User Reviews

More

User comment

3

CommentsWrite a review

2023-03-30 17:10

2023-03-30 17:10 2023-03-30 17:09

2023-03-30 17:09

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.77

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Company Name | IFFX |

| Registered Country/Area | New Zealand |

| Founded Year | 5-10 years |

| Regulation | Regulated by FSPR (Suspicious Clone) |

| Minimum Deposit | RM5,000 |

| Tradable Assets | Managed forex and cryptocurrency trading |

| Account Types | Basic account |

| Demo Account | Not available |

| Customer Support | Available 24/7 via Email (admin@iffx.my) and Telegram (+60 11-1688 7731) |

| Deposit & Withdrawal | Deposits reflected within 0-24 hours on working days, instant withdrawals available |

| Educational Resources | N/A |

IFFX, a trading platform based in New Zealand, has been operating for approximately 5-10 years. It is regulated by the Financial Service Providers Register (FSPR), albeit with a designation of “Suspicious Clone.” The platform requires a minimum deposit of RM5,000 and offers managed forex and cryptocurrency trading under a basic account type. Unfortunately, a demo account is not available.

Customer support is accessible 24/7 via email (admin@iffx.my) and Telegram (+60 11-1688 7731), ensuring assistance is readily available. Deposits are typically reflected within 0-24 hours on working days, with instant withdrawals also offered. However, educational resources are not provided by the platform.

| Pros | Cons |

| Offers managed forex and cryptocurrency trading. | Regulatory status flagged as “Suspicious Clone” |

| 24/7 customer support via email and Telegram. | Lack of educational resources for traders. |

| Allows instant withdrawals for user convenience. | No demo account available for practice trading. |

| Deposits reflected within 0-24 hours on working days. | Limited account types, potentially restricting user options. |

Pros:

Offers managed forex and cryptocurrency trading: IFFX provides users with the opportunity to engage in managed trading activities across both the forex and cryptocurrency markets. This allows users to diversify their investment portfolios and potentially capitalize on opportunities in different asset classes.

24/7 customer support via email and Telegram: IFFX ensures that users have access to customer support round the clock. This accessibility to assistance via email and Telegram enables users to seek help or resolve issues promptly, enhancing their overall experience with the platform.

Allows instant withdrawals for user convenience: One of the key benefits of IFFX is its policy of facilitating instant withdrawals. This feature grants users the flexibility to access their funds quickly and conveniently, improving liquidity and enabling timely financial management.

Deposits reflected within 0-24 hours on working days: IFFX strives to provide efficient deposit processing, with deposits typically being reflected in users' accounts within 0-24 hours on working days. This prompt processing helps users to quickly initiate their investment activities without unnecessary delays.

Cons:

Regulatory status flagged as “Suspicious Clone”: Despite being regulated by the Financial Service Providers Register (FSPR), IFFX's regulatory status is flagged as a “Suspicious Clone.” This designation raises concerns about the platform's legitimacy and compliance with regulatory standards, potentially undermining user trust and confidence.

Lack of educational resources for traders: IFFX falls short in providing educational resources for traders. The absence of educational materials, such as tutorials, webinars, or market analysis, hinder users' ability to acquire knowledge and improve their trading skills, limiting their potential for success.

No demo account available for practice trading: IFFX does not offer a demo account option for users to practice trading with virtual funds. This omission deprives users of the opportunity to familiarize themselves with the platform's features and test their trading strategies in a risk-free environment before committing real capital.

Limited account types, potentially restricting user options: The platform offers only a limited range of account types, which restrict users' options and flexibility in tailoring their trading experience to their individual preferences and requirements. This limitation could deter potential users seeking more diverse account options.

IFFX operates under the regulatory oversight of New Zealand, holding a Financial Service Corporate license (License No.: 177724). It is listed on the Financial Service Providers Register, indicating its compliance with the regulatory standards set forth by New Zealand authorities.

However, it's important to note that its current status is flagged as a “Suspicious Clone.” This designation suggest further investigation should be warranted to ensure compliance and legitimacy.

IFFX is a platform that offers managed forex and crypto trading services. IFFX takes your money and uses it to trade in the foreign exchange (forex) market and the cryptocurrency market. And the promise monthly profits between 5% and 20% deposited directly into your bank account.

IFFX also offers an affiliate program where you can earn money by promoting their platform. If someone signs up for their service through your unique affiliate link, you'll get a 5% commission on their first investment. You can promote IFFX through various methods like testimonial videos, social media posts, or forum advertising. Once your referral invests, your commission becomes available immediately.

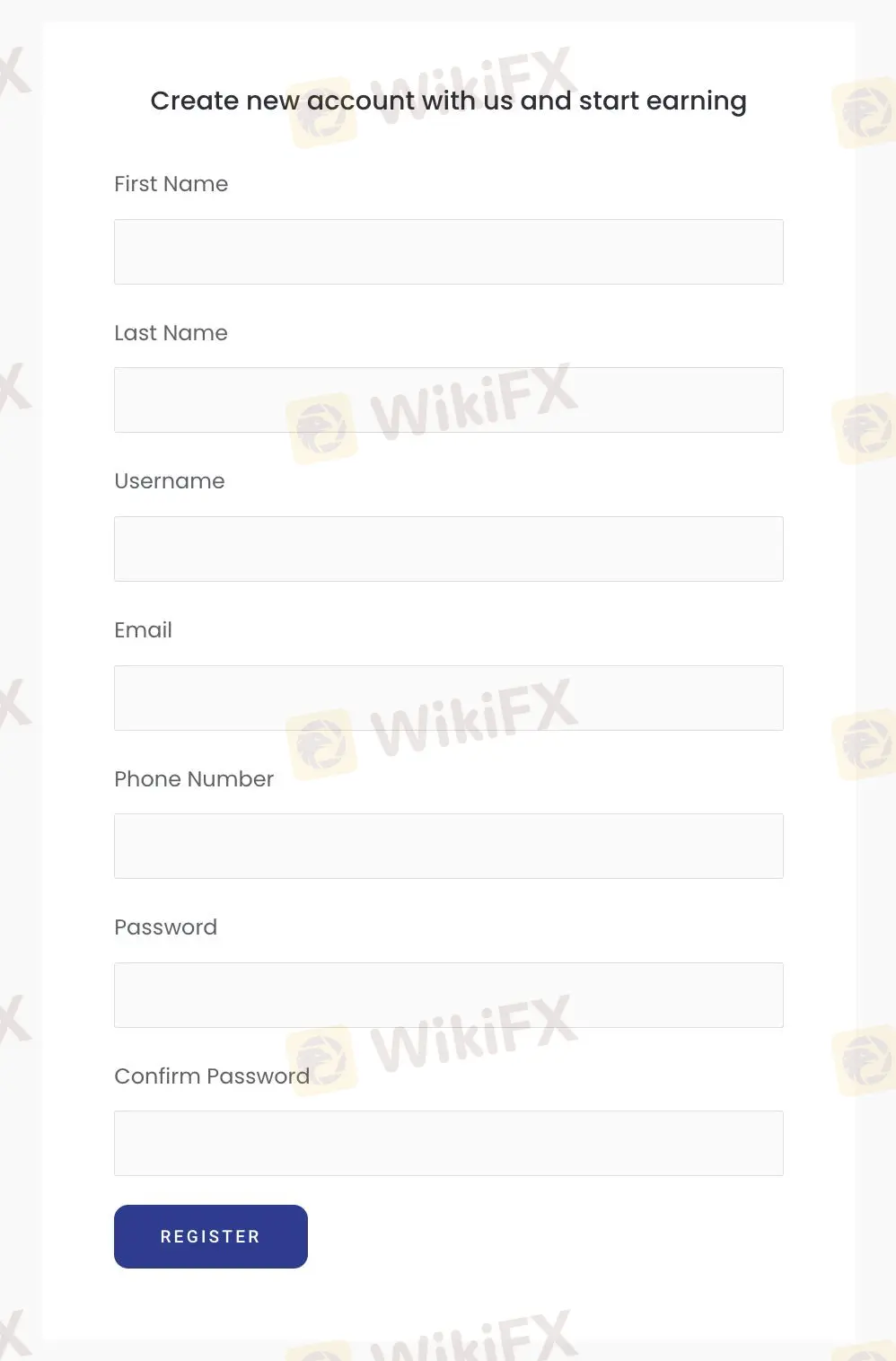

Here's a step-by-step guide on how to open an account with IFFX:

Navigate to the IFFX Website: Open your web browser and go to the official IFFX website (https://iffx.my/#about).

Locate the Registration Section: Look for the “Sign Up” button on the homepage.

Fill in Personal Information: Enter your Name, Username, Email, and Phone Number in the designated fields. Make sure to provide accurate information.

Choose a Password and Confirm the Password: Create a secure password for your account. And re-enter the password you've chosen to confirm it matches the one you entered previously.

Click “Register”: Once you've filled out the form and agreed to any terms, click the button labeled “Register”.

Invest with IFFX to unlock passive income effortlessly, as your investments automatically generate monthly returns. Enjoy the flexibility of instant withdrawals, ensuring you can access your profits promptly each month.

Additionally, after six months of investment, you have the option to withdraw your principal or reinvest with IFFX. Deposits typically reflect in your wallet within 0-24 hours on working days, while the minimum investment amount required is RM5,000.

Investing with IFFX initiates automatic monthly passive income generation, providing users with a steady stream of earnings. Furthermore, users enjoy the convenience of instant withdrawals, with profits accessible for withdrawal at any time. IFFX ensures processing, enabling users to swiftly access their funds whenever needed, enhancing overall investment flexibility and user experience.

In conclusion, while IFFX offers several advantages such as managed forex and cryptocurrency trading, 24/7 customer support, instant withdrawals, and efficient deposit processing, it is not without its drawbacks. The platform's regulatory status being flagged as a “Suspicious Clone” raises concerns about its legitimacy and compliance.

Additionally, the lack of educational resources, absence of a demo account for practice trading, and limited account types hinder users' trading experience and limit their potential for success.

Question: What types of trading does IFFX offer?

Answer: IFFX provides opportunities for trading in managed forex and cryptocurrency markets, allowing users to diversify their investment portfolios.

Question: How can I contact IFFX for support?

Answer: For assistance, users can reach out to IFFX's customer support team through email at admin@iffx.my or via Telegram at +60 11-1688 7731, ensuring assistance is readily available 24/7.

Question: Is there a minimum deposit requirement to start trading with IFFX?

Answer: Yes, to commence trading with IFFX, a minimum deposit of RM5,000 is required.

Question: Can I withdraw my profits from IFFX instantly?

Answer: Yes, IFFX allows for instant withdrawals, ensuring users can access their profits promptly and conveniently.

Question: Does IFFX provide educational resources for traders?

Answer: Unfortunately, IFFX does not offer educational resources for traders, potentially limiting users' ability to acquire knowledge and improve their trading skills.

More

User comment

3

CommentsWrite a review

2023-03-30 17:10

2023-03-30 17:10 2023-03-30 17:09

2023-03-30 17:09