User Reviews

More

User comment

1

CommentsWrite a review

2023-12-15 19:13

2023-12-15 19:13

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.90

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

ReturnsFX

Company Abbreviation

ReturnsFX

Platform registered country and region

China

Company website

Company summary

Pyramid scheme complaint

Expose

| ReturnsFX | Basic Information |

| Company Name | ReturnsFX |

| Founded | 2023 |

| Headquarters | China |

| Regulations | Not regulated |

| Tradable Assets | Forex, Crypto, Indexes, Stocks, Energy, Commodities |

| Account Types | Micro, Standard, VIP, Islamic, Corporate |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:500 (Varies by asset class and account type) |

| Spreads | Starting from 1.5 pips in Forex |

| Commission | Varies by account type and asset class |

| Deposit Methods | Bank wire transfers, Credit/Debit cards, E-wallets |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Customer Support | Email (support@returnsfx.com), Contact form |

| Education Resources | Forex education, Market analysis |

| Bonus Offerings | Welcome offers, Bonus Program |

Established in 2023 and headquartered in China, ReturnsFX positions itself as a trading platform that provides access to an extensive range of financial instruments across six distinct asset classes. With a portfolio covering Forex, Crypto, Indexes, Stocks, Energy, and Commodities, ReturnsFX aims to accommodate diverse trading preferences and strategies. The platform offers various account types, including Micro, Standard, VIP, Islamic, and Corporate, designed to cater to traders with varying levels of experience and trading volumes.

While ReturnsFX boasts flexibility in leverage options, allowing for up to 1:500 leverage on major currency pairs, it's crucial to note that the broker operates without regulatory oversight. This lack of regulatory compliance raises concerns about the safety of traders' funds and the transparency of the broker's operations. Traders considering ReturnsFX should weigh the advantages of its broad instrument range and versatile account types against the potential risks associated with its unregulated status. The platform also provides a choice between the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, enhancing its appeal to traders who appreciate the features and familiarity of these popular tools.

ReturnsFX is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like ReturnsFX carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

ReturnsFX presents a diverse range of trading instruments, spanning six asset classes and offering access to over 500 financial instruments. The platform caters to different trading preferences with a variety of account types, including Micro, Standard, VIP, Islamic, and Corporate accounts. Leveraging options of up to 1:500 on major currency pairs add flexibility for traders. However, it's crucial to consider the lack of regulatory oversight, as ReturnsFX operates without regulation, raising concerns about fund safety and transparency. Traders should carefully weigh the advantages of the platform's offerings against the potential risks associated with its unregulated status.

| Pros | Cons |

|

|

|

|

|

ReturnsFX boasts a robust trading instrument offering, spanning six distinct asset classes and providing traders access to a vast array of over 500 financial instruments. The platform covers the following key categories:

1. Forex:

ReturnsFX facilitates trading in the foreign exchange market, offering major, minor, and exotic currency pairs. This allows traders to participate in the dynamic and liquid forex market, catering to both beginners and experienced investors.

2. Crypto:

Cryptocurrency enthusiasts can explore ReturnsFX for trading digital assets. The platform supports popular cryptocurrencies like Bitcoin and Ethereum, providing opportunities in the volatile and innovative crypto market.

3. Indexes:

Traders can speculate on the performance of major stock market indices, including but not limited to the S&P 500, Dow Jones, and NASDAQ. ReturnsFX enables users to capitalize on broader market trends through its index offerings.

4. Stocks:

ReturnsFX extends its services to individual stocks, allowing traders to invest in and trade shares of companies listed on major global stock exchanges. This feature provides diversification opportunities and the ability to capitalize on specific companies' performances.

5. Energy:

Energy commodities, such as oil and natural gas, are included in ReturnsFX's asset classes. Traders interested in the energy market can leverage price movements in these commodities, influenced by global economic factors and geopolitical events.

6. Commodities:

ReturnsFX covers a spectrum of commodities, from precious metals like gold and silver to agricultural products. This broad range allows traders to navigate various sectors within the commodity market, taking advantage of diverse opportunities.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| ReturnsFX | Yes | Yes | Yes | No | Yes | Yes | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

ReturnsFX offers a range of thoughtfully designed account types to cater to the diverse needs and preferences of traders. Each account type is crafted with specific features and benefits to accommodate traders at various levels of expertise. Here's a brief overview of the available account types:

1. Micro Account:

The Micro Account at ReturnsFX is tailored for beginners and those looking to start with a modest investment. With a low minimum deposit requirement, traders can access the financial markets with ease. This account type provides a suitable entry point for those who are new to trading and want to familiarize themselves with the platform.

2. Standard Account:

The Standard Account is a versatile option suitable for a wide range of traders, offering a balanced set of features. It is designed to accommodate both novice and more experienced traders, providing access to a diverse selection of trading instruments across multiple asset classes. This account type caters to those seeking a comprehensive trading experience.

3. VIP Account:

The VIP Account is curated for traders with more experience and a higher trading volume. It comes with additional perks, including personalized support and enhanced features. VIP Account holders at ReturnsFX enjoy priority customer service, exclusive market insights, and potentially lower trading costs, providing a premium trading environment.

4. Islamic Account:

ReturnsFX acknowledges the diversity of its user base by offering an Islamic Account that adheres to Sharia law principles. This account type is swap-free, eliminating interest payments or receipts, making it suitable for traders who require compliance with Islamic financial principles.

5. Corporate Account:

The Corporate Account is tailored for corporate entities and institutional traders. ReturnsFX recognizes the distinct needs of businesses engaged in financial markets and provides specialized services, including corporate account management and tailored solutions to meet institutional requirements.

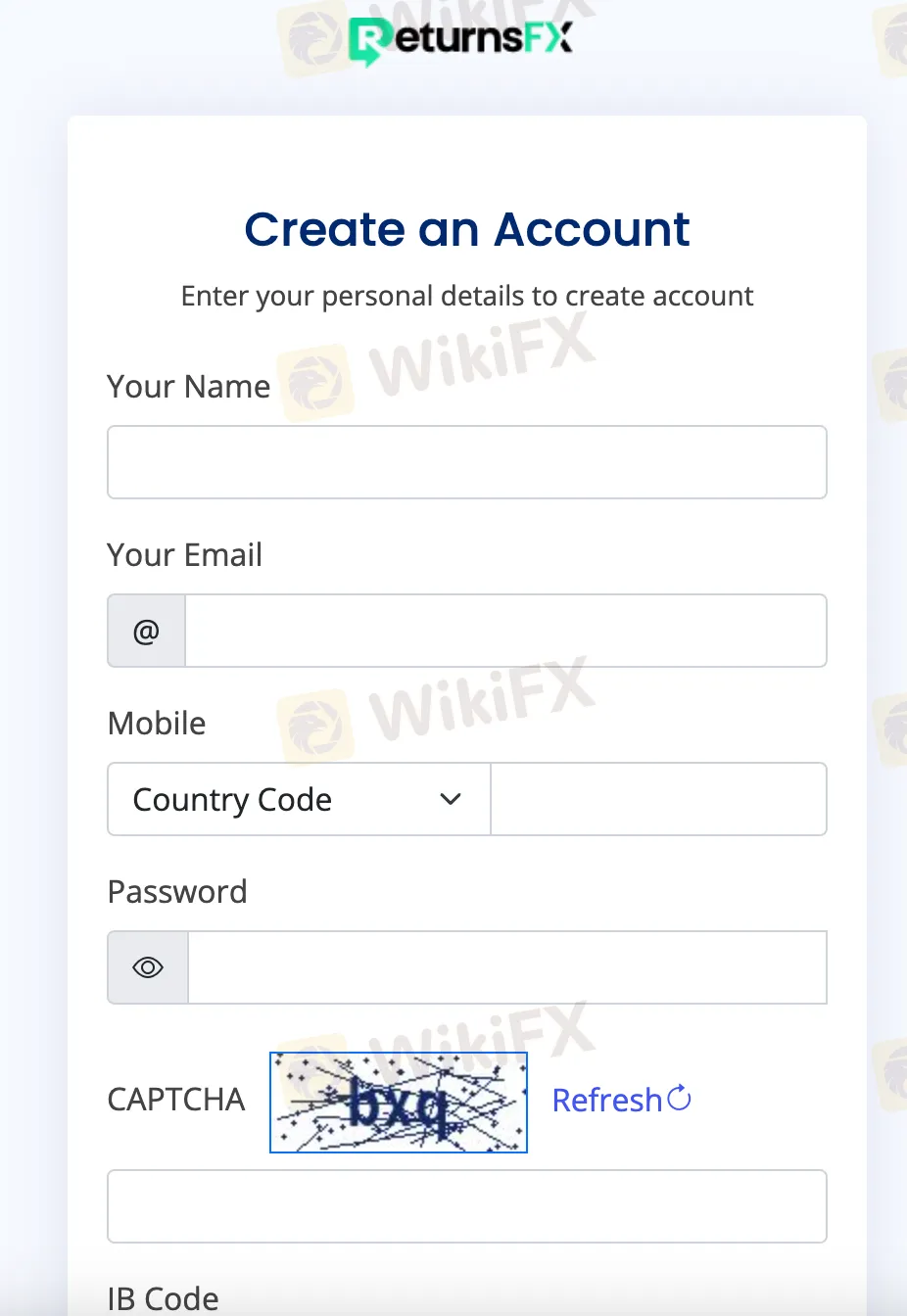

To open an account with ReturnsFX, follow these steps.

Visit the ReturnsFX website. Look for the “Register Now” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

ReturnsFX provides leverage options across various asset classes and account types. Leverage allows traders to control larger positions with a relatively smaller amount of capital, amplifying both potential profits and risks. In the Forex market, ReturnsFX offers leverage up to 1:500 for major currency pairs, and ratios may vary based on the chosen account type. Similar flexibility is extended to stocks, indices, commodities, and cryptocurrencies, with leverage tailored to each asset class. Traders should exercise caution, as higher leverage magnifies both gains and losses, and understanding its implications is crucial for making informed and responsible trading decisions.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | ReturnsFX | FxPro | IC Markets | RoboForex |

| Maximum Leverage | 1:500 | 1:200 | 1:500 | 1:2000 |

ReturnsFX implements a fee structure that includes spreads and commissions, impacting the overall cost for traders. In Forex trading, major currency pairs may experience spreads starting from 1.5 pips, but traders should exercise caution as these spreads can widen, especially for exotic pairs, potentially reaching up to 5 pips. The spread values are indicative and subject to change based on market conditions and account types.

Commissions are applicable, and the rates vary depending on the chosen account type. For example, the Standard Account might incur a commission of 0.03% per side on stock trades, while the Gold Account could feature a reduced commission rate of 0.02% per side. Commissions for other asset classes, including indices, commodities, and cryptocurrencies, also contribute to the overall trading costs. Traders are advised to thoroughly review the specific commission rates associated with their selected account type and preferred trading instruments, as these values can significantly impact the profitability of trades on the ReturnsFX platform.

ReturnsFX offers a straightforward process for deposits and withdrawals, aiming to provide convenience and accessibility to its users. The platform supports a variety of payment methods, including bank wire transfers, credit/debit cards, and popular e-wallet services. Traders can fund their accounts or withdraw profits using these methods, allowing for flexibility based on individual preferences.

For bank wire transfers, users can initiate transactions directly from their bank accounts to the ReturnsFX platform. While this method offers a traditional approach, it may take several business days for the funds to be processed and reflected in the trading account.

Credit/debit cards are widely accepted, providing a quick and convenient way to fund accounts. ReturnsFX likely supports major card providers, enabling users to make transactions securely. However, users should be aware of potential transaction fees associated with card payments.

Additionally, ReturnsFX acknowledges the growing popularity of e-wallets and likely supports widely used services in this category. E-wallets offer a swift and digital means of depositing or withdrawing funds, reducing processing times compared to traditional methods.

It's crucial for traders to carefully review the specific terms, conditions, and any associated fees related to deposits and withdrawals on the ReturnsFX platform. Additionally, understanding the processing times for each method can help users plan their financial activities more effectively.

ReturnsFX provides traders with a choice between two widely recognized and robust trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are popular among retail traders and are known for their user-friendly interfaces, advanced charting tools, and comprehensive features that cater to various trading styles.

MetaTrader 4 (MT4) remains a staple in the trading industry due to its simplicity and efficiency. Traders using MT4 can access real-time price quotes, interactive charts, and a plethora of technical analysis tools. The platform supports the implementation of automated trading strategies through Expert Advisors (EAs), allowing for algorithmic trading.

MetaTrader 5 (MT5) is the successor to MT4 and comes with additional features and capabilities. Traders using MT5 benefit from extended timeframes, an economic calendar, and an expanded set of order types, providing more tools for in-depth market analysis. Similar to MT4, MT5 supports algorithmic trading, empowering users to customize and automate their trading strategies.

Both MT4 and MT5 are versatile platforms accessible across desktop computers, web browsers, and mobile devices (iOS and Android). This flexibility ensures that traders can engage in the financial markets seamlessly, whether at home or on the go. The inclusion of these MetaTrader platforms positions ReturnsFX as a broker committed to offering a reliable and technologically advanced trading experience to its users.

ReturnsFX provides customer support through various channels to address traders' inquiries and concerns. Traders can reach out to the support team via email at support@returnsfx.com. Email communication allows users to articulate their questions or issues in writing, providing a record of their correspondence with the support team. However, the absence of specific details, such as operating hours or additional contact methods, may pose challenges for traders seeking real-time assistance or urgent queries.

The contact form on the ReturnsFX website allows traders to submit their full name, email address, and message. This form serves as an additional avenue for users to get in touch with the support team. While the form provides a structured way to convey messages, the effectiveness and responsiveness of this communication method may depend on the promptness of the support team in addressing submitted queries.

ReturnsFX does not explicitly mention a direct phone line for customer support, and the available contact options seem limited to email and the online form. The lack of a phone support option may be a drawback for traders who prefer immediate assistance or need to resolve urgent issues in real-time.

Traders considering ReturnsFX should be mindful of the available support channels and evaluate them based on their individual preferences and requirements for timely and effective assistance.

ReturnsFX offers educational resources focused on forex education and market analysis to assist traders in enhancing their knowledge and skills in the financial markets. The platform aims to provide valuable insights and educational materials to both beginners and experienced traders.

The forex education section includes a variety of resources such as articles, tutorials, and guides covering fundamental concepts, trading strategies, and technical analysis. These materials are designed to cater to traders at different experience levels, offering a comprehensive learning experience.

In addition to educational content, ReturnsFX provides market analysis reports to keep traders informed about current market trends and potential trading opportunities. These reports, prepared by experienced analysts, offer insights into various currency pairs and market dynamics. The combination of educational resources and market analysis is intended to empower traders with the knowledge needed to make informed trading decisions.

While the specifics of the educational resources, such as the depth of content and the frequency of updates, are not detailed, the emphasis on forex education and market analysis reflects ReturnsFX's commitment to supporting traders in their journey to navigate the complexities of the financial markets. Traders may find these resources valuable for staying informed and honing their trading skills.

ReturnsFX provides a Bonus Program that offers various welcome offers to clients, aiming to enhance the trading experience and potentially increase profitability. These welcome offers are designed to cater to the needs of both new and experienced traders, providing additional incentives for engaging in trading activities on the platform.

While the specific details of the welcome offers, such as the nature of bonuses and the criteria for eligibility, are not explicitly mentioned, the Bonus Program suggests that clients can access different promotions to make their trading more profitable. It's common for brokers to offer bonuses as a way to attract and retain traders, providing them with additional funds or benefits to amplify their trading potential.

Traders interested in maximizing their trading opportunities may explore the available welcome offers through ReturnsFX. It's essential for traders to carefully review the terms and conditions associated with each bonus to ensure a clear understanding of how the bonus program operates and how it may impact their overall trading strategy.

ReturnsFX offers a versatile trading environment with a diverse range of trading instruments and account types, catering to traders with varying preferences. The platform provides flexibility through its leverage options, allowing traders to control larger positions. However, it's crucial to note the absence of regulatory oversight, posing potential risks related to fund safety and transparency. Traders must carefully weigh the platform's advantages, such as the comprehensive instrument offering and flexible accounts, against the disadvantages associated with its unregulated status.

Q: Is ReturnsFX a regulated broker?

A: No, ReturnsFX is not regulated by any recognized financial regulatory authority.

Q: What trading instruments are available on ReturnsFX?

A: ReturnsFX offers a diverse range of trading instruments, including forex, cryptocurrencies, indices, stocks, energy commodities, and commodities.

Q: What leverage options does ReturnsFX provide?

A: ReturnsFX offers flexible leverage options, with leverage up to 1:500 on major currency pairs and varying ratios for other asset classes.

Q: How can I deposit and withdraw funds on ReturnsFX?

A: ReturnsFX supports multiple methods for deposits and withdrawals, including bank wire transfers, credit/debit cards, and popular e-wallet services.

Q: What trading platforms does ReturnsFX offer?

A: ReturnsFX provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering a user-friendly interface and advanced trading features.

Wikifx previously exposed fraudulent broker Cappmorefx for the massive fraud cases it dealt with. Victims complained to us regarding their issues with this particular broker, and we helped all the complainants by publishing their fraud stories in order to expose the broker.

WikiFX

WikiFX

In this review article, we shed light on Returnsfx, a broker formerly known as Cappmorefx, which has gained notoriety for its alleged involvement in a Ponzi scheme and subsequent rebranding. We will examine the claims made against this broker and the warnings issued by independent sources, notably WikiFX, to advise potential investors on the risks associated with Returnsfx.

WikiFX

WikiFX

More

User comment

1

CommentsWrite a review

2023-12-15 19:13

2023-12-15 19:13