User Reviews

More

User comment

1

CommentsWrite a review

2024-05-07 10:41

2024-05-07 10:41

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 12

Exposure

Score

Regulatory Index0.00

Business Index5.79

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

RIF-CAPITAL

Company Abbreviation

RIF-CAPITAL

Platform registered country and region

Australia

Company website

Company summary

Pyramid scheme complaint

Expose

Scam website, please don’t believe it. Cry for my hard-earned money.

The scam company will let you keep depositing money into it, and finally it would say that you are laundering money and freeze your account. They also ask you to invest more money to unblock your account.

I deposited 11998.50 USDT at Rif Capital. Everything is correct on the blockchain and the money appears on the wallet's browser. But it does not appear in my account or trx history, app or website. Forteclaim alerted and recovered for this issue, transaction ID: b34fb9a47275dd9757ba32c3691449587007b73f37c8ab9fa4e6b216402e8232

This platform is nothing but lie and scam they manipulated my trade and extort me ,I should have stopped investing but instead I continued to trade for weeks, gained some money, and then made the decision to stop. I then requested a withdrawal. They answered that my gains have been erased and that I am unable to retrieve my deposit after two days. After I was able to withdraw my investment, Forteclaim,com increased it. I was annoyed that this broker doesn't pay client profits! How desperate of them! They even referred to this broker as regulated but it’s clearly a lie

I was defrauded out of 11,400 euros. When the customer service found out that I wanted to withdraw money, they blocked me.

I started requesting withdrawals in May. I requested dozens of times a day but all failed. They blocked my account access and wouldn't let me take a penny after investing $65,000. All they concerned about is my balance.

In January, a friend recommended me to invest on this platform. In May, I want to withdraw money after making a profit. I invested 4.5 million yen, paid 7.5 million yen in taxes and 1 million yen in risk control insurance, and I was still asked to pay 1.1 million yen. All my life savings are invested, but I cannot withdraw the money. Help me, an old man in his 50s, to get my hard-earned money back. Thank you friends. I'm so desperate.

The platform allows you to pay your money in 2 ways: bank transfer but made out to natural persons and not to the Company, or with cryptocurrencies such as Eth, Usdt. When you ask to withdraw money, for a small amount they pay it to you without problems within 30 minutes. When you make another withdrawal transaction for a higher amount, they block the withdrawal by stating that it is a system error ( obviously an excuse), and they block your withdrawal for 15 days. In the end, what is the purpose of this platform? Maybe it's to get as much money as possible into the platform, and then eat it all up. So far I have tried to make a small withdrawal of 546 usdt, and it was fine. The next step with the total withdrawal request of 11,000usd, they block it for me. Be careful with this platform Guys, really. Don't even put a cent in it. I did it because I was cheated by someone on WhatsApp.

Partnership fraud. Unable to withdraw funds, customer service said the account was frozen and identity verification was required. Let me continue to invest, otherwise my account will be blocked.

When making money on this platform, you will not be able to withdraw funds normally, and the customer service will block you. Transfers on the platform can only be made to individuals, without company accounts. Although it can be found on ASIC in Australia, it is of no use at all.

In January 2024, I was recommended to this platform by a scammer named Li Zixi to trade. I wanted to withdraw my profits in April, the platform refused to withdraw funds for various reasons. I paid all the taxes and margin, and was defrauded of more than 13 million yuan in total. My hard-earned money in this life has been taken by this platform. It’s so miserable. Now I can't sleep well, don't have enough to eat, and I'm still in debt. It's hard to live.

I have been buying and selling futures on this platform, and all the money is in the trading account. Today I want to transfer a portion back to the main account (wallet shown in the picture), but the internal transfer within the platform is blocked (pending shown in the picture). After communicating with the customer service, the reason given was that because I have not used the platform function for a long time (but I trade in the trading account almost every day), the account is considered to be under supervision, and I need to remit an equal amount of US$2,000 to verify my identity before I can re-open. Use the platform. I can understand this security measure, but the concern is to induce transfers. After I informed customer service of my concerns, I was threatened to permanently freeze my account in three days if I didn't do so. This platform only has telegram, and no one even replies to messages via email. The company's website is https://rif.capital/instruments-etf. Please help me, there is nearly $8,000 in it. To me, that's a lot of money.

| RIF-CAPITAL Review Summary in 10 Points | |

| Registered Country/Region | AUSTRALIA |

| Founded Year | 2023 |

| Regulation | Unregulated |

| Market Instruments | Forex, Metals, Energies, Indices, CFD Stocks, Commodities, Bond, ETF, Cryptocurrency |

| Demo Account | Available |

| Leverage | Up to 1:1000 |

| EUR/USD Spread | 0.1 pips |

| Trading Platforms | WEBTRADER |

| Minimum Deposit | $100 |

| Customer Support | Email, address, contact us form, live chat |

RIF-CAPITAL, an international brokerage firm headquartered in AUSTRALIA, provides a broad selection of financial instruments including Forex, Metals, Energies, Indices, CFD Stocks, Commodities, Bond, ETF and Cryptocurrency. However, it currently operates without anyvalid regulatory oversight, which raises great concerns about its legitimacy and commitment to customer safety.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

| Pros | Cons |

| • Demo account available | • Unregulated |

| • Acceptable minimum deposit | • No MT4/5 trading platform |

| • Wide range of market instruments | • Relatively new in the market |

| • Zero commission | |

| • No deposit/withdrawal fees |

Demo Account Available: RIF Capital offers a Demo Account with virtual funds. This allows you to practice trading strategies and get comfortable with the Webtrader platform before risking real capital.

Acceptable Minimum Deposit: The minimum deposit to open an account with RIF Capital is $100. This is a relatively low barrier to entry for new traders who want to start small.

Wide Range of Market Instruments: RIF Capital allows you to trade various market instruments, including Forex, indices etc., which diversifies your investment portfolios for better opportunities within the market.

Zero Commission: RIF Capital does not charge commissions on trades. This can save you money on transaction fees compared to brokers who charge commissions.

No Deposit/Withdrawal Fees: RIF Capital claims they don't charge any fees for depositing or withdrawing funds using any of their available methods. This can be advantageous for traders seeking a cost-effective way to manage their accounts.

Unregulated: RIF Capital is not subject to the same level of oversight and investor protection as brokers regulated by established financial authorities. This could be a concern for some traders seeking additional security.

No MT4/5 Trading Platform: RIF Capital only offers the Webtrader platform for accessing the markets. This platform might lack the features and customization options found in popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Relatively New in the Market: RIF Capital was established on 2023, which is a relatively new company compared to established brokers. This means they have a limited track record, which could be a concern for some traders.

When considering the safety of a brokerage like RIF-CAPITAL or any other platform, it's important to conduct thorough research and consider various factors.

Regulatory sight: Currently, this broker operates without any legitimate regulatory oversight, raising concerns about transparency and accountability.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedback from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms..

Security measures: RIF-CAPITAL uses segregated accounts to secure client assets which means client funds are kept separate from the company's own money, reducing the risk of misuse.

In the end, choosing whether or not to engage in trading with RIF-CAPITAL is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

RIF-CAPITAL provides a vast playground for investors with over 3500 instruments at their fingertips.

You can dive into the world of foreign exchange (Forex) trading with major, minor, and exotic currency pairs. Speculate on price fluctuations of precious metals like Gold and Silver, or tap into the energy sector with instruments like Crude Oil and Natural Gas.

If you prefer broader market exposure, trade Indices that track leading stock exchanges, or take a more focused approach with CFD Stocks, replicating the price movements of individual companies. Exploring the world of commodities like agricultural products and industrial metals is also an option.

For income-oriented investors, RIF-CAPITAL offers Bonds, representing debt issued by governments and corporations. Take ETFs (Exchange Traded Funds) that track specific market segments into consideration if you are looking for diversified basket of asset. And for crypto enthusiasts, RIF-CAPITAL allows trading in popular digital currencies.

RIF Capital offers three account types to suit your trading needs:

Risk-Free Demo Account: This account is a great way to practice trading without risking any real money. You can test out different trading strategies and get a feel for the markets before you start trading with real capital. The Demo Account comes with virtual funds and allows you to simulate real-world trading conditions.

ZERO Spread Account: This account is ideal for beginners or those who want to trade with tight spreads. There is a minimum deposit of $100 to open this account.

Copy Trading Account: This account allows you to automatically copy the trades of successful traders. This can be a great way to learn from experienced traders and potentially generate profits. The minimum deposit for a Copy Trading Account is also set at $100.

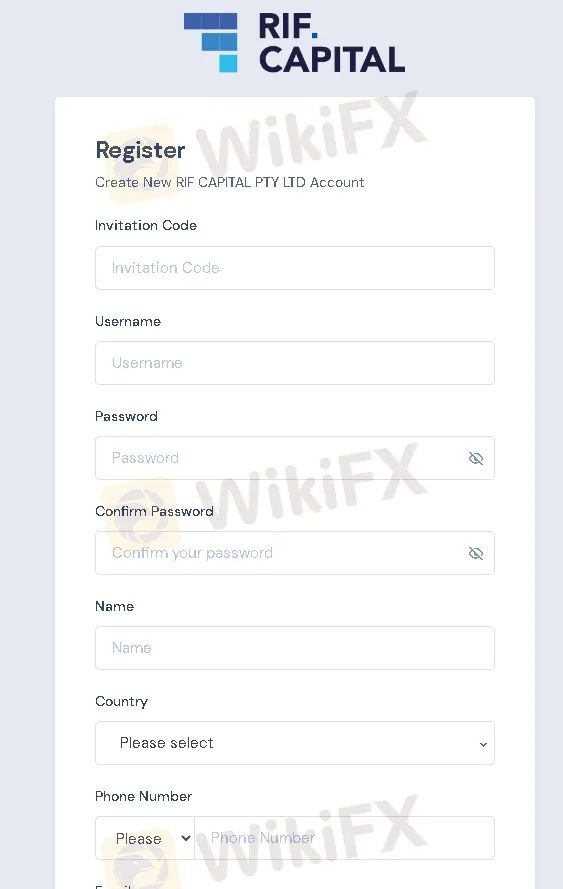

To open an account with RIF-CAPITAL, you have to follow below steps:

Visit the RIF-CAPITAL website, locate and click on the 'Register Now.

Fill in the necessary personal details required.

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

RIF Capital offers aggressive leverage options of up to 1:1000. This means you can control a position much larger than your initial deposit, potentially multiplying your returns. However, you should also be aware at the same time that it also amplifies losses. Always use leverage cautiouly and understand the risks before utilizing high leverage.

RIF Capital boasts competitive pricing for EUR/USD trading. Spreads are tight at 0.1 pips, and they don't charge commission fees on trades. This translates to lower trading costs compared to brokers with wider spreads or commission structures.

However, it's important to consider the overall package offered by RIF Capital. Factor in other features like available markets, margin requirements, and platform functionality when making your decision.

RIF Capital utilizes a Webtrader platform for accessing the Forex market and other assets. This web-based platform eliminates the need for software downloads, offering convenience for traders who prefer browser-based solutions.

Compatibility with various operating systems, including Windows, macOS, and Android, the platform allows accessibility across different devices.

RIF-CAPITAL equips traders with a comprehensive suite of trading tools, including an economic calendar, to enhance their trading experience. The economic calendar provides real-time updates on key economic events, such as interest rate decisions, GDP releases, and employment reports, allowing traders to stay informed about potential market-moving events.

By leveraging this tool, traders can make well-informed decisions, anticipate market volatility, and adjust their trading strategies accordingly.

RIF Capital caters to various funding preferences with options like Mastercard/Visa, Neteller, Tether (USDT), Skrill, and wire transfer. The minimum deposit and withdrawal amount is set at $100, and RIF Capital itself doesn't charge any fees for deposits or withdrawals using any of these methods.

Processing times are efficient, with deposits and withdrawals typically approved within 1-3 hours and transfers completed within an hour.

This combination of multiple funding options, low minimums, and zero fees can be advantageous for traders seeking a convenient and cost-effective way to manage their accounts.

RIF-CAPITAL offers a range of customer service channels for trader support, including email assistance, a physical address for in-person visits, a convenient contact us form on their website, and live chat for immediate support. This multi-channel approach ensures timely and accessible support for traders' queries and concerns.

Address: 98, Forrest Street, COTTESLOE WA 6011, AUSTRALIA.

Email: cs@rif-capital.com.

RIF Capital claims to offer educational resources to cater to both new and experienced traders.

For beginners, they provide a course covering the fundamental aspects of trading, equipping you with the foundational knowledge to navigate the markets.

Additionally, RIF Capital hosts regular webinars and live trading sessions. These sessions can be a valuable tool for further developing your trading skills, regardless of your experience level. By attending live sessions, you can observe experienced traders navigate the markets and glean valuable insights to inform your own trading strategies.

In summary, RIF-CAPITAL is an online brokerage firm located in AUSTRALIA, offering a wide range of trading instruments, including Forex, Metals, Energies, Indices, CFD Stocks, Commodities, Bond, ETF and Cryptocurrency. However, RIF-CAPITAL currently operates without valid regulations, raising concerns about its accountability and commitment to client safety.

| Q 1: | Is RIF-CAPITAL regulated? |

| A 1: | No, it‘s been confirmed that the broker is currently under no valid regulation. |

| Q 2: | Is RIF-CAPITAL a good broker for beginners? |

| A 2: | No, it’s not a good broker because its not regulated by any authorities. |

| Q 3: | Does RIF-CAPITAL offer the industry leading MT4 & MT5? |

| A 3: | No. |

| Q 4: | Does RIF-CAPITAL offer demo accounts? |

| A 4: | Yes. |

| Q 5: | What is the minimum deposit for RIF-CAPITAL? |

| A 5: | The minimum initial deposit to open an account is $100. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

When searching for "RIF-CAPITAL" in WikiFX, we found that we have not yet confirmed its valid license information. WikiFX has received eight complaints against the trader in the past three months.

WikiFX

WikiFX

Uncover the truth about RIF-Capital, an unregulated broker scam manipulating trades and denying withdrawals. Protect your investments by choosing regulated brokers.

WikiFX

WikiFX

RIF-CAPITAL is an online forex broker offering various industry market instruments. In this article, we make a comprehensive review of this broker in order to help you understand RIF-CAPITAL better.

WikiFX

WikiFX

More

User comment

1

CommentsWrite a review

2024-05-07 10:41

2024-05-07 10:41