User Reviews

More

User comment

3

CommentsWrite a review

2023-02-23 09:37

2023-02-23 09:37 2022-12-02 15:44

2022-12-02 15:44

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.45

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

| Basic | Information |

| Registered Countries | United Kingdom |

| Regulation | No License |

| Minimum Deposit | N/A |

| Maximum Leverage | 1:50 |

| Minimum Spread | N/A |

| Trading Platform | Webtrader |

| Trading Assets | Currencies, Indices, Cryptos, Futures |

| Payment Methods | N/A |

| Customer Support | 7/24 Customer Support, Email Support |

General Information

Registered in the United Kingdom, Mixfinancing presents itself as an online broker in the world, but their website is suspiciously light on details, such as trading costs, minimum deposits, trading platforms, leverage and more. Mixfinancing provides clients access to trading on currencies, indices, cryptos, and futures, with the maximum leverage up to 1:50.

When it comes to regulation, it has been verified that Mixfinancing is not subject to any regulation to operate illegally. And thats why WikiFX has given this broker a very low score of 1.06/10. Trading with an unregulated forex broker is taking huge risk of losing your money. Please be aware of the risk involved.

Market Instruments

With the Mixfinancing platform, four classes of trading assets covering currencies, indices, futures, and cryptos, available through the brokerage platform.

Account Types

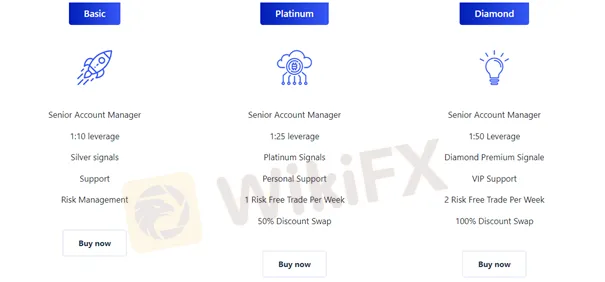

Basic accounts, Platinum accounts and Diamond accounts are available options for all clients. Some account features designed exclusively including the following:

Basic account: silver signals, risk management

Platinum account: Platinum signals, personal support, 1 risk free trade per week, 50% discount swap.

Diamond accounts: Diamond premium signals, VIP support, 2 risk free trade per week, 100% discount swap.

Leverage

Trading leverage varies depending on trading accounts, ranging from 1:10 to 1:50. Since leverage can amplify both gains and losses, it can result in devastating losses for investors who lack experience. If you're just starting out in the trading world, it's best to stick with the lower size, no more than a 1:10.

Trading Platform

Unfortunately, Mixfinancing is quite light on details about the trading platform it provides.

Customer Support

Contacting Mixfinancing is not an easy thing, as only an email is provided. Lack of online chat, and phone support makes its poor customer service much worse.

Email: contact@mix-financing.net

Company Address: 22 Bishopsgate, London, England, EC2N 4BQ

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Pros & Cons

| Pros | Cons |

| Flexible trading account options | No regulation |

| Insufficient website information | |

| Limited trading assets | |

| Conservative leverage |

Frequently Asked Questions

What items can I trade with on Mixfinancing?

Mixfinancing offers access to currencies, indices, futures, and cryptos.

What types of trading instruments does Mixfinancing offer?

Three types of trading accounts are available: Basic, Platinum and Diamond.

What is the maximum leverage available?

The maximum trading leverage that is available on the Mixfinancing platform is up to 1:50.

More

User comment

3

CommentsWrite a review

2023-02-23 09:37

2023-02-23 09:37 2022-12-02 15:44

2022-12-02 15:44