User Reviews

More

User comment

1

CommentsWrite a review

2023-03-20 17:28

2023-03-20 17:28

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index0.00

Business Index7.23

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

BEXCHANGES SOLUTION LIMITED

Company Abbreviation

Bexchange

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

| Bexchange | Basic Information |

| Registered Country/Region | United Kingdom |

| Founded in | 2021 |

| Company Name | BEXCHANGES SOLUTION LIMITED |

| Regulation | No Regulation |

| Minimum Deposit | $1,000 |

| Trading Instruments | Forex, CFDs, Commodities, Indices |

| Account Types | Silver, Gold, and VIP |

| Trading Platforms | MetaTrader 5 |

| Mobile Trading | Yes |

| Spreads | From 1.6 pips |

| Maximum Leverage | 1:500 |

| Deposit Methods | Wire Transfer, PayBnB |

| Withdrawal Methods | Wire Transfer, PayBnB |

| Customer Support | Email, Phone |

| Educational Resources | Trading Guides, Webinars, Market Analysis |

| Bonus Offers | None |

*Please note that the information in this table is subject to change and you should always refer to the broker's official website for the most up-to-date information.

Bexchange is a UK-based forex broker established in 2021. The broker offers a range of trading instruments, including forex, indices, commodities, and cryptocurrencies. Bexchange is regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its strict regulatory standards.

Bexchange offers three different account types: Silver, Gold, and VIP, with the minimum deposit to open Silver account from $1000. The broker offers high leverage up to 1:500 for forex trading. Bexchange offers the popular MetaTrader 5 (MT5) platform for desktop, mobile, and web trading.

Bexchange also offers fast and reliable customer support through live chat, email, and phone.

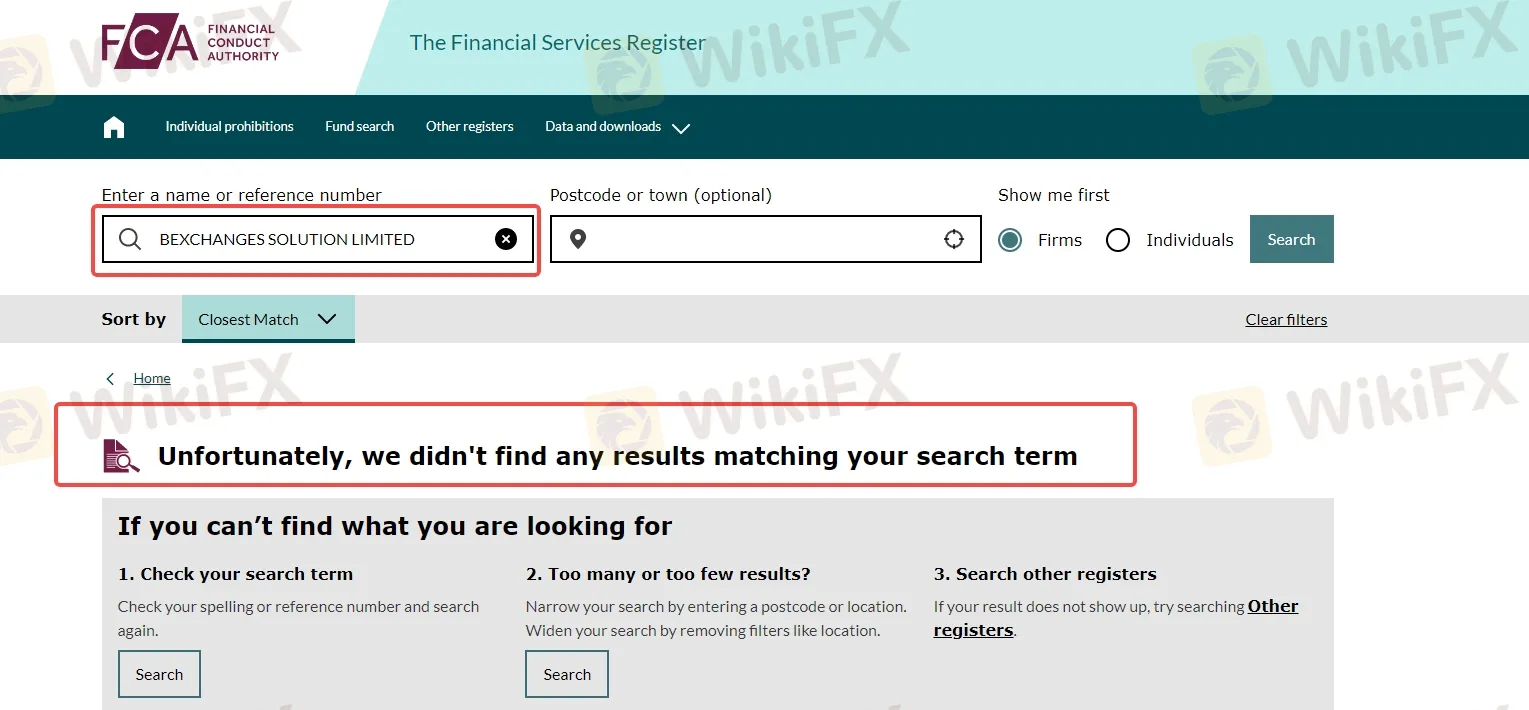

Bexchange claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the registration number 906799. However, Bexchange's name was unable to locate on the official website of the Financial Conduct Authority (FCA). That being said, Bexchange is not regulated by any financial authority.

This may be a cause for concern as regulatory oversight can provide an added layer of security for traders. Regulated brokers are required to adhere to certain standards and regulations to ensure fair trading practices and the safety of client funds. Without regulation, there is a higher risk of fraudulent activity, such as misuse of client funds, unfair trading practices, and lack of transparency.

Bexchange offers a range of account types and trading instruments, with competitive spreads and leverage. The broker's trading platform is user-friendly and offers some advanced trading tools and features, three types of trading accounts to choose from. However, it's worth noting that Bexchange is not regulated, which may be a concern for some traders. In addition, the broker's customer support is limited and lacks live chat support, which may be inconvenient for some traders.

| Pros | Cons |

| Wide range of trading instruments | Unregulated broker |

| MT4 trading platform supported | No negative balance protection |

| High leverage options available | High Spreads |

| Three types of trading accounts available | Inactivity fees applied |

| Limited educational resources | |

| Limited customer support availability | |

| No demo account available | |

| Lack of transparency and regulation information | |

| No bonuses offered |

Bexchange offers a range of trading instruments to its clients, including forex currency pairs, indices, commodities, and cryptocurrencies. Clients can trade major and minor forex pairs, such as EUR/USD, GBP/USD, and USD/JPY, as well as exotic pairs like USD/ZAR and USD/TRY. In terms of indices, Bexchange offers popular ones like the US30, UK100, and Germany30. Clients can also trade commodities such as gold, silver, crude oil, and natural gas. In addition, Bexchange provides access to a range of cryptocurrencies including Bitcoin, Ethereum, and Litecoin

| Pros | Cons |

| Diverse range of tradable instruments, including forex, commodities, indices, and cryptocurrencies. | Limited selection of individual stocks available for trading. |

| No access to trading on futures markets. | |

| No option to trade on options markets. | |

| Limited selection of cryptocurrencies available for trading. | |

| No option to trade on bond markets. |

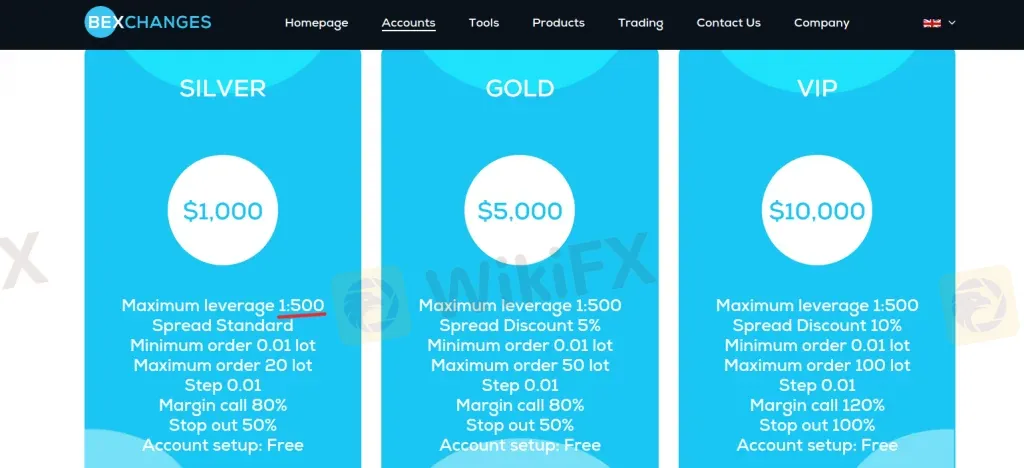

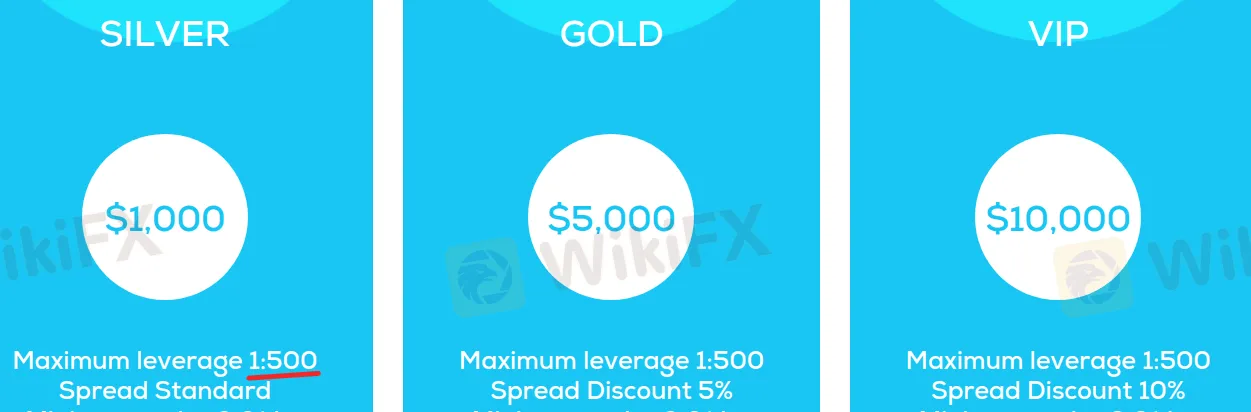

Bexchange offers three different account types: Silver, Gold, and VIP. The Silver account requires a minimum deposit of $1000, while the Gold account requires a minimum deposit of $5000. The VIP account, on the other hand, requires a minimum deposit of $10,000. Each account type comes with its own set of features and benefits.

The Silver account provides traders with access to a wide range of trading instruments, including forex, commodities, indices, and shares. The account also offers competitive spreads and leverage up to 1:500. In addition, Silver account holders receive daily market analysis, trading signals, and access to Bexchange's educational materials.

The Gold account includes all the features of the Silver account, with the addition of some extra benefits. These include personal account management, customized investment advice, and access to premium trading tools and strategies. Gold account holders also receive higher leverage, up to 1:500.

The VIP account is the most exclusive account type offered by Bexchange. It includes all the features of the Gold account, as well as additional benefits such as priority customer support, higher trading limits, and exclusive access to trading seminars and events. VIP account holders also enjoy the same leverage as another two types of trading accounts, up to 1:500.

Below is a table comparing the different account types and minimum deposits for Bexchange and several other brokers in the industry, including Travelex, Fair Markets, IC Markets, and JB Markets:

| Broker | Account Type | Minimum Deposit |

| Bexchange | Silver | $1,000 |

| Gold | $5,000 | |

| VIP | $10,000 | |

| Travelex | Basic | $100 |

| Advanced | $500 | |

| Pro | $5,000 | |

| Fair Markets | Mini | $10 |

| Standard | $100 | |

| VIP | $5,000 | |

| JB Markets | Basic | $250 |

| Standard | $1,000 | |

| Premium | $10,000 |

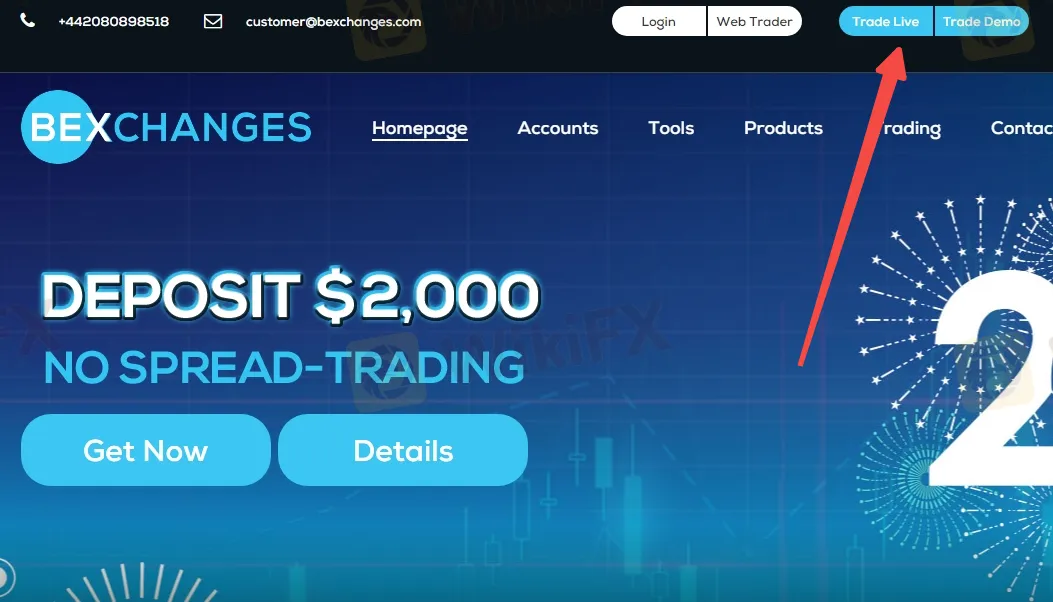

To open an account with Bexchange, you'll first need to navigate to their website and click on the “Trade Live or Trade Demo” button.

From there, you'll be taken to a registration form where you'll need to provide your personal information, such as your name, email address, and phone number. You'll also need to choose an account type and select a base currency.

Once you've filled in all the required fields, you can submit the form and wait for a confirmation email from the broker.

After receiving the confirmation email, you'll need to provide additional documentation to verify your identity and address. This may include a passport or government-issued ID, a utility bill, or a bank statement. Once your account has been approved and verified, you can fund your account and start trading.

Bexchange offers a maximum trading leverage of 1:500, which is considered high and can amplify both profits and losses. It's important for traders to exercise caution when using high leverage and to have a solid understanding of risk management strategies. Traders should also be aware that high leverage can increase the potential for margin calls and should only use leverage that is suitable for their trading style and risk tolerance.

It appears that Bexchange offers relatively high spreads for its trading instruments. The spread for the EUR/USD pair starts at 2 pips, which is higher than many other brokers in the industry. This means that traders will incur higher trading costs when opening and closing positions in this currency pair.

However, traders with different types of accounts can enjoy different levels of spread discounts. The Silver account offers standard spreads, and the Gold account offers a spread discount of 5%. The most expensive trading account, the VIP account, offers a spread discount of 10%. However, commissions are not disclosed.

Apart from trading fees, Bexchange also charges non-trading fees, which include deposit and withdrawal fees, inactivity fees, and overnight swap fees. Deposit fees vary depending on the payment method used and can range from 0% to 4%. Withdrawal fees are also charged and can range from $2 to $20, depending on the payment method used. Inactivity fees are charged if an account remains inactive for a period of 180 days, and this fee is $30 per month. Overnight swap fees are charged on positions that are held open overnight, and the amount charged varies depending on the trading instrument and market conditions. It is important to note that non-trading fees can have a significant impact on the overall profitability of trading, and traders should carefully consider these fees when choosing a broker.

Bexchange offers its clients the popular and advanced MetaTrader 5 (MT5) trading platform, which is a top choice for many traders in the industry. MT5 offers advanced charting tools, multiple timeframes, and a wide range of technical indicators, allowing traders to analyze the market and make informed trading decisions. Additionally, the platform offers one-click trading, allowing traders to open and close positions quickly and efficiently. MT5 also supports automated trading through the use of expert advisors (EAs), which can help traders automate their trading strategies and reduce their emotional involvement in the trading process. Furthermore, the platform is available for desktop, web, and mobile, allowing traders to access their accounts and trade from anywhere and at any time. Overall, MT5 is a highly reliable and efficient trading platform, making it a great choice for traders of all levels of experience.

Bexchange offers two methods for depositing and withdrawing funds: Wire Transfer and PayBnB. Both methods are secure and easy to use. To deposit funds, clients can simply log in to their Bexchange account and select their preferred deposit method. For wire transfer, clients will need to provide their bank details and follow the instructions provided by Bexchange. With PayBnB, clients can use their credit/debit card to make a deposit. Withdrawals can also be made using either method, with the funds typically taking 2-5 business days to process. It is important to note that Bexchange does not charge any deposit or withdrawal fees, but clients may be subject to fees from their bank or payment provider.

Bexchange offers customer support via email and phone. However, it does not offer live chat support. Customers can reach out to the support team by sending an email to the dedicated support email address provided on the website or by calling the phone number listed. The customer support team is available during market hours to assist with any queries or issues that customers may have. Bexchange also offers a FAQ section on its website that covers a range of topics, from account opening and funding to trading and platform usage. Customers can access the FAQ section to find answers to common questions without having to contact customer support.

In conclusion, Bexchange is a UK-based forex broker that offers a range of trading instruments and account types to traders. However, the broker is not regulated, and minimum deposit requirements for its various account types are relatively high, and the broker only supports wire transfer and PayBnB for deposits and withdrawals. Bexchange's non-trading fees are also relatively high, and the broker does not offer live chat support. Its customer support team is available through email and phone. Overall, traders may consider Bexchange as an option for trading, but should also consider its drawbacks before making a decision.

Q: Is Bexchange a regulated broker?

A: No, Bexchange is not a regulated broker.

Q: What trading instruments are offered by Bexchange?

A: Bexchange offers a range of trading instruments, including forex, commodities, indices, and shares.

Q: What account types are offered by Bexchange?

A: Bexchange offers three account types: Silver, Gold, and VIP.

Q: What is the minimum deposit required to open an account with Bexchange?

A: The minimum deposit required to open a Silver account with Bexchange is $1,000.

Q: What is the maximum trading leverage offered by Bexchange?

A: The maximum trading leverage offered by Bexchange is 1:500.

Q: What trading platform does Bexchange offer?

A: Bexchange offers the MT5 trading platform.

Q: What deposit and withdrawal methods are supported by Bexchange?

A: Bexchange supports deposit and withdrawal methods such as wire transfer and PayBnB.

Q: Does Bexchange charge any non-trading fees?

A: Yes, Bexchange charges non-trading fees such as withdrawal fees and inactivity fees.

Q: Does Bexchange offer customer support?

A: Yes, Bexchange offers customer support through email and phone, but not live chat.

Q: What are the pros and cons of trading with Bexchange?

A: The pros of trading with Bexchange include a wide range of trading instruments, competitive spreads, and access to educational materials. The cons include the lack of regulation, non-disclosure of commissions, and limited deposit and withdrawal methods.

According to experts at the Bureau for Economic Research, South Africa is likely to witness another interest rate hike next week, albeit it may be greater than originally expected (BER).

WikiFX

WikiFX

"In order to curb forex scams, Nigerians must start viewing forex trading as a talent, not a get-rich-quick scheme." People must be patient in order to see their investments increase." These are the remarks of Emmanuel Okwara Jnr., Equiti's Nigerian country manager. The worldwide FX market is the world's largest financial market, with an estimated daily trading volume of around $7 trillion.

WikiFX

WikiFX

Forex trading has become increasingly popular in Nigeria today. Many foreign brokers have seen the potential of the youthful population of this country who prefer quick and easy money-making business and sought to extend their services within the country. Given our preference for ECN brokers over other rest, we have provided a list of the most popular ten brokers operating in Nigeria today as well as the Wikifx rating for these brokers.

WikiFX

WikiFX

This is risk as a forex trader to invest your money in bexchange that is not regulated in WikiFX, because if a broker is not regulated that means any moment you can lose your money. Bexchange has only 1.31 scores in WikiFX, without company license or valid regulatory information. About the complains the number of complaints received by WikiFX have reached 4 for this broker within the past three months.

WikiFX

WikiFX

More

User comment

1

CommentsWrite a review

2023-03-20 17:28

2023-03-20 17:28