User Reviews

More

User comment

5

CommentsWrite a review

2026-02-12 05:08

2026-02-12 05:08

2025-06-03 00:26

2025-06-03 00:26

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT5 Full License

Global Business

High potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index7.38

Risk Management Index0.00

Software Index7.94

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

GANN Markets Ltd

Company Abbreviation

GANN MARKETS

Platform registered country and region

Comoros

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

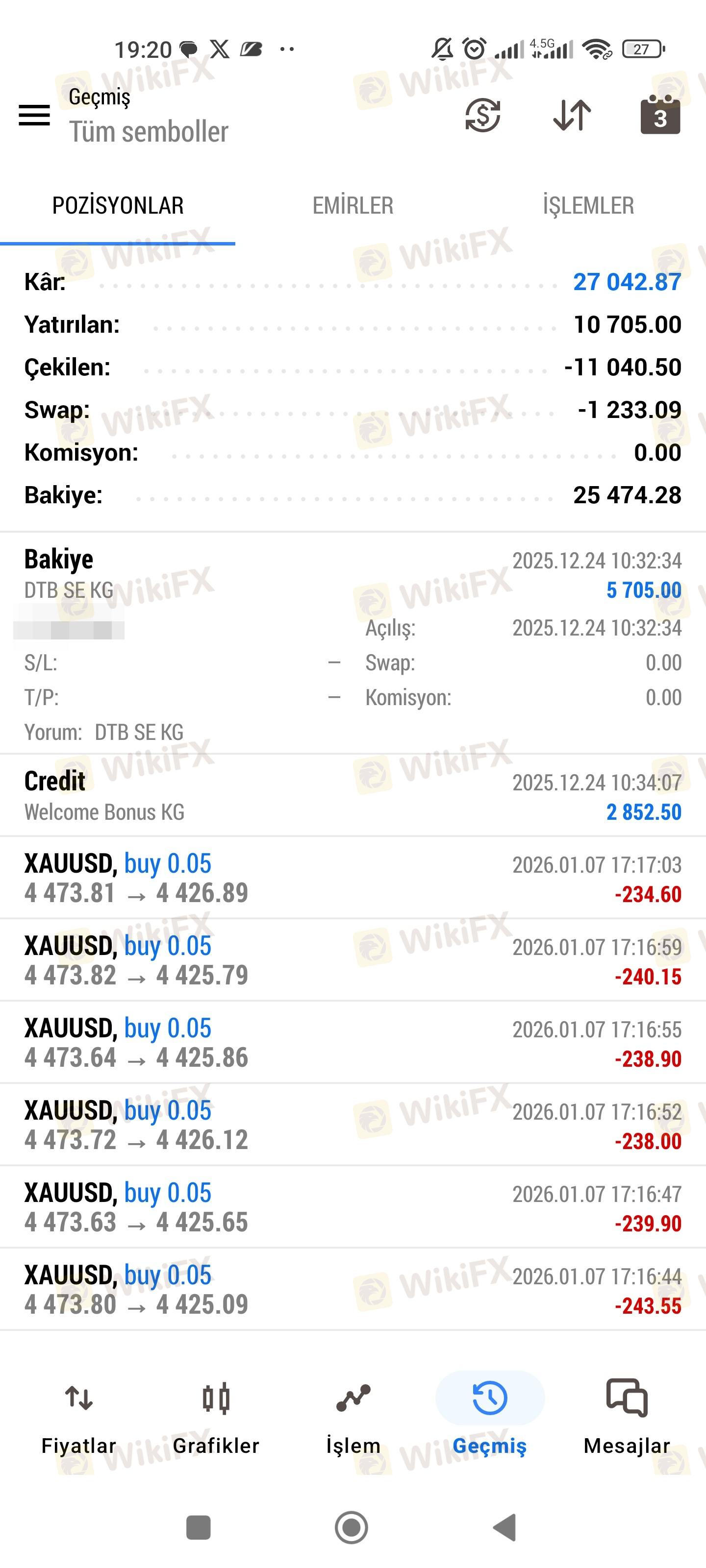

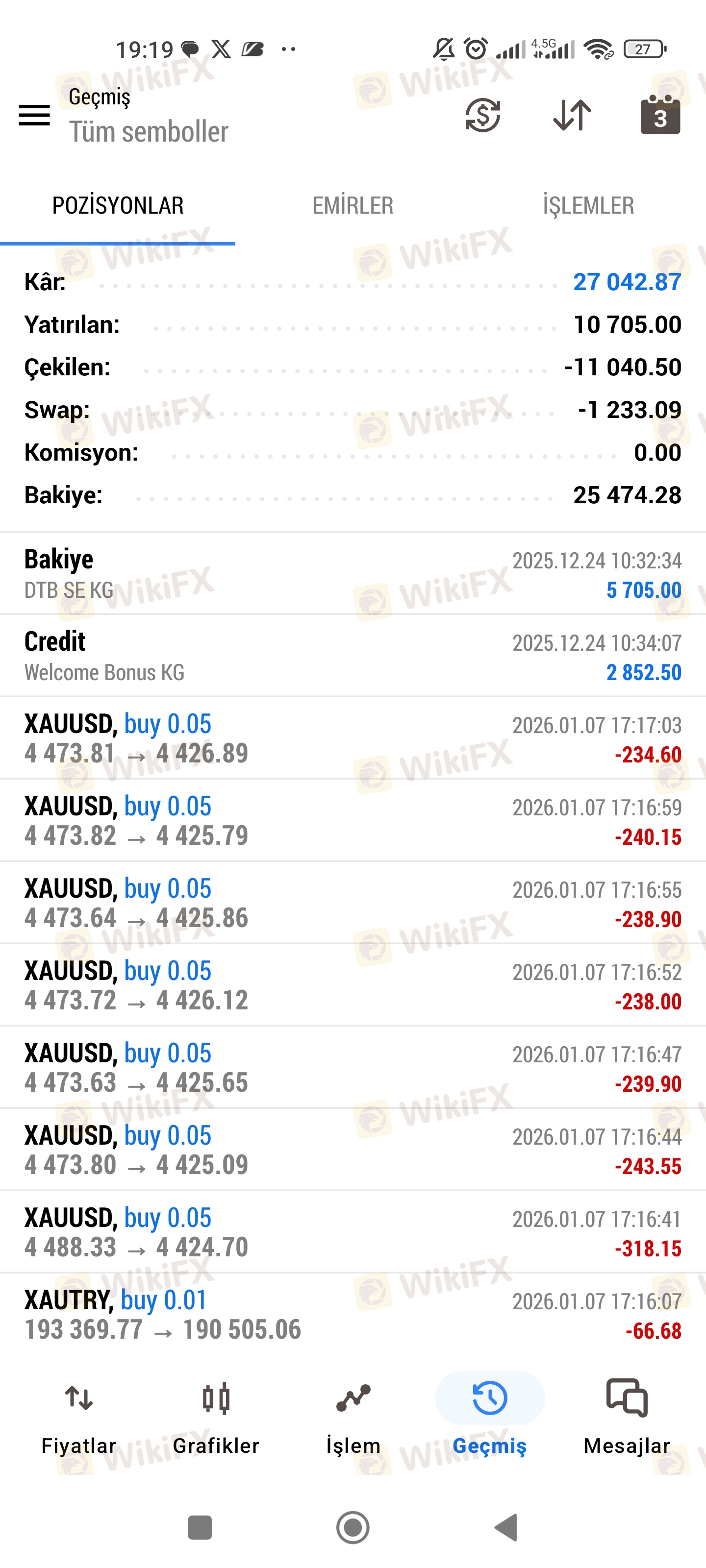

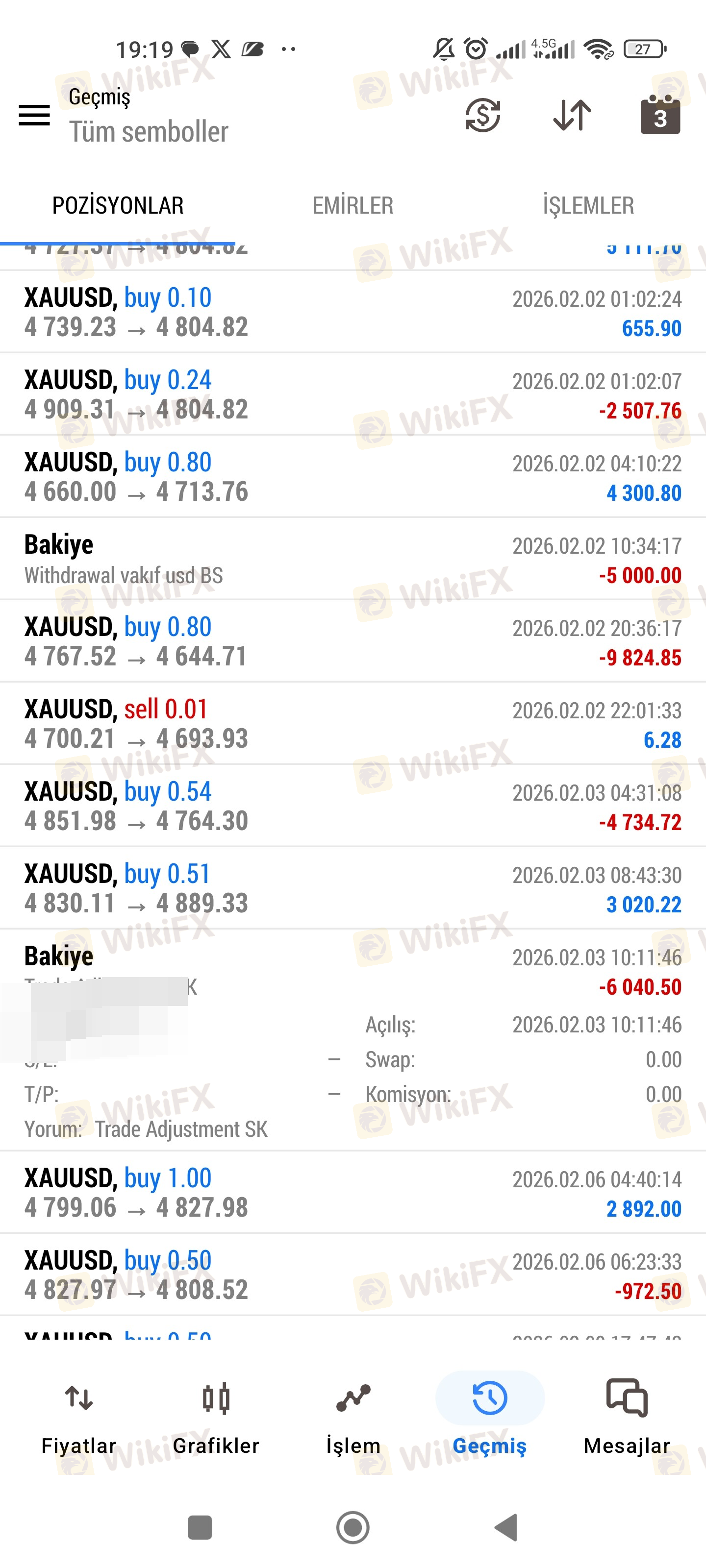

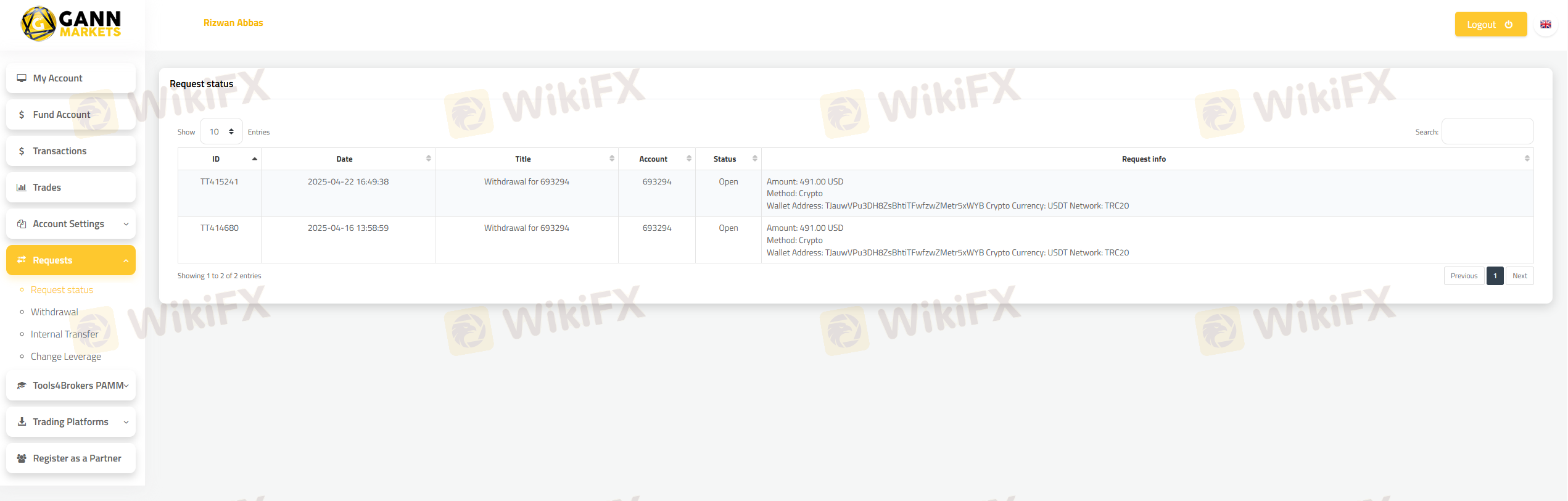

| GANN Review Summary | |

| Founded | 1996 |

| Registered Country/Region | Saint Lucia |

| Regulation | Not Regulated |

| Market Instruments | Forex, Commodities, Cryptocurrencies, Stocks, Indices |

| Demo Account | Not Mentioned |

| Leverage | Up to 1:400 |

| Trading Platform | Meta Trader 5 |

| Min Deposit | $100 |

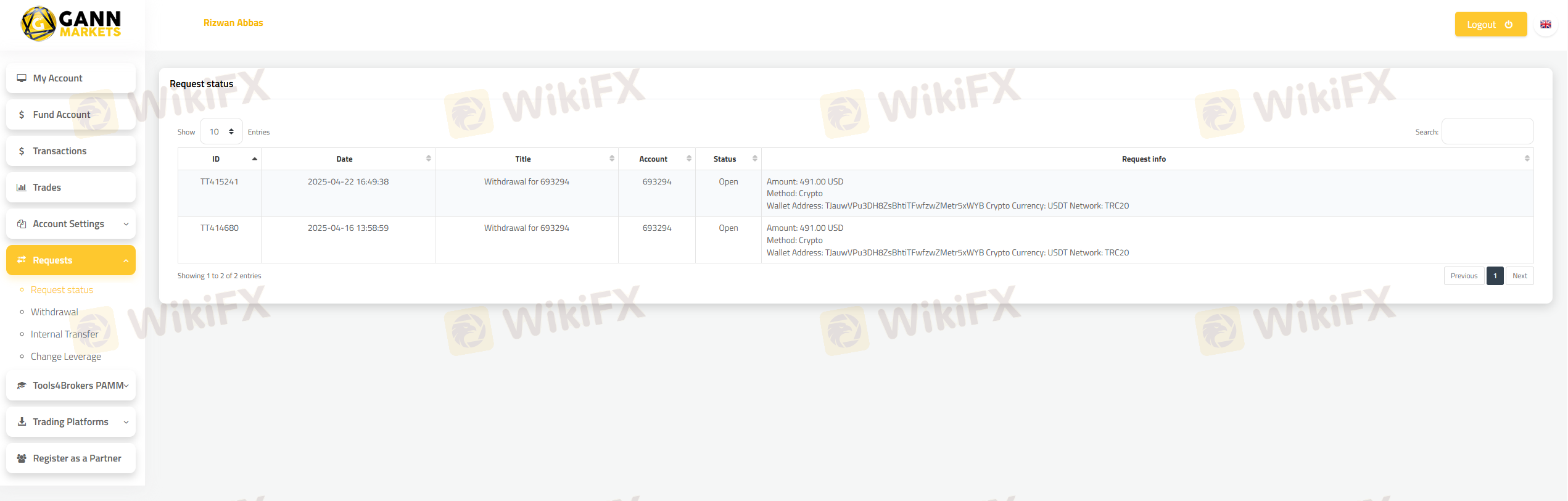

| Customer Support | info@gannmarkets.com |

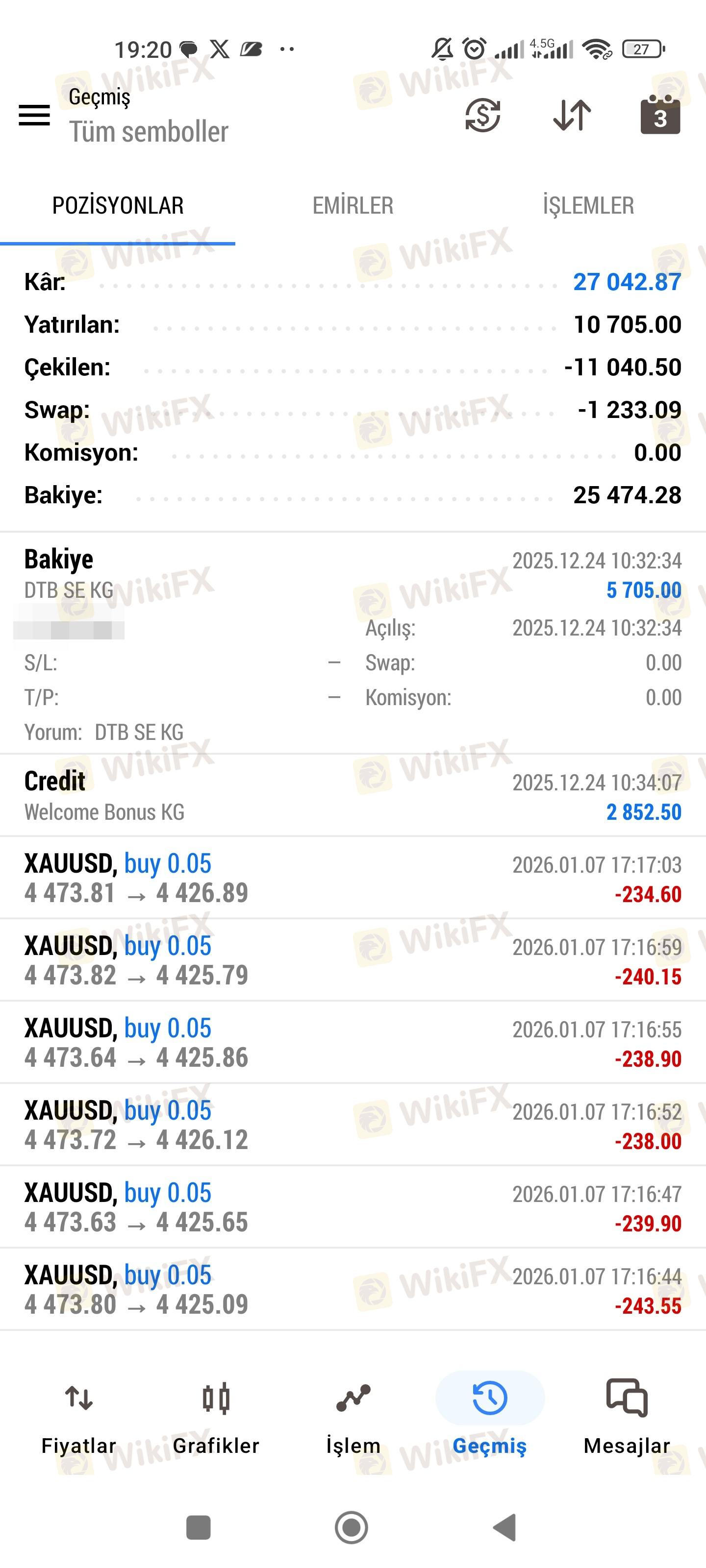

GANN is an online trading platform providing many assets such as forex, commodities, cryptocurrencies, stocks, and indices. Traders can choose between the Standard or ECN accounts with a minimum deposit of $100, and leverage is available up to 1:400. Yet, there is little said about commissions.

| Pros | Cons |

|

|

|

|

|

GANN is not regulated by any financial authorities.

GANN offers many tradable assets including Forex, Commodities, Cryptocurrencies, Stocks, and Indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stock | ✔ |

| Indices | ✔ |

| Cryptocurrency | ✔ |

| Shares | ❌ |

| Metals | ❌ |

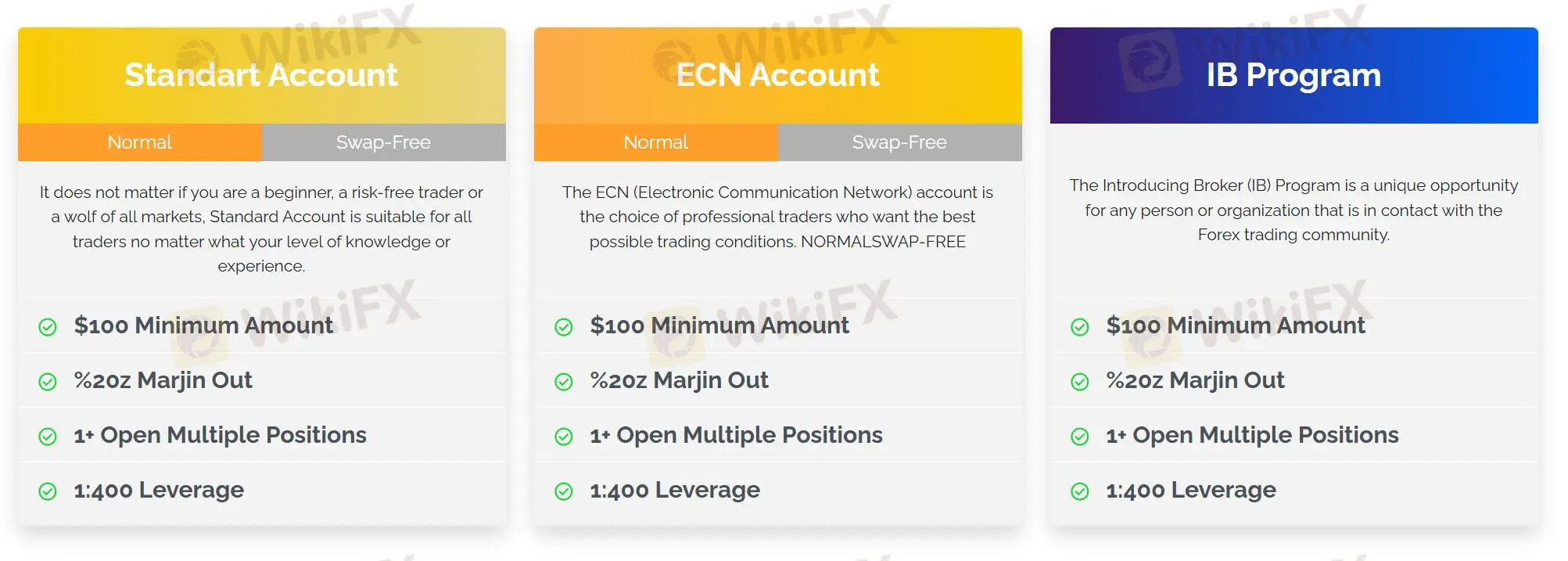

GANN offers three types of accounts: Standard, ECN, and IB Program. All accounts have high leverage up to 1:400 and a minimum deposit of $100.

| Account Type | Minimum Deposit | Margin Call | Maximum Open Positions | Leverage | Swap-Free Option |

| Standard | $100 | 20% | Unlimited | 1:400 | Yes |

| ECN | $100 | 20% | Unlimited | 1:400 | Yes |

| IB Program | $100 | 20% | Unlimited | 1:400 | Yes |

| Trading Platform | Supported | Available Devices | Suitable for |

| Meta Trader 5 | ✔ | PC and Mobile | Investors of all experience levels |

GANN requires a minimum deposit of $100 for all accounts.

More

User comment

5

CommentsWrite a review

2026-02-12 05:08

2026-02-12 05:08

2025-06-03 00:26

2025-06-03 00:26