User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Self-developed

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index6.20

Risk Management Index0.00

Software Index4.58

License Index0.00

Single Core

1G

40G

More

Company Name

INGOT KE LTD.

Company Abbreviation

INGOT

Platform registered country and region

Kenya

Company website

X

YouTube

+254727 174 174

Company summary

Pyramid scheme complaint

Expose

| INGOT Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Kenya |

| Regulation | ASIC/FSA (Unverified) |

| Market Instruments | Forex, Indices, Stocks, Commodities, Metals, Energies, ETFs |

| Demo Account | ✅ |

| Leverage | Up to 400x |

| EUR/USD Spread | From 0.7 pips |

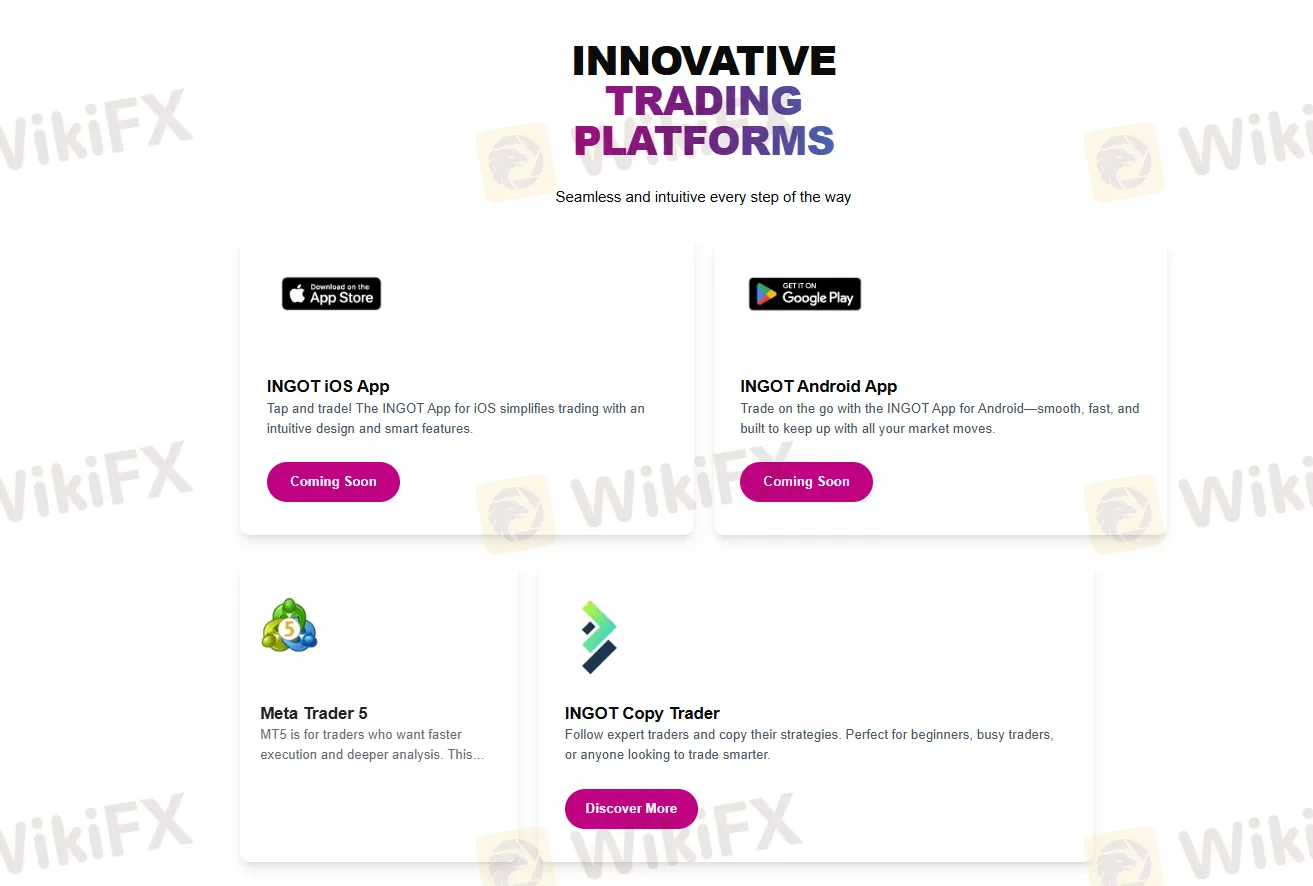

| Trading Platform | MetaTrader 5, INGOT Copy Trader |

| Copy Trading | ✅ |

| Minimum Deposit | $10 |

| Customer Support | Online chat |

| Tel: 25411 119 3877; 0202 172 172 | |

| WhatsApp: +254727 174 174 | |

| Email: info-KE@ingot.io; customerservice-ke@ingot.io | |

| Social platform: Twitter, LinkedIn, Telegram, Facebook, Instagram, Tiktok | |

| Address: Unit C, 4th Floor, Delta Chambers, Westlands, Nairobi, Kenya | |

| Restricted Area | United States of America |

INGOT is a Kenya-based financial services company who offers trading services in forex, commodities, indices, stocks and ETFs. The broker offers a demo account for practicing and two tiered live accounts for traders to choose from, with an affordable minimum deposit of $10. It implements segregated accounts to protect investor funds even during insolvencies.

Except for that, the broker provides trading tools such as economic calendars and calculators for investors to catch up with latest market intelligence and understand their trading costs easily.

In addition, educational resources such as glossary and video tutorials equip traders with necessary trading knowledge to make better informed decisions.

What's more, the broker allows copy trading, enabling novice traders to follow and simulate strategies of successful predecessors for quicker gains. The use of the award-winning MetaTrader 5 platform enhances customer experience and absence of deposit/withdrwal/commission fees significantly decrease trading costs of investors.

However, the broker claims to own ASIC and FSA licenses, which is unverified so far by the authorities,indicating possible incompliance to financial regulations and less customer protection set by the regulatory bodies.

| Pros | Cons |

| MetaTrader 5 platform | Unverified ASIC and FSA regulation |

| Copy trading | Inactivity/currency conversion fees charged |

| Zero commission | No services in certain areas |

| No deposit/withdrawal fees | Limited info on payment methods |

| Low minimum deposit | |

| Segregated accounts | |

| Educational resources offered | |

| Live chat support |

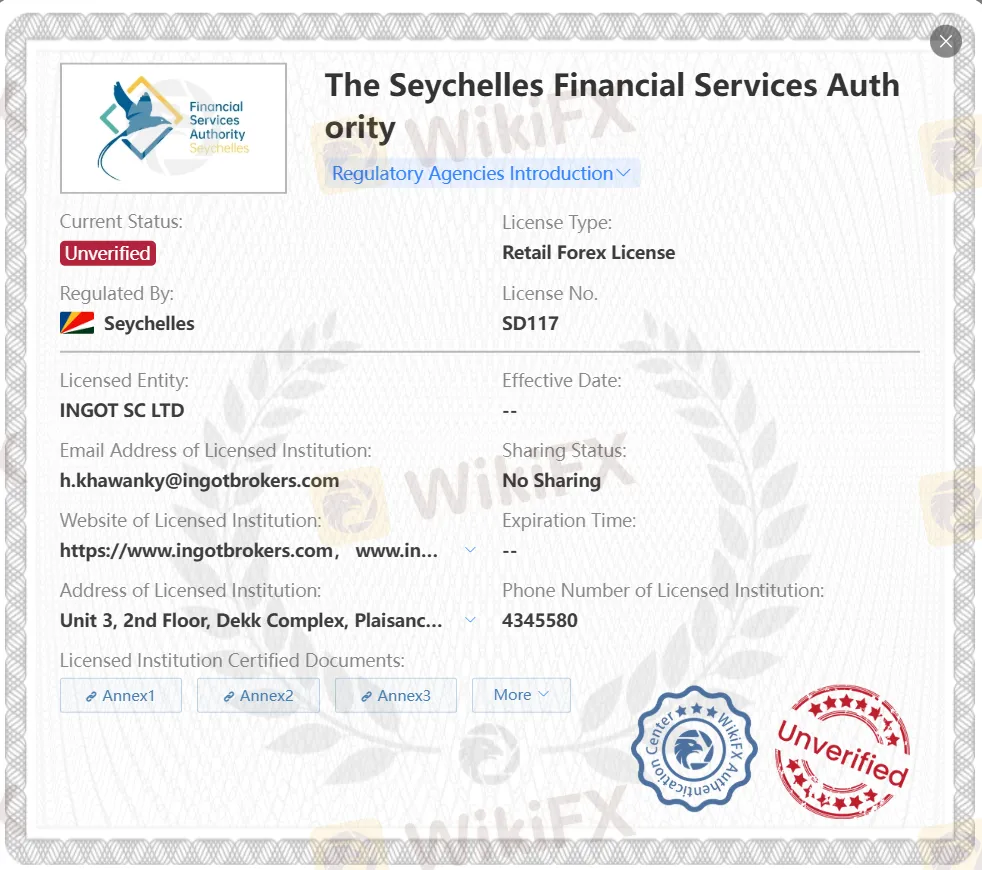

INGOT's ASIC (Australia Securities & Investment Commission) with license no. 000428015 and FSA (Seychelles Financial Services Authority) with license no. SD117 are unverified so far by the authorities, indicating that the company might not be regulated by any financial bodies. Investors should be vigilant and cautious about this.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| ASIC | Unverified | INGOT AU PTY LTD | Market Maker (MM) | 000428015 |

| FSA | Unverified | INGOT SC LTD | Retail Forex License | SD117 |

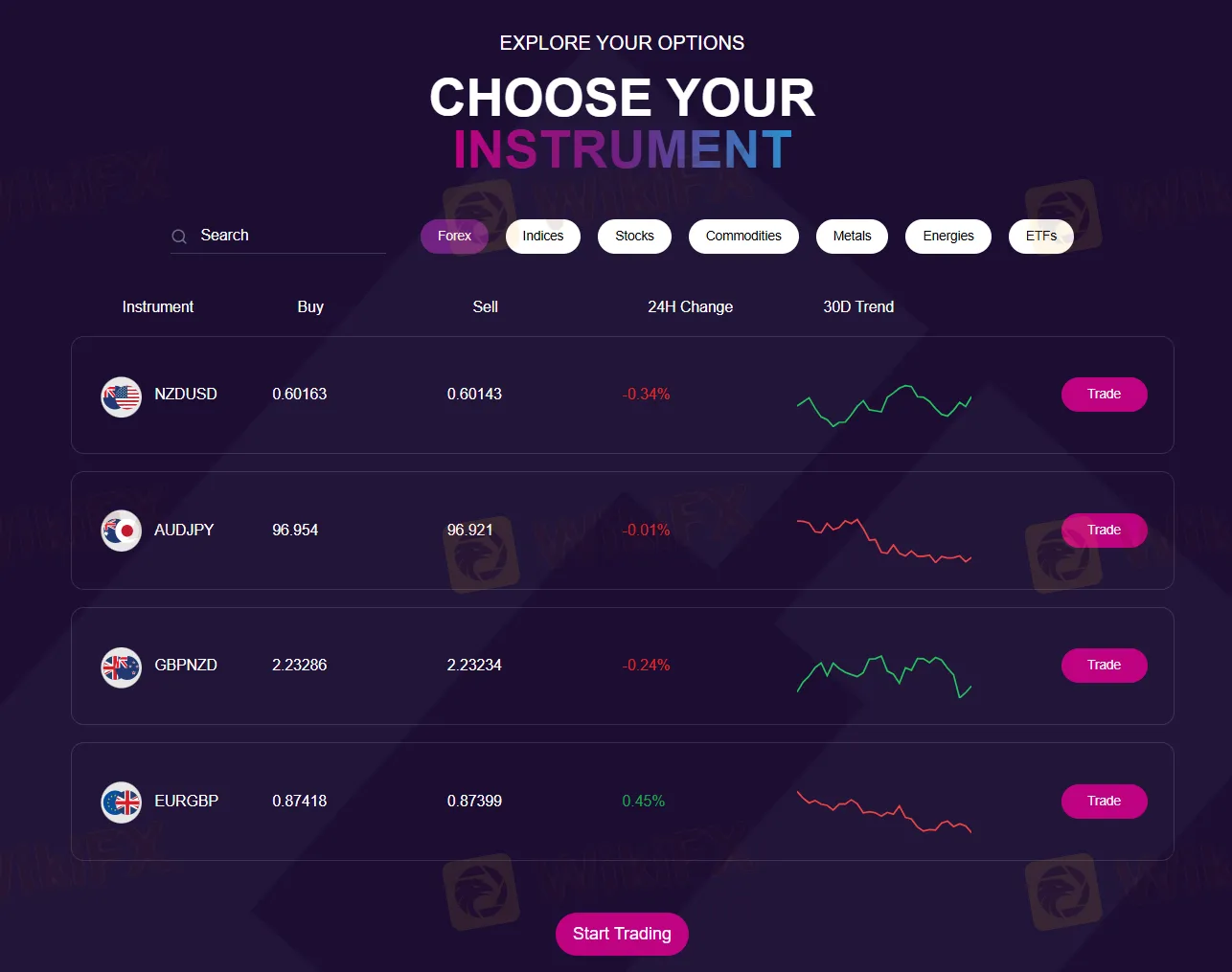

INGOT offers more than 1,000 market instruments for clients to trade with:

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Energies | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| Mutual Funds | ❌ |

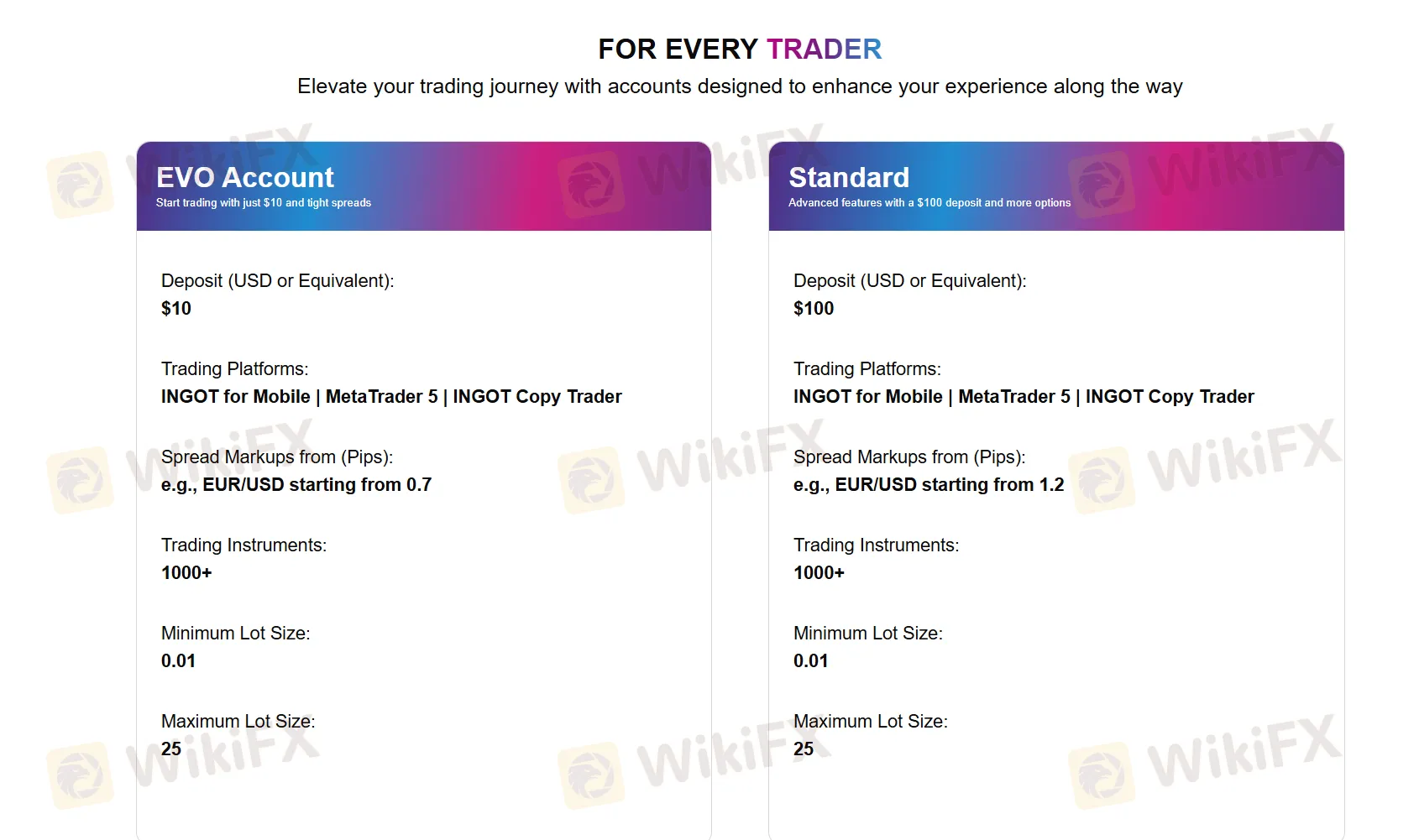

INGOT provides a demo account for practicing in a risk-free environment, allowing traders to test their trading strategies without losing real money.

While for live trading, there are 2 tiered accounts to choose from, basing on your trading experience and financial capabilities:

| Account Type | Account Currency | Minimum Deposit | EUR/USD Spread | Commission | Available CFD Products |

| EVO | EUR & USD | $10 | From 0.7 pips | 0 | Major & Minor Forex Pairs | Metals (Spot & Futures) | Indices (Spot & Futures) | Energies (Spot & Futures) | UK and EU Stocks | US Stocks and ETFs |

| Standard | $100 | From 1.2 pips | 0 | Major, Minor, Exotic Forex Pairs | Metals (Spot & Futures) | Indices (Spot & Futures) | Energies (Spot & Futures) | Agricultural Softs | Agricultural Grains | UK and EU Stocks | US Stocks and ETFs |

INGOT offers different leverage levels for different products:

| Asset Class | Maximum Leverage |

| Gold | 400x |

| FX majors | |

| FX minors | |

| Crude oil | |

| Brent oil | |

| Silver | 300x |

| Major stocks | 50x |

Please note that high leverage can amplify not only profits but also losses.

INGOT claims to use both the world renowned MetaTrader 5 platform, which is popular among investors worldwide for its user-friendly interface, robust functions, comprehensive market access and advanced analysis tools.

The broker also provides the CopyTrader platform for users to access and imitate top-performing traders with a proven track record and copy their strategies to elevate trading experience.

Furthermore, the broker's proprietary INGOT app is said to be coming soon, let's stay tuned.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web | Experienced traders |

| Copy Trader | ✔ | Web | All traders |

| INGOT App | Coming soon | Mobile phones | / |

| MT4 | ❌ | / | Beginners |

INGOT indicates on its websiste that it charges inactivity fees and currency conversion fees, but the details are not disclosed. You should reach the broker before you choose to trade with them to ensure you have full understanding of these costs.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment