity to enhance the trading experience for its clients.

Q: What are the trading hours at CM Index?

A: The trading hours at CM Index vary depending on regions and seasons. Different active currencies are traded during specific hours in Asia, the United Kingdom and Europe, America, and the Pacific region.

More

User comment

4

CommentsWrite a review

2023-02-17 11:29

2023-02-17 11:29 2023-01-03 11:45

2023-01-03 11:45