CG FinTech Information

Established in 2024 and registered in Mauritius, CG FinTech operates as a broker offshore regulated by the Financial Services Commission (FSC). The company offers six asset classes: forex, indices, precious metals, cryptocurrencies, stocks, and energies. It also provides access to the MT4 trading platform and supports the use of demo accounts.

CG FinTech says it focuses on enhancing the accessibility of financial services through technological innovation and compliance practices, with operations spanning over 100 countries worldwide. The company supports businesses and traders and offers tailored solutions.

Pros and Cons

Is CG FinTech Legit?

CG FinTech is under the offshore regulation of The Financial Services Commission(FSC), holding License number C118023669.

What Can I Trade on CG FinTech?

CG FinTech offers six asset classes, including forex, indices, precious metals, cryptocurrencies, stocks, and energies, with access to over 300 popular trading products.

- Forex: Trade over 30 currency pairs with light execution speeds.

- Indices: Access major global indices with zero commissions.

- Precious Metals: Trade Gold and Silver crosses with spreads starting from 0.1 pips.

- Cryptocurrencies: Instantly access top cryptocurrencies like Bitcoin and Ethereum. Trade pairs like BTC/USD, ETH/USD, LTC/USD, and more.

- Stocks: Trade shares of world-renowned companies.

- Energies: Trade three types of energy commodities via CFDs.

Account Types

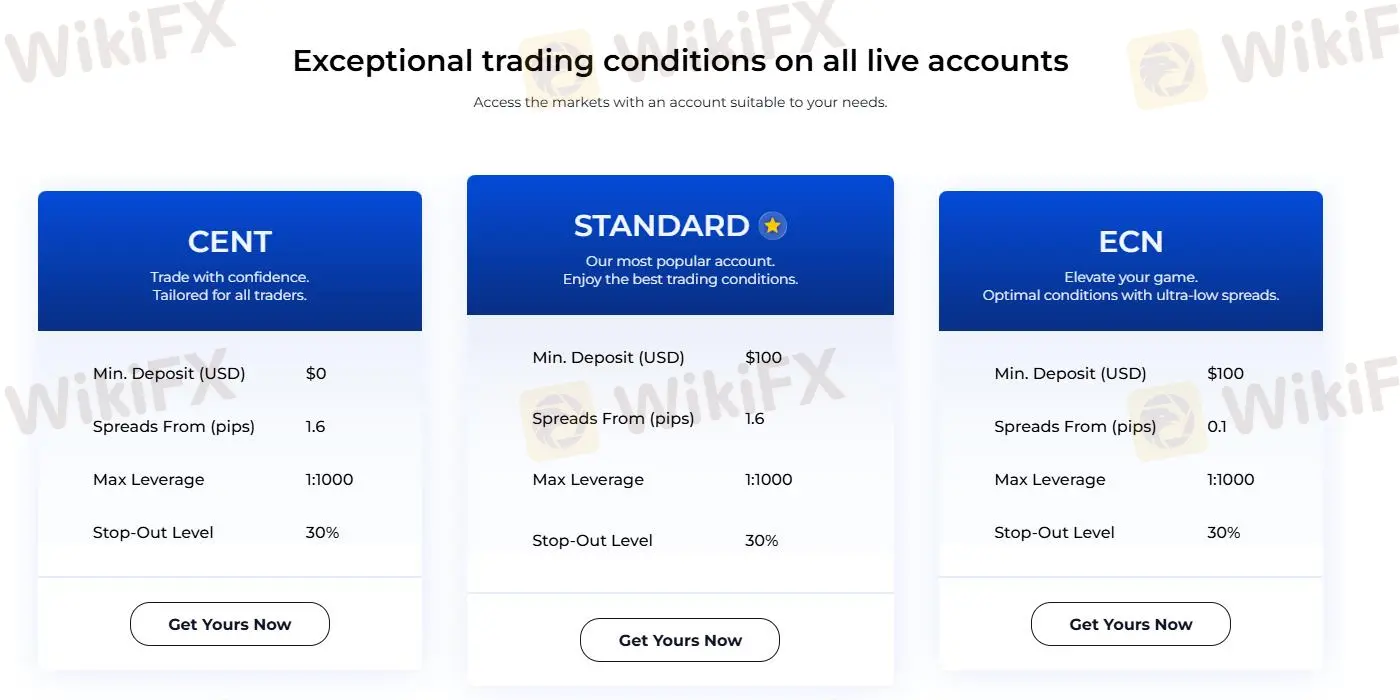

CG FinTech offers three types of accounts: ECN Account, CENT Account, and STANDARD Account. It also offers demo accounts for traders.

The minimum deposit required for an ECN account is $100, spreads start at 0.1 and a commission of $3 is payable. In contrast, CENT and STANDARD accounts require a minimum deposit of $0 and $100 respectively, both of which are commission-free, but with spreads starting at 1.6.

To open an account, There are three steps.

1. Registration: Click on ‘Register’ and fill in your personal details to register for free.

2. Deposit: Open an account and make a deposit through the secure payment gateway.

3. Trading: Download the trading platform and login with credentials to start trading.

Leverage

ECN Account, CENT Account, and STANDARD Account have a leverage of 1:1000. High leverage means high returns but also high risk.

CG FinTech Fees

CG FinTech's spread and commission structure differ across account types.

The ECN Account offers spreads starting from 0.1 and charges a commission of $3, while both the CENT Account and STANDARD Account have spreads starting from 1.6 but do not charge any commission.

Here is the fees comparison table:

Trading Platform

Spring Gold Market offers traders the MetaTrader 4 platform.

Deposit & Withdrawal

CG FinTech offers deposit methods including cryptocurrency, local bank transfers, credit card payments, and wire transfers.

Deposit Policy: CG FinTech offers a zero-fee policy for deposits.

Minimum Withdrawal: $50.00 USD or the equivalent in any supported local currency.

Withdrawal Processing Time:

- Requests are processed within one business day.

- The time for funds to reach the bank account depends on the bank's policy.

- Bank wire withdrawals may take 2 to 5 business days.

5-10 years

5-10 years

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX