User Reviews

More

User comment

2

CommentsWrite a review

2024-08-16 15:13

2024-08-16 15:13

2023-03-03 16:33

2023-03-03 16:33

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index8.90

Software Index7.05

License Index7.85

Single Core

1G

40G

More

Company Name

KIMURA SECURITIES CO.,LTD.

Company Abbreviation

KIMURA SECURITIES

Platform registered country and region

Japan

Company website

Company summary

Pyramid scheme complaint

Expose

| KIMURA SECURITIES Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading Products | Stocks, Bonds, Investment Trusts, and Insurance |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: (052)241-4211 (Main) |

| Fax: (052)262-7284 | |

| Address: 8-21 Sakae 3-chome, Naka-ku, Nagoya 460-0008 | |

KIMURA SECURITIES (Kimura Securities) is an established financial institution in Japan. Headquartered in Nagoya with 5 branch offices, it is regulated by Japan's Financial Services Agency (FSA) and holds the No. 6 license from the Commissioner of the Tokai Local Finance Bureau. Its services cover Japanese, US, and Hong Kong stock trading, fixed/floating-rate individual government bonds, multi-theme investment trusts, and family property/earthquake insurance.

| Pros | Cons |

| Regulated by FSA | Limited service scope (mainly the domestic Japanese market) |

| Multiple trading products | No info on deposit and withdrawal |

| A large number of branch offices | |

| Long operation time |

KIMURA SECURITIES operates legally and compliantly. It is strictly regulated by the Financial Services Agency (FSA) of Japan and holds the No. 6 certification license from the Commissioner of the Tokai Local Finance Bureau (Kinsho), indicating that it must adhere to a series of strict laws, regulations, and industry standards in its operations.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | 木村証券株式会社 | Japan | Retail Forex License | 東海財務局長(金商)第6号 |

KIMURA SECURITIES provides securities and stock trading, bond products, investment trusts, and insurance products.

| Trading Products | Supported |

| Domestic Stocks | ✔ |

| Foreign Stocks | ✔ |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Insurance Products | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

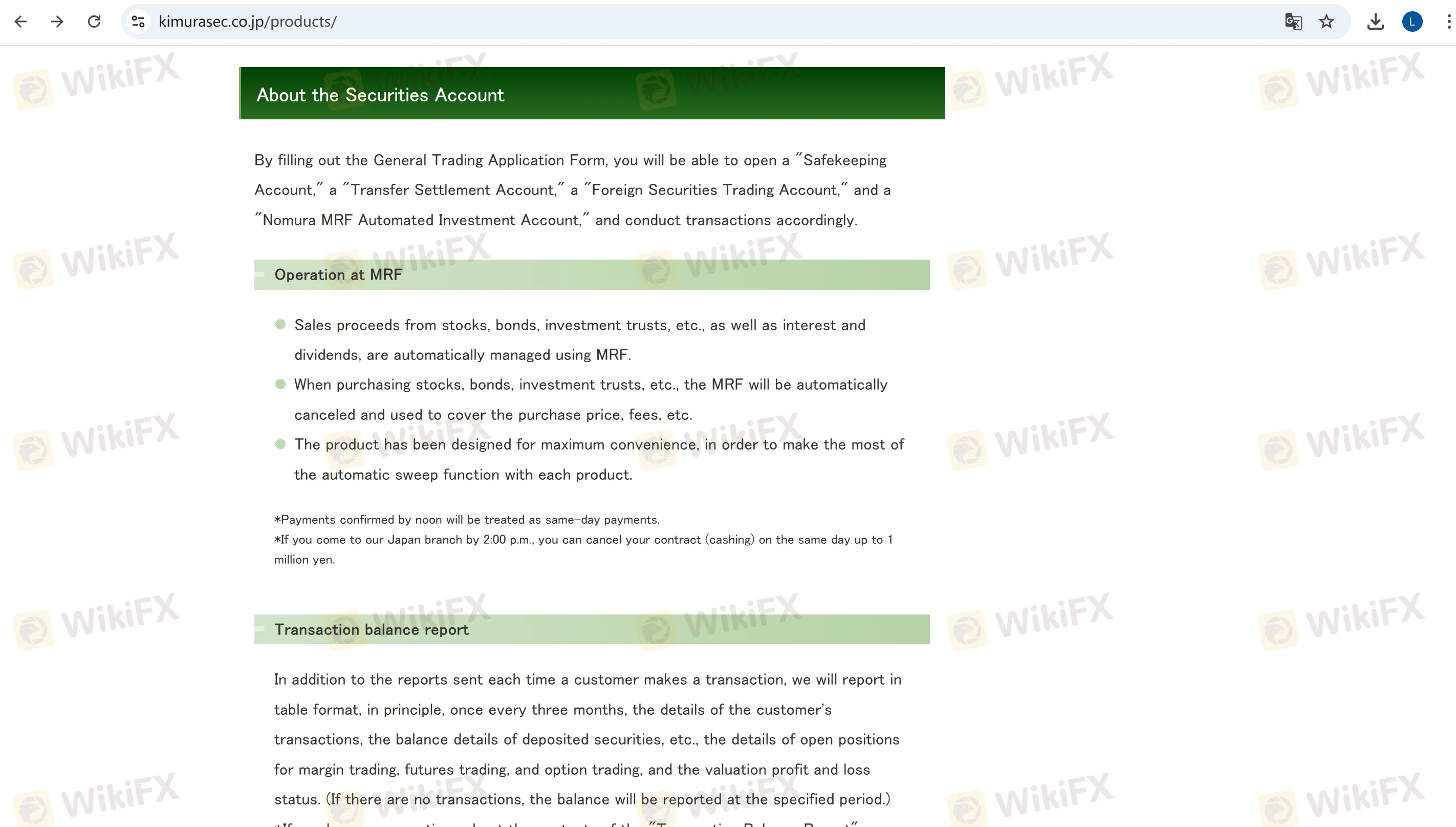

It mainly provides a comprehensive securities account, through which sub-accounts with different functions, such as “safekeeping account”, “transfer settlement account”, “foreign securities trading account”, and “Nomura MRF automatic continuous (accumulative) investment account” can be opened.

The upper limit of commission fees for foreign stock trading is 11% (10% excluding tax). The maximum subscription fee for investment trusts is 3.30% (3.00% excluding tax), and the maximum trust fee is 2.42% (including tax).

More

User comment

2

CommentsWrite a review

2024-08-16 15:13

2024-08-16 15:13

2023-03-03 16:33

2023-03-03 16:33