User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.79

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

Danger

| Aspect | Information |

| Registered Country | Australia |

| Company Name | TraderAi |

| Regulation | Unregulated broker |

| Minimum Deposit | 250$ |

| Maximum Leverage | 1:50 |

| Trading Platforms | MetaTrader 5 (MT5) |

| Tradable Assets | Forex, shares, cryptocurrencies, commodities, indices, ETFs |

| Demo Account | Available |

| Customer Support | 24/5 customer support via phone and email |

| Payment Methods | Cryptocurrencies, bank transfers |

TraderAi, headquartered in Australia, operates as an unregulated broker offering a minimum deposit requirement of $250 and a maximum leverage of 1:50. Traders can access the MetaTrader 5 (MT5) platform to trade a diverse range of assets, including Forex, shares, cryptocurrencies, commodities, indices, and ETFs. The platform provides a demo account for users to practice trading strategies risk-free. Customer support is available 24/5 via phone and email, and payment methods include cryptocurrencies and bank transfers.

TraderAi operates as an unregulated broker, lacking oversight from financial authorities. Investors should exercise caution when engaging with unregulated brokers as they may pose higher risks of fraud or misconduct due to the absence of regulatory scrutiny. It's advisable for traders to prioritize platforms regulated by reputable authorities to safeguard their investments.

TraderAi offers a diverse range of market instruments, including Forex, shares, cryptocurrencies, commodities, indices, and ETFs, catering to various trading strategies and investment goals. However, being an unregulated broker, TraderAi lacks oversight from financial authorities, posing potential risks to investors. While the platform provides convenient deposit and withdrawal options, users should exercise caution with leverage and prioritize risk management. With a user-friendly MT5 trading platform and dedicated customer support, TraderAi aims to support traders in navigating the markets effectively, but users should remain vigilant and informed about potential risks.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

TraderAi offers a comprehensive array of market instruments across different asset classes:

Forex: Currency pairs for trading foreign exchange, allowing investors to speculate on the relative strength of different currencies.

Shares: Stocks of publicly listed companies available for trading, offering opportunities to invest in individual companies across various industries.

Cryptocurrencies: Digital currencies like Bitcoin, Ethereum, and others, enabling traders to participate in the rapidly evolving cryptocurrency market.

Commodities: Physical goods such as gold, silver, oil, and agricultural products, providing avenues for diversification and hedging against inflation.

Indices: Benchmarks representing a basket of stocks or other assets, allowing traders to speculate on the overall performance of specific markets or sectors.

ETFs (Exchange-Traded Funds): Investment funds traded on stock exchanges, offering exposure to a diversified portfolio of assets such as stocks, bonds, or commodities in a single trade.

TraderAi's offering of these instruments caters to a wide range of trading strategies and investment goals, but potential investors should be mindful of the risks associated with trading on an unregulated platform.

TraderAi offers a maximum trading leverage of 1:50, allowing traders to amplify their positions by up to 50 times the amount of their initial investment. Leverage can magnify both profits and losses, making it crucial for traders to exercise caution and implement risk management strategies. It's essential for traders to fully understand the implications of leverage before utilizing it in their trading activities to mitigate potential risks.

Trader AI provides users with a flexible and convenient deposit and withdrawal process, offering various options to suit individual preferences:

Deposit Options:

Cryptocurrencies: Users can securely deposit cryptocurrencies directly from their private cold or hot wallets, ensuring the safety and efficiency of asset transfer.

Crypto Exchanges: Assets can be easily transferred from various crypto exchanges directly to the Trader AI account, streamlining the deposit process for users.

Withdrawal Options:

Cryptocurrencies: Withdrawals can be made in cryptocurrencies, providing users with the flexibility to transfer their funds to their private wallets.

Bank Transfer: Trader AI supports bank transfers for withdrawals, allowing users to withdraw funds directly to their bank accounts.

Trader AI offers the MetaTrader 5 (MT5) trading platform, which is user-friendly and packed with features for traders of all levels. Here's what you get:

Easy-to-use charts with customizable indicators.

Access to various assets like Forex, stocks, commodities, and cryptocurrencies.

Option for automated trading using Expert Advisors.

Market depth view for better decision-making.

Economic calendar to track important events.

Tools for managing risks like stop-loss orders.

Mobile app for trading on-the-go.

In short, Trader AI's MT5 platform provides everything you need for efficient and informed trading across different markets.

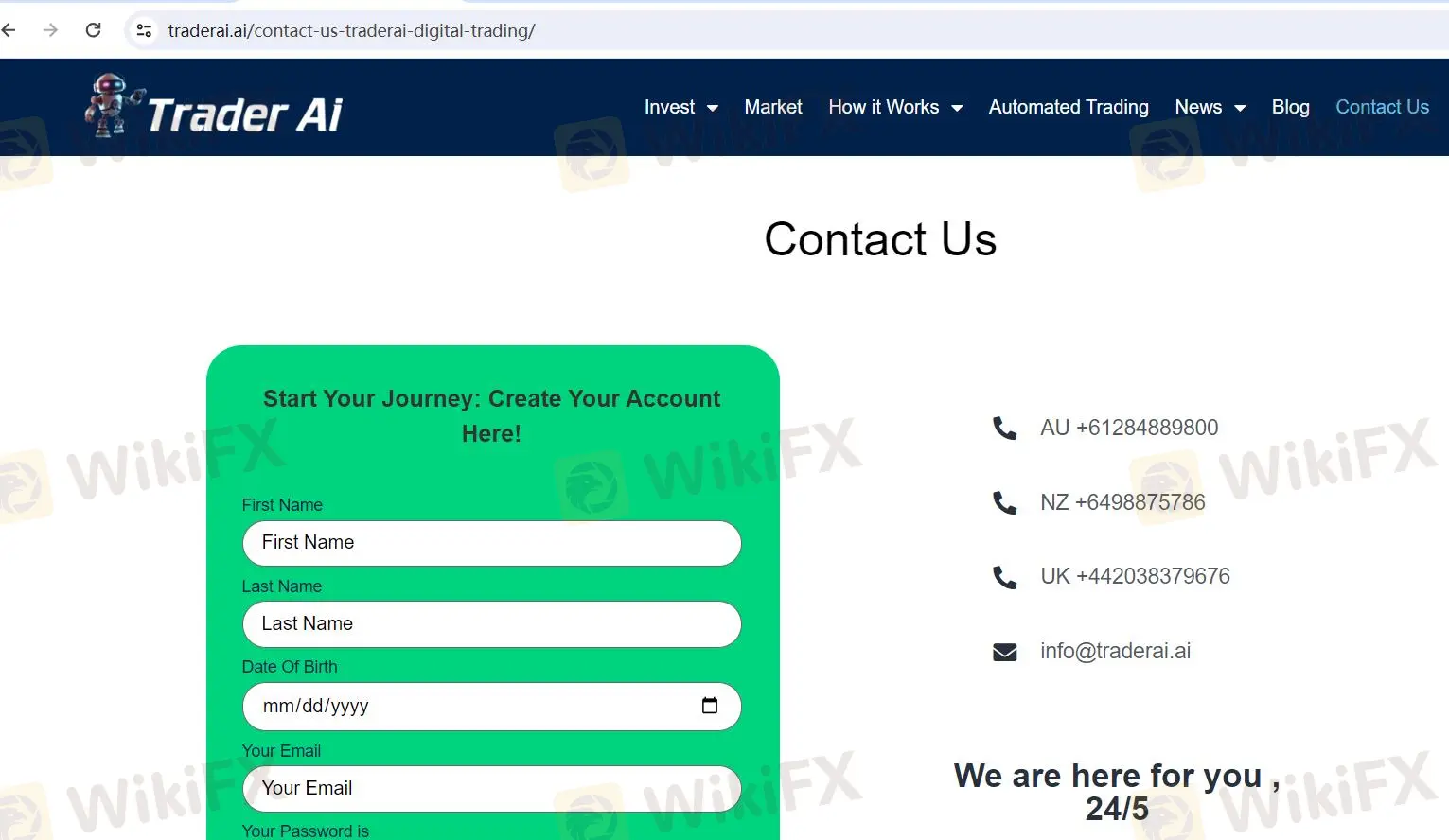

Trader AI's customer support is readily available to assist users 24/5, offering personalized assistance tailored to individual needs. Traders can contact the support team via phone using the following international numbers: +61284889800 (AU), +6498875786 (NZ), and +442038379676 (UK). Additionally, users can reach out via email at info@traderai.ai or fill out an online contact form. Whether it's help with account setup, technical queries, or general assistance, Trader AI's knowledgeable support representatives are committed to providing timely and effective solutions to ensure a smooth trading experience for all users.

In conclusion, TraderAi presents a range of trading opportunities across various asset classes, including Forex, stocks, cryptocurrencies, and more. However, it's important to note the absence of regulatory oversight and the potential risks associated with unregulated brokers. While the platform offers convenient deposit and withdrawal options, traders should approach leverage cautiously and implement risk management strategies. With a user-friendly MT5 trading platform and dedicated customer support available 24/5, TraderAi aims to support traders in navigating the markets effectively, but users should remain vigilant and informed about potential risks.

Q1: Is TraderAi regulated?

A1: No, TraderAi operates as an unregulated broker.

Q2: What deposit options does TraderAi offer?

A2: TraderAi provides deposit options including cryptocurrencies and transfers from crypto exchanges.

Q3: What is the maximum trading leverage offered by TraderAi?

A3: TraderAi offers a maximum trading leverage of 1:50.

Q4: What trading platform does TraderAi offer?

A4: TraderAi offers the MetaTrader 5 (MT5) trading platform.

Q5: How can I contact TraderAi's customer support?

A5: You can contact TraderAi's customer support via phone or email using the provided international numbers and email address.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment