User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index7.00

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Key Information | Details |

| Company Name | FOXCEL FX LIMITED |

| Years of Establishment | 2-5 years |

| Headquarters | Marshall Islands |

| Office Locations | Ajeltake Island, Majuro |

| Regulation | Unregulated |

| Tradable Assets | Forex, Precious Metals |

| Account Types | Standard |

| Minimum Deposit | $100 |

| Leverage | Up to 1:100 |

| Spread | 3 pips |

| Deposit/Withdrawal Methods | Credit Cards, Debit Cards, Wire Transfers, E-wallets |

| Trading Platforms | MetaTrader 4 |

| Customer Support Options | Email, Phone |

FOXCEL FX LIMITED is an unregulated forex broker founded around 2-5 years ago, with its headquarters situated in the Marshall Islands. The company offers forex and precious metals trading services through its MetaTrader 4 platform. Traders can access a Standard Account with a minimum deposit requirement of $100 and a leverage ratio of up to 1:100, and spreads start at 3 pips.

Customers can use various deposit and withdrawal methods, including credit cards, debit cards, wire transfers, and e-wallets. The company provides customer support through email and phone. It should be noted that FOXCEL FX LIMITED operates from Ajeltake Island, Majuro, and currently does not have any physical office locations beyond its headquarters, and its website appears inoperable since 2022.

FOXCEL FX LIMITED operates without regulation as it has been labeled unauthorized by major financial regulators. This means that the company is not authorized or licensed to offer financial services in regulated jurisdictions. There is no specific regulator mentioned in the provided information, and the company does not possess any license numbers that indicate compliance with financial regulations. As an unauthorized entity, FOXCEL FX LIMITED is not subject to the oversight and scrutiny that regulated brokers undergo.

FOXCEL FX LIMITED offers forex and precious metals trading services through its MetaTrader 4 platform, providing customers with accessibility and ease of use. The company allows a low minimum deposit of $100 for a Standard Account, giving traders the opportunity to start with a relatively small investment. The leverage ratio of up to 1:100 offers potential for increased trading power. Furthermore, FOXCEL FX LIMITED supports multiple deposit and withdrawal methods, including credit cards, debit cards, wire transfers, and e-wallets, providing clients with flexibility in managing their funds. The 24/7 customer support via email and phone, available in various languages, ensures availability and responsiveness to address client queries and concerns promptly.

FOXCEL FX LIMITED operates as an unregulated broker, lacking the necessary oversight and approval from recognized financial regulators. Being unauthorized poses higher risks for traders, as the company may not adhere to stringent compliance standards and might lack transparency in its practices. Additionally, the absence of regulatory protection could leave customers vulnerable to potential disputes without access to dispute resolution mechanisms or compensation schemes. The company's negative reputation on certain review websites, citing issues with regulation, slow withdrawal processes, and poor customer service, raises concerns about its overall reliability and credibility.

| Pros | Cons |

| Accessibility and ease of use | Unregulated status |

| Low minimum deposit | Lack of oversight and transparency |

| Up to 1:100 leverage | Potential risks for traders |

| Multiple deposit/withdrawal methods | Negative reputation on review websites |

| 24/7 multilingual customer support | No regulatory protection |

FOXCEL FX LIMITED's website has been inaccessible since April 2022, which raises concerns about the company's credibility. A non-functional website can indicate potential issues such as financial instability, technical problems, or even a cessation of operations. Traders who cannot access the website may face significant disadvantages. They are unable to gather essential information about the company's services, trading conditions, and regulatory status.

Moreover, potential clients cannot create trading accounts with FOXCEL FX LIMITED through the website. The inability to open accounts directly with the broker restricts traders from engaging in forex and precious metals trading offered by the company.

FOXCEL FX LIMITED provides forex and precious metals trading services.

Forex Trading: FOXCEL FX LIMITED provides forex trading services, allowing traders to speculate on currency price movements in major currency pairs and crosses.

Precious Metals Trading: FOXCEL FX LIMITED offers the opportunity to trade precious metals, enabling traders to speculate on the price movements of assets like gold and silver.

The following is a table that compares FOXCEL FX LIMITED to competing brokerages:

| Broker | Market Instruments |

| FOXCEL FX | Forex, Precious Metals |

| OctaFX | Forex, Precious Metals, Indices, Cryptocurrencies |

| FXCC | Forex, Precious Metals, Indices, Energies, Cryptocurrencies |

| Tickmill | Forex, Precious Metals, Indices, Bonds, Cryptocurrencies |

| FxPro | Forex, Precious Metals, Indices, Energies, Cryptocurrencies |

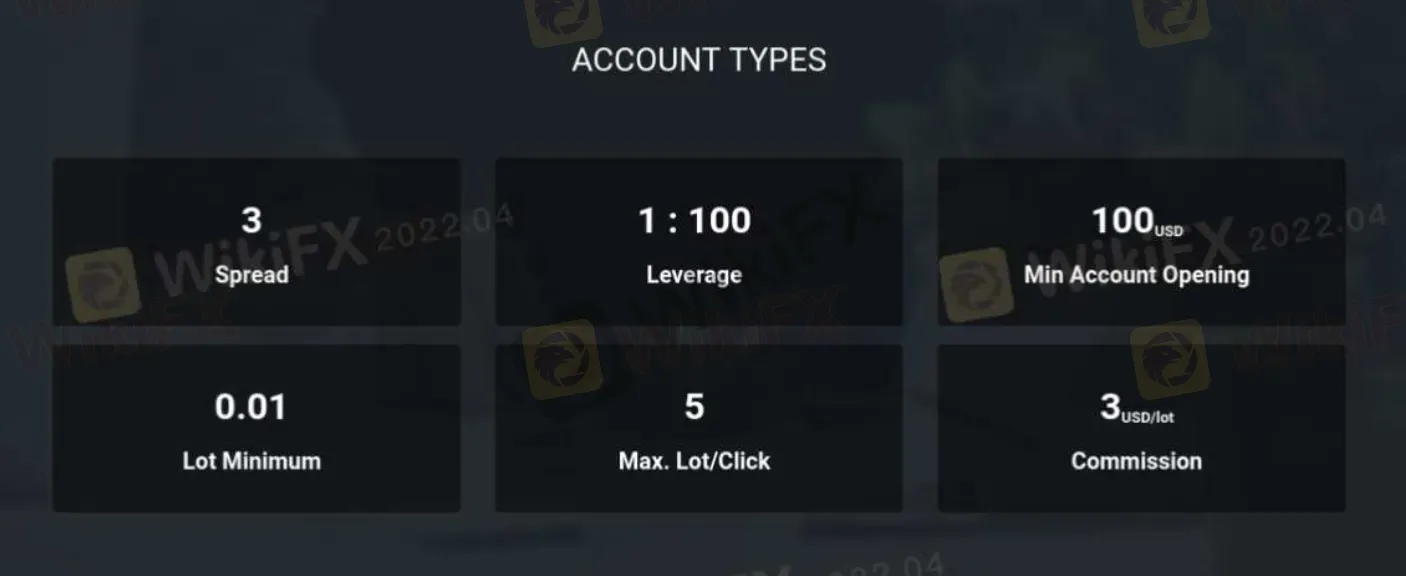

FOXCEL FX LIMITED offers a singular Standard Account, which allows traders to start with a minimum deposit of $100. This account type provides a leverage ratio of up to 1:100 and offers spreads starting at 3 pips. Traders can access the MetaTrader 4 trading platform with this account, enabling them to trade forex and precious metals.

For the standard account, the only account currently offered by FOXCEL FX, the minimum deposit required is $100. The minimum deposit amount allows traders to get started with their chosen account type, whether it's the Standard Account, Mini Account, or Cent Account, without having to commit large amounts of capital upfront.

FOXCEL FX LIMITED offers a leverage ratio of up to 1:100 for traders. Leverage allows traders to control larger positions in the market with a smaller amount of capital, potentially increasing their exposure and trading power. A leverage ratio of 1:100 means that for every $1 in the trader's account, they can control a position worth up to $100 in the market.

Here is a table comparing FOXCEL FX to other brokers:

| Broker | Forex Leverage | Precious Metals Leverage |

| FOXCEL FX | Up to 1:100 | Up to 1:100 |

| OctaFX | Up to 1:500 | Up to 1:100 |

| FXCC | Up to 1:300 | Up to 1:200 |

| Tickmill | Up to 1:500 | Up to 1:500 |

| FxPro | Up to 1:500 | Up to 1:125 |

FOXCEL FX LIMITED offers spreads starting at 3 pips for traders. The spread represents the difference between the buying (ask) and selling (bid) prices of a financial instrument, and it is an essential factor affecting trading costs. A spread of 3 pips means that traders will need the market to move at least 3 pips in their favor before they can potentially generate a profit.

FOXCEL FX LIMITED offers a variety of deposit and withdrawal methods for its clients. Traders can fund their accounts using credit cards, debit cards, wire transfers, and e-wallets. Credit and debit cards provide a convenient and widely used method for instant deposits, while wire transfers offer a more traditional and direct way to transfer funds. E-wallets, on the other hand, offer a digital payment solution that can expedite both deposits and withdrawals. The availability of multiple deposit and withdrawal options allows traders to choose the method that best suits their preferences and needs, providing flexibility and ease in managing their funds.

FOXCEL FX LIMITED offers the popular MetaTrader 4 trading platform to its clients. MetaTrader 4 is a widely recognized and user-friendly platform, known for its comprehensive charting tools, technical indicators, and expert advisors (EAs). It provides traders with access to real-time market data, advanced order types, and a customizable interface. The platform's mobile version allows traders to stay connected and manage their trades on the go.

The following table compares the trading platforms offered by various brokers:

| Broker | Trading Platforms |

| FOXCEL FX | MetaTrader 4 |

| OctaFX | MetaTrader 4, MetaTrader 5, cTrader |

| FXCC | MetaTrader 4, MetaTrader 5, cTrader |

| Tickmill | MetaTrader 4, MetaTrader 5 |

| FxPro | MetaTrader 4, MetaTrader 5, cTrader |

FOXCEL FX LIMITED offers customer support through email and phone, providing traders with multiple channels to reach out for assistance.

Email Support: To reach customer support via email, traders can send their inquiries and concerns to support@foxcelfx.com. Email support offers a written communication channel, allowing clients to provide detailed information about their issues.

Phone Support: Traders can contact customer support through the phone at the provided English support number: +1 (814) 349-3885. Phone support allows for direct and immediate communication, enabling clients to seek real-time assistance.

Customer feedback about FOXCEL FX LIMITED indicates a negative reputation on certain review websites. Traders have expressed concerns regarding the company's lack of regulation, slow withdrawal processes, and poor customer service. These reviews highlight potential issues with the company's overall reliability and credibility.

FOXCEL FX LIMITED, an unregulated forex broker, offers a singular Standard Account making for a simplistic and straightforward experience. The company provides trading services for forex and precious metals through the widely-used MetaTrader 4 platform. Traders can access multiple deposit and withdrawal options, including credit cards, debit cards, wire transfers, and e-wallets.

Despite its accessible entry point and user-friendly platform, FOXCEL FX LIMITED has garnered negative customer feedback on review websites, raising concerns about its overall credibility and reliability. The absence of regulation further contributes to the uncertainties surrounding the company's practices and client fund security.

Q: What is FOXCEL FX LIMITED's minimum deposit requirement for the Standard Account?

A: The minimum deposit for the Standard Account is $100.

Q: What leverage ratio does FOXCEL FX LIMITED offer to traders?

A: FOXCEL FX LIMITED provides a leverage ratio of up to 1:100.

Q: What are the available deposit and withdrawal options for traders?

A: Traders can use credit cards, debit cards, wire transfers, and e-wallets for deposits and withdrawals.

Q: Does FOXCEL FX LIMITED have any physical office locations other than its headquarters?

A: No, FOXCEL FX LIMITED operates solely from its headquarters.

Q: What trading platform does FOXCEL FX LIMITED offer?

A: FOXCEL FX LIMITED offers the MetaTrader 4 trading platform.

Q: How can traders contact customer support?

A: Traders can reach customer support through email and phone.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment