User Reviews

More

User comment

6

CommentsWrite a review

2025-04-20 19:02

2025-04-20 19:02

2023-12-04 14:17

2023-12-04 14:17

Score

2-5 years

2-5 yearsRegulated in Indonesia

Derivatives Trading License (AGN)

MT4 Full License

Regional Brokers

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.40

Business Index6.72

Risk Management Index9.55

Software Index8.08

License Index6.40

Single Core

1G

40G

More

Company Name

PT Maxco Futures

Company Abbreviation

maxco

Platform registered country and region

Indonesia

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

| Maxco Review Summary | |

| Founded | 2-5 years |

| Registered Country/Region | Indonesia |

| Regulation | Regulated |

| Market Instruments (70+) | Forex/Metals/Futures/CFD-Stock |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | Variable |

| Trading Platform | MT4, WebTrader and Mobile App |

| Min Deposit | $100 |

| Customer Support | Email: cs@maxco.co.id |

| Phone: +62 21 720-5868 | |

Maxco is a broker registered in Indonesia. The tradable instruments with a maximum leverage of 1:500 include forex, metals, futures, and CFD-stock. The broker also provides demo and real accounts. This brokerage provides various spreads, which can be tight, and the minimum deposit is $100. Although MaxCo is regulated by the JFX, risks cannot be avoided completely.

| Pros | Cons |

| Regulated | No 24/7 customer support |

| Leverage up to 1:500 | No copy trading information |

| MT4 available | |

| Demo account available | |

| Various tradable instruments |

Maxco is regulated by JFX under the Retail Forex License and license number SPAB-057/BBJ/12/03. However, it also claims to be regulated by BAPPEBTI under license number 353/BAPPEBTI/SI/V/2004, which should be verified.

Maxco offers over 70 trading instruments, including forex, metals, futures, and CFD-stock.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| CFD-Stocks | ✔ |

| Futures | ✔ |

| Cryptocurrencies | ❌ |

| Precious Metals | ❌ |

| Commodities | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Maxco provides a real and a demo account. The real account supports trading in US dollars and Indonesian rupiah. Novices can use the demo account, which provides up to $10,000 in virtual funds and is valid for one month, and applies to all trading platforms.

| Account Type | Real | Demo |

| Commission | $1 per lot | - |

| Leverage | 1:500 | - |

| Currency | USD, IDR | - |

Maxco provides variable spreads. The commission is $1 per lot. The lower the spread, the faster the liquidity.

The maximum leverage is 1:500,meaning that profits and losses are magnified 500 times.

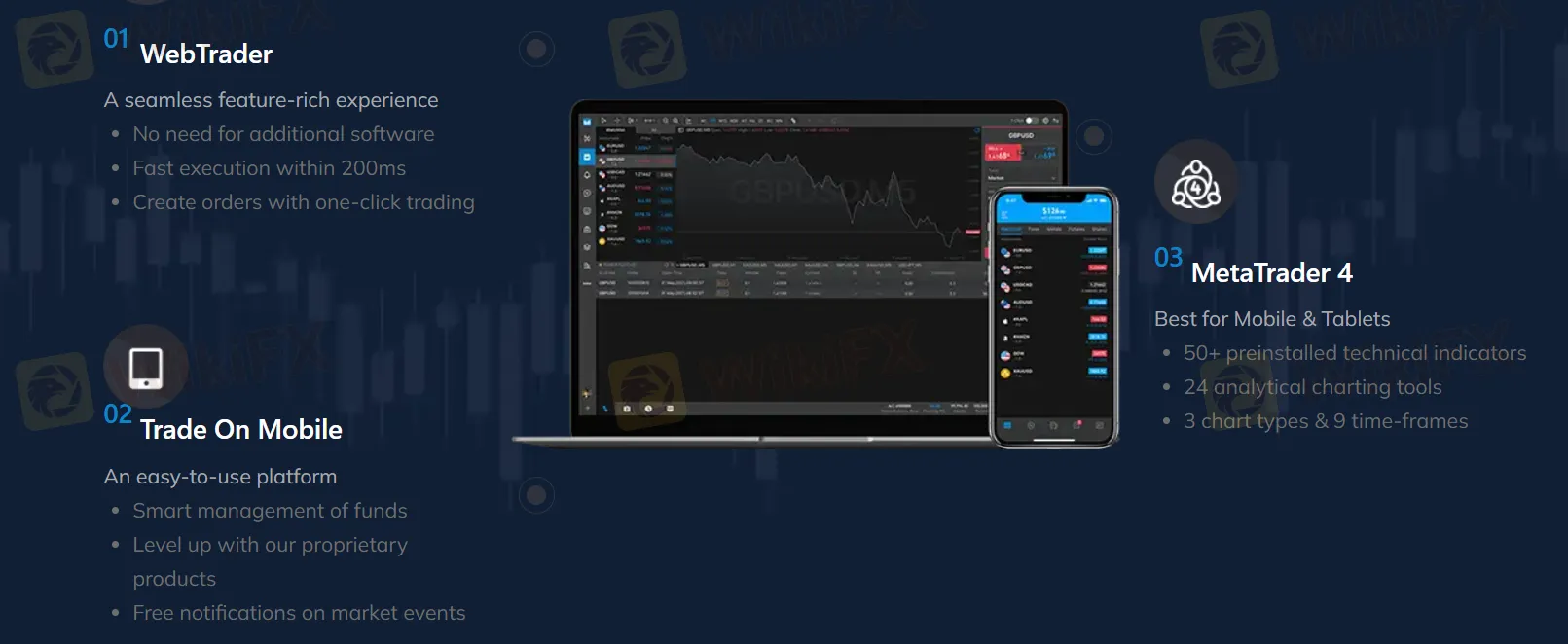

Maxco has various trading platforms, including WebTrader, which doesn't require the installation of additional software, Trade On Mobile, and MetaTrader 4, which is suitable for use on mobile phones and tablets.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web(Windows)/Mobile(iOS/Android) | Beginners |

| WebTrader | ✔ | Web | All |

| Maxco Apps/Desktop | ✔ | Mobile/Desktop | All |

The minimum deposit is $100. Maxco accepts both Indonesian Rupiah and US Dollar currency types for deposit and withdrawal. The time taken for a deposit to be updated in a trading account depends on the deposit method used and the Account Settings. Funds can be deposited on working days. The withdrawal processing times are carried out on business days only, and traders can make multiple withdrawals before 6:00 PM on working days. Besides, traders can make deposits and withdrawals on the same day, and associated fees are not charged.

Maxco provides customers with a variety of promotional activities and rewards. For example, in the trading festival activities, customers can collect tickets by trading on the platform and have the opportunity to win prizes, exclusive electronic products, and shopping vouchers. All new customers can receive a welcome bonus worth 300,000 Indonesian rupiah, which helps new customers reduce costs in the initial stage of trading.

More

User comment

6

CommentsWrite a review

2025-04-20 19:02

2025-04-20 19:02

2023-12-04 14:17

2023-12-04 14:17