User Reviews

More

User comment

28

CommentsWrite a review

2026-01-21 12:01

2026-01-21 12:01

2025-12-23 00:06

2025-12-23 00:06

Score

5-10 years

5-10 yearsRegulated in South Africa

Derivatives Trading License (EP)

MT4 Full License

Global Business

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index4.00

Business Index7.04

Risk Management Index0.00

Software Index9.49

License Index0.79

Single Core

1G

40G

More

Company Name

Trade Quo Global Ltd

Company Abbreviation

TRADEQUO

Platform registered country and region

Seychelles

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Trade Quo Review Summary | |

| Founded | 2020-06-30 |

| Registered Country/Region | Seychelles |

| Regulation | Offshore regulated |

| Market Instruments | Forex/Metals/Indices/Energies/Crypto/Stocks |

| Demo Account | ❌ |

| Leverage | No limit |

| Spread | EUR/USD: 0.8 pips(Standard account average spread) |

| Trading Platform | MT5(Desktop/Mobile), MT4(Mobile) |

| Min Deposit | $1 |

| Customer Support | Email: support@tradequo.com/support@tqgbltd.com |

| Phone: +35725123894 | |

| Twitter, LinkedIn, Instagram, Facebook, TikTok, YouTube, Line | |

Traders can use the industry-standard MT4 and MT5 platforms, along with 4 real accounts featuring unlimited leverage. The broker offers competitive pricing, with a minimum spread starting from 0 pips (though the Standard account averages around 0.8 pips on EUR/USD) and a minimum deposit requirement of just $1.

| Pros | Cons |

| Offshore regulated | High max leverage(No limit) |

| Standard account average EUR/USD spread: 0.8 pips | Demo account unavailable |

| MT4/MT5 available |

Trade Quo is authorized and offshore regulated by the Seychelles Financial Services Authority, with License No. is SD140 and the License Type is Retail Forex License, making it safer than unregulated.

Trade Quo offers various market instruments, including Forex, Metals, Indices, Energies, Crypto, and Stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Precious Metals | ✔ |

| Crypto | ✔ |

Trade Quo has four live account types: RAW, Standard, ZERO, and LIMITLESS ∞. Traders who want low spreads can choose a ZERO account, while those who prefer high leverage can open a LIMITLESS ∞ account. In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only.

| Account Type | RAW | Standard | ZERO | LIMITLESS ∞ |

| Maximum Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:2000 | LIMITLESS ∞* |

| Spread on all majors | 0.1 pip | 0.4 pip | 0.0 pip | 0.6 pip |

| Commission | $3 per side | $0 | $4 per side | $0 |

| Minimum Deposit | Depending on the Payment System, starting from $1 | |||

| Stop Out Level | 20% in accounts, except THB 0% | |||

For more information about the Account types, please refer to the following link: https://www.tradequo.com/fsu/accounts/

The average EUR/USD spread of the standard account is 0.8 pips andthe commission is from 0. The lower the spread, the faster the liquidity.

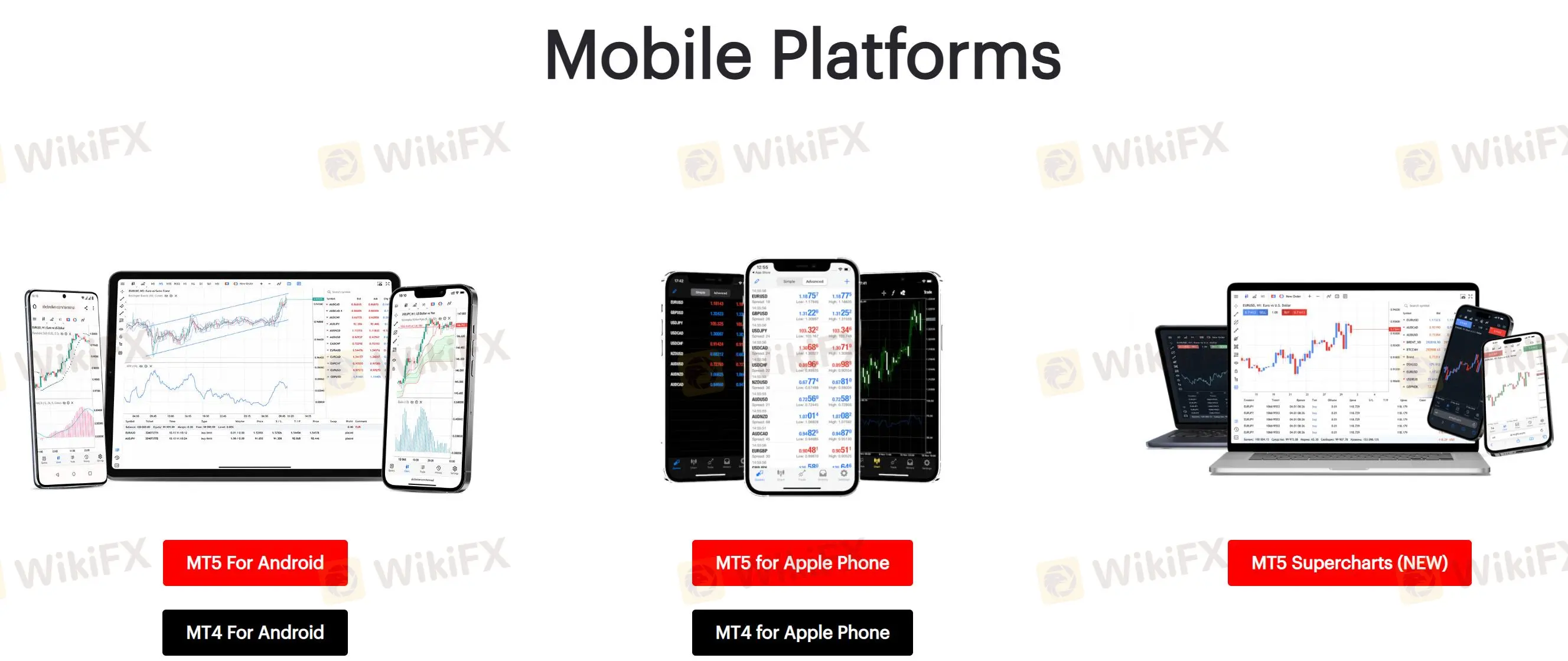

Both MT4 and MT5 provide a wide range of trading strategies and support Expert Advisor (EA) systems, allowing traders to automate their trading approaches efficiently.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop(Windows, Supercharts, Mac), Mobile(Android, Apple Phone,Supercharts) | Experienced traders |

| MT4 | ✔ | Mobile | Junior traders |

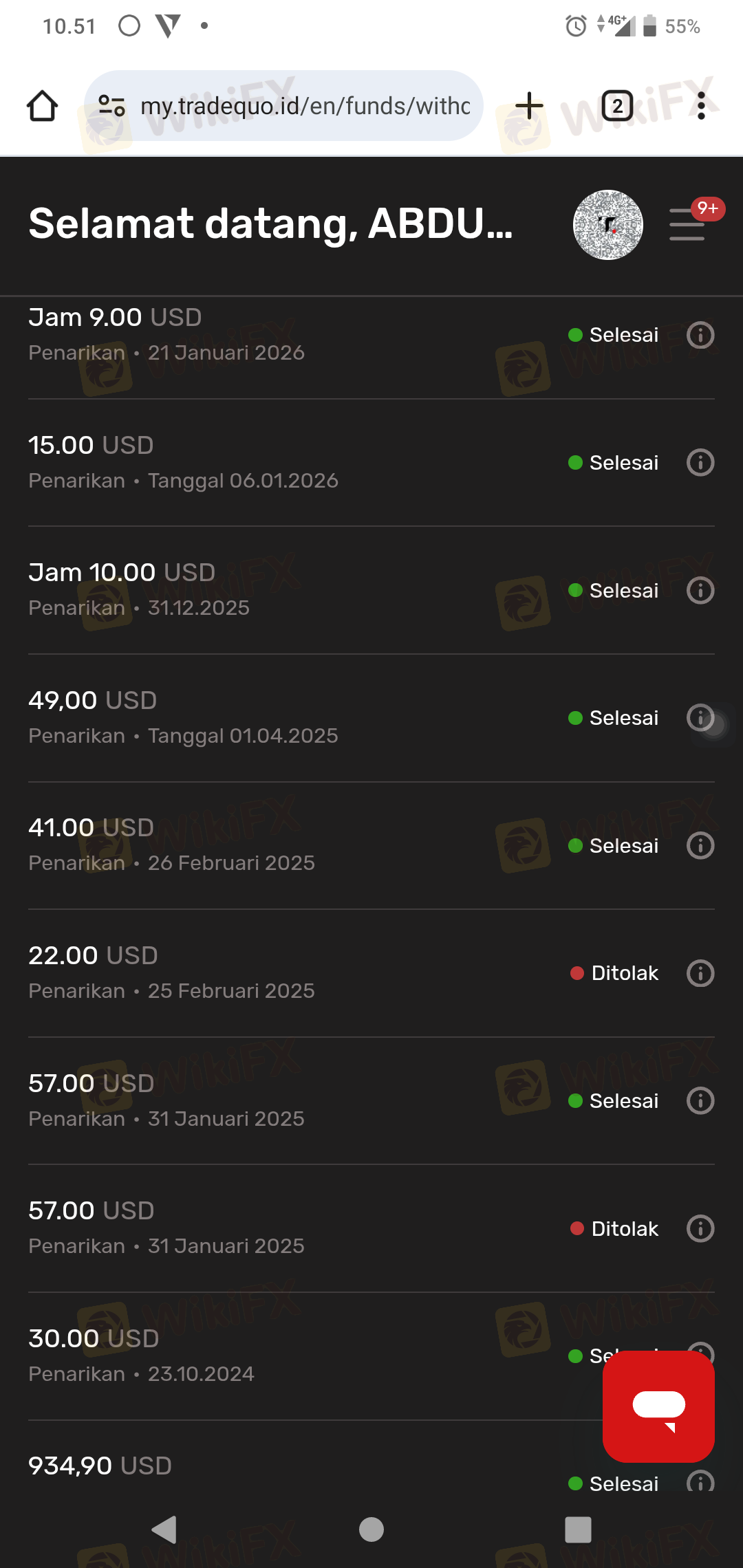

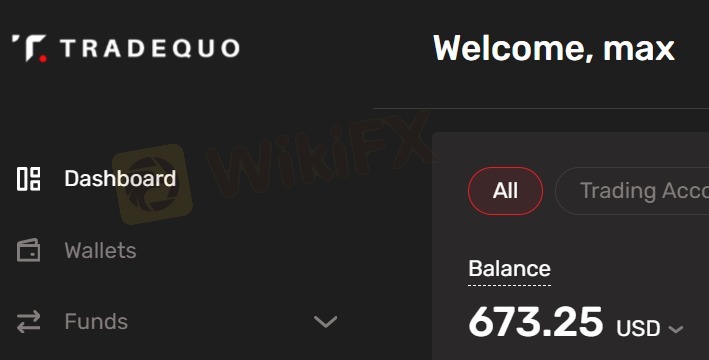

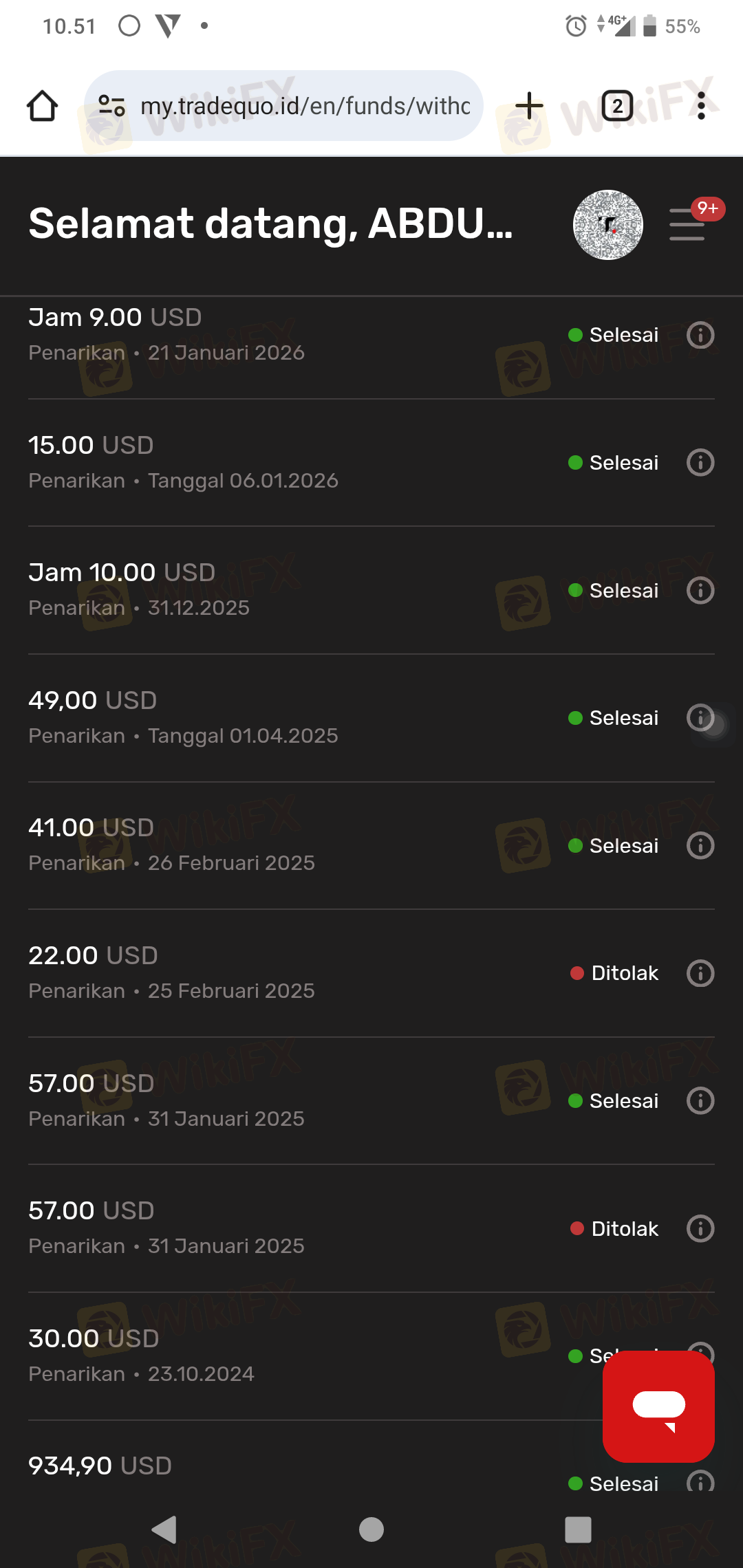

The first deposit amount must be $1 or above and the minimum transaction amount depends on different payment methods. Trade Quo accepts Crypto deposits (Coins and Stablecoins), Card payments, and Bank Transfer details for bank transactions for deposits and Credit/debit cards, e-wallets & Crypto Wallets, and Other methods for Withdrawal. Withdrawal time depends on different withdrawal methods. Most are processed within 5 days.

More

User comment

28

CommentsWrite a review

2026-01-21 12:01

2026-01-21 12:01

2025-12-23 00:06

2025-12-23 00:06