User Reviews

More

User comment

6

CommentsWrite a review

2023-08-23 07:11

2023-08-23 07:11

2023-08-22 06:21

2023-08-22 06:21

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index0.00

Business Index6.10

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

MEXO Finance GROUP LIMITED

Company Abbreviation

MEXO Finance

Platform registered country and region

China

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | MEXO Finance |

| Registered Country/Area | China |

| Founded year | 2023 |

| Regulation | Lack of regulatory information |

| Minimum Deposit | RMB 250 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Variable, starting from 1.0 pips |

| Trading Platforms | WebTrader, MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Tradable assets | Forex pairs, commodities, indices, cryptocurrencies |

| Account Types | Standard, ECN |

| Customer Support | Limited |

| Deposit & Withdrawal | Multiple payment methods |

| Educational Resources | Limited |

MEXO Finance, established in 2023 and operating from China, operates within a regulatory environment where specific details on regulatory oversight are not provided. The platform caters to various types of traders, offering a diverse range of trading assets, including Forex pairs, commodities, indices, and cryptocurrencies. To begin trading, the minimum deposit stands at RMB 250, while the platform allows leverage up to 1:500, providing flexibility to users in managing their positions. The spreads are variable, typically starting from 1.0 pips, allowing traders access to competitive pricing structures. Traders can engage through different trading platforms such as WebTrader, MetaTrader 4 (MT4), and MetaTrader 5 (MT5), each offering distinct features and interfaces. MEXO Finance provides limited customer support through channels like live chat, email, and phone. Additionally, the platform supports multiple payment methods for deposit and withdrawal transactions. However, the educational resources provided by MEXO Finance are limited, potentially impacting the learning experience and knowledge acquisition for new traders.

MEXO Finance operates without regulation from any overseeing authority, potentially prompting concerns regarding transparency and oversight within the exchange. Such unregulated platforms lack the safeguards and legal support offered by regulatory bodies, raising the risk of potential fraud, market manipulation, and security vulnerabilities. The absence of regulatory oversight might present challenges for users seeking redress or resolution in disputes. Moreover, this lack of oversight contributes to a less transparent trading atmosphere, making it challenging for users to gauge the exchange's legitimacy and reliability.

| Pros | Cons |

| Wide range of cryptocurrencies available | Lack of regulatory oversight |

| Competitive leverage | Limited educational resources |

| Varied account types | Minimal customer support options |

Pros

Wide Range of Cryptocurrencies: MEXO Finance offers an extensive selection of cryptocurrencies, providing traders with various options to diversify their portfolios and explore different market opportunities.

Competitive Leverage: The platform provides competitive leverage options, allowing traders to amplify their positions in the market. However, it's essential to note that higher leverage involves increased risk.

Varied Account Types: MEXO Finance offers multiple account types, catering to different trading styles and preferences. This diversity might accommodate various traders, each with distinct needs and strategies.

Cons

Lack of Regulatory Oversight: The platform operates without regulation from any overseeing authority. This absence of regulatory oversight raises concerns about transparency, user protection, and legal safeguards.

Limited Educational Resources: There's a scarcity of comprehensive educational resources like user guides, video tutorials, webinars, or blogs. This dearth might hinder new users' learning curve and confidence in trading activities.

Minimal Customer Support Options: The platform provides limited customer support avenues, potentially impacting users seeking immediate assistance or more diverse support channels for resolving queries or issues.

MEXO Finance offers a diverse array of trading assets, including Forex pairs, enabling users to engage in currency pair trading. Additionally, they provide CFDs (Contracts for Difference) on commodities, presenting opportunities to trade in various commodities such as gold, oil, or agricultural products. The platform extends its offerings to indices, allowing traders to speculate on the performance of various stock market indices. Furthermore, MEXO Finance includes cryptocurrencies among its tradable assets, facilitating trading in digital currencies like Bitcoin, Ethereum, and other popular cryptocurrencies.

MEXO Finance offers two distinct account types: the Standard account and the ECN account.

The Standard account is designed to cater to a wide range of traders and comes with leverage of up to 1:500. Spreads on this account type are variable, commencing at 1.0 pips, providing flexibility in trading conditions. Importantly, there are no commissions charged on trades within the Standard account.

For those opting for the ECN account, it offers similar leverage of up to 1:500 but stands out with its variable spreads and no commissions, enhancing the trading experience for those who prefer this account type. The minimum deposit required for either account is RMB 250, enabling accessibility for traders with varying capital levels. Withdrawals are processed promptly within 48 hours, and users have the advantage of exploring their trading strategies risk-free through the availability of a demo account.

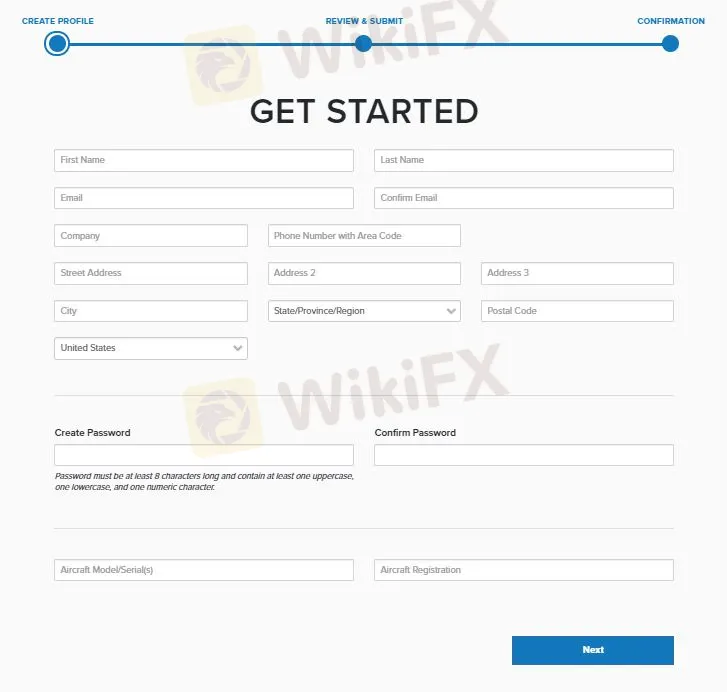

Here's a step-by-step guide on how to open an account with MEXO Finance:

Visit the Official Website: Go to the MEXO Finance official website using a web browser.

Account Registration: Look for the “Register” or “Sign Up” button and click on it.

Provide Personal Information: Fill in the required details, including your name, email address, contact information, and a secure password for your account.

Select Account Type: Choose the type of account you wish to open—Standard or ECN, depending on your trading preferences.

Verify Identity: Complete the identity verification process by uploading the necessary documents (e.g., ID, proof of address) as prompted.

Account Confirmation: After verification, confirm your account creation via the link sent to your email.

Remember to thoroughly review the terms and conditions before finalizing your registration, and ensure all information provided is accurate and up-to-date to avoid potential issues during the verification process.

MEXO Finance offers a maximum leverage of up to 1:500 for its trading accounts. Leverage allows traders to control larger positions in the market with a smaller amount of capital. With a 1:500 leverage ratio, traders can potentially magnify their trading positions up to 500 times the initial investment, increasing both potential profits and losses. It's important for traders to understand the implications of using leverage and the associated risks before engaging in trading activities.

MEXO Finance provides variable spreads that start from 1.0 pips for its trading accounts. Spreads refer to the difference between the buy and sell prices of a trading asset, and a lower spread often signifies a more competitive pricing structure for traders. Regarding commissions, MEXO Finance does not charge commissions for its standard account; however, for the ECN account, there might be a commission fee. The specific commission rates for the ECN account may vary based on the traded assets and market conditions. It's recommended for traders to verify the current commission rates for the ECN account before engaging in trading activities.

MEXO Finance offers traders access to multiple robust trading platforms, including WebTrader, MetaTrader 4 (MT4), and MetaTrader 5 (MT5). These platforms are renowned in the trading industry for their user-friendly interfaces, advanced charting tools, technical indicators, and customizable features.

WebTrader: This web-based platform allows traders to access their accounts and trade various assets directly from their web browsers, providing convenience and accessibility.

MetaTrader 4 (MT4): Known for its stability and versatility, MT4 offers a comprehensive suite of tools for technical analysis, automated trading through Expert Advisors (EAs), and a user-friendly interface.

MetaTrader 5 (MT5): Building upon the features of MT4, MT5 further enhances trading capabilities with additional technical indicators, timeframes, and an expanded range of tradable instruments, catering to diverse trading strategies.

These platforms facilitate trading across various markets, providing a seamless and efficient trading experience for both novice and experienced traders alike.

MEXO Finance offers multiple payment methods for depositing funds into trading accounts, ensuring flexibility and convenience for users. The accepted payment methods typically include bank transfers, credit/debit cards, and occasionally e-wallet options. The minimum deposit required to open an account with MEXO Finance is generally set at AUD 250, providing accessibility to traders with varying capital preferences.

Payment processing times can vary depending on the chosen method. Typically, deposits made through credit/debit cards or e-wallets are processed instantly or within a few hours, while bank transfers might take a few business days for the funds to reflect in the trading account. Withdrawals, on the other hand, are usually processed within 48 hours, allowing users timely access to their funds after submitting withdrawal requests. It's advisable to check the specific processing times for each payment method through MEXO Finance's official channels for the most accurate information.

Customer support at MEXO Finance is described as limited in terms of available avenues and possibly the scope of assistance provided. Users typically have access to basic customer service channels such as email, occasionally supplemented by phone support and live chat services. However, the range and availability of these support channels might be constrained compared to other financial platforms. This limitation in customer support might impact response times and the range of queries that can be addressed promptly, potentially affecting users seeking immediate assistance or detailed guidance. Users might experience delays in query resolution or might find it challenging to access real-time support for complex issues.

The absence of comprehensive educational resources within MEXO Finance poses a challenge for newcomers seeking guidance on navigating the platform and engaging in cryptocurrency trading. The platform lacks vital resources such as a detailed user guide, video tutorials, live webinars, and informative blogs. This shortfall in educational materials creates a steep learning curve for novice users, potentially resulting in errors and financial losses. The dearth of educational support might deter new users from confidently participating in trading activities, impacting their overall trading experience and confidence.

MEXO Finance offers a diverse range of cryptocurrencies, competitive leverage, and multiple account types catering to various trading preferences.

However, its lack of regulatory oversight raises concerns regarding transparency and user protection. Additionally, the platform suffers from limited educational resources, potentially hindering new users' learning experiences and confidence in trading. Coupled with minimal customer support options, these drawbacks might pose challenges for users seeking guidance or immediate assistance while navigating the platform.

Q: What are the available payment methods for deposits and withdrawals on MEXO Finance?

A: MEXO Finance offers multiple payment methods, including bank transfers, credit/debit cards, and potentially cryptocurrencies, providing flexibility for users.

Q: What is the minimum deposit required to start trading on MEXO Finance?

A: The minimum deposit on MEXO Finance is RMB 250, enabling users to initiate trading with this initial amount.

Q: Does MEXO Finance offer a demo account for new users?

A: Yes, MEXO Finance provides a demo account, allowing new users to familiarize themselves with the platform's features and practice trading without risking real funds.

Q: What trading platforms are available on MEXO Finance?

A: MEXO Finance offers WebTrader, MetaTrader 4 (MT4), and MetaTrader 5 (MT5) as its trading platforms, providing diverse options for traders.

Q: How long does it take for withdrawals to be processed on MEXO Finance?

A: Withdrawals on MEXO Finance are processed within 48 hours, ensuring timely access to funds for users.

Q: What support options are available for users on MEXO Finance?

A: MEXO Finance offers limited customer support through live chat, email, and phone, providing assistance to users during trading hours.

More

User comment

6

CommentsWrite a review

2023-08-23 07:11

2023-08-23 07:11

2023-08-22 06:21

2023-08-22 06:21