User Reviews

More

User comment

18

CommentsWrite a review

2025-04-16 05:19

2025-04-16 05:19

2024-10-12 11:15

2024-10-12 11:15

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT4 Full License

High potential risk

Influence

Add brokers

Comparison

Quantity 7

Exposure

Score

Regulatory Index0.00

Business Index7.52

Risk Management Index0.00

Software Index8.98

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

COINEXX LTD

Company Abbreviation

COINEXX

Platform registered country and region

Comoros

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

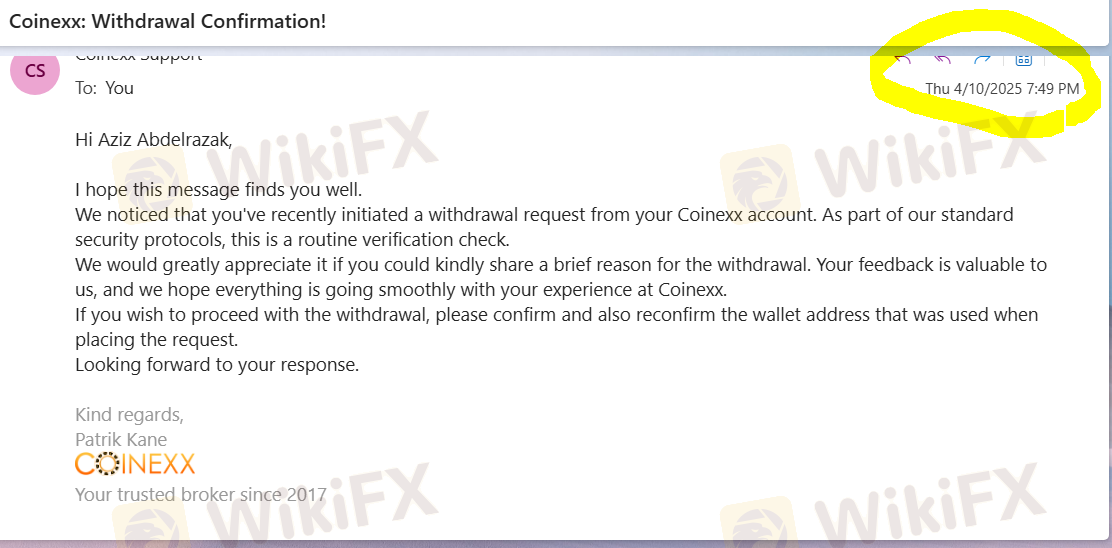

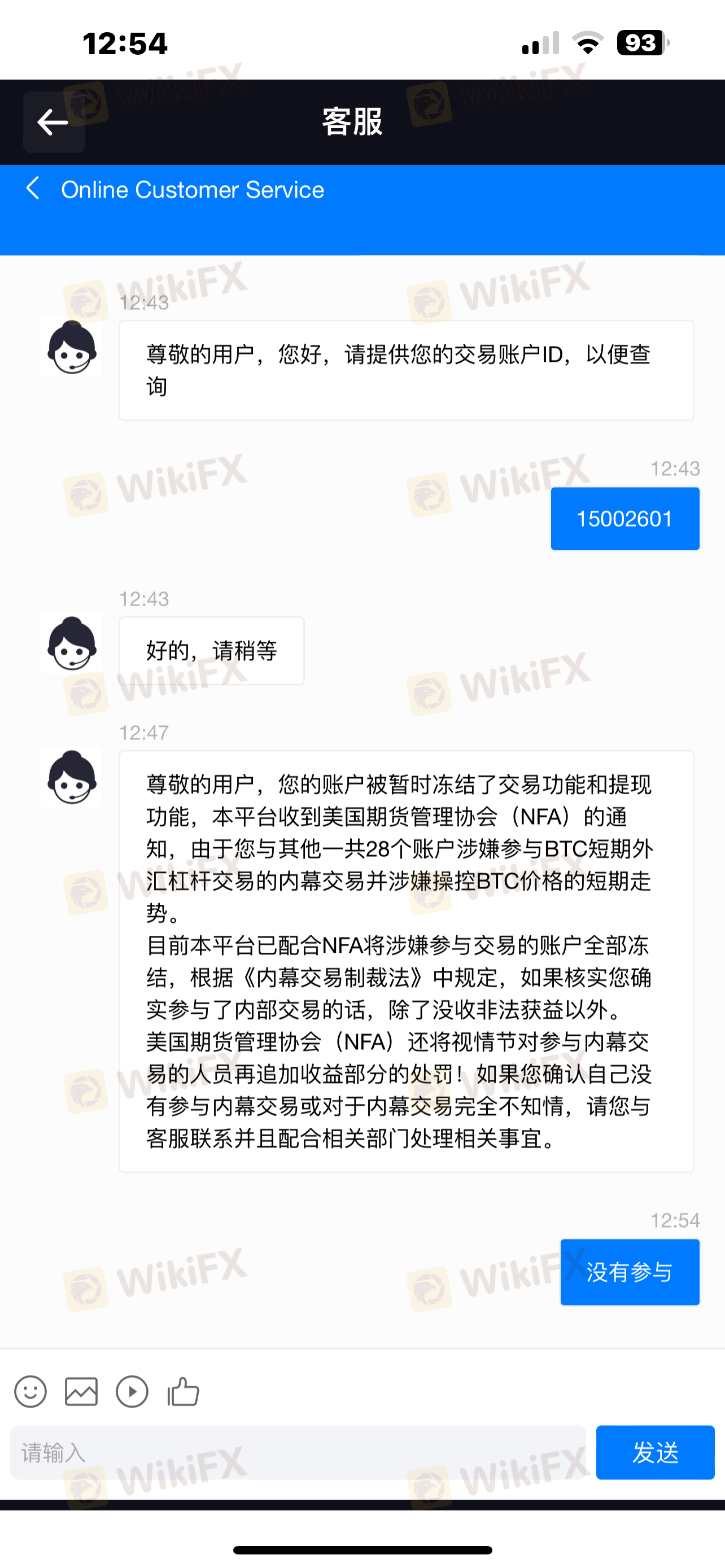

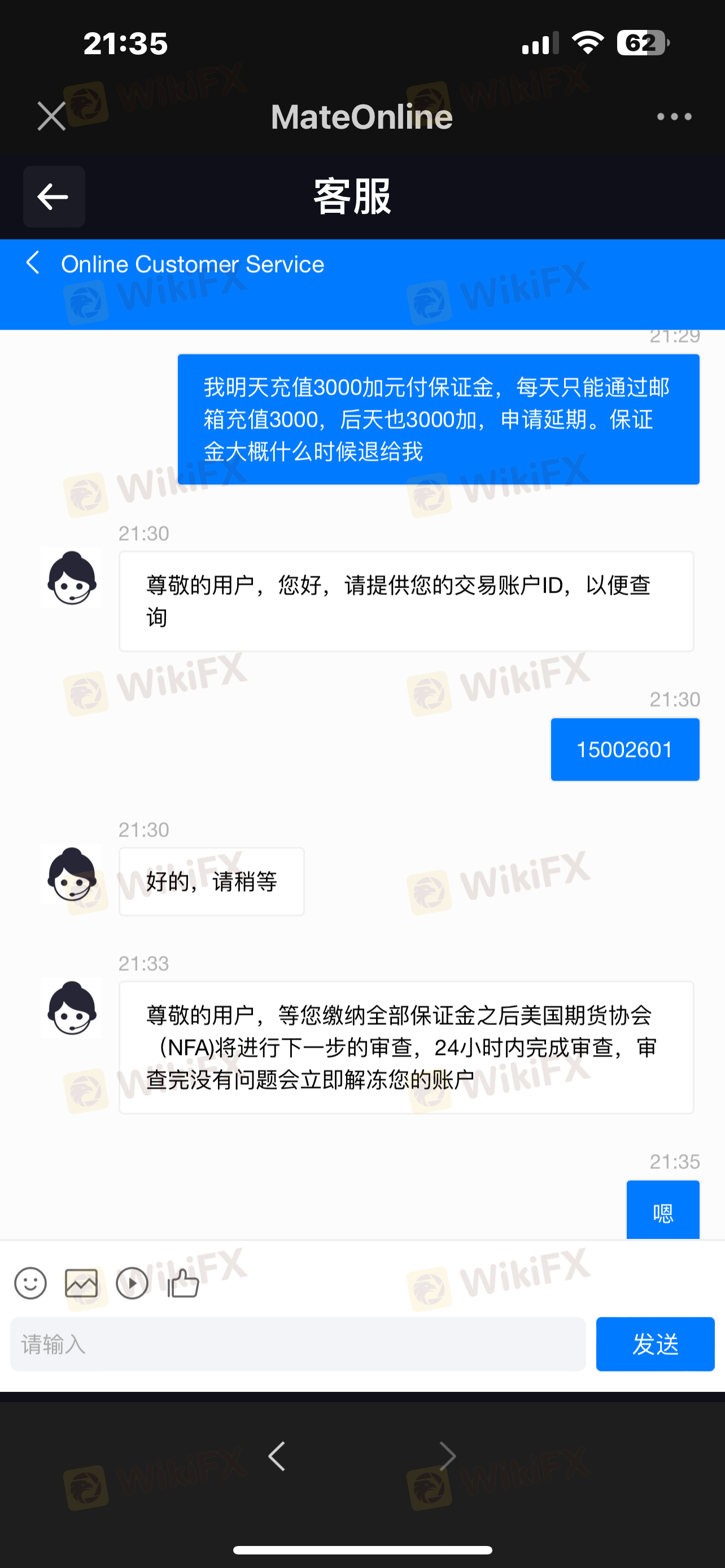

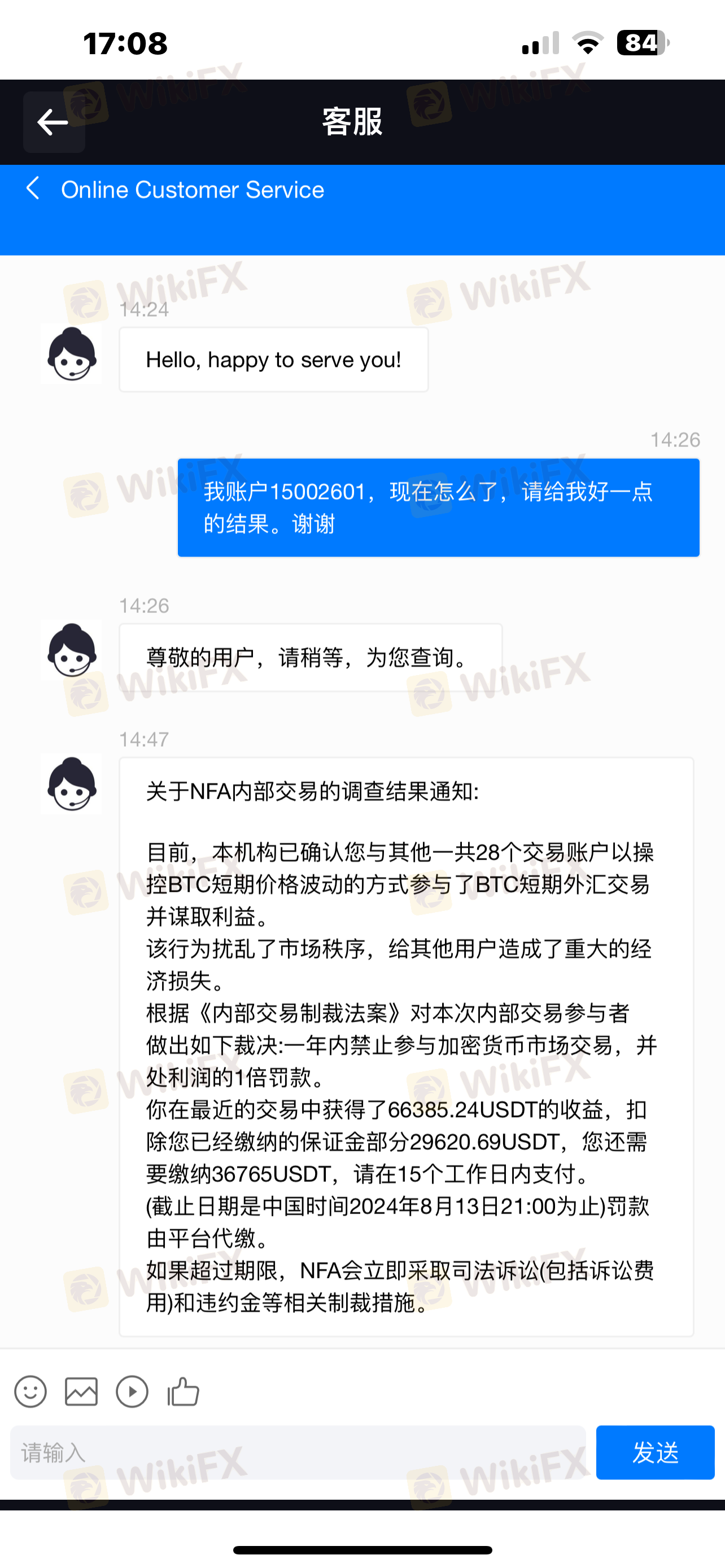

I have been trying to withdraw $29000 USD since last year, keep emailing them and doing what I can to provide data yet they are not doing anything about it, just generic email response. Help me get my money back

I trade with coinexx on demo, everything was perfect, as soon as I switched to live, I started getting all kind of slippage, didn’t matter if its market or limit it order slow or fast market, and those crook get me in the worth price possible when I get it or get out with this dishonest people

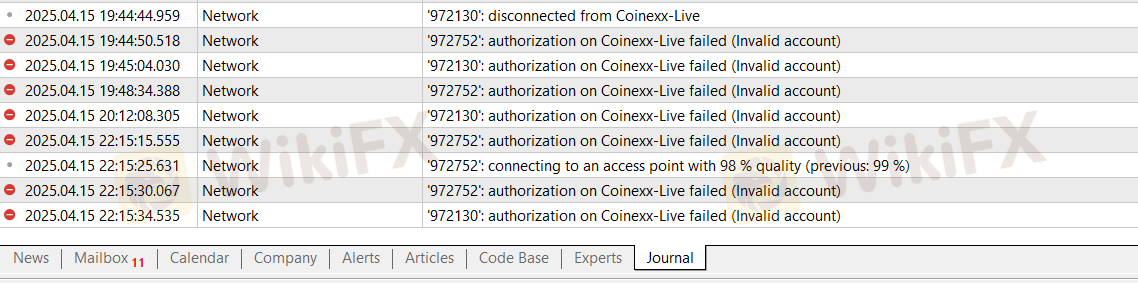

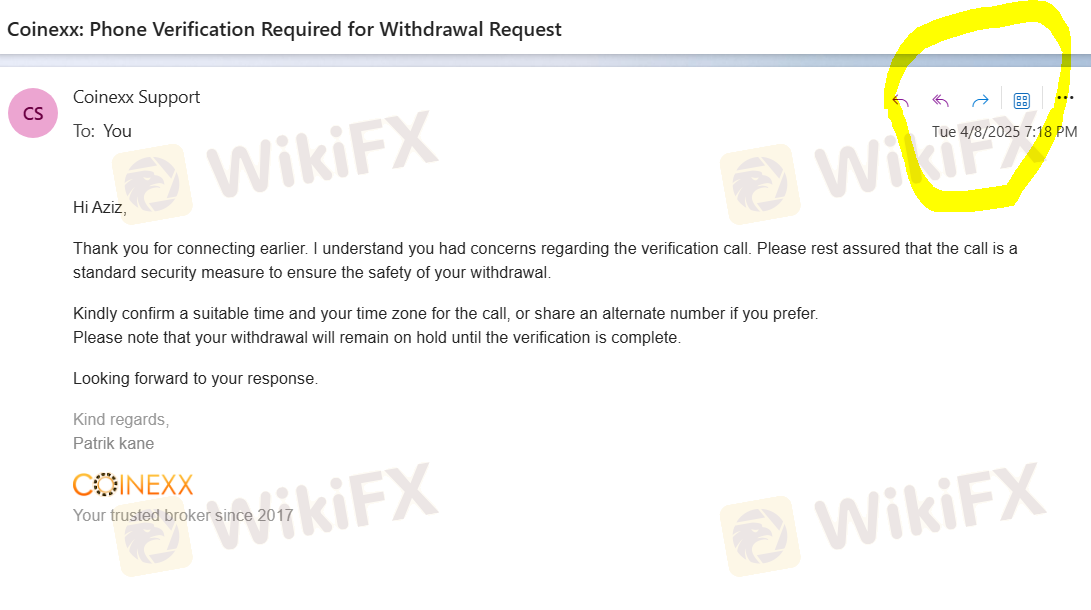

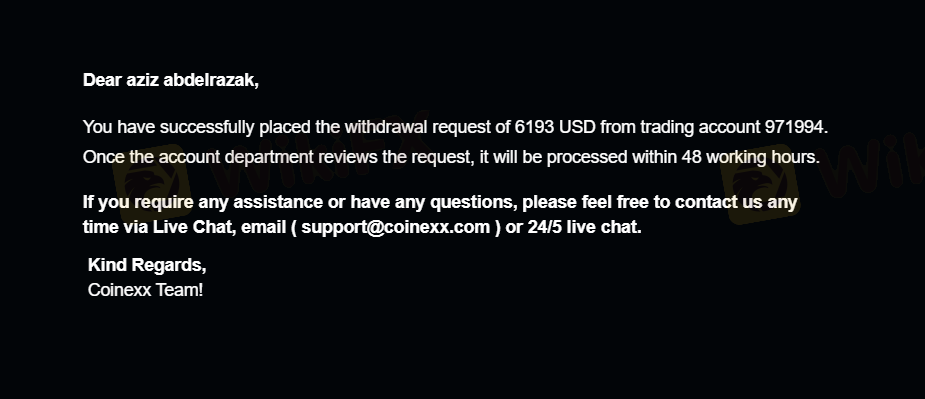

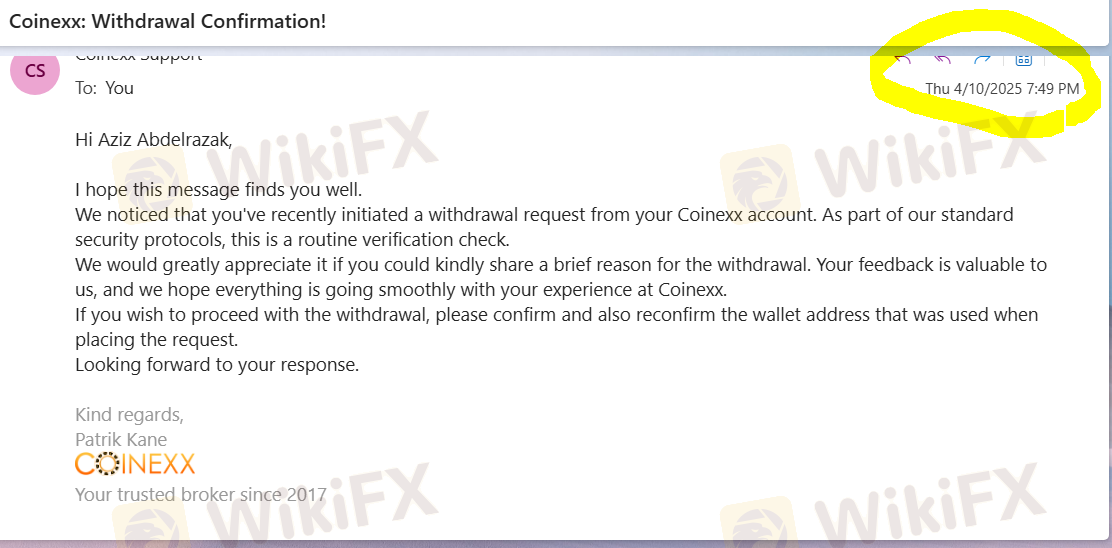

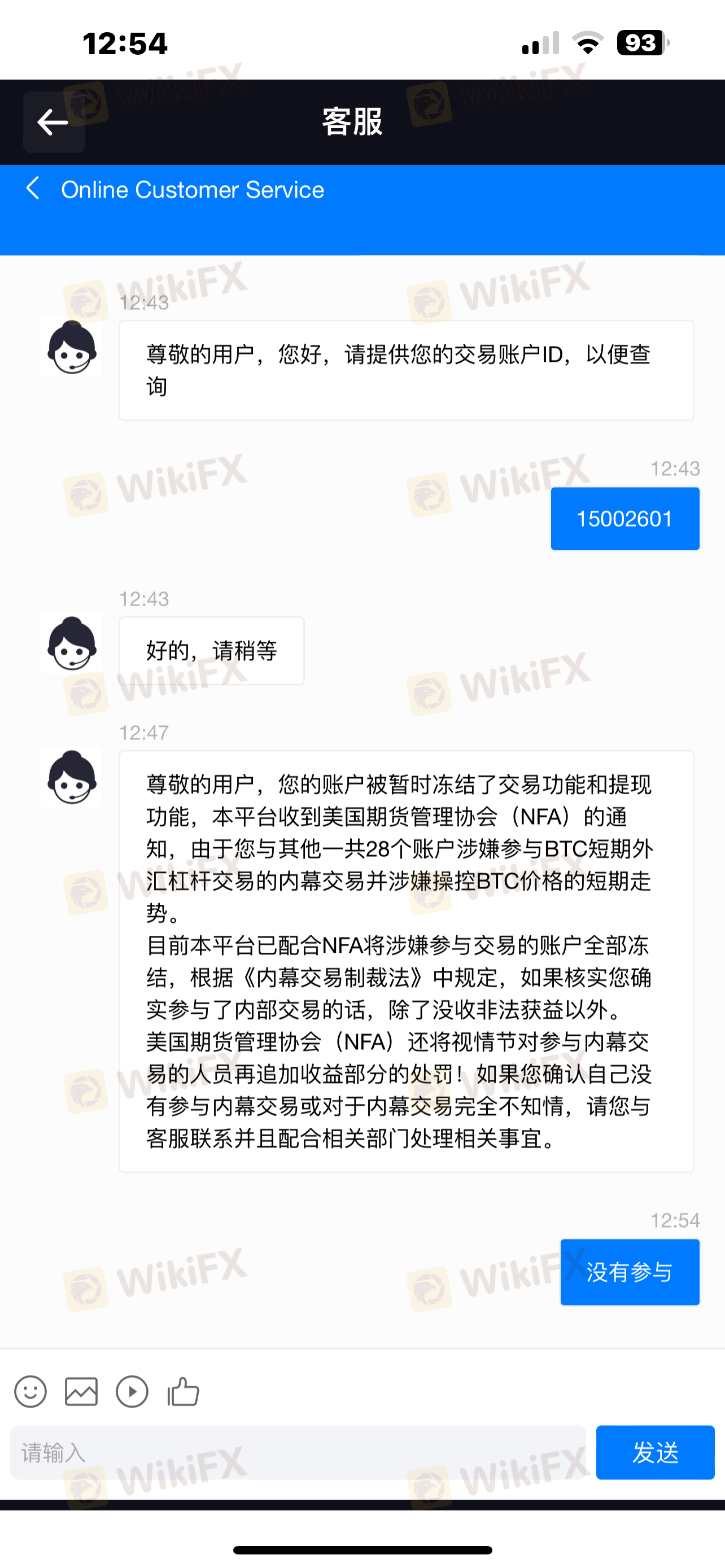

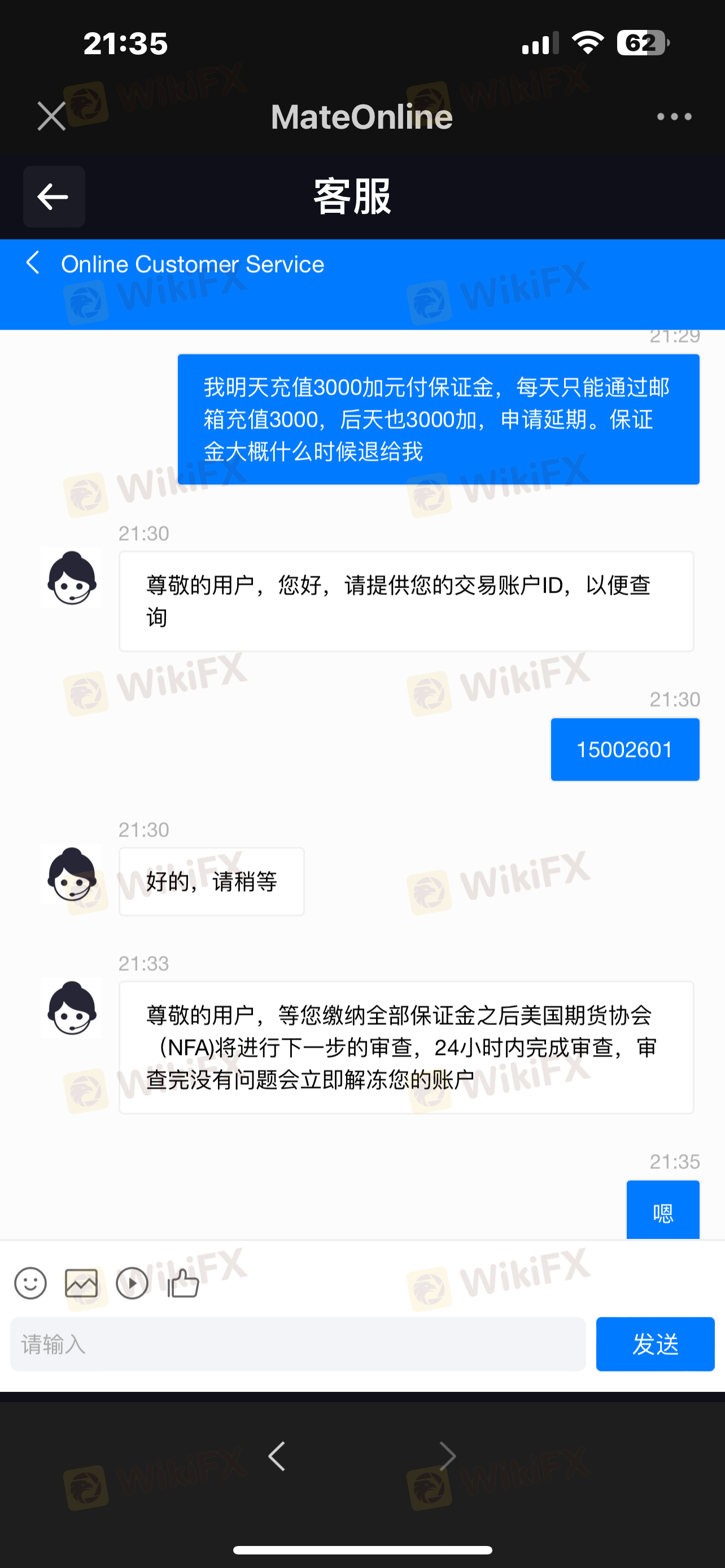

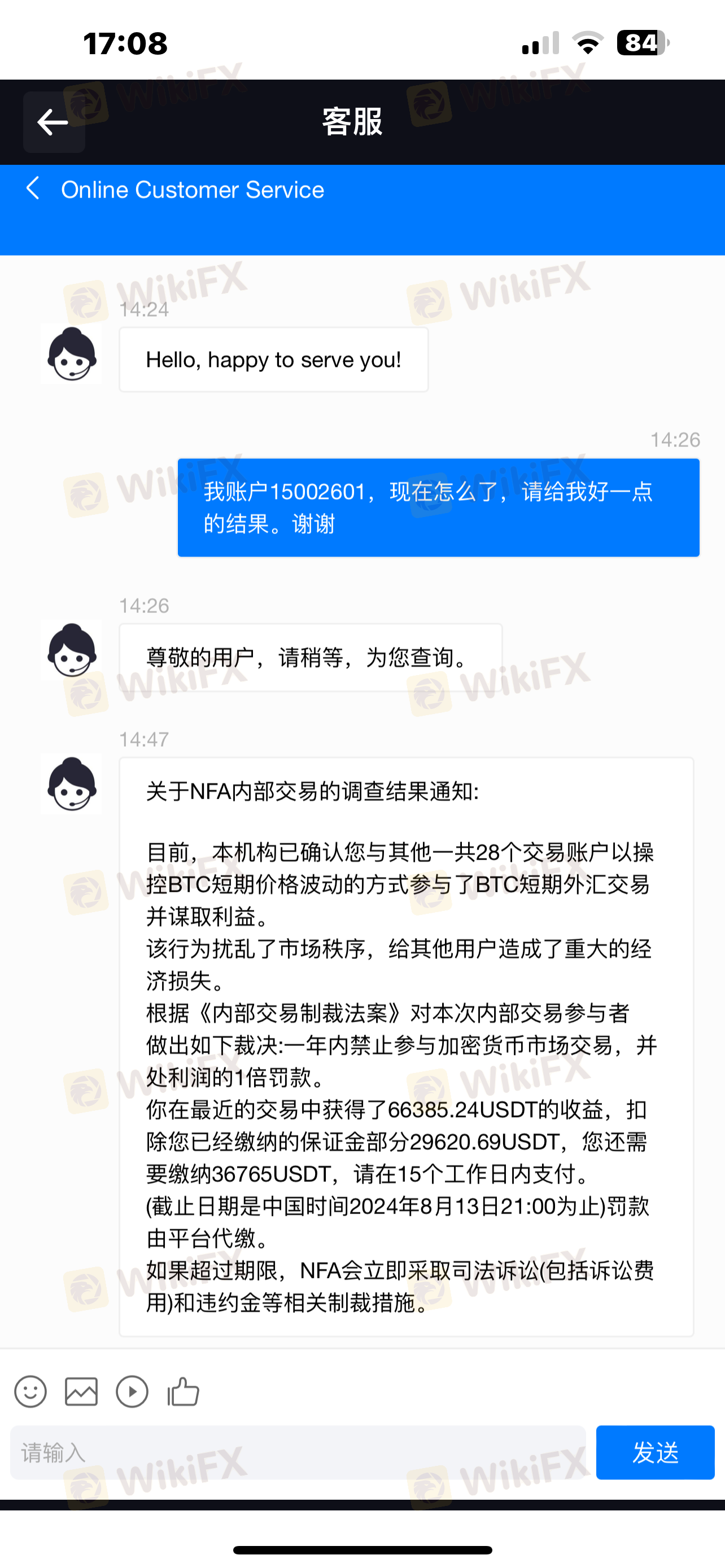

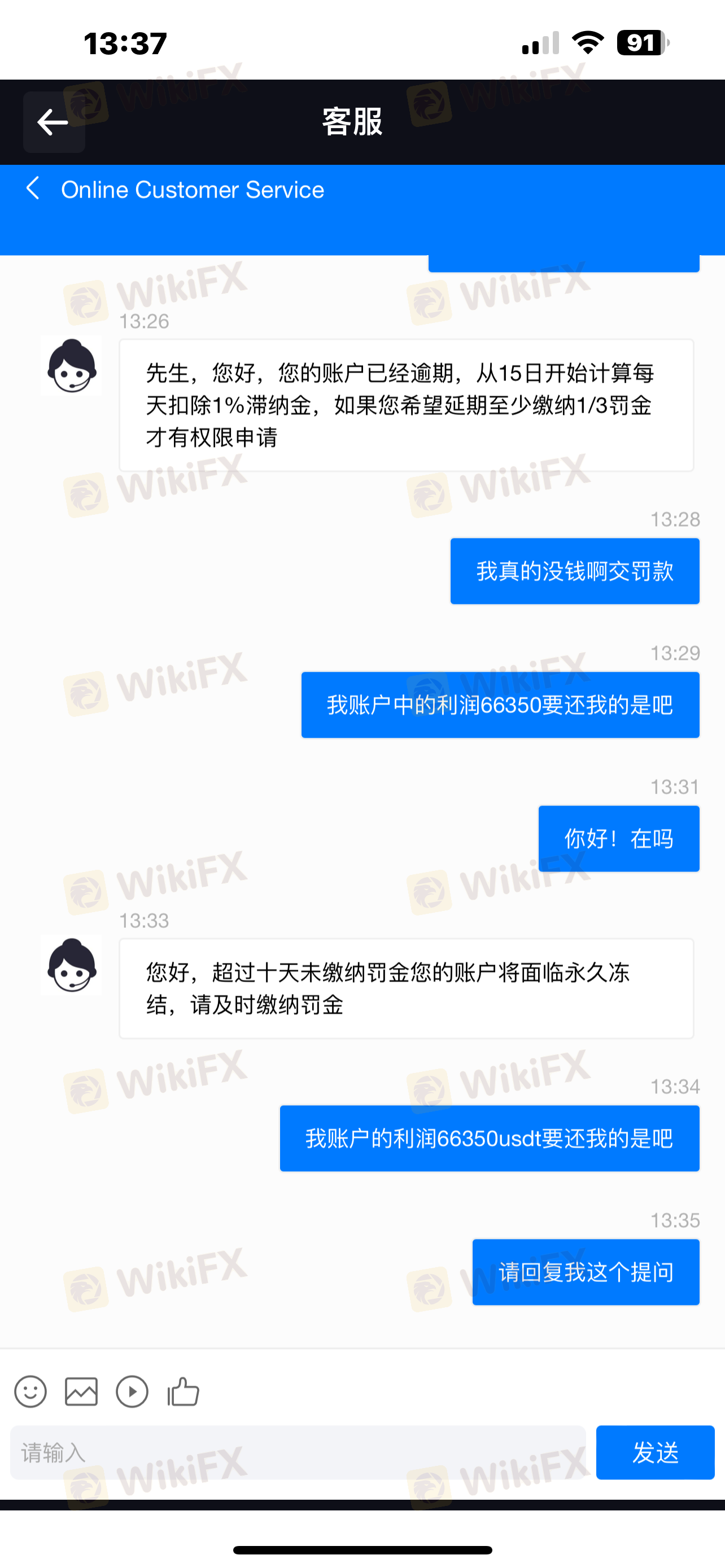

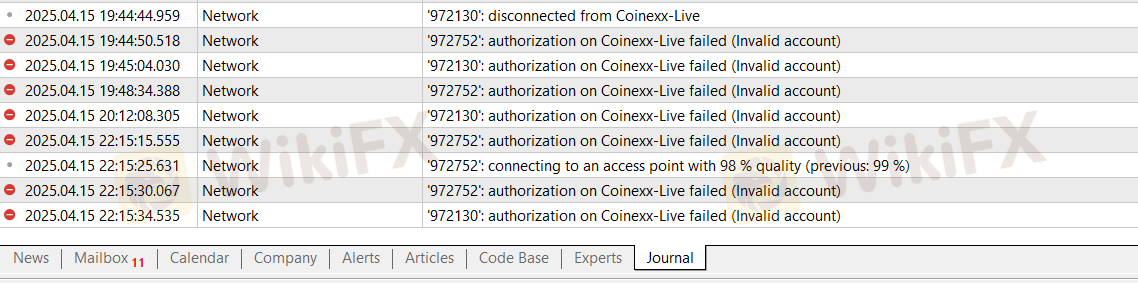

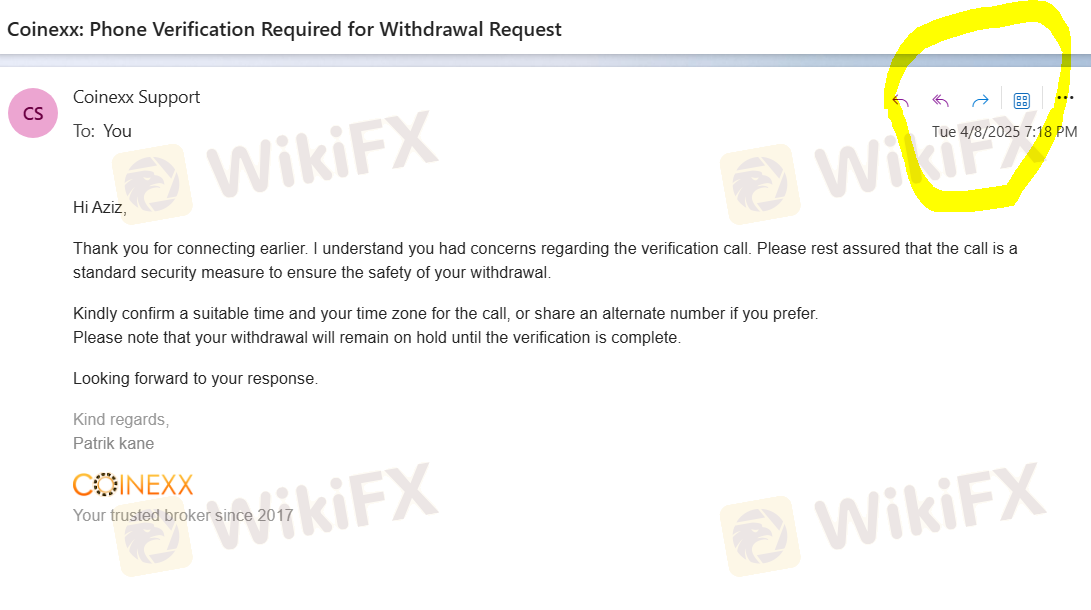

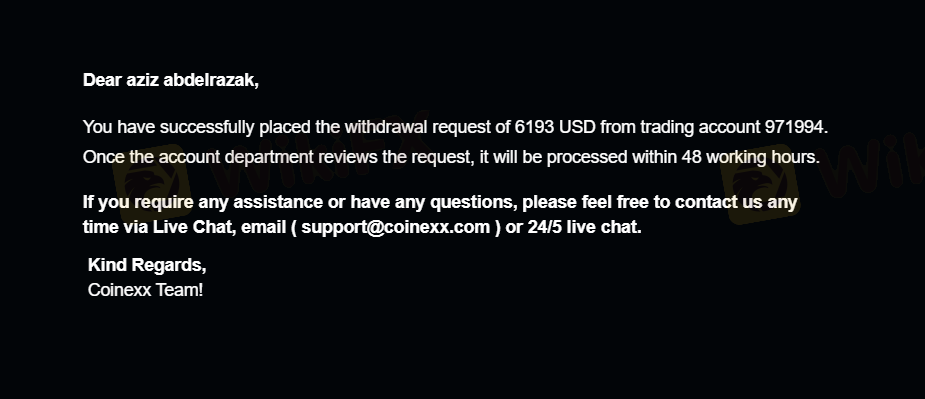

Coinexx has blocked access to my personal space, when I try to connect to my mt5 accounts I have an error message saying invalid accounts, the story is just crazy, it started after requesting a withdrawal of 6000 dollars of profit, I was contacted by phone first additional to carry out a verification according to them and confirm to me later that my withdrawal will be launched. The next day I contacted them, they told me that my withdrawal will be received before the market closes the same day (Friday), I contacted them again yesterday about the withdrawal they told me that it will be processed as quickly as possible. and today I realize that all access to my accounts has been blocked, I contact them by chat, they tell me that the accounts have been blocked due to inactivity on the accounts or that it is false I placed trades yesterday, then I am told that my accounts have been "RECYCLED", and that I would be contacted later by email. I find myself without total visibility with my depo

Malicious Withdrawal Denials by Coinexx This is a report of improper falsification of transaction records, improper swap collection, withdrawal denial, profit cancellation, etc. [Warning.] Users should withdraw funds and non-users should refrain from opening new accounts. Below is a description of each piece of evidence and contradictory answers from emails and support. The prerequisite is "there are no restrictions on trading strategies" as shown in the image. Is it true? Unjustified reduction of profits and inability to withdraw funds. As far as we can confirm, there were several victims, and the actual number of victims is believed to be even higher. As a response, we reported to MetaQuote about the fraudulent damage caused by the denial of withdrawal. In the past, when we reported other cases of fraudulent withdrawals (GemForex, FXfiar, etc.), MetaTrade's license was revoked, and we are concerned that Coinexx's license may be suspended and its business may be suspended as a result. If the insincerity continues in the future, we believe that the damage report should be spread and the appropriate punishment should be taken. [Wise people who saw this article If you are a user, we recommend that you withdraw your funds. After the license is suspended, new deposits will be cut off and further withdrawal refusals are expected. If you are a new user, we recommend you to use another firm. Spreads (EURUSD0.2~0.6) seem narrow, but slippage (EURUSD1.0~2.0) is terrible and actual trading costs are huge. If you are a victim, please report to Meta Quotes.

I made my investment and then they told me that I had to invest more to be able to withdraw and well I didn't have anymore and for the first investment I borrowed money. I still have access to the platform and I tried to withdraw my money and it tells me that it is yet to be verified.

Refusal to withdraw principal and profits, falsification of transaction records, unreasonable swap requests.Refusal to withdraw more than 100000USD.I have asked them every day, but they keep repeating that they will withdraw the money, but it has not been processed.The MT4 shows that the withdrawal has been processed, which is a fraudulent act itself.They are falsifying transaction records and reducing profits unfairly.Also, even though negative swap is deducted from the position, they are also unfairly collecting negative swap, which is not in the rules.We have secured screenshots and have proof.Email correspondence can also be made public.

| Quick COINEXX Review Summary | |

| Founded in | 2017 |

| Registered in | Comoros |

| Regulated by | No license |

| Trading Instruments | 80+, forex, commodities, cryptos, indices |

| Demo Account | ✅ |

| Min Deposit | $10 |

| Leverage | Up to 1:500 |

| EUR/USD Spread | Floating around 0.1 pips |

| Trading Platform | MT4/5, Alpha |

| Deposit & Withdrawal Fee | ❌ |

| Customer Service | Live chat |

| Bonus | 100% bonus on every deposit (up to $40,000) |

| Regional Restrictions | United States of America, Afghanistan, Belarus, Burundi, China, Cuba, Congo, Sudan, Sri Lanka, North Korea (Democratic People's Republic of Korea) and Yemen |

Coinexx is an unregulated online brokerage firm that offers trading services in a wide range of financial instruments, including forex, commodities, cryptos, and indices. It was established in 2017 and is registered in Comoros, with a physical office in Dubai, UAE. The company offers its clients a variety of account types, competitive spreads, and high leverage up to 1:500. Coinexx provides access to trading platforms such as MT4 and MT5.

| Pros | Cons |

| Demo accounts | No regulation |

| Tight EUR/USD spread | Limited trading instruments |

| MT4 and MT5 platform | Regional restrictions |

| Low minimum deposit | |

| No deposit/withdrawal fee | |

| Live chat support | |

| 100% bonus on every deposit (up to $40,000) |

COINEXX offers 80+ trading instruments, including forex, commodities, cryptos, and indices.

| Trading Assets | Available |

| Forex | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Coinexx offers a single account type, the Pro ECN account, which offers low spreads starting from 0.0 pips for forex, commodities, indices and cryptos, and high leverage of up to 500x. Traders can use any trading style they prefer, and the account accepts BTC, BCC, LTC, ETH & USD. The account also offers a large maximum trade size of 100 lots and a 100% deposit bonus. However, Coinexx is an unregulated broker, which could be a disadvantage for some traders.

COINEXX offers a maximum leverage of up to 1:500, which is quite high and allows for traders to potentially achieve high profits from their trades. However, high leverage also increases the risk of significant losses, and inexperienced traders may not fully understand the risks associated with trading on high leverage.

Additionally, regulatory bodies may impose restrictions on the maximum leverage offered by brokers. For experienced traders with a well-planned strategy, high leverage can be a useful tool for trading, but excessive leverage can lead to margin calls and forced liquidation of positions.

In summary, while COINEXX offers low commissions and transparency in their fees, the spreads for major currency pairs are not competitive and may not be attractive to traders. Additionally, the high swap rates and limited payment options may also be a disadvantage for some traders. It is also important to note that COINEXX is an unregulated broker, which may pose potential risks for traders.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are both popular trading platforms widely used by forex brokers. They are available on desktop and mobile devices, and provide a user-friendly interface for traders. The platforms offer a wide range of trading tools and indicators, as well as the ability to use Expert Advisors for automated trading.

However, the platforms have limited customization and charting capabilities, as well as limited automation and risk management tools. Additionally, backtesting capabilities are also limited on both platforms. Overall, MT4 and MT5 are reliable and popular platforms for traders who prioritize ease of use and accessibility.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, Desktop, Mobile | Beginners |

| MT5 | ✔ | Web, Desktop, Mobile | Experienced traders |

| Alpha | ✔ | Web, Desktop, Mobile | / |

Coinexx offers its clients the convenience of funding their trading account with major cryptocurrencies and access to dedicated crypto wallets. Clients can transfer funds directly from these wallets to their trading accounts or any external crypto wallets. Withdrawals are also processed within the stipulated timeframe. However, withdrawals are reviewed and processed manually to avoid any unauthorized activities, which may result in longer processing times.

Choosing the right online broker is critical for the safety of your funds. COINEXX, established in 2018, presents itself as an ECN broker offering high leverage and low spreads. However, despite its claims of specialized trading services, the broker holds a concerningly low score on WikiFX, raising questions about its legitimacy.

WikiFX

WikiFX

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

WikiFX

WikiFX

In online trading, choosing a reliable broker is one of the most important decisions a trader can make

WikiFX

WikiFX

What does COINEXX look like? Is COINEXX legal in your country? WikiFX made a comprehension review on this broker to help you better understand the truth, we will analyse the reliability of this broker from specific information, regulation, exposure and etc. And you should never miss it.

WikiFX

WikiFX

More

User comment

18

CommentsWrite a review

2025-04-16 05:19

2025-04-16 05:19

2024-10-12 11:15

2024-10-12 11:15