User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index6.00

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded year | Within 1 year |

| Company Name | Loyal Brokers |

| Regulation | Unauthorized and unregulated |

| Minimum Deposit | Classic: $100, PRO: $1000<br>ECN: $1000 |

| Maximum Leverage | 1:500 |

| Spreads | Not specified on the website |

| Trading Platforms | Metatrader 5 (MT5), MT5 Mobile App, Automated Technology Analysis Tool |

| Tradable assets | Forex (60+ currency pairs), Precious Metals, Stock Index/Stock, CFDs |

| Account Types | Classic, PRO, ECN |

| Demo Account | N/A |

| Islamic Account | N/A |

| Customer Support | Email: support@loyalmarkets-svg.com, support@loyalbrokers-svg.com, Phone: +44 20 7946 0237, Skype: loyal.brokers |

| Payment Methods | Vietcombank, Mastercard, VISA, Skrill, NETELLER, Perfect Money, UnionPay |

| Educational Tools | Economic Calendar |

Loyal Brokers is an unauthorized and unregulated financial service provider based in the United Kingdom. It offers access to the forex market with over 60 currency pairs and leverage of up to 400:1. Additionally, clients can trade precious metals like gold and silver with leverage up to 100 times for gold and 50 times for silver. The broker also provides access to major global stock indexes and European and American listed stocks, offering higher leverage options compared to traditional stock markets. Furthermore, Loyal Brokers offers a variety of CFDs catering to different investment preferences, allowing investors to align their portfolios accordingly.

The broker provides three types of trading accounts: Classic, PRO, and ECN, each with specific features and minimum deposit requirements. The Classic account requires a minimum deposit of $100, while the PRO and ECN accounts have higher minimum deposits of $1000. Loyal Brokers offers a maximum leverage of 1:500, and although the website does not provide specific information about spreads and commissions, it charges zero fees for account opening.

The trading platform offered is Metatrader 5 (MT5), providing extensive analysis tools with over 50 indicators and nine time quotes for detailed market analysis. Traders can execute instant and pending orders on the platform. Loyal Brokers also integrates an award-winning automated analysis tool into its platform, utilizing advanced graphics recognition engines for identifying trading opportunities and predicting price trends. The broker supports multiple payment methods and offers customer support through email, phone, and Skype channels. However, it is essential to note that Loyal Brokers lacks valid regulation and has been flagged as having an abnormal regulatory status, raising concerns about its legitimacy and reliability. Potential clients should exercise caution and consider the associated risks when dealing with this broker.

Loyal Brokers, based in the United Kingdom, presents both advantages and drawbacks to potential traders. On the positive side, it grants access to the forex market, along with leverage of up to 500:1, enabling traders to take larger positions relative to their invested capital. Additionally, clients can trade precious metals and enjoy diverse CFD options with a low threshold. The platform utilizes MT5, providing advanced analysis tools for comprehensive market analysis. Furthermore, it supports multiple payment methods and offers an economic calendar to keep traders informed. However, caution is essential as Loyal Brokers is an unauthorized and unregulated financial service provider, and specific information about market instruments, spreads, commissions, and trading conditions remains undisclosed. Moreover, the lack of a demo account and limited information on withdrawals and deposits may pose challenges for potential clients.

| Pros | Cons |

| Offers access to forex market | Unauthorized and unregulated financial service provider |

| Provides leverage of up to 500:1 | Limited types of market instruments |

| Allows trading of precious metals | No information on specific market instruments provided |

| Diverse CFD options with low threshold | No demo account available |

| Different account types with high leverage | Lack of specific information on trading conditions and execution quality |

| MT5 platform with advanced analysis tools | Specific spreads and commissions not disclosed on the website |

| Supports various payment methods | Minimum deposit requirements vary for different account types |

| Offers automated analysis tool | Limited information on withdraws and deposit |

| Provides economic calendar | Limited trading tools available |

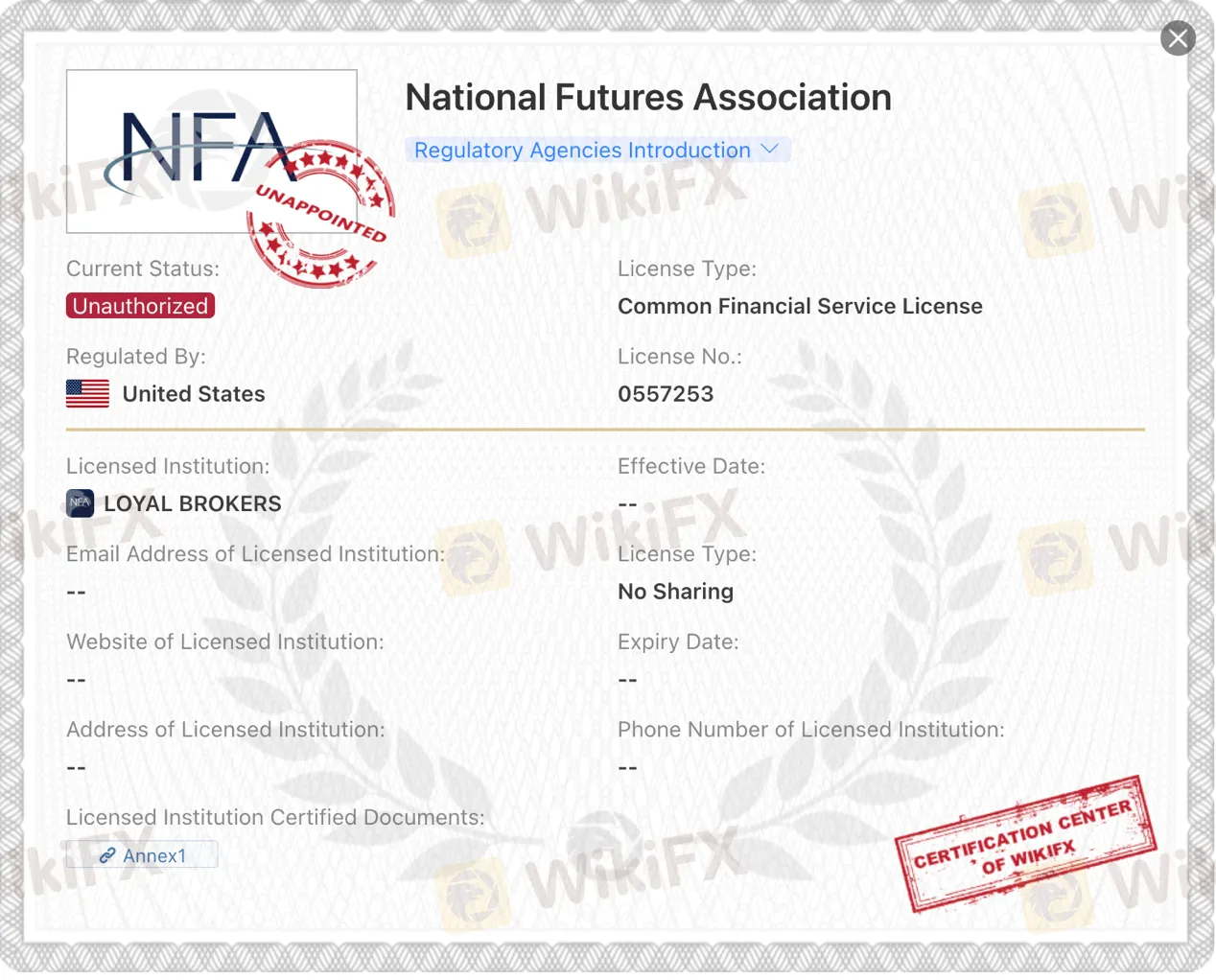

Loyal Brokers is an unauthorized and unregulated financial service provider. It lacks a valid regulation and exceeds the business scope regulated by the United States National Futures Association (NFA) under license number 0557253. It has been flagged as having an abnormal regulatory status. As such, it is crucial to be cautious of the associated risks when dealing with this broker. Additionally, the broker's website, email address, phone number, and certified documents have not been provided, raising further concerns about its legitimacy and reliability. Potential clients should exercise caution and consider the risks before engaging with Loyal Brokers.

Forex:

Loyal Brokers offers access to the forex market, which is the largest financial market globally. Traders can choose from over 60 currency pairs and enjoy leverage of up to 400:1. The market operates 24 hours a day, 5 days a week, with T+0 bilateral transaction capabilities.

Precious Metals:

Clients can trade precious metals like gold and silver, which are popular hedging assets. The leverage for gold products can go up to 100 times, while silver products offer leverage up to 50 times. The transaction threshold is extremely low, making it accessible to a wide range of investors.

The Stock Index/Stock:

Loyal Brokers provides access to 20 major global stock indexes, along with more than one hundred well-known European and American listed stocks. Traders can leverage above what traditional stock markets offer, providing potential opportunities for profit.

CFD:

The broker offers a variety of CFDs (Contracts for Difference) that cater to different investment preferences. With diverse asset choices, investors can align their portfolios to meet specific asset allocation requirements.

| Pros | Cons |

| Access to the forex market, the largest financial market globally | Unregulated financial service provider |

| Trading precious metals with high leverage and low transaction threshold | Limited information on specific market instruments provided |

| Access to major global stock indexes and over one hundred listed stocks | Lack of specific information on trading conditions and execution quality |

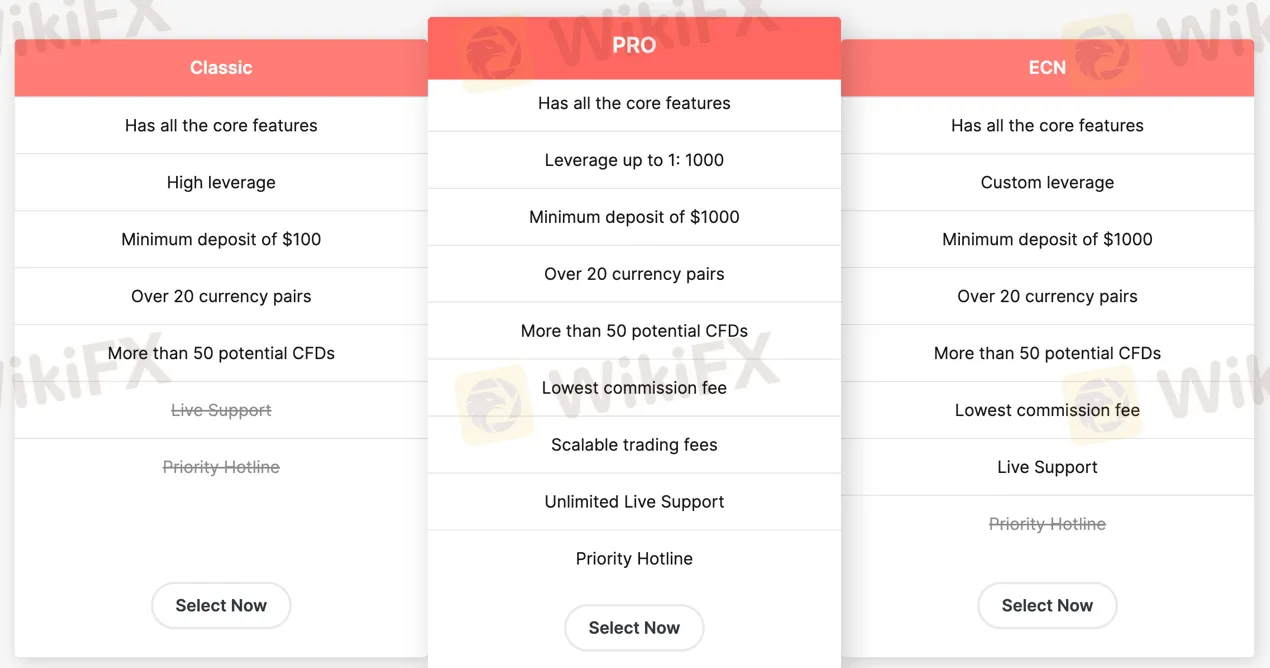

Classic: This account type offered by Loyal Brokers includes all the core features necessary for trading. It provides high leverage options and requires a minimum deposit of $100. Traders using the Classic account can access over 20 currency pairs and more than 50 potential CFDs.

PRO: The PRO account at Loyal Brokers also encompasses all the core features for trading. It offers leverage up to 1:1000 and has a higher minimum deposit requirement of $1000. Similar to the Classic account, it provides access to over 20 currency pairs and more than 50 potential CFDs. The PRO account stands out with its lowest commission fees, scalable trading fees, and additional perks like Unlimited Live Support and a Priority Hotline.

ECN: Loyal Brokers' ECN account, like the previous types, includes all the core features essential for trading. This account offers custom leverage options and requires a minimum deposit of $1000. Traders using the ECN account can access over 20 currency pairs and more than 50 potential CFDs. Similar to the PRO account, it also comes with the benefit of the lowest commission fees and Live Support.

| Pros | Cons |

| Classic account provides core trading features | No specific information on trading conditions and execution quality |

| PRO account offers high leverage and lowest commission fees | Lack of transparency on spreads and commissions |

| ECN account allows custom leverage options | Minimum deposit requirements vary for different account types |

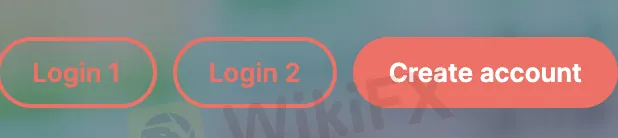

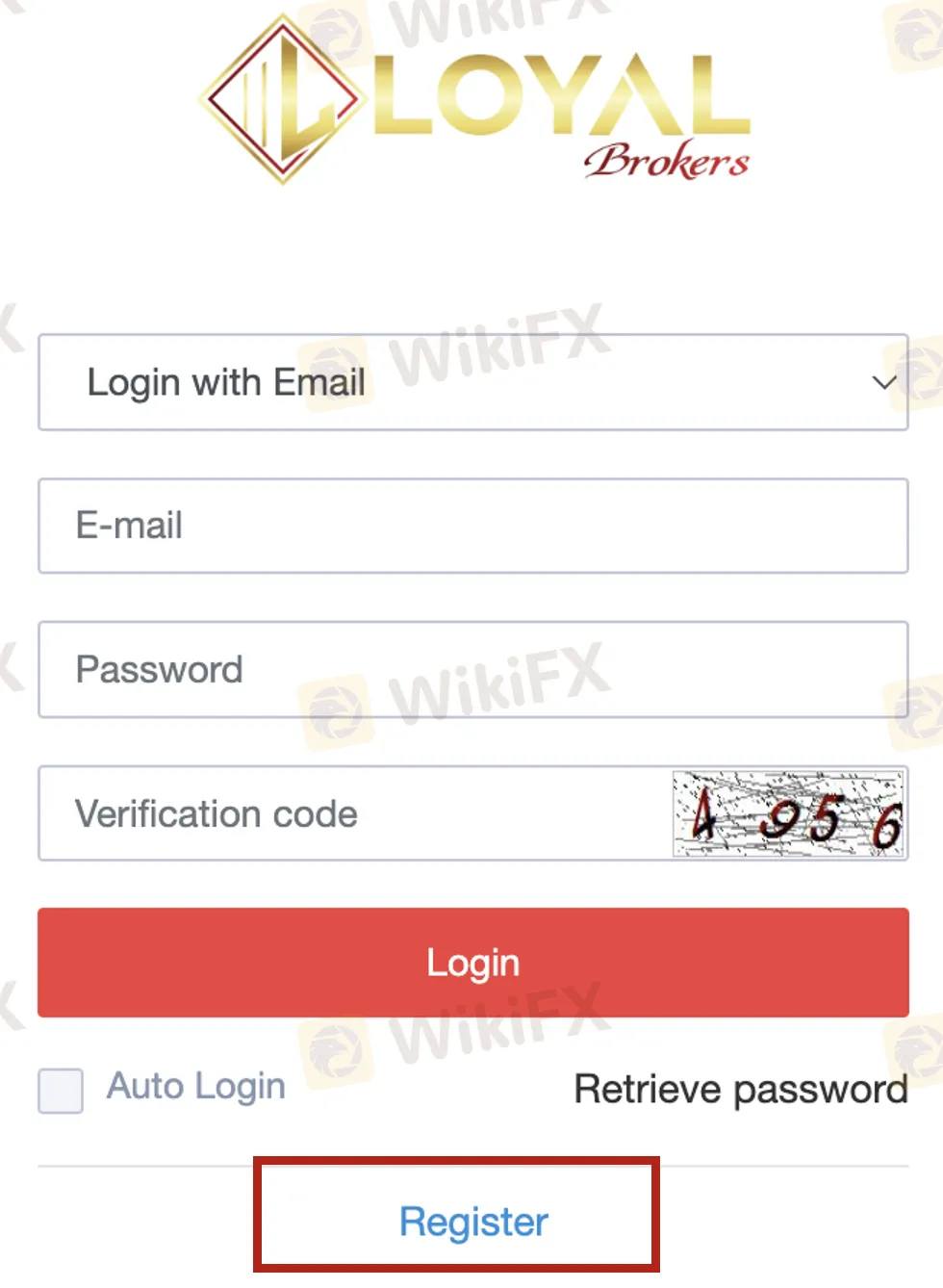

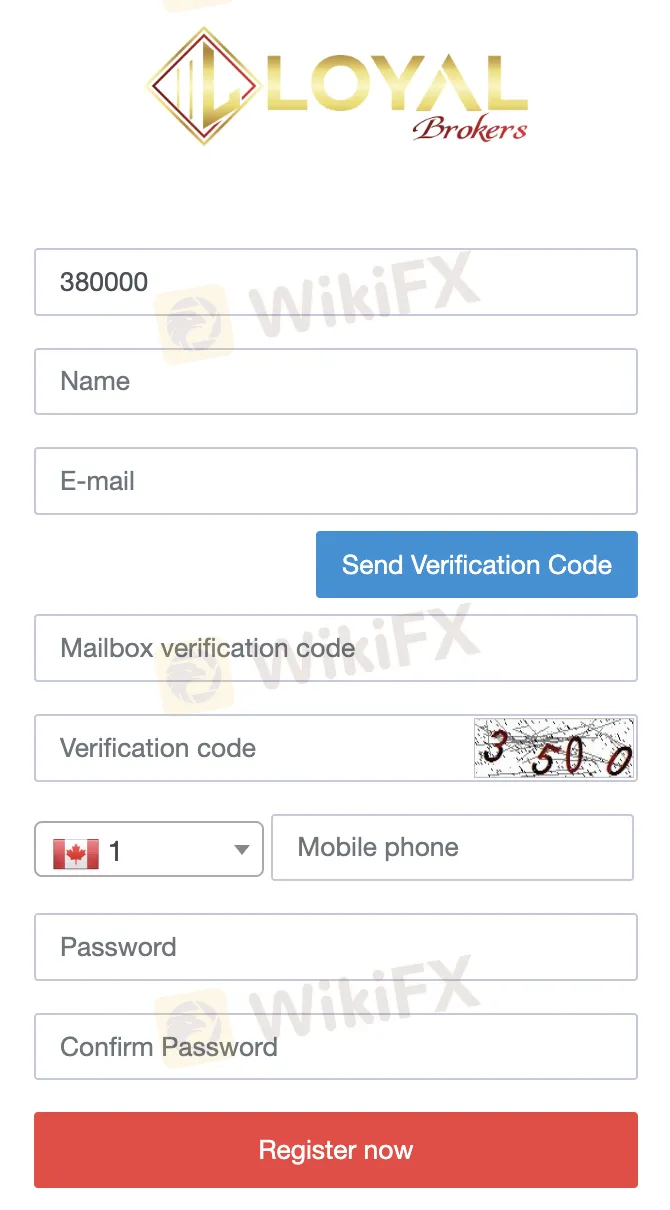

To open an account with Loyal Brokers, follow these steps:

Click on the “Create account” button on the website.

On the next page, click “Register” to proceed to the registration page.

3. Fill in your details, including your name, email address, and mobile phone number.

4. Complete the mailbox verification by entering the code sent to your email.

5. Set a password and confirm it for your account.

6. Finally, click on “Register now” to complete the account registration process.

Loyal Brokers offers a maximum leverage of 1:500, allowing traders to access higher positions in the market relative to their invested capital.

The website of Loyal Brokers does not provide specific information regarding their spreads and commissions at this time.

Loyal Brokers offers different account types with specific minimum deposit requirements. For the Classic account, the minimum deposit is $100, while for the ECN account, a higher minimum deposit of $1000 is required.

Loyal Brokers charges zero fees for account opening.

Metatrader 5 (MT5)

Loyal Brokers' MT5 provides extensive analysis tools, including over 50 indicators and nine time quotes for detailed market analysis. It offers two types of order execution - instant and pending – providing with comprehensive trading options. The platform's embedded graphic design and alarm tool aid in accurate price analysis and tracking entry and exit opportunities. MT5 is a popular choice globally and supports mobile trading on IOS devices.

MT5 Mobile App

Loyal Brokers' MT5 mobile app enables traders to access forex trading, technical analysis with 30 indicators, and account management from anywhere.

Loyal Brokers integrates an award-winning automated analysis tool into its platform. The tool utilizes advanced graphics recognition engines to continuously scan the market, identifying favorable trading opportunities and predicting price trends for multiple financial products. Traders can make informed decisions and implement strategies with this feature.

| Pros | Cons |

| Extensive analysis tools with over 50 indicators and nine-time quotes for detailed market analysis | No specific information on spreads and commissions |

| Two types of order execution (instant and pending) for trading options | Lack of transparency on trading conditions and execution quality |

| Award-winning automated analysis tool for identifying favorable trading opportunities | Limited information on withdrawals and deposits |

Loyal Brokers supports multiple payment methods, including Vietcombank, Mastercard, VISA, Skrill, NETELLER, Perfect Money, and UnionPay.

Loyal Brokers offers a comprehensive Economic Calendar as part of its educational tools, providing traders with up-to-date financial information. The calendar covers various economic events and announcements, such as interest rate decisions, GDP releases, and employment reports, enabling traders to stay informed and make well-informed trading decisions.

Loyal Brokers' trading hours start on Sunday at 21:00 GMT and end on Friday at 21:00 GMT.

Loyal Brokers offers customer support through various channels. Traders can reach them via email at support@loyalmarkets-svg.com and support@loyalbrokers-svg.com. Additionally, they can contact customer support by phone at +44 20 7946 0237 or through Skype at loyal.brokers.

Loyal Brokers, based in the United Kingdom, offers access to various trading instruments, including forex, precious metals, stock indexes, and CFDs. On the positive side, the broker provides a diverse range of market instruments, multiple account types, and a user-friendly trading platform. However, it is essential to note that Loyal Brokers operates as an unauthorized and unregulated financial service provider, which raises concerns about its legitimacy and reliability. Additionally, the lack of detailed information on fees and the absence of proper regulatory oversight should be carefully considered by potential clients before engaging with this broker for any trading activities.

Q: Is Loyal Brokers a regulated financial service provider?

A: No, Loyal Brokers is an unauthorized and unregulated financial service provider.

Q: What market instruments does Loyal Brokers offer?

A: Loyal Brokers offers access to Forex, precious metals, stock indexes/stocks, and CFDs.

Q: What are the account types available at Loyal Brokers?

A: Loyal Brokers offers Classic, PRO, and ECN account types.

Q: How can I open an account with Loyal Brokers?

A: To open an account, click on “Create account” on the website, fill in your details, and complete the registration process.

Q: What is the maximum leverage offered by Loyal Brokers?

A: Loyal Brokers offers a maximum leverage of 1:500.

Q: What trading platform does Loyal Brokers use?

A: Loyal Brokers uses Metatrader 5 (MT5) as its trading platform.

Q: What payment methods does Loyal Brokers support?

A: Loyal Brokers supports various payment methods, including Vietcombank, Mastercard, VISA, Skrill, NETELLER, Perfect Money, and UnionPay.

Q: What are the trading hours of Loyal Brokers?

A: Loyal Brokers' trading hours are from Sunday 21:00 GMT to Friday 21:00 GMT.

Q: How can I contact customer support at Loyal Brokers?

A: You can contact Loyal Brokers' customer support via email, phone, or Skype.

Q: Does Loyal Brokers provide an Economic Calendar for traders?

A: Yes, Loyal Brokers offers a comprehensive Economic Calendar as part of its educational tools.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment