User Reviews

More

User comment

1

CommentsWrite a review

2024-08-07 10:34

2024-08-07 10:34

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.37

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

XcelFX

Company Abbreviation

XcelFX

Platform registered country and region

Saint Lucia

Company website

Company summary

Pyramid scheme complaint

Expose

| Company Name | XcelFX |

| Registered Country/Area | Saint Lucia |

| Founded year | 2023 |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, Stocks |

| Account Types | Standard, ECN, PRO, Prime |

| Minimum Deposit | $10 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 0.2 pips |

| Trading Platforms | MetaTrader 5 |

| Customer Support | support@www.myxcelfx.net |

| Aspect | Information |

XcelFX, established in 2023 in Saint Lucia, operates as an unregulated brokerage offering a variety of trading assets including forex, commodities, indices, and stocks.

Traders can access these markets through the MetaTrader 5 platform, renowned for its advanced tools and automated trading capabilities. The brokerage offers multiple account types with varying minimum deposits starting from $100, accommodating both novice and experienced traders.

While it provides competitive spreads and leverages up to 1:500, educational resources are limited.

XcelFX operates without any regulatory license. This lack of regulation means there is no official oversight to ensure fair practices, security, or transparency. Users face higher risks of fraud, unfair trading conditions, and potential loss of funds. Trading on an unregulated platform like XcelFX can result in financial losses with limited or no legal recourse.

| Pros | Cons |

| Leverage up to 1:500 | Unregulated |

| 0 commissions charged | Lack of educational resources |

| Multiple account types | High $25,000 minimum for Prime account |

| Wide range of assets | |

| MetaTrader 5 platform provided |

Pros:

Cons:

XcelFX offers a wide range of trading assets across multiple categories. Currency Pairs include over 40 options covering major, minor, and cross pairs, characterized by ultra-low spreads and rapid execution.

For Futures, traders can speculate on the price movements of precious metals such as gold and silver, along with opportunities in global oil and natural gas markets. This asset class appeals to investors looking to diversify their portfolios with commodities known for their economic significance and volatility.

Indices at XcelFX comprise more than 90 cash and forward instruments, including prominent indices like the UK 100, US 30, and Germany 30. These baskets of top shares reflect the overall performance of national economies, providing traders with opportunities to capitalize on broader market trends and economic indicators.

Similarly, Stocks trading allows access to a selection of top shares from various global markets, facilitating investments in companies that represent the economic health and performance of their respective countries. This asset category supports various trading strategies, ranging from short-term speculation to long-term investment approaches.

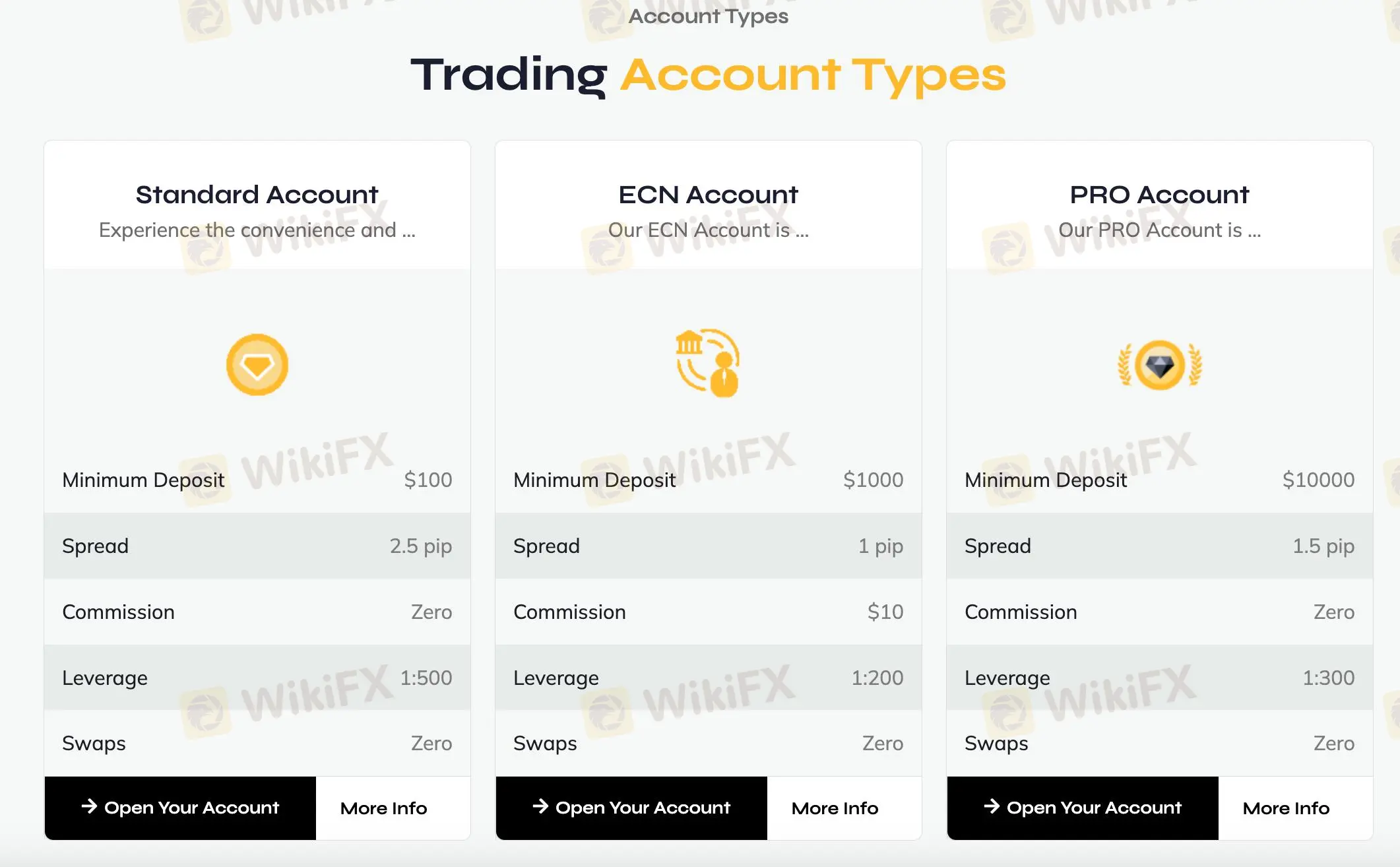

XcelFX offers a range of account types tailored to different levels of trading experience and investment preferences. The Standard Account requires a minimum deposit of $100 and features a spread of 2.5 pips with no commission. This account is suitable for beginners or traders looking to start with a modest investment, offering higher spreads but no additional trading costs.

For more seasoned traders, the ECN Account demands a higher minimum deposit of $1000 and provides a tighter 1 pip spread with a $10 commission per trade. This account type appeals to traders who prioritize lower spreads and are comfortable with paying a commission for potentially enhanced trading conditions and execution speed.

The PRO Account targets professional traders with a minimum deposit of $10000, offering a 1.5 pip spread with zero commission. This account type is designed for traders who execute larger volumes and require competitive spreads without additional transaction costs.

Additionally, XcelFX offers a Prime Account requiring a $25000 minimum deposit, featuring a 1.2 pip spread and zero commission, along with a 1:200 leverage. This account is suitable for high-net-worth individuals or institutional clients seeking premium trading conditions and lower spreads.

| Account Type | Minimum Deposit | Spread | Commission | Leverage | Swaps |

| Standard Account | $100 | 2.5 pip | Zero | 1:500 | Zero |

| ECN Account | $1000 | 1 pip | $10 | 1:200 | Zero |

| PRO Account | $10000 | 1.5 pip | Zero | 1:300 | Zero |

| Prime Account | $25000 | 1.2 pip | Zero | 1:200 | Zero |

Here are the steps to open an account with XcelFX:

XcelFX offers varying maximum leverage based on account type: Standard and PrimeAccount users can leverage up to 1:500, ECN Account users up to 1:200, and PRO Account users up to 1:300.

This high leverage allows traders to control larger positions with a smaller initial investment, increasing both potential returns and risks.

XcelFX offers a range of spreads and commission structures across its account types.

The Standard Account features a spread of 2.5 pips with no commission, making it accessible for entry-level traders or those who prefer simplicity in trading costs. In contrast, the ECN Account presents a tighter spread of 1 pip, coupled with a $10 commission per trade. This account type suits more experienced traders who prioritize competitive spreads and are willing to pay a commission for enhanced trading conditions.

The PRO Account offers a 1.5 pip spread with zero commission, accommodating professional traders who trade in larger volumes and seek competitive spreads without additional transaction fees.

Comparatively, against popular brokers, XcelFX's spreads on its Standard and PRO Accounts may appear higher than some leading brokers that offer spreads as low as 0.5 pips for similar account types.

However, the ECN Accounts combination of 1 pip spread and $10 commission per trade is competitive in the market where some brokers offer commission-free trading with slightly higher spreads. These fee structures position XcelFX as suitable for a broad spectrum of traders—from beginners who prioritize low initial investment and straightforward costs, to more advanced traders who value tighter spreads and are comfortable with commission-based trading models for potentially better execution and market access.

XcelFX offers a range of account types with varying minimum deposit requirements.

The Standard Account requires a minimum deposit of $100, making it accessible for traders looking to start with a modest initial investment. For those seeking tighter spreads and enhanced trading conditions, the ECN Account mandates a higher deposit of $1000. The PRO Account is designed for professional traders with a minimum deposit of $10000, offering competitive features and potentially lower trading costs. Lastly, the Prime Account serves high-net-worth individuals or institutional clients, requiring a substantial deposit of $25000 to access premium trading conditions.

XcelFX provides various payment methods for depositing funds into trading accounts, although specific details regarding these methods and associated fees are not readily available on their trading platform's website.

XcelFX provides accessible customer support available 24/7. For inquiries or assistance, contact them via phone or email at support@www.myxcelfx.net. Their dedicated team ensures prompt responses to help traders resolve issues or get answers to their questions effectively.

In conclusion, XcelFX presents itself as a dynamic brokerage offering a range of trading opportunities across forex, commodities, indices, and stocks through the MetaTrader 5 platform.

While operating without regulation, it provides flexibility with multiple account types and competitive leverage options up to 1:500. While it boasts accessible customer support, potential traders should consider the lack of regulatory oversight and limited educational resources.

XcelFX serves traders seeking varied market access and robust trading tools, albeit with awareness of associated risks.

What trading platform does XcelFX offer?

XcelFX offers the MetaTrader 5 platform.

What is the minimum deposit for a Standard account?

The minimum deposit for a Standard account is $100.

Is XcelFX regulated?

No, XcelFX is not regulated.

What leverage options are available at XcelFX?

XcelFX offers leverage up to 1:500.

Which assets can be traded on XcelFX?

Traders can access forex, commodities, indices, and stocks.

How can traders contact XcelFX customer support?

Customer support is available 24/7 via phone and email.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

More

User comment

1

CommentsWrite a review

2024-08-07 10:34

2024-08-07 10:34