User Reviews

More

User comment

7

CommentsWrite a review

2024-08-07 13:58

2024-08-07 13:58

2023-12-25 20:41

2023-12-25 20:41

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index0.00

Business Index6.39

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

WHIZ FX, LLC

Company Abbreviation

WHIZFX

Platform registered country and region

Saint Vincent and the Grenadines

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | Australia |

| Founded Year | 1-2 years ago |

| Company Name | WHIZ FX, LLC |

| Regulation | Suspicious Regulatory License |

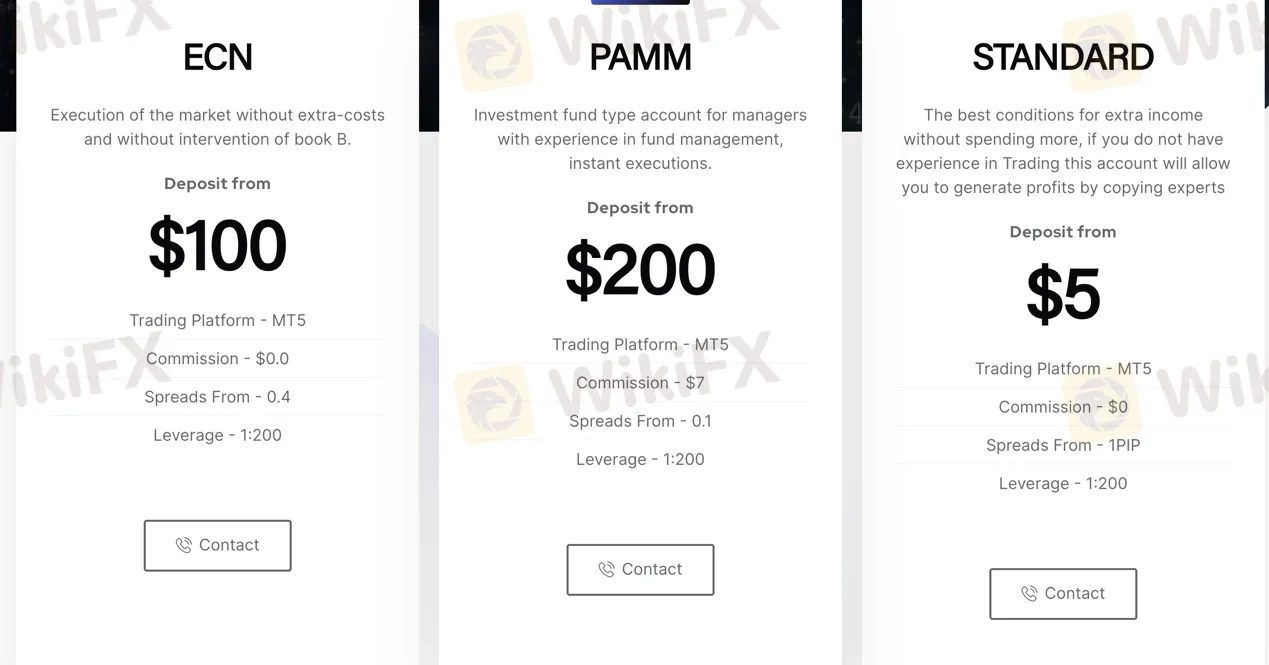

| Minimum Deposit | $5 (STANDARD), $100 (ECN), $200 (PAMM) |

| Maximum Leverage | 1:200 |

| Spreads | From 0.4 pips (ECN), 0.1 pips (PAMM) |

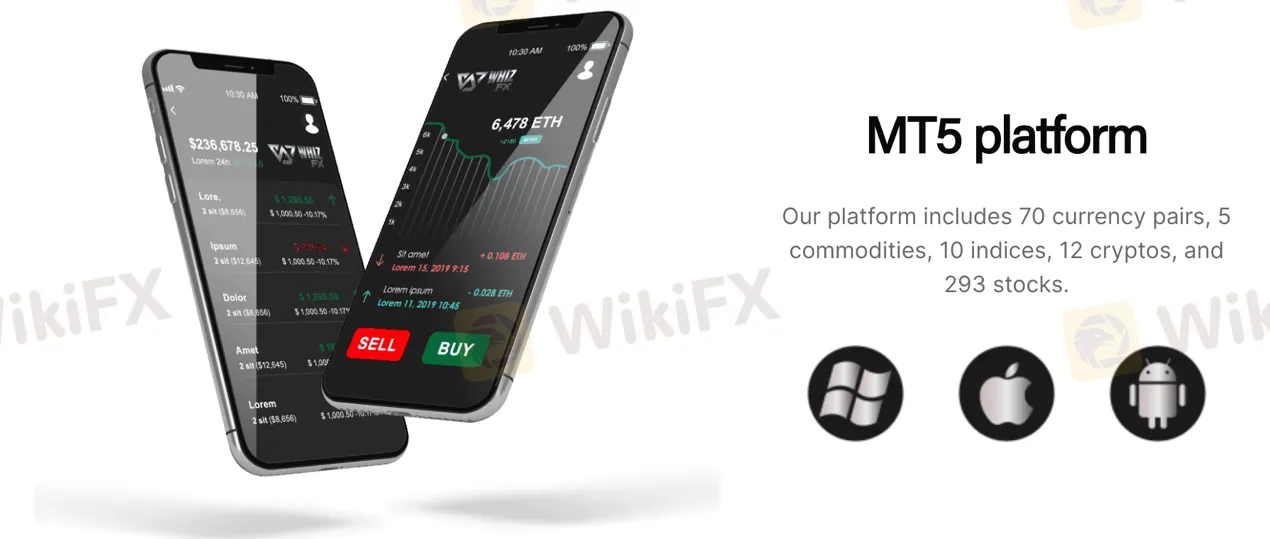

| Trading Platforms | MT5 |

| Tradable Assets | 70 currency pairs, 5 commodities, 10 indices, 12 cryptocurrencies, 293 stocks |

| Account Types | ECN, PAMM, STANDARD |

| Demo Account | Available |

| Islamic Account | Available |

| Customer Support | Website form, phone call, live chat, social media |

| Payment Methods | N/A |

WHIZFX, LLC is a brokerage company based in Australia. However, it is important to note that there are suspicious regulatory license issues associated with this broker, as verified by sources. The lack of valid regulation raises potential risks for traders, and it is advisable to approach this broker with caution and carefully consider the implications before engaging in any financial activities with them.

WHIZFX offers a range of market instruments to its traders, including 70 currency pairs, 5 commodities, 10 indices, 12 cryptocurrencies, and 293 stocks. Traders can participate in Forex trading, speculating on the fluctuations in exchange rates between global currencies. Additionally, WHIZFX provides access to cryptocurrency trading, allowing users to buy and sell popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Contracts for Difference (CFDs) are also available, enabling traders to speculate on the price movements of various financial assets without owning the underlying assets.

WHIZFX offers three different account types: ECN, PAMM, and STANDARD, each catering to different trading preferences and experience levels. The ECN account provides market execution without additional costs, while the PAMM account is suitable for experienced fund managers. The STANDARD account is designed for generating additional income by copying trading strategies from experts. It is important to note that WHIZFX lacks valid regulation, so caution is advised when considering these account types.

WHIZFX, a brokerage firm, has its own set of pros and cons. On the positive side, they offer three different account types tailored to meet the preferences and experience levels of traders. They also provide demo and Islamic accounts, catering to different needs. The spreads offered by WHIZFX start from as low as 0.1 pips, which can be advantageous for traders. Additionally, the leverage ratio of up to 1:200 can potentially amplify trading positions. WHIZFX utilizes the popular MT5 trading platform, which is known for its versatility and features. They also offer social trading technologies, allowing users to benefit from the expertise of experienced traders. However, there are several drawbacks. Firstly, WHIZFX lacks valid regulation, which raises concerns about the safety and security of traders' funds. There have been allegations of operating a ponzi/pyramid scheme, which further adds to the doubts surrounding the broker's integrity. The lack of specific information about market instruments offered by WHIZFX makes it difficult for potential traders to evaluate the available options. Additionally, there is a lack of information regarding deposit and withdrawal processes. Furthermore, WHIZFX does not provide sufficient educational resources for traders to enhance their knowledge and skills in the financial markets.

| Pros | Cons |

| Provides three different account types for various preferences and experience levels | Lacks valid regulation |

| Demo and Islamic accounts available | Allegations of operating a ponzi/pyramid scheme |

| Spreads from 0.1 pips | No specific information about market instruments provided |

| Leverage up to 1: 200 | Lack of information about deposit and withdraw |

| Offers the popular MT5 trading platform | Lack of educational resources |

| Provides social trading technologies |

WHIZFX, a broker in question, lacks valid regulation according to verification sources. This absence of regulation poses potential risks to traders. It is important to exercise caution and carefully consider the implications before engaging in any financial activities with this broker.

WHIZFX offers a variety of Market Instruments to its traders, including 70 currency pairs, 5 commodities, 10 indices, 12 cryptocurrencies, and 293 stocks.

Forex: One of the available options is Forex trading, where users can engage in the buying and selling of different currency pairs. This allows traders to speculate on the fluctuations in exchange rates between various global currencies. Examples of forex instruments commonly traded include EUR/USD, GBP/JPY, and USD/CAD.

Forex: In addition to forex, WHIZFX provides access to cryptocurrency trading. Traders can participate in the buying and selling of popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). This enables users to take advantage of the price volatility and potential profit opportunities within the cryptocurrency market.

CFDs: Furthermore, WHIZFX offers Contracts for Difference (CFDs) as another trading instrument. CFDs allow traders to speculate on the price movements of various financial assets without actually owning the underlying assets. Examples of CFDs available for trading through WHIZFX may include stock indices like the S&P 500, commodities such as gold and oil, and individual company shares.

For more detailed information about the market instruments offered by WHIZFX, it is advisable to contact the company directly. They will be able to provide specific details regarding the available trading options, including any additional instruments or asset classes that may be offered.

Pros and Cons

| Pros | Cons |

| Offers Contracts for Difference (CFDs) | No specific examples or charts provided |

| Offers access to Forex trading with currency pairs | Lack of detailed information about market options |

| Provides cryptocurrency trading opportunities |

WHIZFX offers three different account types: ECN, PAMM, and STANDARD, each with its own features and suitability for various trading preferences and experience levels.

ECN:

The ECN (Electronic Communication Network) account type offered by WHIZFX provides traders with market execution without additional costs and without the intervention of a book B. Traders can open this account type with a minimum deposit of $100. The trading platform available for ECN accounts is MT5. There is no commission charged for trades, and spreads start from 0.4 pips. The leverage offered for ECN accounts is 1:200. For further information or assistance, traders can contact the company.

PAMM:

WHIZFX offers a PAMM (Percentage Allocation Management Module) account type, which is suitable for experienced fund managers. This type of account functions as an investment fund, providing instant executions. To open a PAMM account, a minimum deposit of $200 is required. The trading platform available for PAMM accounts is MT5. The commission charged for trades on PAMM accounts is $7, and spreads start from 0.1 pips. The leverage offered for PAMM accounts is 1:200. Traders interested in this account type can contact the company for more details.

STANDARD:

The STANDARD account type provided by WHIZFX is designed to offer favorable conditions for generating additional income without requiring extensive trading experience. This account allows traders to generate profits by copying trading strategies from experts. The minimum deposit required to open a STANDARD account is $5. The trading platform available for STANDARD accounts is MT5. There is no commission charged for trades, and spreads start from 1 pip. The leverage offered for STANDARD accounts is 1:200. Traders can reach out to the company for further information or assistance regarding the STANDARD account.

WHIZFX offers a demo account option for traders. The demo account allows users to practice and familiarize themselves with the trading platform and its features without risking real money.

In addition, WHIZFX also provides Islamic accounts to cater to traders who adhere to Islamic principles. Islamic accounts are designed to be compliant with Sharia law, ensuring that trading activities are conducted in a manner that aligns with Islamic finance principles.

Pros and Cons

| Pros | Cons |

| Provides three account types for different trading preferences and experience levels | Minimum deposit of $200 for PAMM account |

| Offers a demo account and Islamic accounts | |

| No commission for standard account |

The leverage offered by WHIZFX for their various account types is set at 1:200, allowing traders to potentially amplify their trading positions relative to their invested capital.

WHIZFX offers spreads starting from as low as 0.4 pips for ECN accounts and 0.1 pips for PAMM accounts. The broker does not charge any commission for trades on ECN and STANDARD accounts, while PAMM accounts have a commission of $7 per trade.

MT5 Platform:

WHIZFX offers the MT5 platform, which provides a wide range of trading options. Traders can access a diverse selection of financial instruments, including 70 currency pairs, 5 commodities, 10 indices, 12 cryptocurrencies, and 293 stocks. The MT5 platform is known for its versatility and is designed to cater to the needs of various traders.

WHIZFX provides a mobile trading platform that is compatible with both Windows and iOS systems. This allows traders to access the markets and manage their trades on their mobile devices. The mobile platform offers a user-friendly interface and enables traders to monitor their positions, execute trades, and access essential market information while on the go.

WHIZFX also emphasizes reduced spreads, allowing for fast executions using specialized software and Expert Advisors (EAs). The broker does not increase SWAP costs and offers the option to apply for Islamic accounts for those seeking to comply with Sharia principles.

Pros and Cons

| Pros | Cons |

| Wide range of trading options on the MT5 platform | MT5 platform can be complex for beginners |

| Mobile trading platform for trade management | The mobile platform does not offer all the features of the MT5 platform |

| Emphasis on reduced spreads for fast executions | No alternative platforms available |

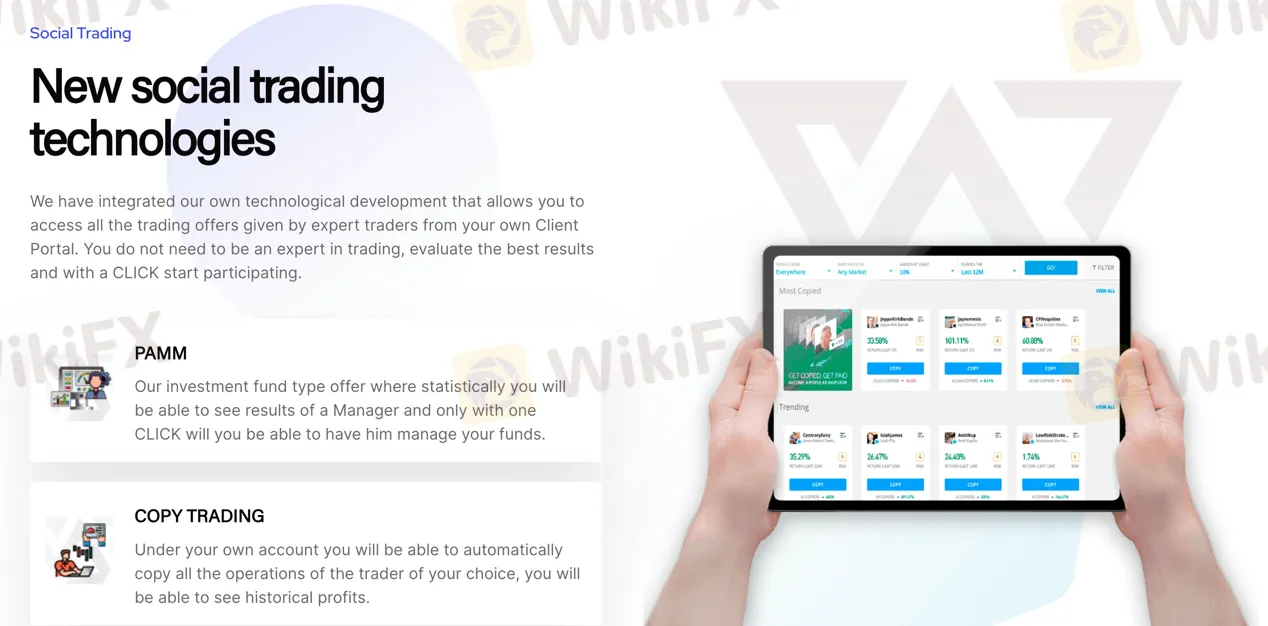

Social Trading is a feature offered by WHIZFX that allows users to leverage the expertise of experienced traders and managers. Through their Client Portal, users can access a range of trading opportunities provided by these experts without requiring extensive trading knowledge. There are two types of social trading available: PAMM and Copy Trading.

1. PAMM: WHIZFX offers an investment fund option where users can view the performance of a Manager and easily manage their funds with a single click. This allows investors to benefit from the skills and results of experienced traders.

2. Copy Trading: Under their own account, users can automatically replicate the trading activities of a chosen trader. They can review the historical profits of these traders and select the ones that suit their preferences. This enables investors to mirror the trades of successful traders and potentially achieve similar results.

The social trading technology provided by WHIZFX offers several value-added benefits. Users can access statistics of different traders, evaluate the risk associated with each trade, and make informed decisions based on their preferences. The platform also emphasizes speed and ease of use, allowing users to connect and follow professional strategies with just a click.

Monitoring tools are available to users, including constant graphs and statistics that track the movement of their accounts. For PAMM users, this includes the ability to monitor joint investment funds. Managers can access new capital through the PAMM tool and collect fees on their earnings, while investors can view the results of each trade closed by the manager and have control over the risk of their capital.

In the case of Copy Trading, successful traders can share their results on the platform and allow others to replicate their trades. They can charge fees on the profits generated by the copied trades. Investors who are not experienced in trading can select a trader from the portal and copy their strategy. They only need to pay fees based on the profits earned.

The interface provided by WHIZFX offers a comprehensive domain interface where users can view their account statements, track profits and losses, assess the risk associated with each trade, and easily connect or disconnect from PAMM or Copy Trading. It provides a user-friendly experience for both investors and traders, facilitating seamless interaction and execution of trades.

WHIZFX provides various channels for customer support. Users can send a message through the website by filling out a form with their name, company, phone number, email, subject, and message. Additionally, WHIZFX is active on social media platforms such as Facebook, Instagram, Twitter, and YouTube, allowing customers to follow their updates and potentially reach out for assistance.

For more direct communication, customers can call WHIZFX at the provided phone number, which is +61 280057907. However, it is important to note that this information is subject to change and should be verified independently. WHIZFX also offers a live chat feature on their website.

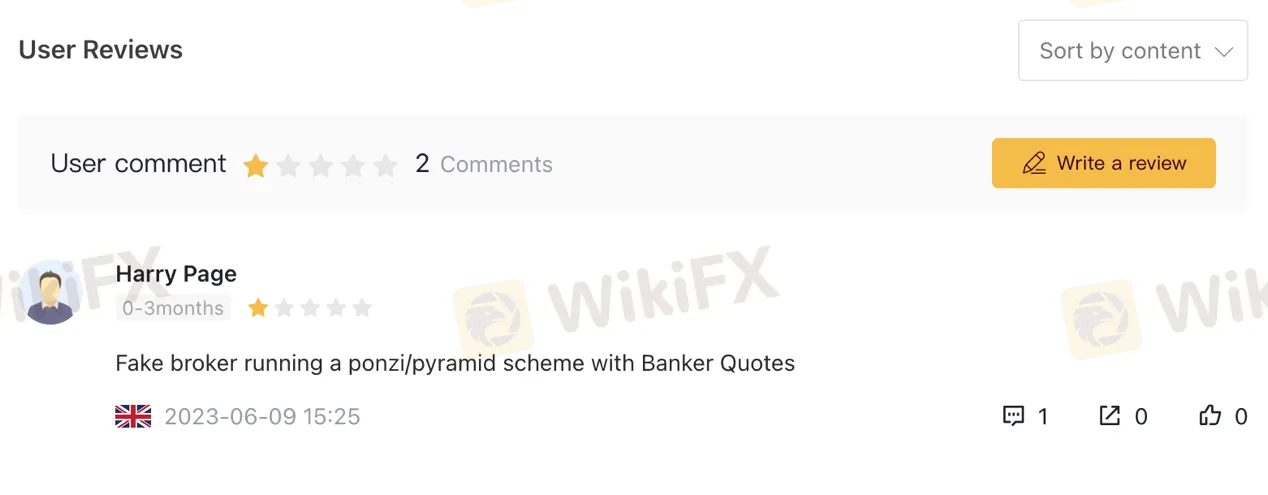

According to the review by Harry Page on WikiFX, WHIZFX is perceived as a fake broker that is allegedly operating a ponzi/pyramid scheme, accompanied by the use of Banker Quotes. The comment raises concerns about the legitimacy and integrity of the brokerage, warning potential users to exercise caution when dealing with them.

In conclusion, WHIZFX lacks valid regulation according to verification sources, which raises potential risks for traders. The broker offers a variety of market instruments, including forex, cryptocurrencies, and CFDs, but caution should be exercised due to the suspicious regulatory license. WHIZFX provides three account types with different features, leverage of 1:200, and spreads starting from 0.4 pips. The broker uses the MT5 platform and offers social trading technologies such as PAMM and Copy Trading. Customer support is available through various channels, including a phone number and live chat. However, it is important to note that WHIZFX has received negative reviews, raising concerns about its legitimacy and integrity as a broker.

Q: Is WHIZFX a legitimate broker?

A: WHIZFX lacks valid regulation and poses potential risks to traders.

Q: What market instruments does WHIZFX offer?

A: WHIZFX offers forex, cryptocurrencies, and CFDs on indices, commodities, and stocks.

Q: What are the different account types offered by WHIZFX?

A: WHIZFX offers ECN, PAMM, and STANDARD accounts.

Q: What is the leverage offered by WHIZFX?

A: WHIZFX offers a leverage of 1:200.

Q: What are the spreads and commissions at WHIZFX?

A: Spreads start from 0.4 pips for ECN accounts and 0.1 pips for PAMM accounts. ECN and STANDARD accounts have no commission, while PAMM accounts have a $7 commission per trade.

Q: Which trading platform does WHIZFX use?

A: WHIZFX uses the MT5 platform.

Q: Does WHIZFX offer social trading?

A: Yes, WHIZFX offers social trading through PAMM and Copy Trading.

Q: How can I contact customer support at WHIZFX?

A: You can contact WHIZFX through their website, social media platforms, phone number, or live chat feature.

Q: What do the reviews say about WHIZFX?

A: According to a review on WikiFX, there are concerns about WHIZFX's legitimacy and integrity.

More

User comment

7

CommentsWrite a review

2024-08-07 13:58

2024-08-07 13:58

2023-12-25 20:41

2023-12-25 20:41