User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

White label MT4

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.35

Risk Management Index0.00

Software Index8.85

License Index0.00

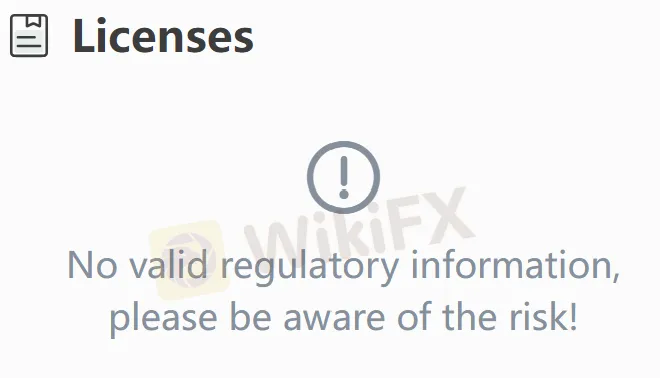

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Unicapital Review Summary | |

| Founded | / |

| Registered Country/Region | Azerbaijan |

| Regulation | No regulation |

| Market Instruments | Forex, stocks, ETFs, cryptocurrencies, bonds and currencies |

| Demo Account | ❌ |

| Leverage | / |

| Spread | Discounted spreads |

| Trading Platform | MT4, UTrader |

| Minimum Deposit | $50 |

| Customer Support | 24/5 support, live chat, contact form |

| Tel: +994 50 573 01 17;+994 50 527 11 17 | |

| Email: info@unicapital.az | |

| Social Media: Youtube, Facebook, Instagram, LinkedIn, Telegram | |

| Postal Address: Baku, 8 November Prospect, 15 (“Azure” Business Center, 12th floor, office 72) | |

Unicapital is an unregulated broker, offering trading on forex, stocks and ETFs, cryptocurrencies, bonds and currencies with discounted spreads on MT4 and UTrader trading platform. The minimum deposit requirement is $50.

| Pros | Cons |

| Various contact channels | No regulation |

| MT4 platform | No demo accounts |

| Low minimum deposit requirement | Limited info on trading conditions |

| No commission fees charged |

No. Unicapital currently has no valid regulations. Please be aware of the risk!

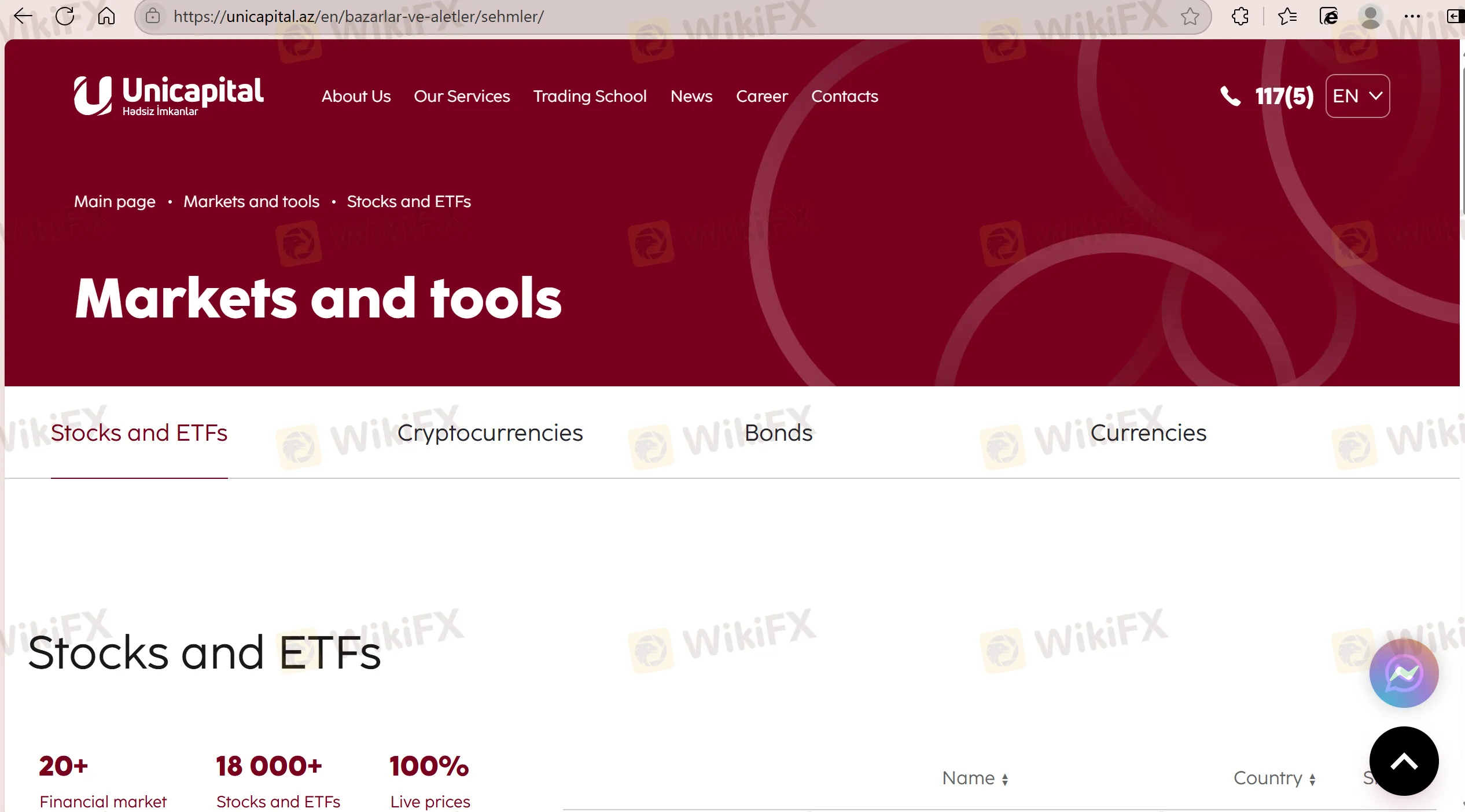

Unicapital offers trading on forex, stocks and ETFs, cryptocurrencies, bonds and currencies.

| Tradable Instruments | Supported |

| Forex/Currencies | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Options | ❌ |

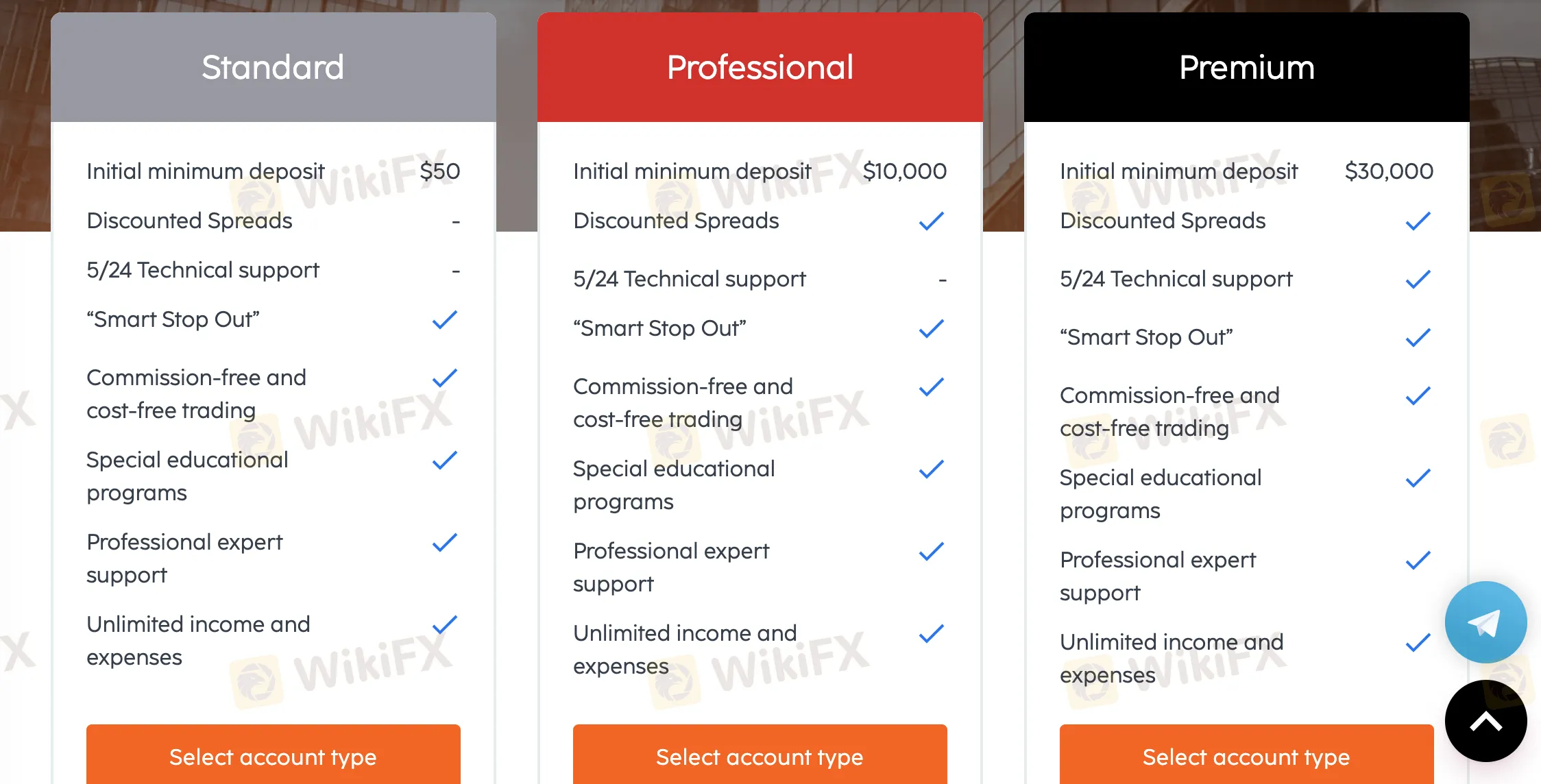

Here are three account types Unicapital offers:

| Account Type | Minimum Deposit |

| Standard | $50 |

| Professional | $10,000 |

| Premium | $30,000 |

Unicapital offers discounted spreads as the website shows, but the details are not specified. No commission fees are charged.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC, mobile, web | Beginners |

| UTrader | ✔ | Mobile | / |

| MT5 | ❌ | / | Experienced traders |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment