User Reviews

More

User comment

2

CommentsWrite a review

2025-07-25 17:28

2025-07-25 17:28

2025-07-24 22:40

2025-07-24 22:40

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index5.63

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Roc Bank Limited

Company Abbreviation

Roc Bank

Platform registered country and region

Vanuatu

Company website

Company summary

Pyramid scheme complaint

Expose

| Roc BankReview Summary | |

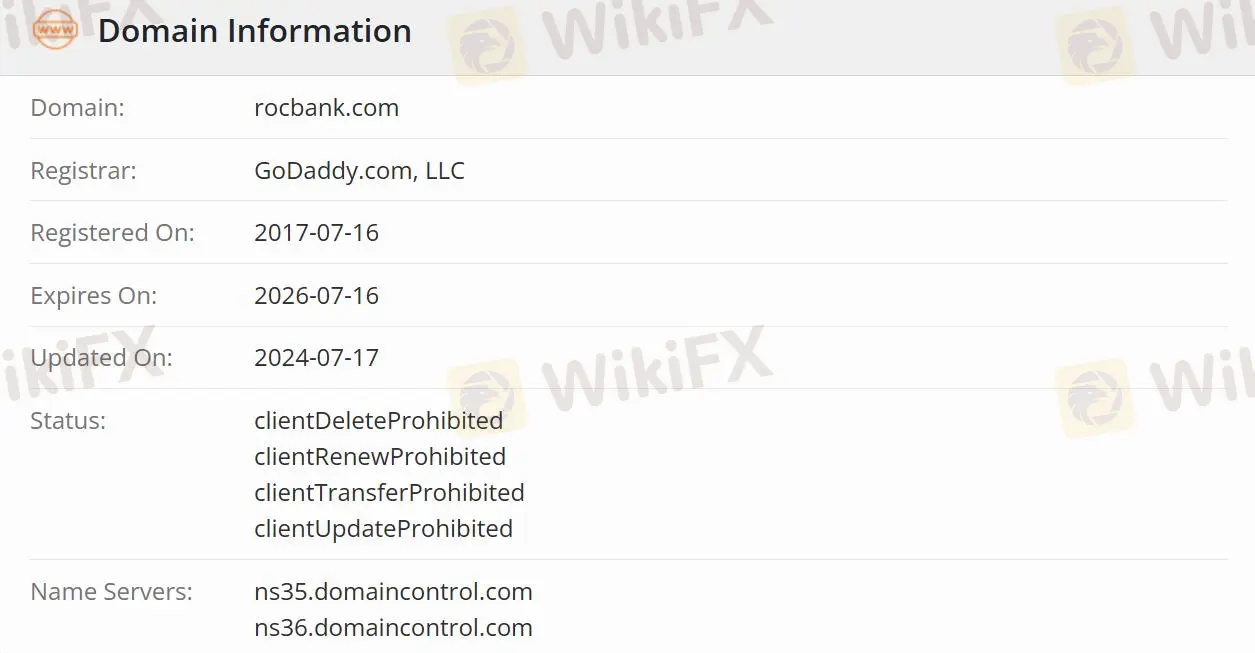

| Founded | 2017-07-16 |

| Registered Country/Region | Vanuatu |

| Regulation | Unregulated |

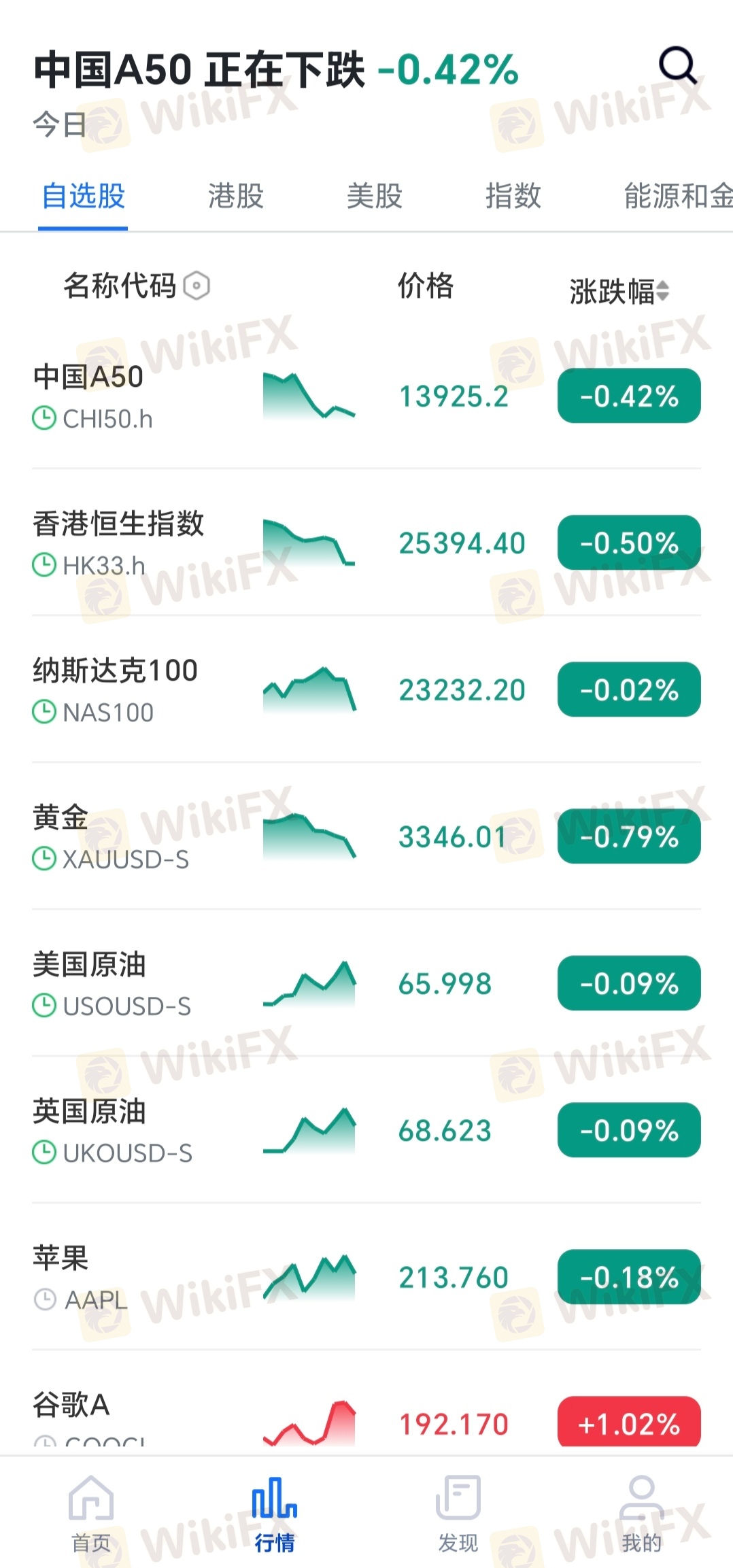

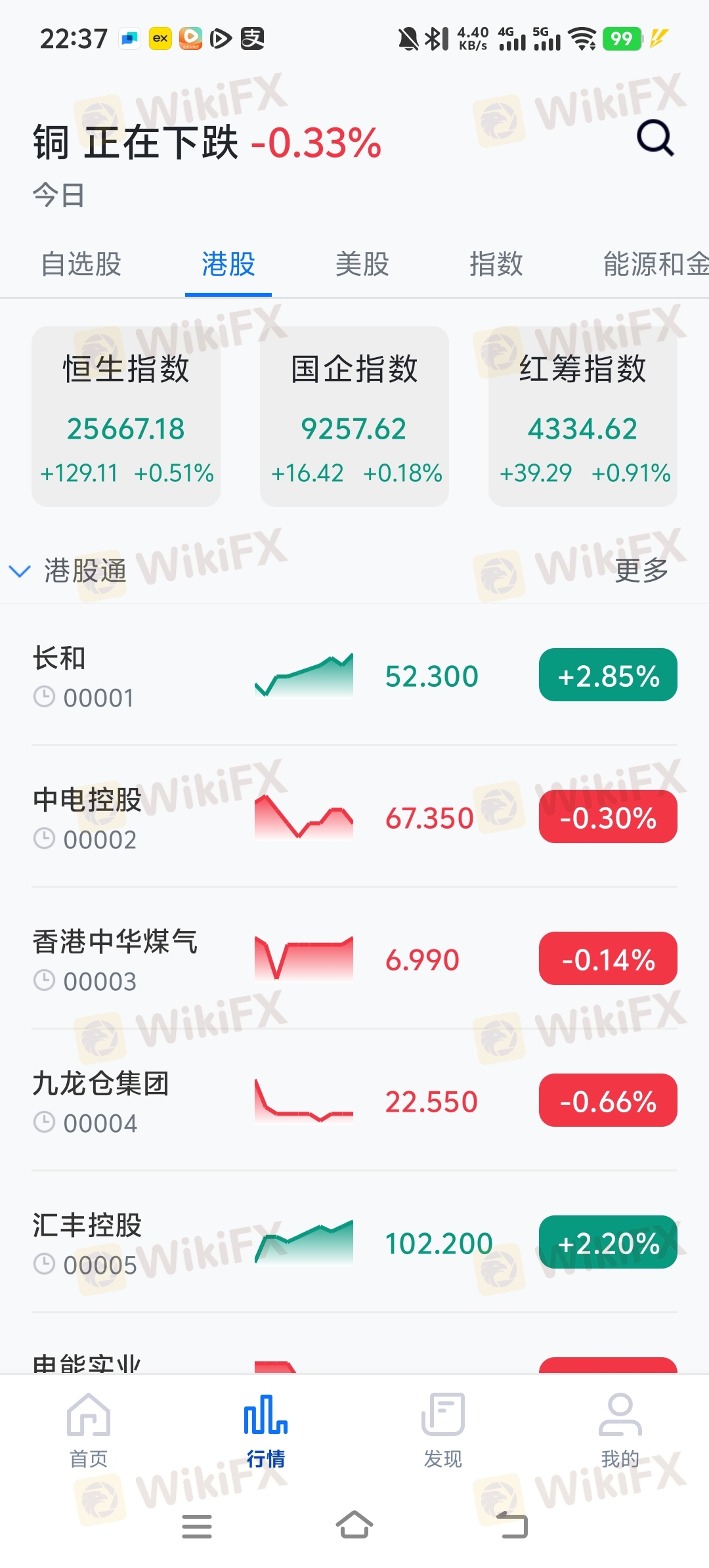

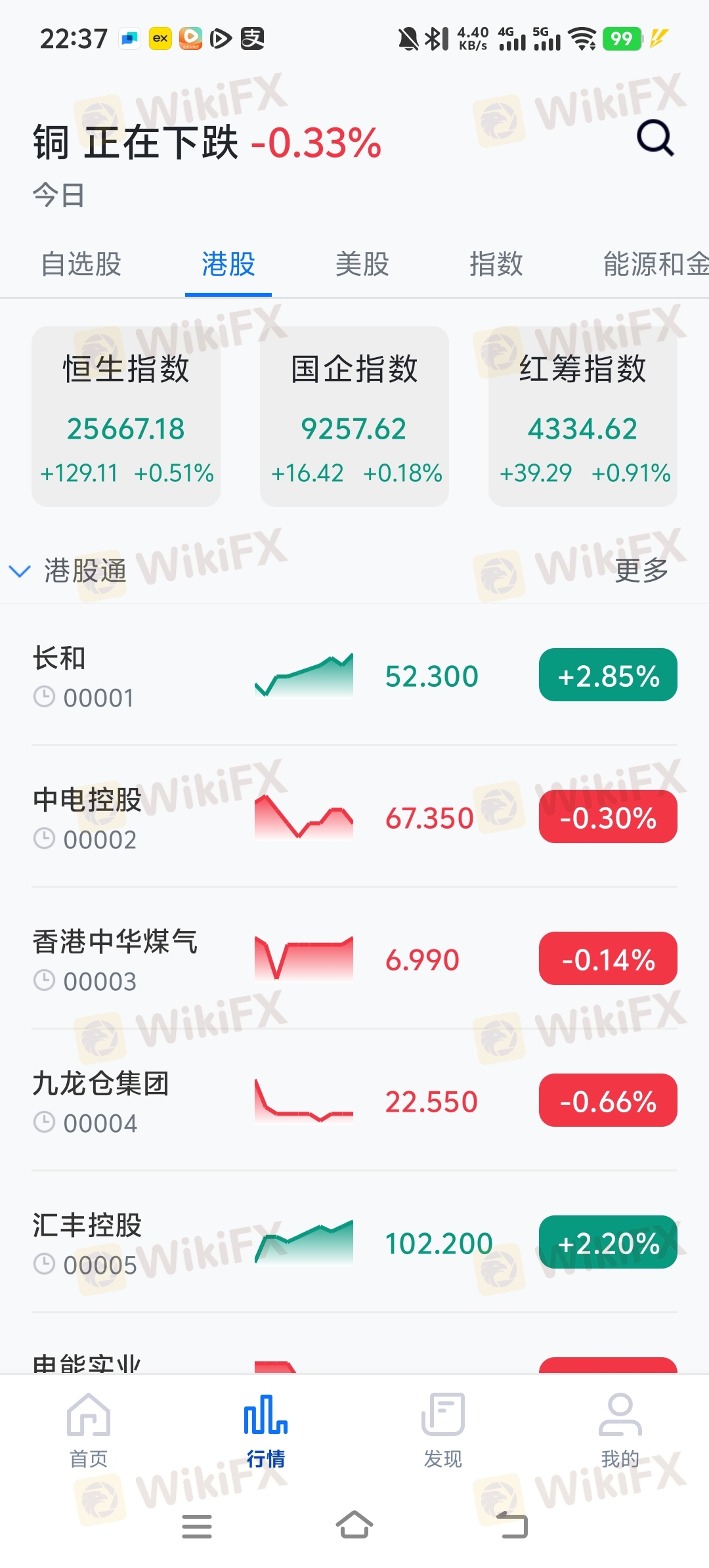

| Market Instruments | Derivatives/ETFs/Stocks/Funds/Fixed Income |

| Demo Account | ❌ |

| Trading Platform | Roc Bank |

| Min Deposit | No limited |

| Customer Support | Phone: +678 28188 |

| Email: contact@rocbank.com | |

Roc Bank is an international bank registered in Vanuatu with the purpose of the establishment to provide digital banking solutions for Asia-Pacific individuals and SMEs. The bank provides over 15000 global securities products. Roc Bank is still risky due to its unregulated status.

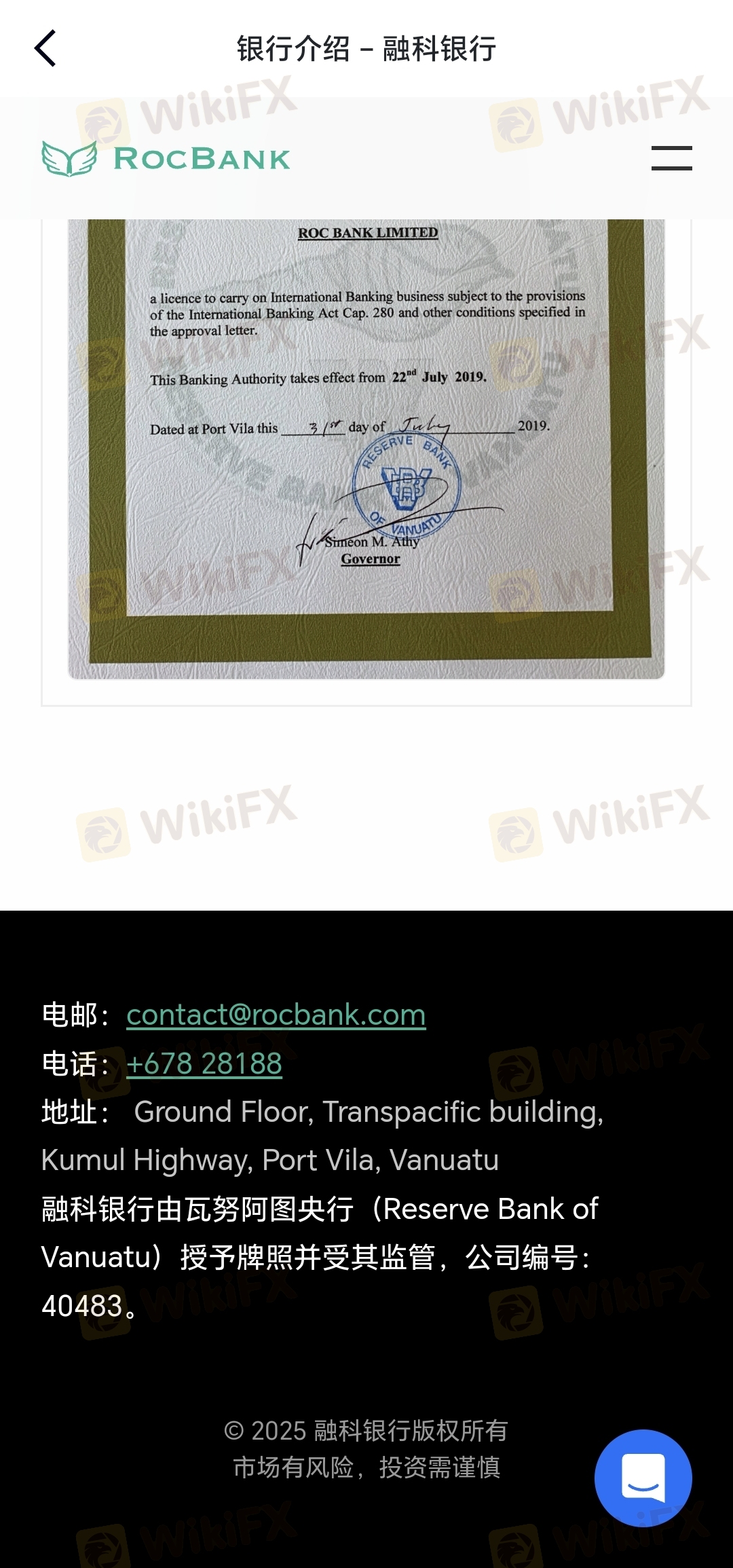

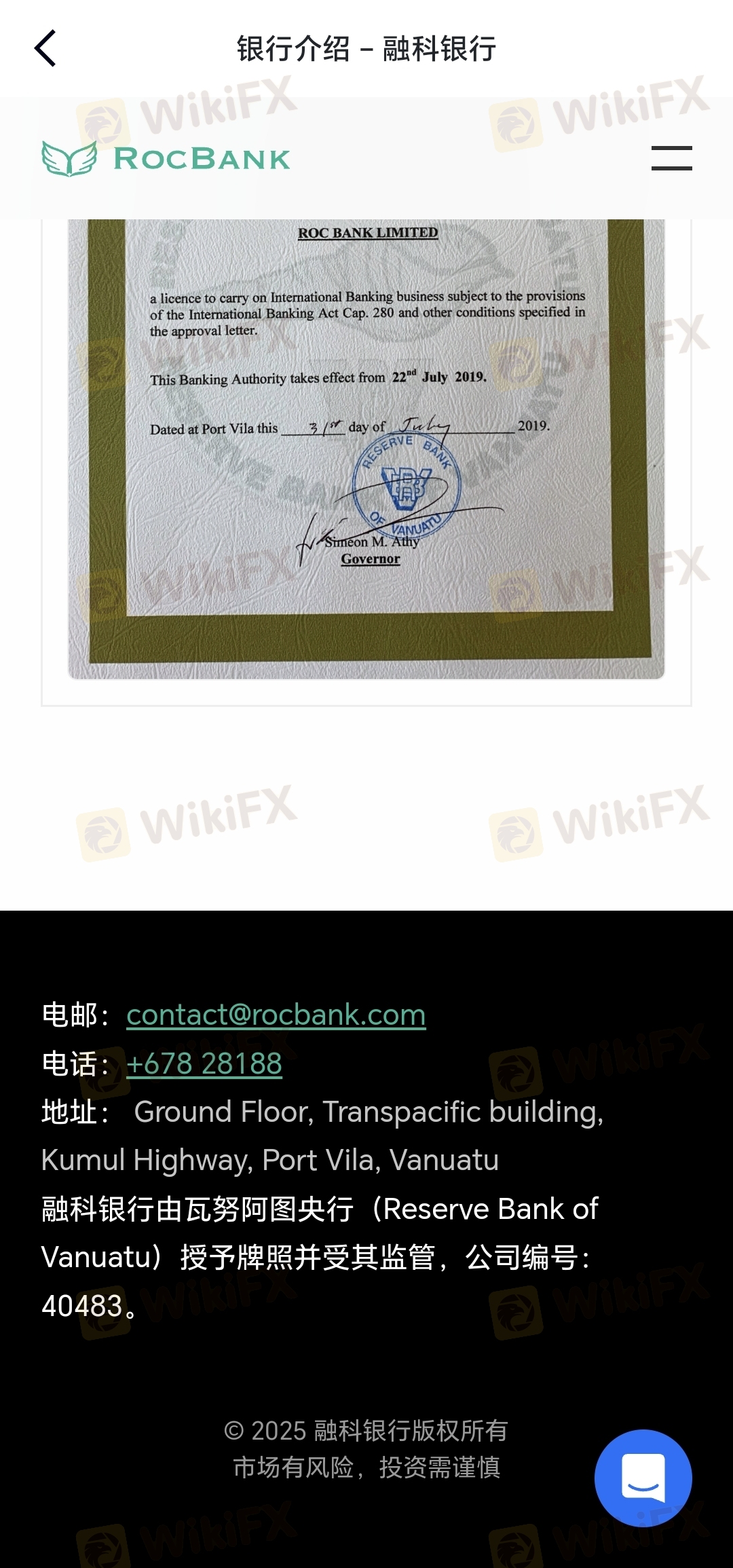

Roc Bank is not regulated, even though it claims to be regulated by the Reserve Bank of Vanuatu. Company number: 40483. However, an unregulated broker is not as safe as a regulated one.

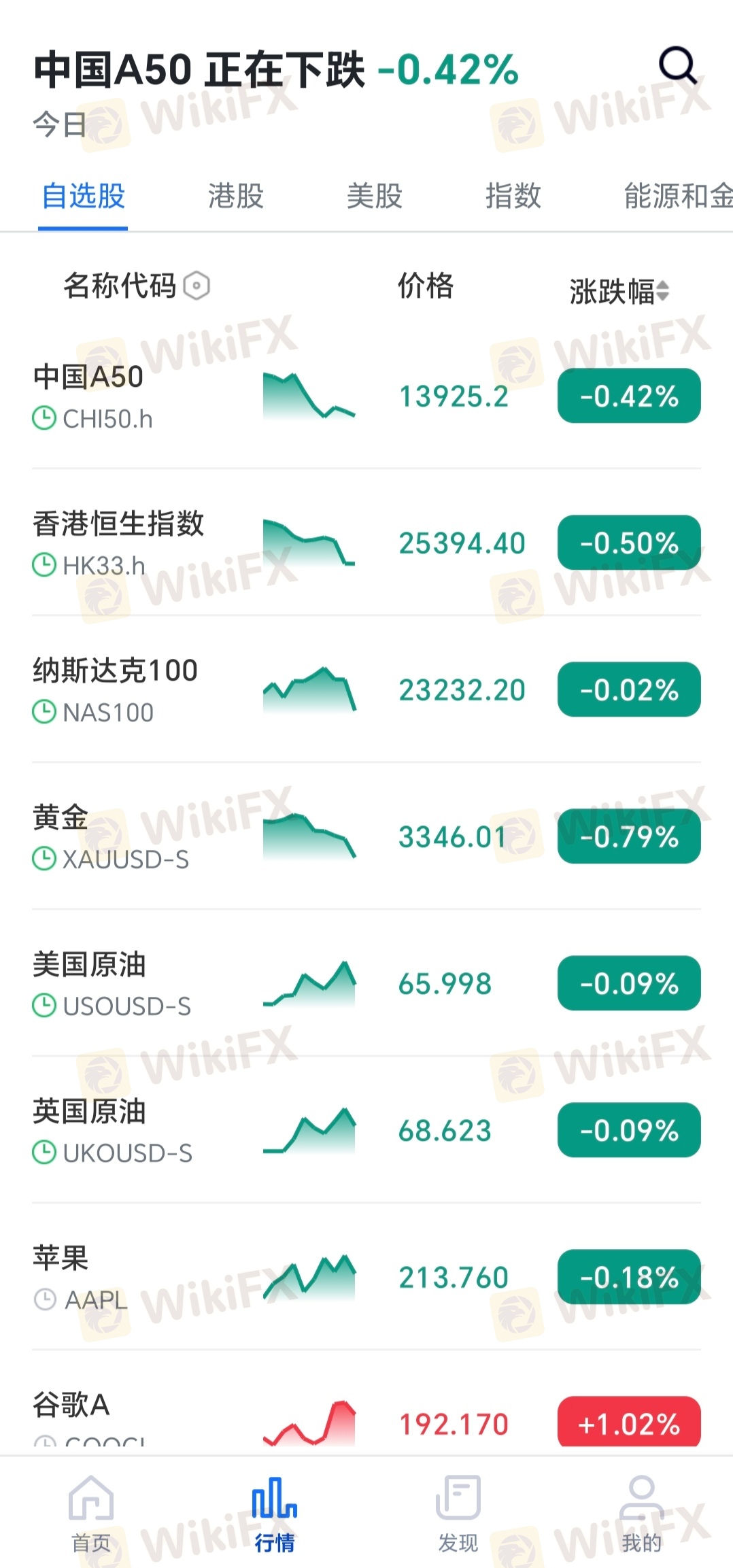

Vanuatu offers 15000 global securities products covering stocks, ETFs, derivatives, funds, fixed income, etc.

| Tradable Instruments | Supported |

| Derivatives | ✔ |

| ETFs | ✔ |

| Stocks | ✔ |

| Funds | ✔ |

| Fixed Income | ✔ |

Roc Bank has five account types with a minimum commission of 0: Personal, U.S.Omnibus, Hong Kong Stocks Integrated, U.S.Global, and Hong Kong Global.

| Account Type | Personal | U.S.Omnibus | Hong Kong Stocks Integrated | U.S.Global | Hong Kong Global |

| Commission | - | From $0.50 per transaction | From 0 | From $0.50 per transaction | 0.03% * trade value |

Roc Bank provides a proprietary platform for banking with low bank charges.

| Trading Platform | Supported |

| Roc Bank | ✔ |

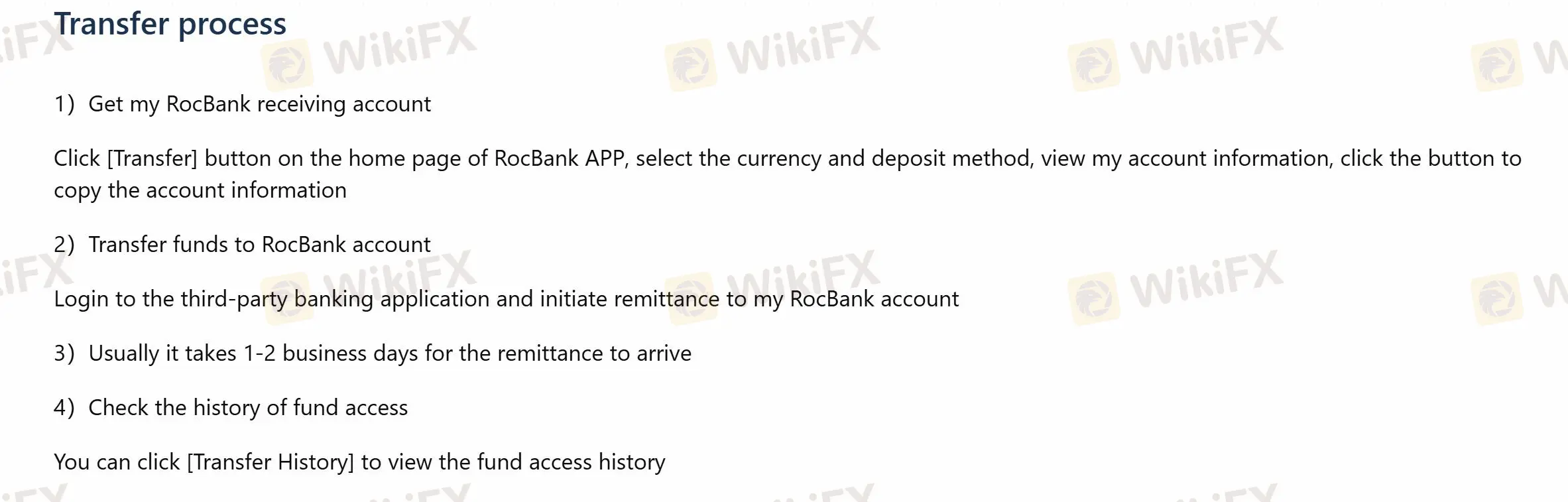

No minimum deposit requirement. Deposits and withdrawals by third-party banking within 2 days. A deposit account currently only supports US dollars and a securities account supports US dollars and Hong Kong dollars.

Clients can contact Roc Bank via phone and email.

| Contact Options | Details |

| Phone | +678 28188 |

| contact@rocbank.com | |

| Supported Language | English |

| Website Language | English |

| Physical Address | Ground Floor, Transpacific building, Kumul Highway, Port Vila, Vanuatu |

More

User comment

2

CommentsWrite a review

2025-07-25 17:28

2025-07-25 17:28

2025-07-24 22:40

2025-07-24 22:40