User Reviews

More

User comment

5

CommentsWrite a review

2025-06-08 11:02

2025-06-08 11:02

2025-01-18 15:01

2025-01-18 15:01

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index0.00

Business Index5.95

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

SD STAR FX LTD

Company Abbreviation

SDstar FX

Platform registered country and region

Comoros

Company website

Company summary

Pyramid scheme complaint

Expose

| SDstar FX Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Comoros |

| Regulation | No regulation |

| Market Instruments | Currency Pairs, Indices, Stocks, Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| EUR/USD Spread | 1.4 pips (Standard account) |

| Trading Platform | MetaTrader 5 (MT5) |

| Minimum Deposit | $100 |

| Customer Support | Email: support@sdstarfx.com |

SDstar FX, created in 2023 and registered in the Comoros, is not subject to any recognized financial regulations. It trades currencies, indices, stocks, and commodities using the MetaTrader 5 platform, with three actual account types and a demo account for practice. While it offers high leverage of up to 1:500 and reasonable spreads, the absence of regulatory control is a problem.

| Pros | Cons |

| Offers MetaTrader 5 platform across devices | No regulation |

| Provides demo accounts for practice | No swap-free accounts |

| Multiple account types with flexible leverage options | Only email support |

SDstar FX is not a regulated broker. It says it is registered in Comoros, but this area does not have a recognized financial authority that oversees forex or brokerage services.

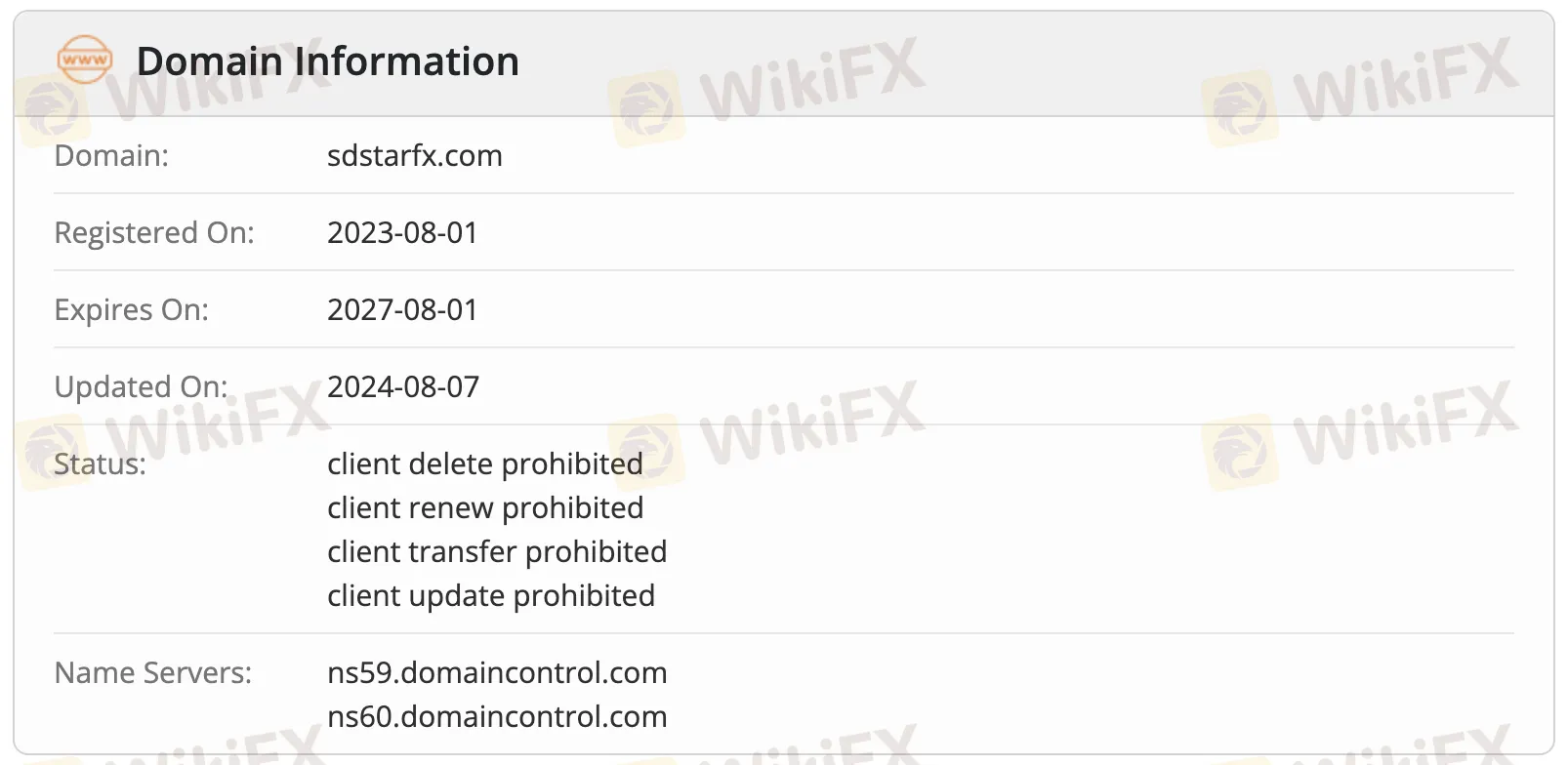

Whois data show that the domain sdstarfx.com was registered on August 1, 2023, and last updated on August 7, 2024. It will expire on August 1, 2027. The domain is currently “client delete prohibited,” “client renew prohibited,” “client transfer prohibited,” and “client update prohibited”.

SDstar FX provides trading in several asset types, including as currency pairs, indices, stocks, and commodities.

| Tradable Instrument | Supported |

| Currency Pairs | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Cryptos | ✖ |

| Bonds | ✖ |

| Options | ✖ |

| ETFs | ✖ |

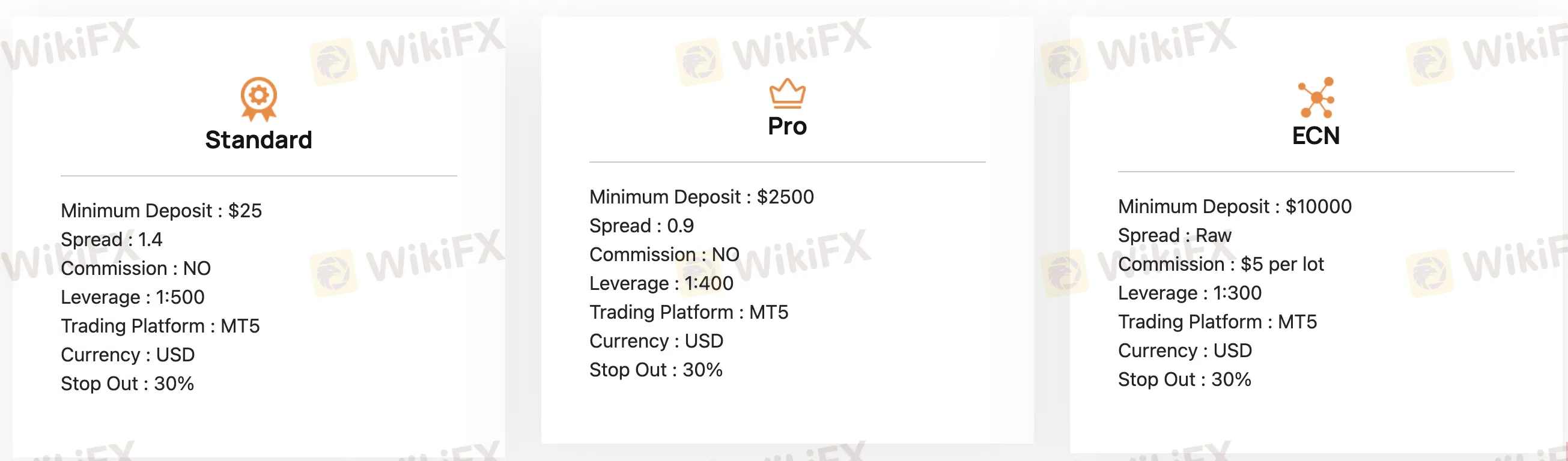

SDstar FX offers three types of live accounts: Standard, Pro, and ECN, as well as a demo account for practice.

| Account Type | Minimum Deposit | Maximum Leverage | EUR/USD Spread | Commission | Suitable for |

| Standard | $25 | 1:500 | 1.4 pips | 0 | Beginners, small-scale traders |

| Pro | $2,500 | 1:400 | 0.9 pips | 0 | Intermediate traders seeking better pricing |

| ECN | $10,000 | 1:300 | Raw | $5 per lot | Advanced, high-volume traders |

SDstar FX offers leverage of up to 1:500 on its Standard account, 1:400 on Pro, and 1:300 on ECN. High leverage raises the potential for enormous profits, but it also increases the danger of significant losses, particularly in volatile markets; traders should utilize leverage with caution.

SDstar FX's trading fees are typically consistent with industry standards, with moderate spreads on Pro and ECN accounts, however, Standard accounts have slightly higher spreads.

| Account Type | Spread (EUR/USD) | Commission |

| Standard | 1.4 pips | 0 |

| Pro | 0.9 pips | 0 |

| ECN | Raw | $5 per lot |

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 5 (MT5) | ✔ | Web, Windows, macOS, Android | Experienced traders |

| MetaTrader 4 (MT4) | ✖ | — | Beginners |

SDstar FX makes no mention of any deposit or withdrawal fees on its website. The minimum deposit is $100.

| Payment Method | Minimum Deposit | Processing Time |

| Crypto | $100 | Instant or a few minutes; longer on weekends/holidays |

| Wire/Bank Transfer | ||

| Google Pay | ||

| UPI ID | ||

| Cash |

Have you been witnessing long fund withdrawal delays by SDstar FX, a Comoros-based forex broker? Does the broker disallow you from withdrawing either principal or profit? Are you made to deposit every time you demand a withdrawal? Does the SDstar FX customer support team fail to address your queries? This has reportedly become the case of many traders here. In this SDstar FX review article, we have highlighted these complaints. Read on!

WikiFX

WikiFX

SDStarFX is another Forex Broker in the competitive world of forex trading. But the key question is: Is it safe or is it a scam?

WikiFX

WikiFX

"Thinking about investing? Make sure you've gone through this list thoroughly. Here is the list of 20 scam brokers that you must avoid.

WikiFX

WikiFX

In the ever-evolving world of online trading, new forex brokers are constantly emerging, offering a wide range of services and instruments to attract traders. SDstar FX is a newcomer to the forex industry, registered in Mauritius, and is making its presence known in the market.

WikiFX

WikiFX

More

User comment

5

CommentsWrite a review

2025-06-08 11:02

2025-06-08 11:02

2025-01-18 15:01

2025-01-18 15:01