User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.71

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Smart Prop Trader LLC

Company Abbreviation

Smart Prop Trader

Platform registered country and region

United States

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Smart Prop Trader Review Summary | |

| Founded | 2021 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Forex, Indices, Commodities, Cryptos |

| Demo Account | ✅ |

| Leverage | Up to 100x |

| Spread | / |

| Min Deposit | $5000 |

| Trading Platform | DXtrade |

| Customer Support | Live chat (8am-5pm EST, Monday-Friday) |

| Email: support@smartproptrader.com | |

| Social media: Twitter, Instagram, LinkedIn, YouTube, Medium, Tiktok | |

| Address: 5830 E. 2nd Street, Casper, WY 82609 | |

Smart Prop Trader, with its domain registered in 2021 in the United States, is a financial company and mainly deals with trading services in Forex, Cryptos, Indices, Commodities. A free demo account is provided for practicing and the entry point for live account opening is $5000, quite high comparing to industry standard.

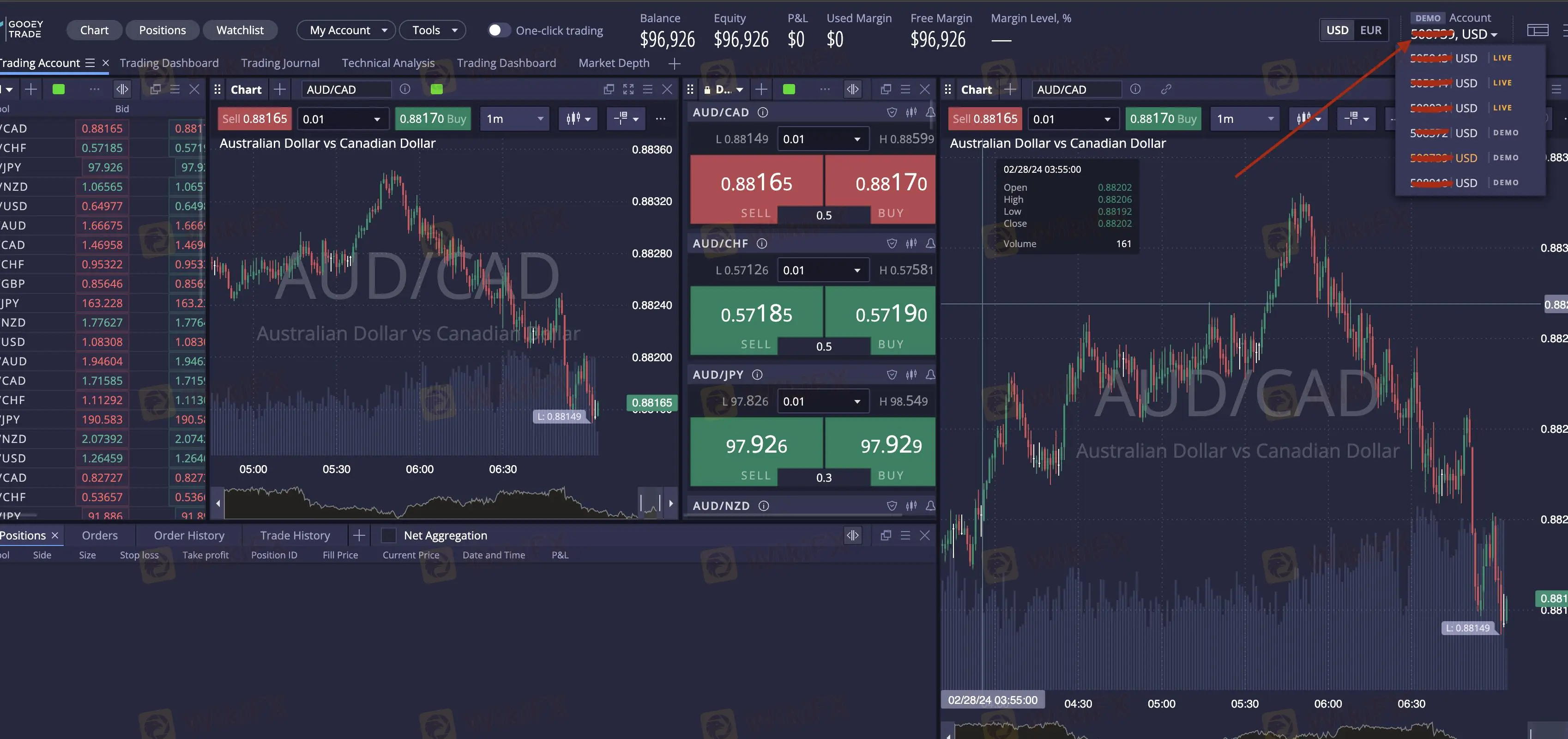

Moreover, the broker offers leverage ranging from 1:2 to 1:100 for different products in different live accounts. Commissions are charged at $6 per lot for forex and metals, and the broker requires profit split, eating up investors' profits. Traders can execute trades on the broker's own proprietary platform “DXtrade” via GooeyTrade.

However, one fact worth noting is that the broker currently operates without regulation from any authorities, degrading its credibility and reliability.

| Pros | Cons |

| Demo accounts | Lack of regulation |

| 24/7 customer service | High initial capital required |

| Commissions charged for forex and metals | |

| Profit split from the broker |

The broker operates without any valid supervision from any regulatory authorities. It raises a question about its legitimacy and credibility because regulated brokers usually adhere to strict industry standards to protect customer funds.

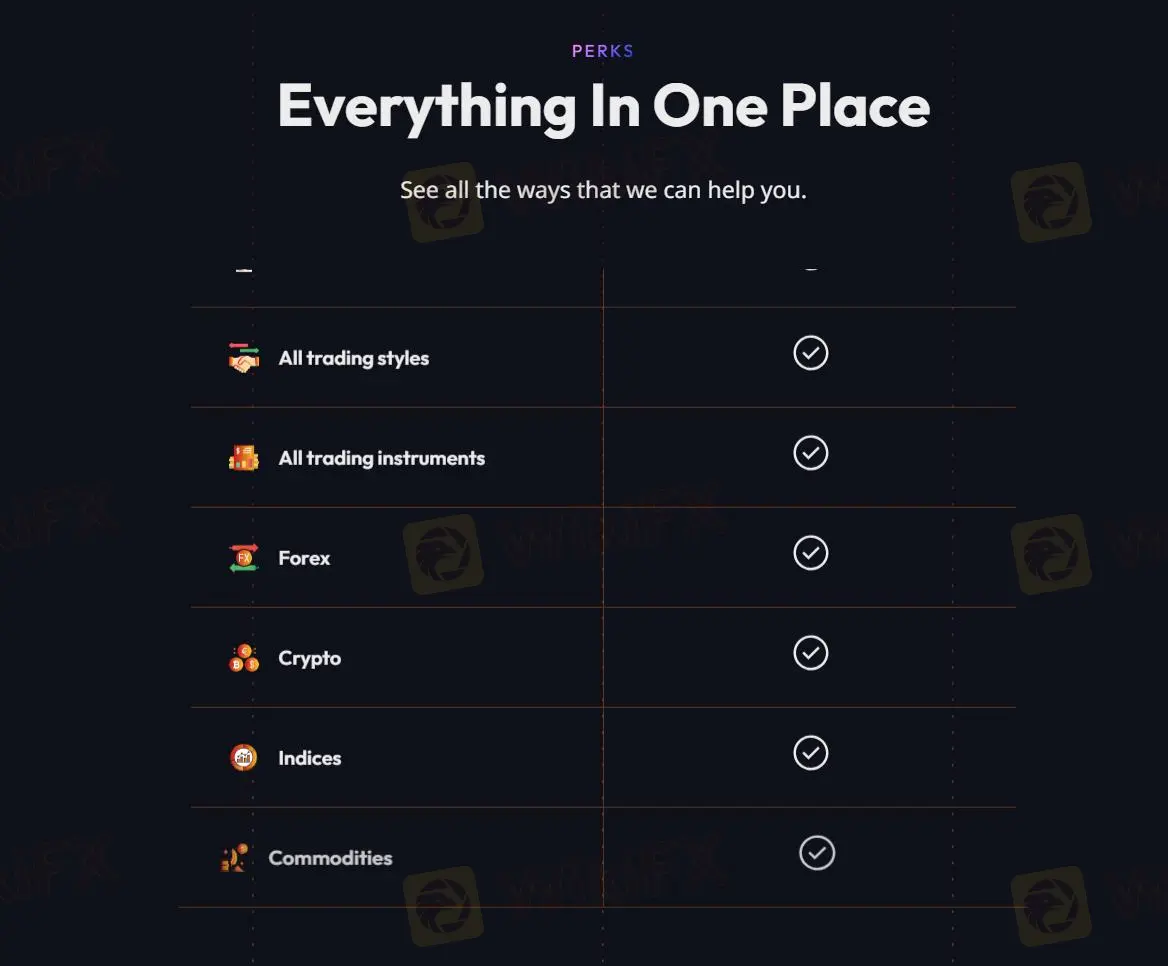

With Smart Prop Trader, you can expand your trading portfolio and seize abundant market opportunities by trading in Forex, Shares, Indices, Commodities and Cryptos.

Forex: Forex, or foreign exchange, is the global marketplace for trading national currencies against one another, facilitating international trade and investment. Smart Prop Trader enables trading in major, minor and exotic forex pairs such as AUDCAD, EURGBP, USDCHF, EURNOK, etc.

Commodities: Commodities are basic goods used in commerce that are interchangeable with other goods of the same type, such as spot metals and oil products.

Indices: Indices are statistical measures that represent the performance of a specific group of assets, such as stocks or bonds, helping investors gauge market trends and economic health. With Smart Prop Trader, you can trade common indices like NAS100, JPN225, SPX500.

Cryptos: Trade digital currencies like Bitcoin, Litecoin and Ethereum against USD, tapping into the evolving crypto landscape.

When dealing with investment activities, always adhere to the principle of diversification by allocating funds across various products rather than concentrating on a single one you feel optimistic about.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Smart Prop Trader provides demo accounts that siTraders can thus practice their trading strategies in a risk-free environment without losing real money.mulates real market conditions that has no restrictions on holding positions over the weekend or trading during macroeconomic news releases.

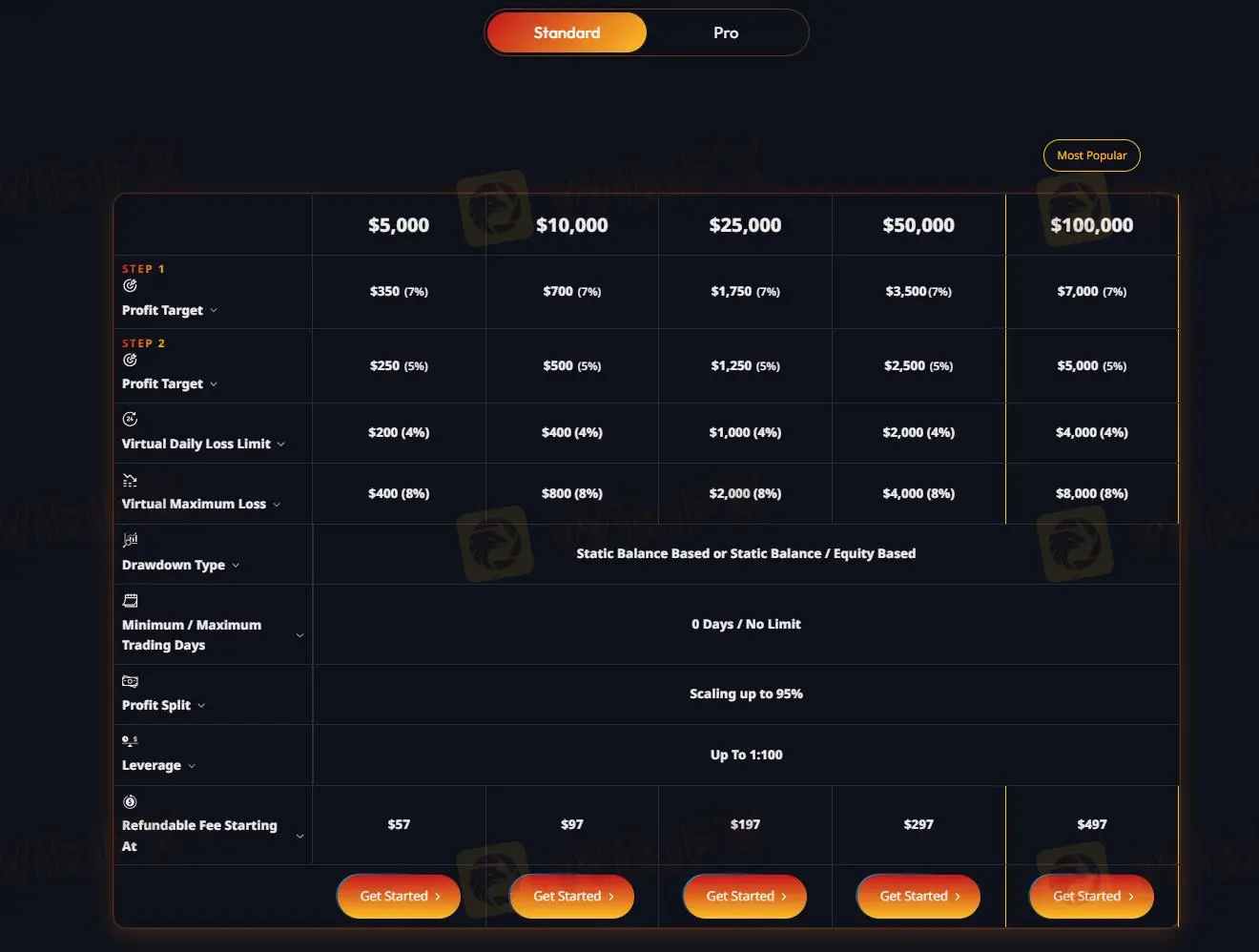

Besides, the broker provides two live accounts: Standard and Pro account with different profit targets.

The Standard Account offers funding options from $5,000 to $100,000, with a profit target of 7% in Step 1 and 5% in Step 2. It features a virtual daily loss limit of up to 4% and a maximum loss of 8%.

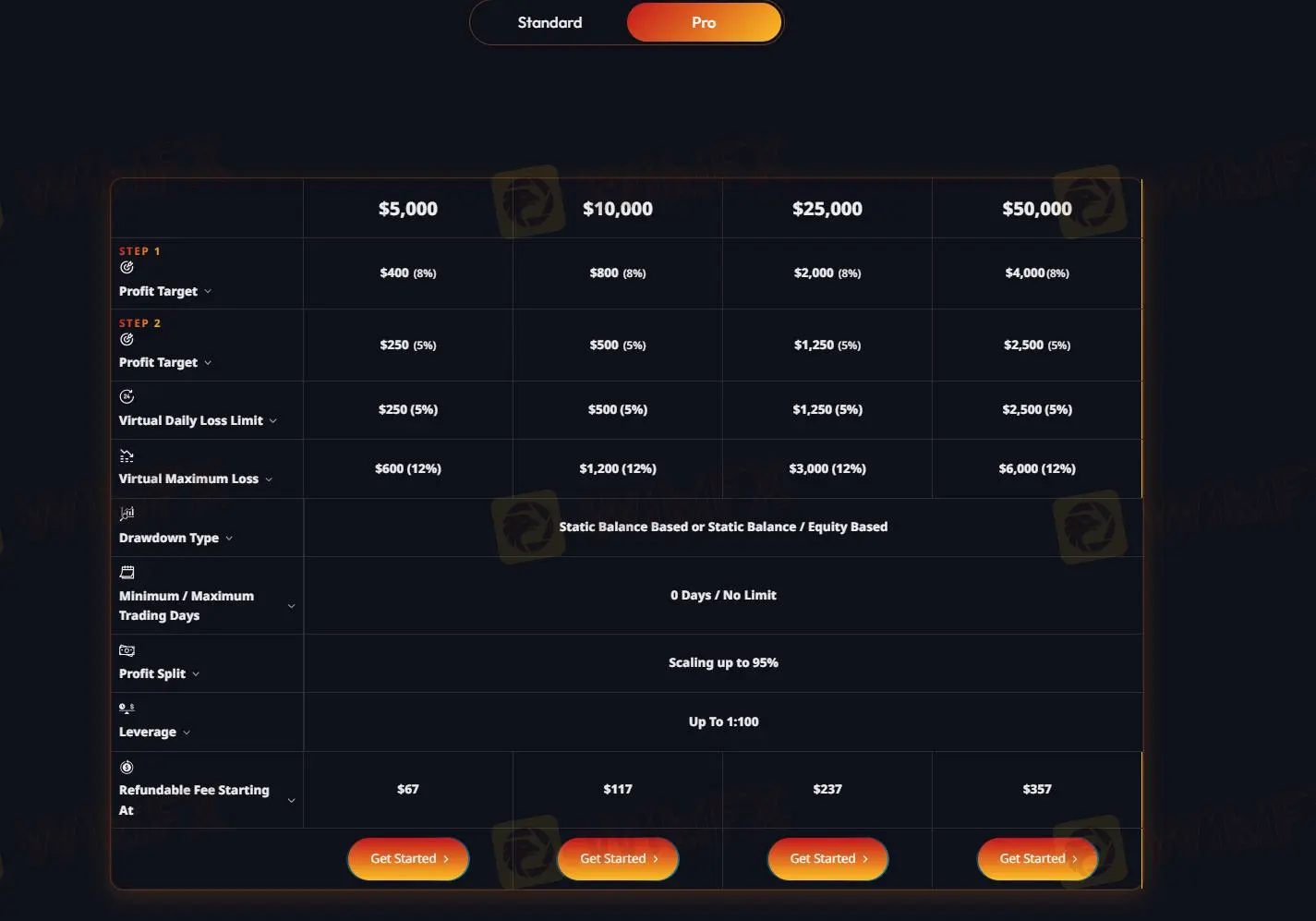

The Pro Account also ranges from $5,000 to $50,000, requiring an 8% profit target in Step 1 and a 5% target in Step 2. Its daily loss limits and maximum loss are higher at 5% and 12% respectively.

The default payout ratio is 75:25, but profit split for both accounts can go up to 95% if traders meet the condition of the broker's scaling plan.

You should choose the account size that is in line with your financial capacity and risk appetite to minimize loss and maximize profitability.

| Acount Type | Account Size | Step 1 Profit Target | Step 2 Profit Target | Virtual Daily Loss Limit | Virtual Maximum Loss | Minimum/Maximum Trading Days | Profit Split | Refundable Fee Starting At |

| Standard | $5,000 | $350 (7%) | $250 (5%) | $200 (4%) | $400 (8%) | 0 Days/No Limit | Up to 95% | $57 |

| $10,000 | $700 (7%) | $500 (5%) | $400 (4%) | $800 (8%) | $97 | |||

| $25,000 | $1,750 (7%) | $1,250 (5%) | $1,000 (4%) | $2,000 (8%) | $197 | |||

| $50,000 | $3,500 (7%) | $2,500 (5%) | $2,000 (4%) | $4,000 (8%) | $297 | |||

| $100,000 | $7,000 (7%) | $5,000 (5%) | $4,000 (4%) | $8,000 (8%) | $497 | |||

| Pro | $5,000 | $400 (8%) | $250 (5%) | $250 (5%) | $600 (12%) | $67 | ||

| $10,000 | $800 (8%) | $500 (5%) | $500 (5%) | $1,200 (12%) | $117 | |||

| $25,000 | $2,000 (8%) | $1,250 (5%) | $1,250 (5%) | $3,000 (12%) | $237 | |||

| $50,000 | $4,000 (8%) | $2,500 (5%) | $2,500 (5%) | $6,000 (12%) | $357 |

Leverage is up to 1:100 in both Standard account and Pro account, while for different products, maximum leverage is up to 1:30 for forex majors and minors, 1:10-1:25 for forex exotic, 1:10 for indices and spot metals, 1:5 for oil, and 1:2 for cryptos.

Leverages are always suggested to be used prudently by investors due to potential amplified losses along with gains.

For forex and spot metals trading, Smart Prop Trader will charge a commission fee of $6 per lot traded, while commission is absent for other products.

Traders can execute trades on DXtrade with Smart Prop Trader. Apps with iOS and Android versions for the platform can be downloaded on GooeyTrade website at https://gooeytrade.com/dxtrade-platform-tutorials/.

The platform provide traders with charting tools for technical analysis, swift order execution, and customizable interfaces. Users can acess additional resources like TradingView to switch over between demo and live accounts, manage watchlists, and place various types of orders.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment