User Reviews

More

User comment

12

CommentsWrite a review

2023-08-28 19:36

2023-08-28 19:36

2023-08-28 01:01

2023-08-28 01:01

Score

Influence

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index6.35

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

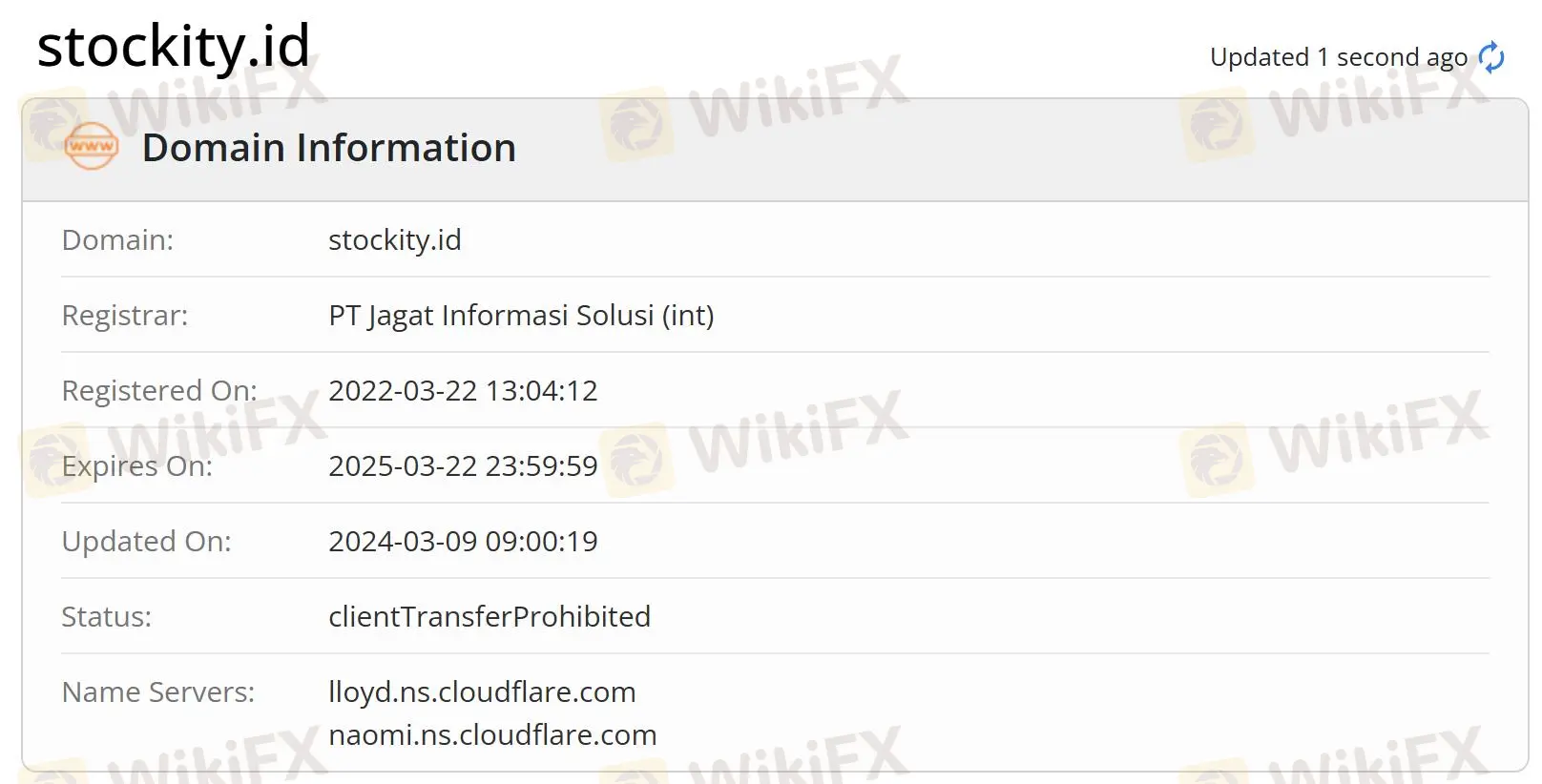

Company Name

Caracol Ltd

Company Abbreviation

Stockity

Platform registered country and region

Marshall Islands

Company website

Company summary

Pyramid scheme complaint

Expose

| StockityReview Summary | |

| Founded | 2022 |

| Registered Country/Region | Marshall Islands |

| Regulation | No regulation |

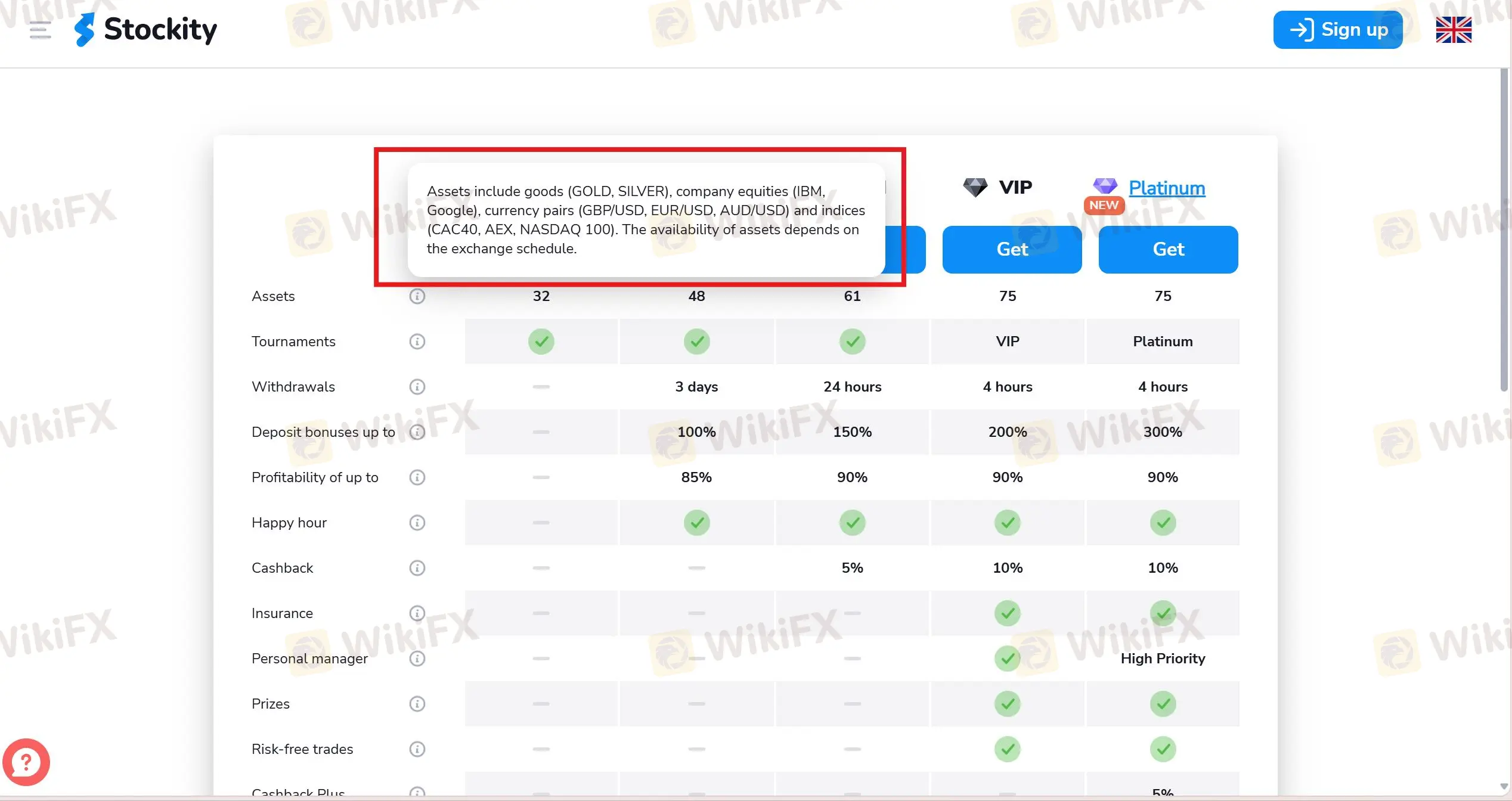

| Market Instruments | Gold, silver, company equities, currency pairs, indices |

| Demo Account | ✅(with a virtual balance of $10,000) |

| Leverage | / |

| Spread | / |

| Trading Platform | Stockity APP |

| Min Deposit | $10 |

| Customer Support | Email: support@stockity.id |

| Address: Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands, MH96960 | |

Stockity was registered in 2022 in Marshall Islands. It claims to offer trading services related to the gold, silver, company equities, currency pairs, and inndices markets, with a minimum deposit of $10. However, this company is not regulated, and it does not provide much information about trading details.

| Pros | Cons |

| Diverse tradable instruments | No regulation |

| Multiple account types | Limited info on trading conditions |

| Demo accounts | No MT4 or MT5 |

| Low minimum deposit | Only accept crypto payments |

| Only email support |

No, Stockity is not regulated by the financial services regulatory authority in Marshall Islands, which means that the company lacks regulation from its registration site. Please note the potential risks!

Stockity provides several types of products, including gold, silver, company equities, currency pairs, and indices.

| Tradable Instruments | Supported |

| Gold & Silver | ✔ |

| Company Equities | ✔ |

| Currency Pairs | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

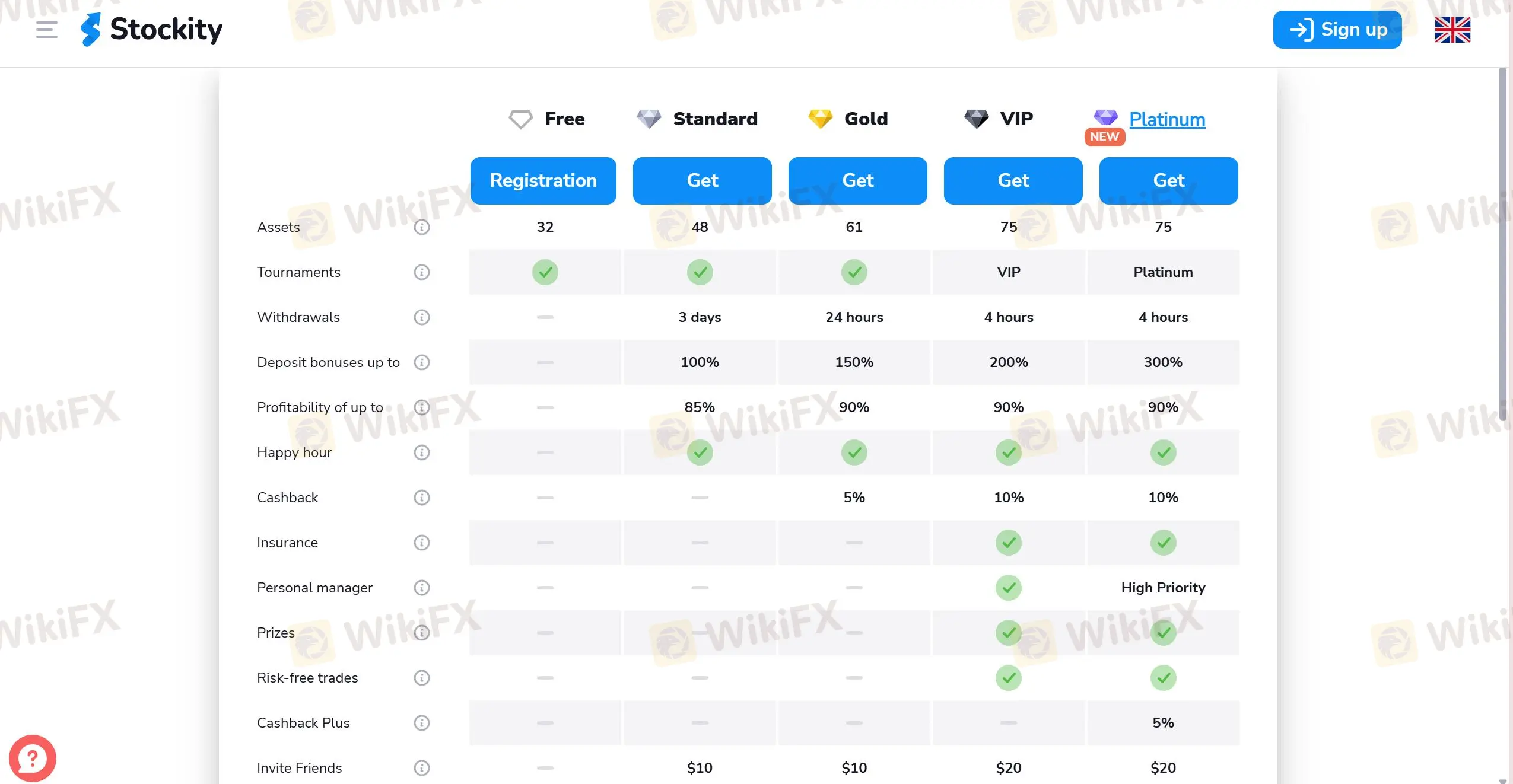

Stockity has 5 types of “account status”: Free, Standard, Gold, VIP, and Platinum.

| Account Status | Number of Assets | Withdrawal | Max Deposit Bonuses | Bonuses for Inviting Friends |

| Free | 32 | / | ||

| Standard | 48 | 3 days | 100% | $10 |

| Gold | 61 | 24 hrs | 150% | $10 |

| VIP | 75 | 4 hrs | 200% | $20 |

| Platinum | 75 | 300% | $20 | |

Stockity uses its own trading platform which is a mobile APP, and it does not support MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| Stockity APP | ✔ | Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Stockity supports different types of payment options, which include Binance Pay, Tether, BTC, Litecoin, and Ethereum.

Stockity is an online brokerage firm established in 2022 and registered in the Marshall Islands. While it has established a marketing presence in regions such as Indonesia, South America (Argentina, Brazil, Colombia, Peru, Chile), and parts of Asia (India, Thailand), its regulatory standing raises significant concerns. With a WikiFX score of just 1.42 out of 10, Stockity is categorized as a high-risk entity due to the absence of valid regulatory licenses and multiple unresolved user complaints.

WikiFX

WikiFX

Are your profits through the Stockity platform vanishing suspiciously? Does the forex broker allow you to withdraw only your initial deposit? Do you face illegitimate login issues on Stockity? Have you witnessed unexplained fund losses while trading binary options on Stockity? Traders report these unfavorable experiences on online review platforms. These experiences indicate a potential scam from this Marshall Islands-based forex broker. In this article, we have highlighted trader reviews of Stockity. Keep reading!

WikiFX

WikiFX

More

User comment

12

CommentsWrite a review

2023-08-28 19:36

2023-08-28 19:36

2023-08-28 01:01

2023-08-28 01:01