User Reviews

More

User comment

13

CommentsWrite a review

2024-08-18 12:58

2024-08-18 12:58

2024-08-13 22:43

2024-08-13 22:43

Score

1-2 years

1-2 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 15

Exposure

Score

Regulatory Index0.00

Business Index4.76

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Driss IFC Limited

Company Abbreviation

Driss IFC

Platform registered country and region

United States

Company website

Company summary

Pyramid scheme complaint

Expose

Thieves stole all my money

They couldn't continue to steal from us like Sin Nada Deleno and set up similar websites to deceive people.

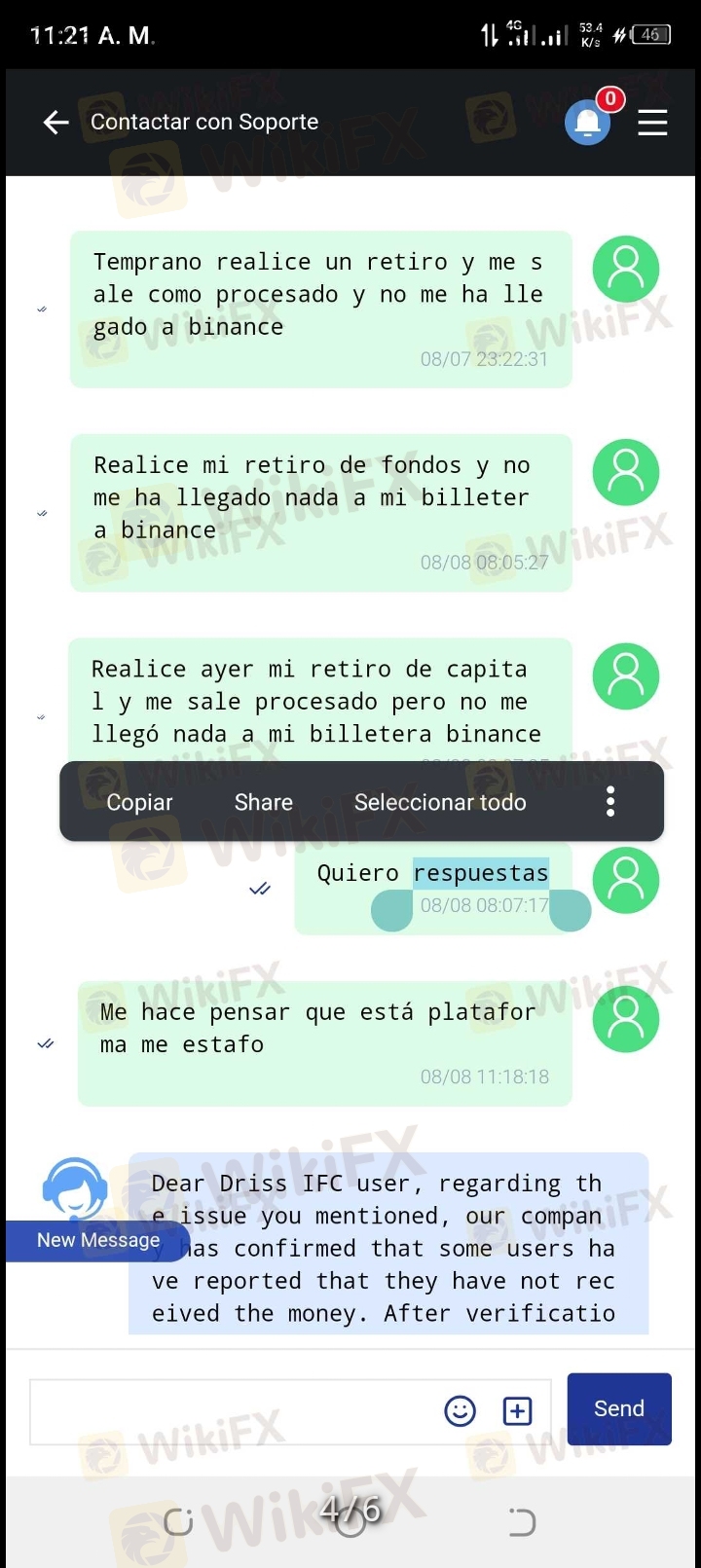

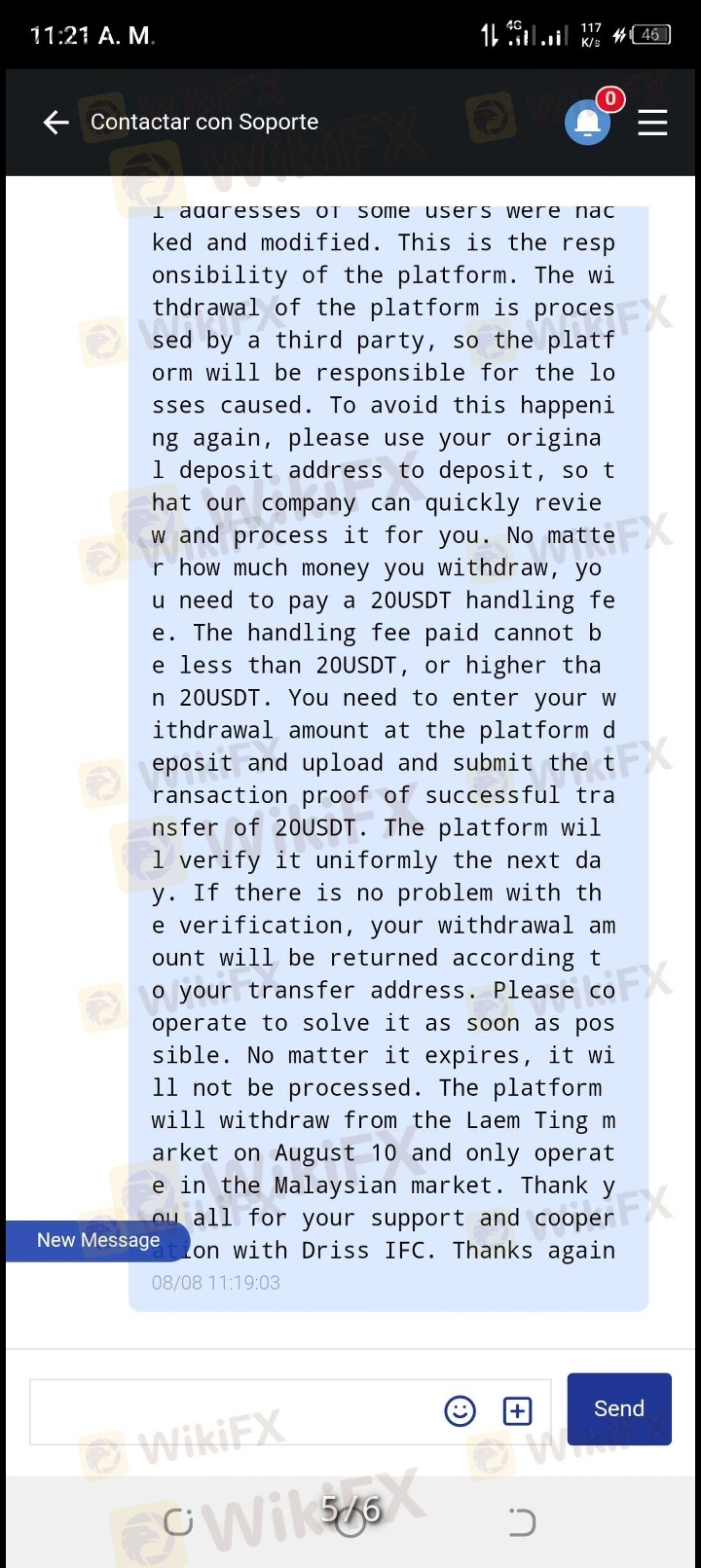

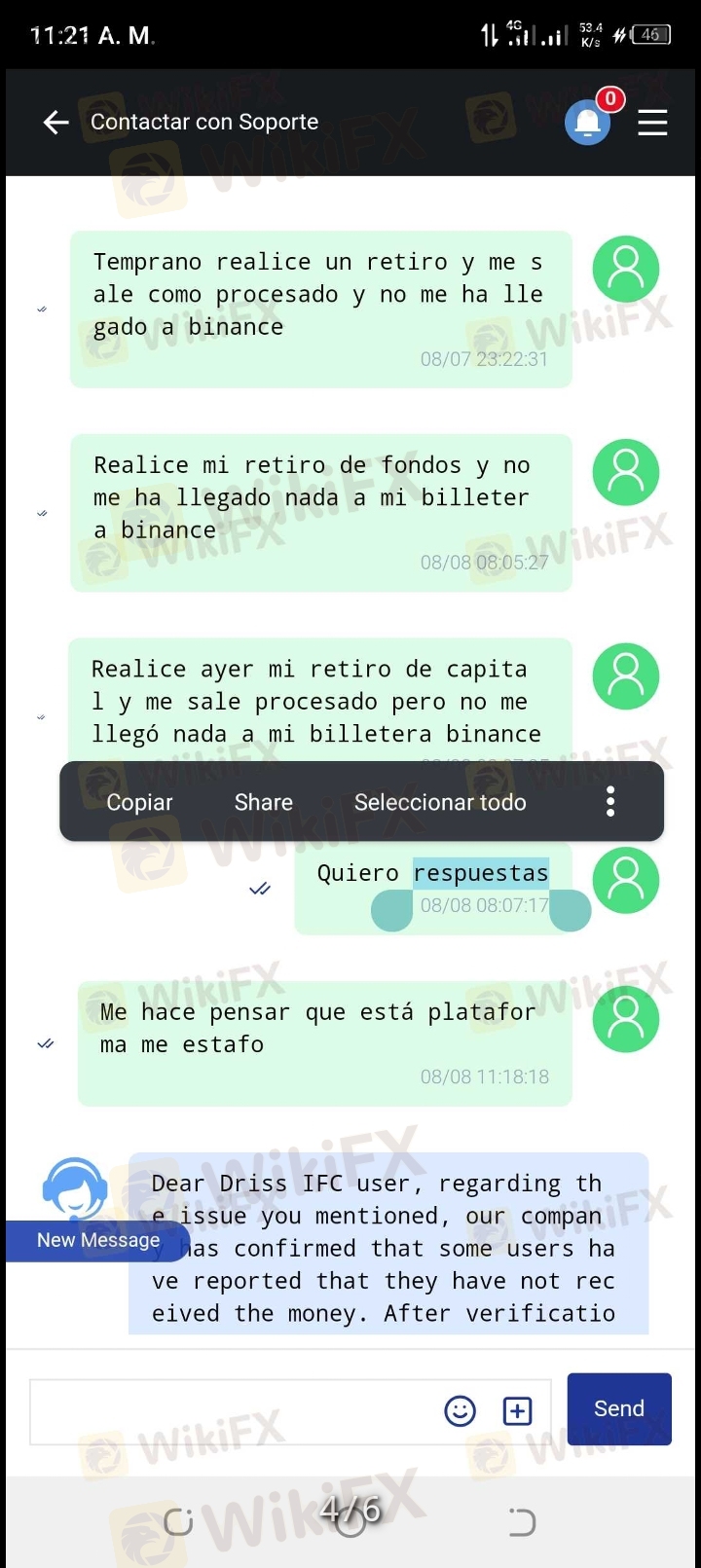

Driss failed for a week and demanded that we withdraw our investments. We made the withdrawals, but the payment never arrived in our wallets. Driss stole our investments and profits. DRISS IS A SCAM. IT DOES NOT ALLOW WITHDRAWALS.

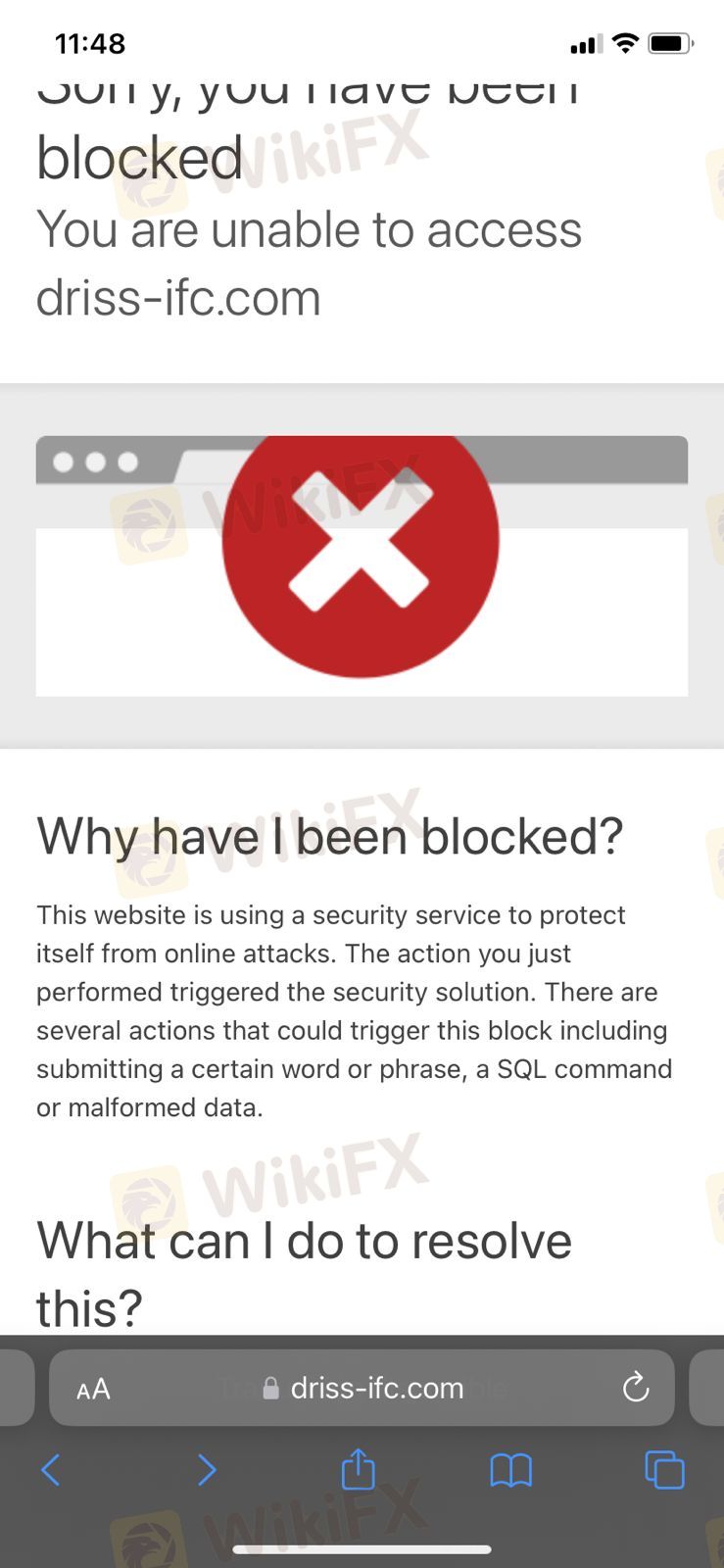

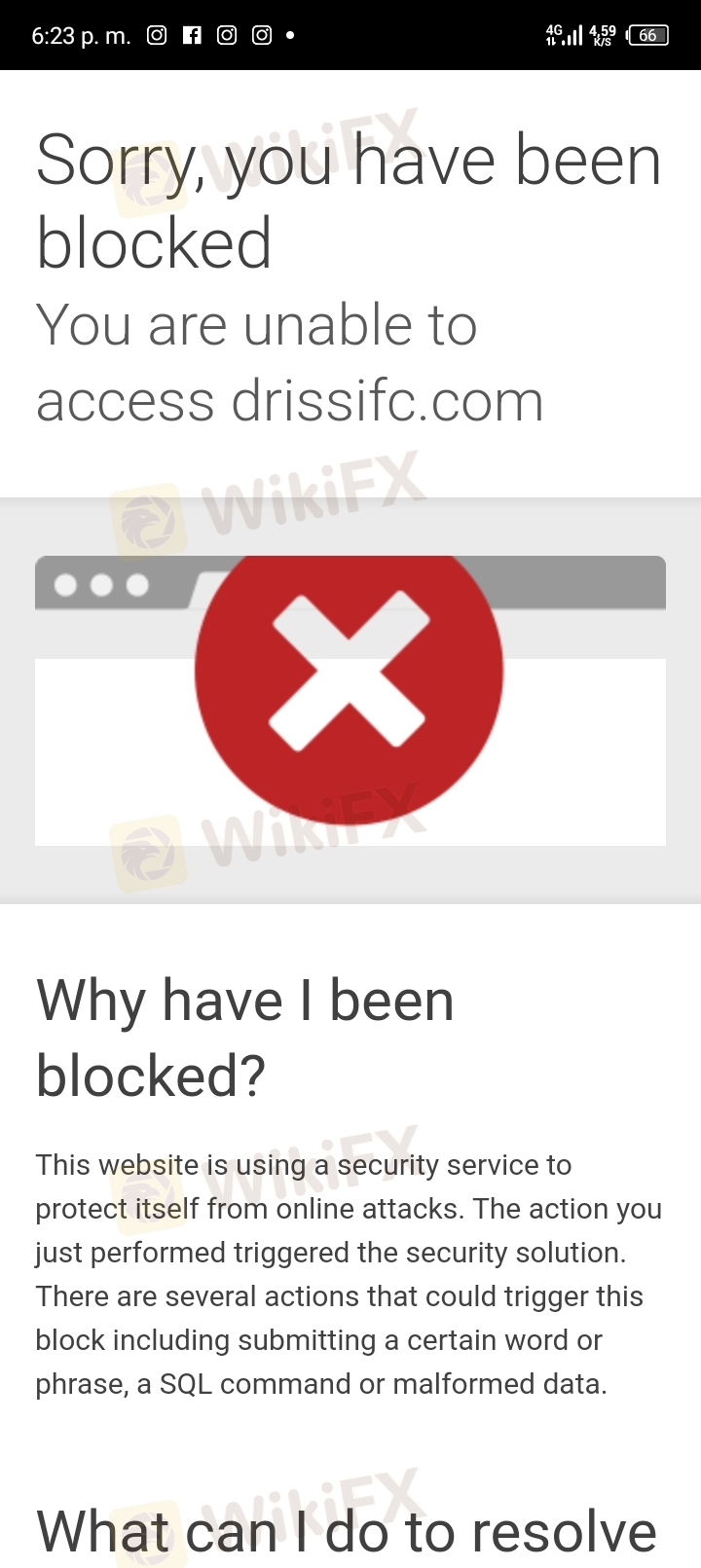

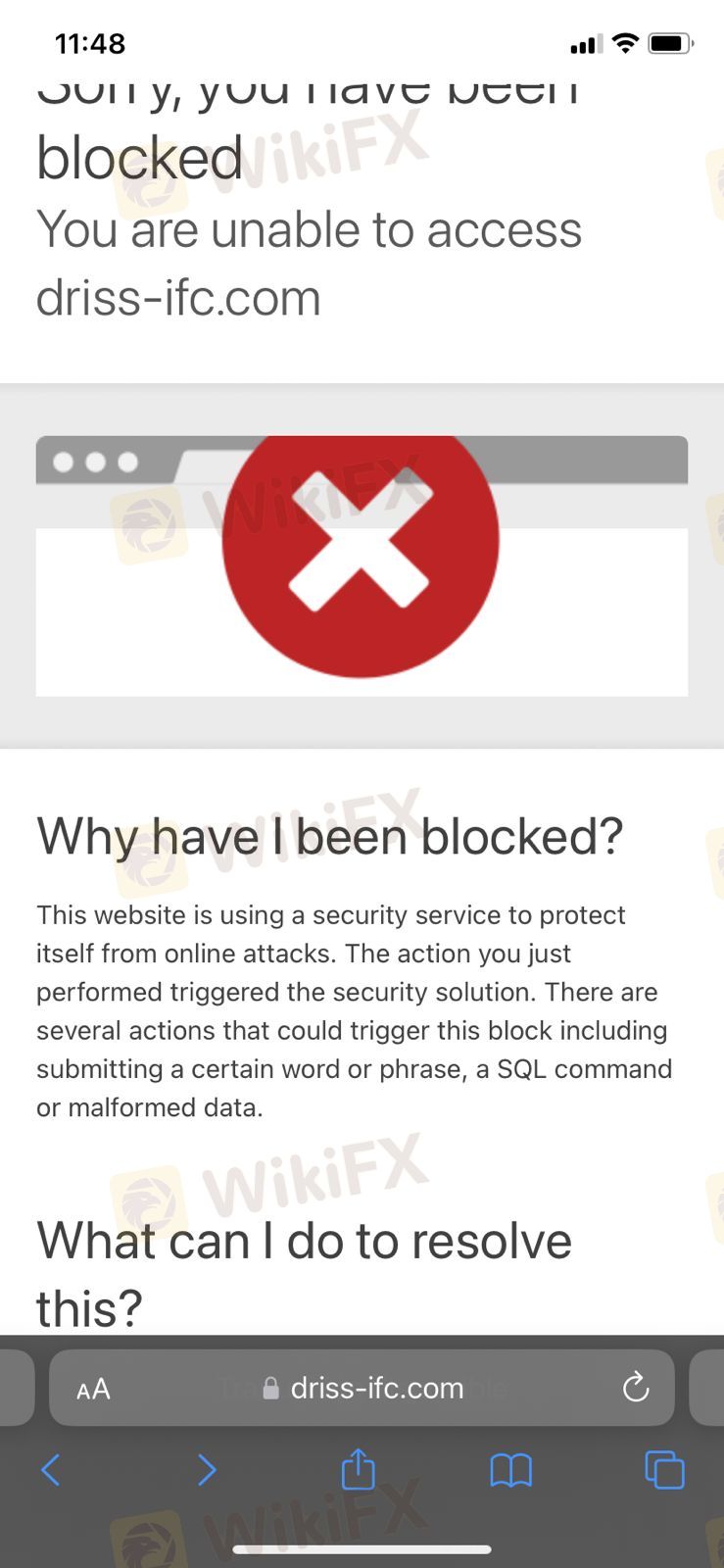

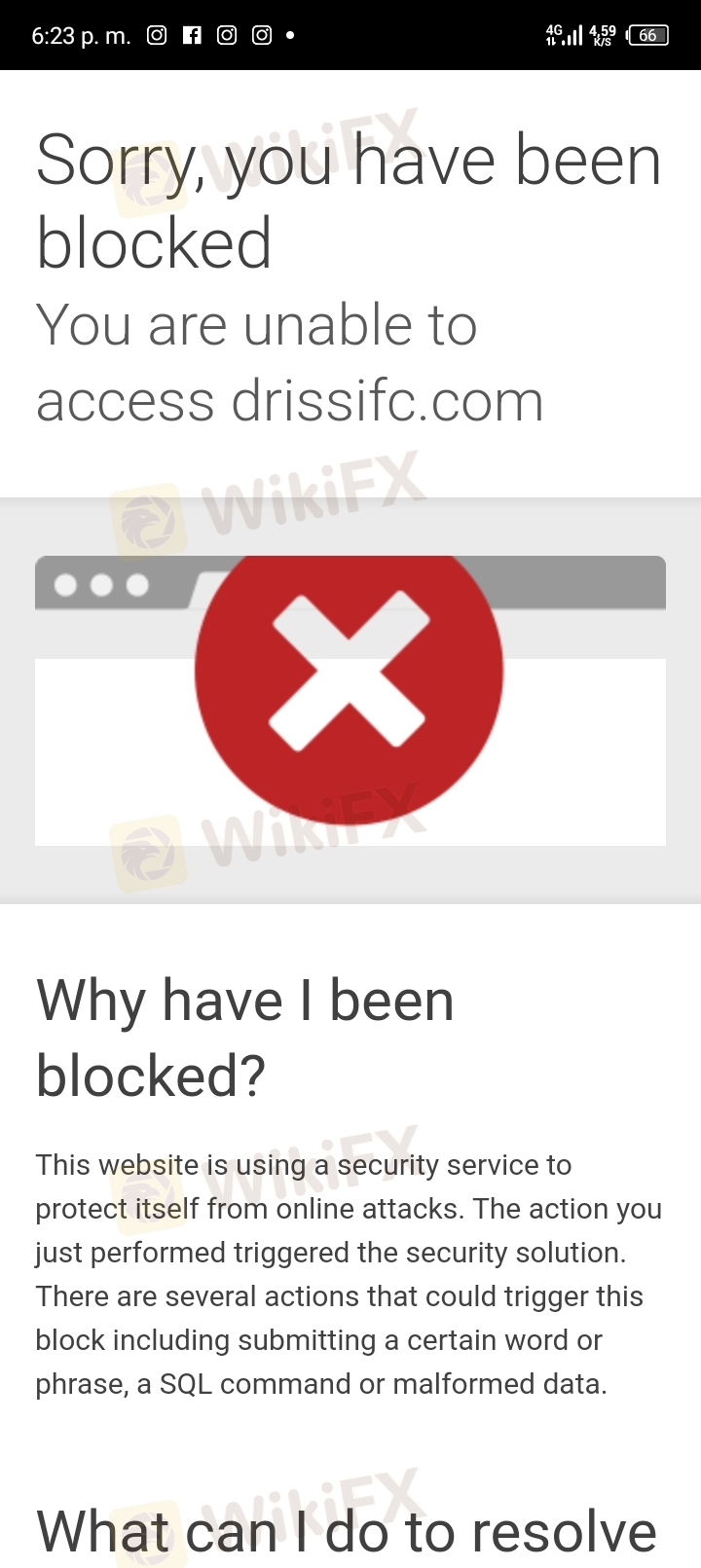

A week and a half of not being able to operate because the page is blocked, I do not have a screenshot of the current balance but I am attaching it, which corresponds to 452 dollars, however, if you need any information to find out, do not hesitate to contact me, I am attaching a screenshot of evidence of the blocked page.

We ask for our money back, I just joined and they already blocked me.

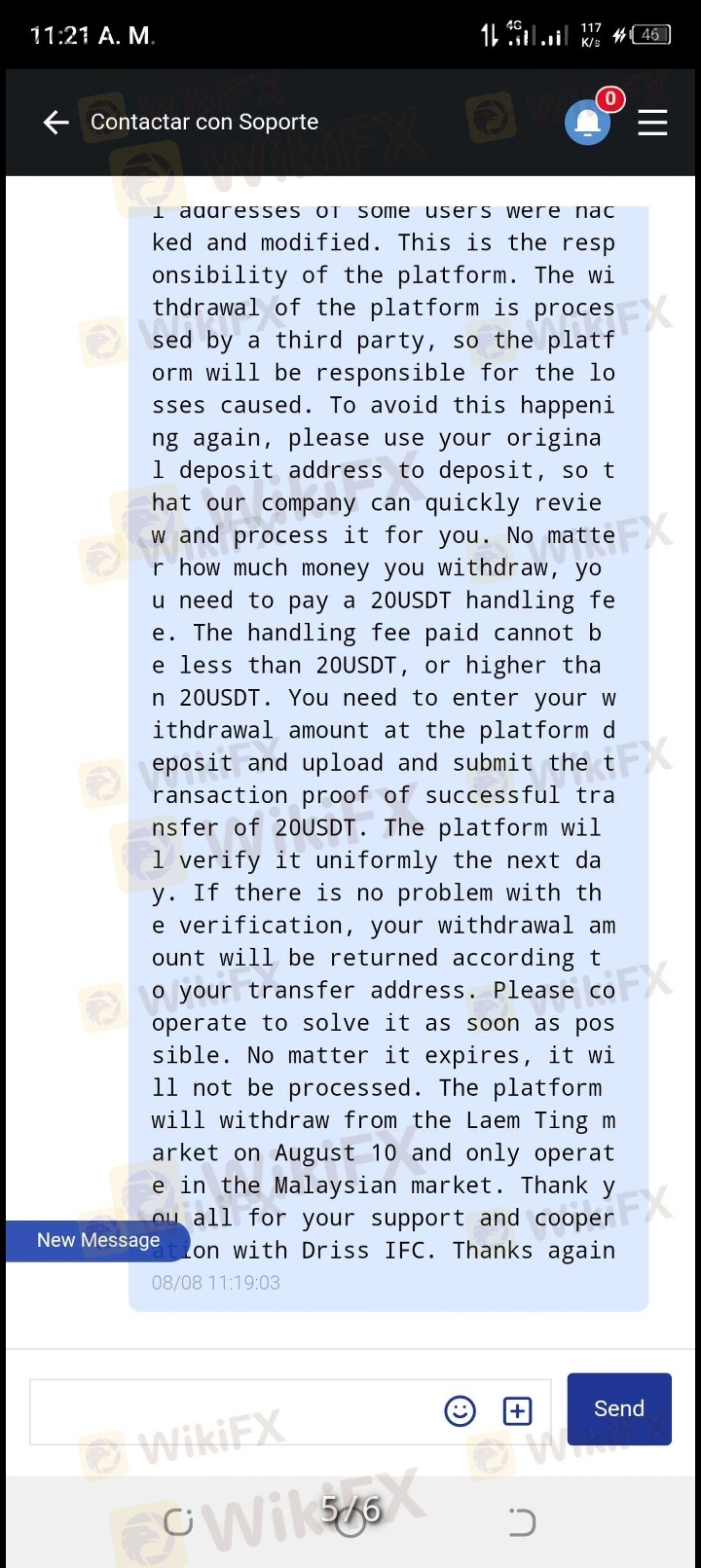

A withdrawal request was made successfully, but it was not deposited into the wallet. To stop it, $20 dollars must be given.

I made a withdrawal on the Driss ifc limited platform; it shows confirmed review, but the funds have not arrived in my wallet. A week ago, I was experiencing difficulties in my operations, and the explanation given was cyber attacks.

Good morning, I made the withdrawal on Thursday and until now the money has not come to me, the platform is already down, it is blank and at no time did I receive the money, it only said in process and nothing arrived, I am making my complaint for the simple fact that my withdrawal never came to me, when it said successful withdrawal, please if you can help me I would really appreciate it

They indicate that in order to withdraw, we must pay 20 dollars, which seems like a scam to me.

I expose this fraudulent company as they instructed us to withdraw the funds immediately, however, after the transaction was made, the platform approved the payment which never arrived in our wallets.

Suddenly, the application sent a withdrawal request because it was not going to operate in Latin America, only in Malaysia. I made the withdrawal but the money never arrived, it was stolen. It shows as completed but never arrived. And they don't provide any response. They are asking for $20 to return the money.

Good morning, I made a withdrawal on Wednesday and it hasn't been credited to my account. It said it was in process but nothing happened. And now I logged in and the app is not working, it crashed. My money hasn't arrived, the application is not working, they are scammers. They said I should pay 20% of the capital and supposedly the money would be credited, but it didn't happen. They did the same as Deleno, pure scamming.

First, the withdrawal was rejected. Then it appears confirmed. But it did not reach the wallet.

No, they do not allow us to withdraw our funds. They have already started with the Ponzi fraud, please do not deposit money in this platform anymore, the one who is supposed to be the leader answers nonsense

| Driss IFC | Basic Information |

| Founded in | 2024 |

| Registered in | United States |

| Regulation | FinCEN |

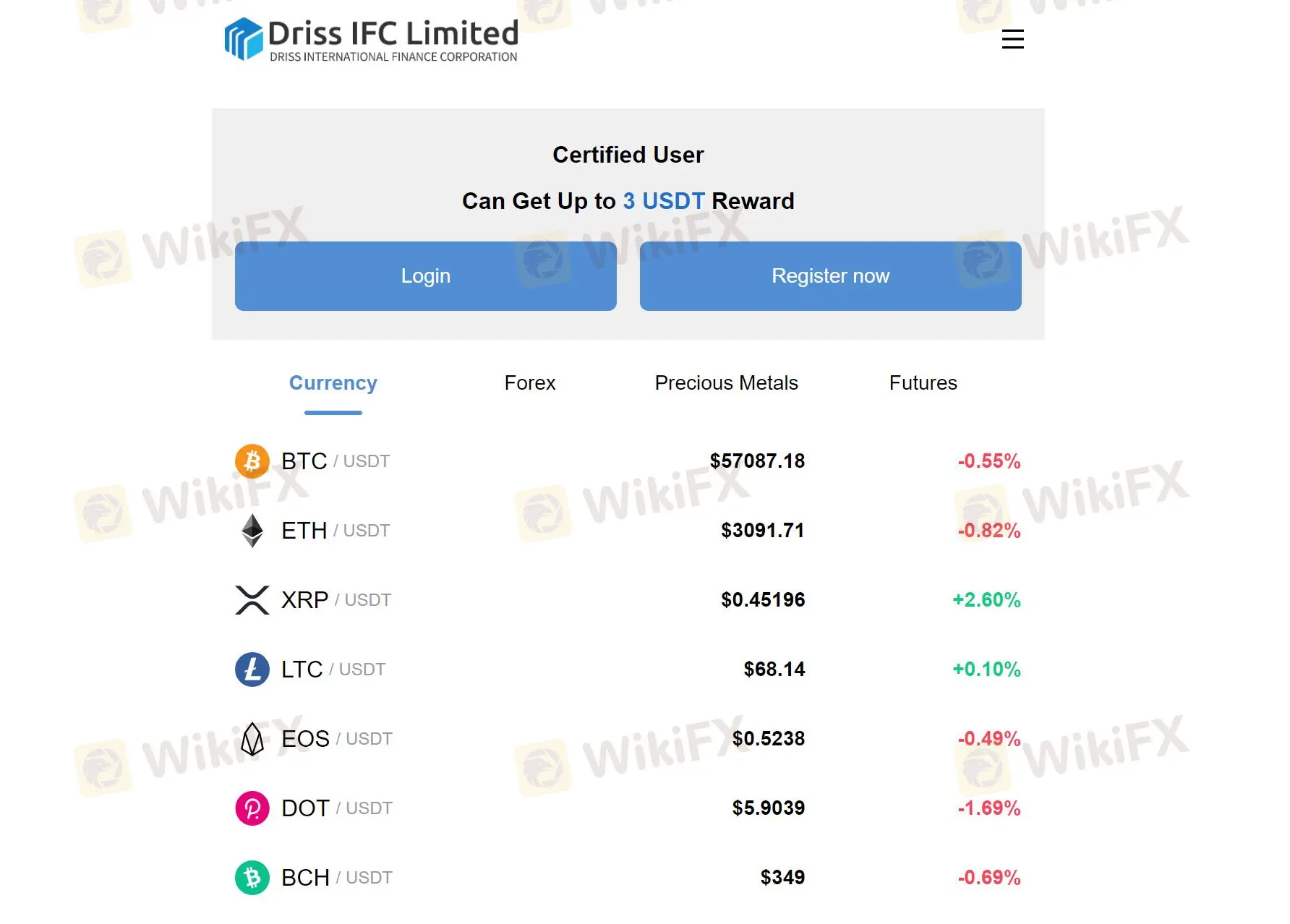

| Tradable Assets | Cryptos, Forex, Precious Metals, Futures |

| Trading Platform | Trading App |

| Customer Support | Online Chat |

| Promotions | Yes |

Driss IFC is a newly established brokerage firm founded in 2024 and registered in the United States. The company offers trading in cryptocurrencies, forex, precious metals, and futures through a proprietary trading app.

Driss IFC is regulated in the United States, authorized by the Financial Crimes Enforcement Network (FinCEN). It holds a Crypto license under license no.31000274201881.

| Pros | Cons |

|

|

|

|

| |

|

Pros:

Cons:

Driss IFC offers four classes of tradable assets in total, with a particular focus on cryptocurrencies. The broker provides access to an impressive selection of 350 digital currencies, available for trading across spot, futures, and USDT-margined markets. In addition to its robust crypto selection, Driss IFC extends its asset portfolio to include traditional financial instruments such as forex pairs and precious metals, as well as futures contracts.

Driss IFC provides a streamlined trading experience through its proprietary trading app, accessible via both web-based and downloadable versions.

For customer support, Driss IFC relies exclusively on an online chat feature, offering real-time assistance to traders. However, the absence of additional contact methods such as phone or email support may limit communication options for users who prefer alternative channels.

In summary, Driss IFC shines with its impressive array of 350 tradable cryptocurrencies and a website that caters to a global audience in 10 languages. However, the glaring absence of regulatory oversight casts a long shadow over the broker's operations, raising problems about trader safety and fund security.

Is Driss IFC legit?

Driss operates legally and it is regulated FinCEN in the United States.

Is Driss IFC safe to trade?

The safety of trading with Driss IFC cannot be guaranteed, as online trading always involves many risks.

Is Driss IFC good for beginners?

For beginners, Driss IFC is not a good choice. Specifically, beginners may find it less suited because of insufficient regulation, a lack of educational content, and limited customer support options.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

More

User comment

13

CommentsWrite a review

2024-08-18 12:58

2024-08-18 12:58

2024-08-13 22:43

2024-08-13 22:43