User Reviews

More

User comment

100

CommentsWrite a review

2026-01-24 15:13

2026-01-24 15:13

2026-01-22 16:49

2026-01-22 16:49

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

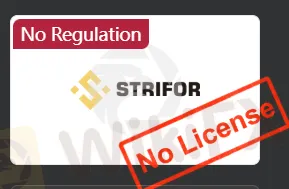

Regulatory Index0.00

Business Index6.19

Risk Management Index0.00

Software Index7.94

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

7 Lucky Trading (Mauritius) Ltd

Company Abbreviation

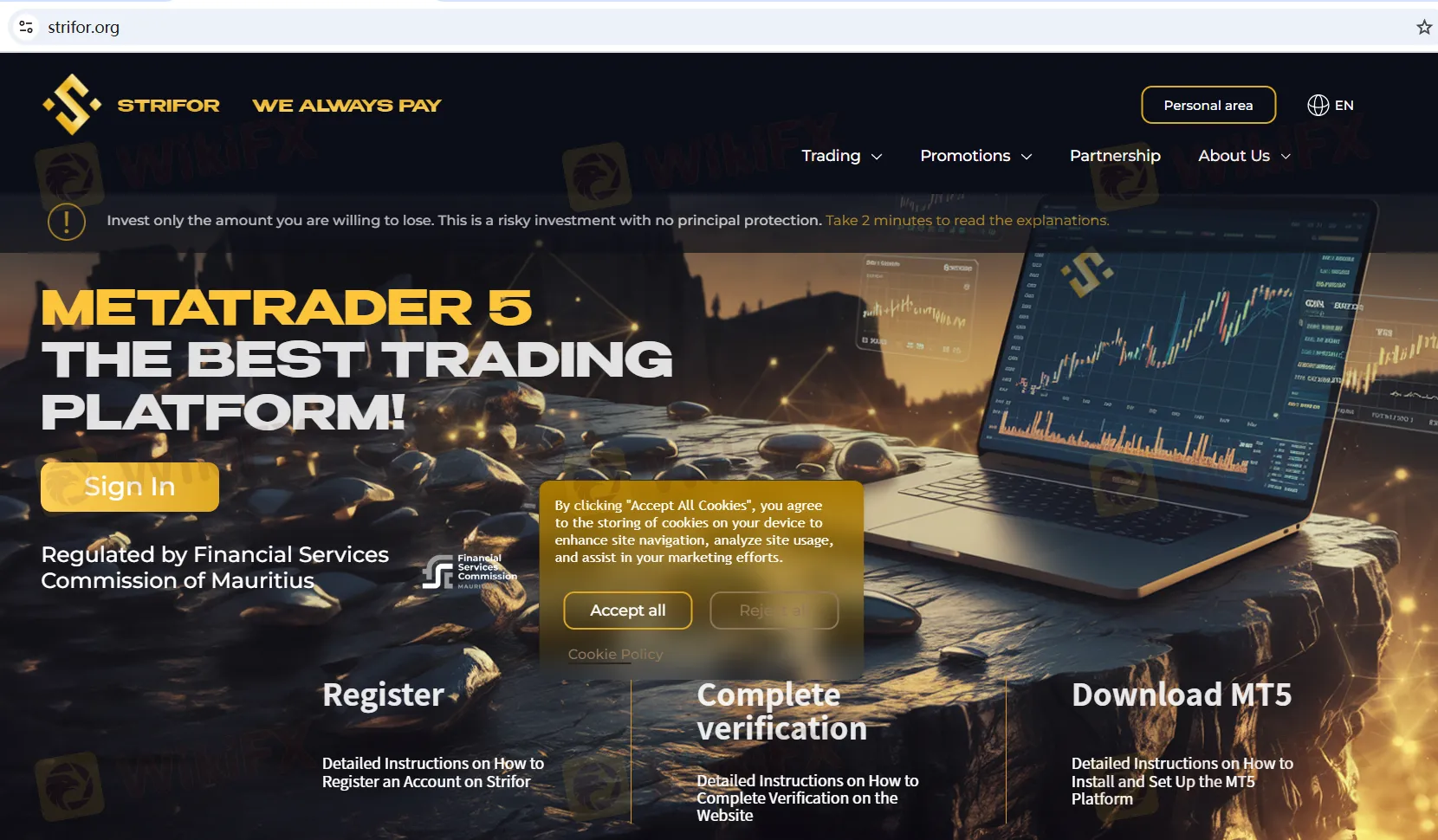

STRIFOR

Platform registered country and region

Mauritius

Company website

X

YouTube

447458148338

Company summary

Pyramid scheme complaint

Expose

| StriforReview Summary | |

| Founded | 2015 |

| Registered Country/Region | Mauritius |

| Regulation | No regulation |

| Market Instruments | Cryptos, forex, shares, metals, indices, commodities |

| Demo Account | / |

| Islamic Account | ✔ |

| Leverage | / |

| Spread | From 0 pip |

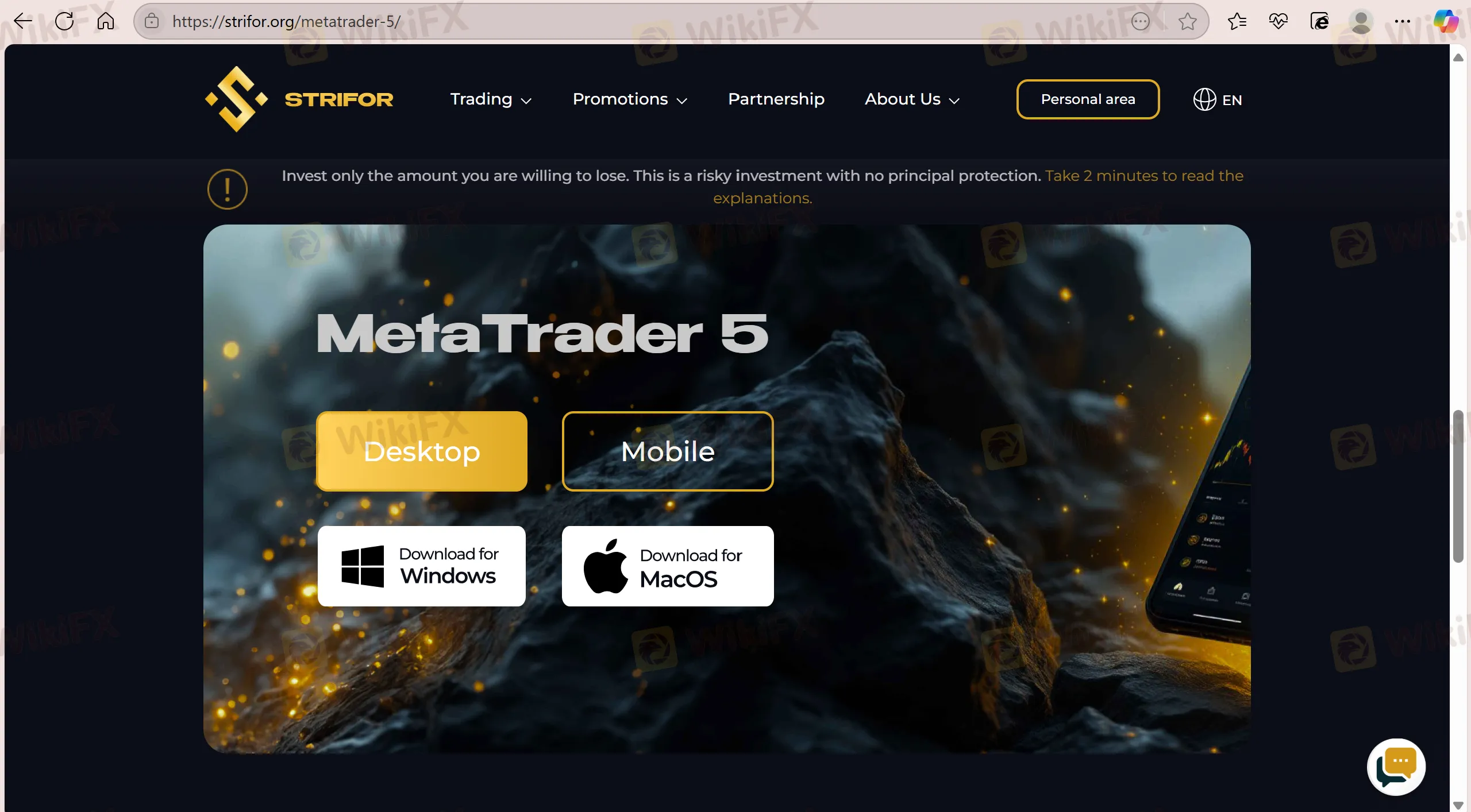

| Trading Platform | MT5 |

| Minimum Deposit | 0 |

| Customer Support | Phone: +230 463 7993 |

| Telegram: @strifor_official_bot | |

| Email: help@strifor.org | |

| Address: Suite 001, Ebene Junction Building, Rue de la Democratie, Ebene, 72201, Mauritius | |

| Regional Restriction | USA, Japan, Canada |

Strifor, founded in 2015, is a brokerage registered in Mauritius. The trading instruments it provides cover crypto CFD, forex, shares, metals, indices, and commodities. It provides 3 types of account and Islamic account, with a minimum deposit of $0 on MT5 platform. However, it is unregulated and does not provide services for residents from certain areas.

| Pros | Cons |

| Wide range of trading instruments | Unregulated |

| Three types of account to choose from | Regional restriction |

| MT5 trading platform supported | Lack of leverage information |

| Islamic account available | Commission fees charged |

| Low minimum deposit of 0 |

Strifor doesn't have any license, which means traders should be more careful when trading through Strifor.

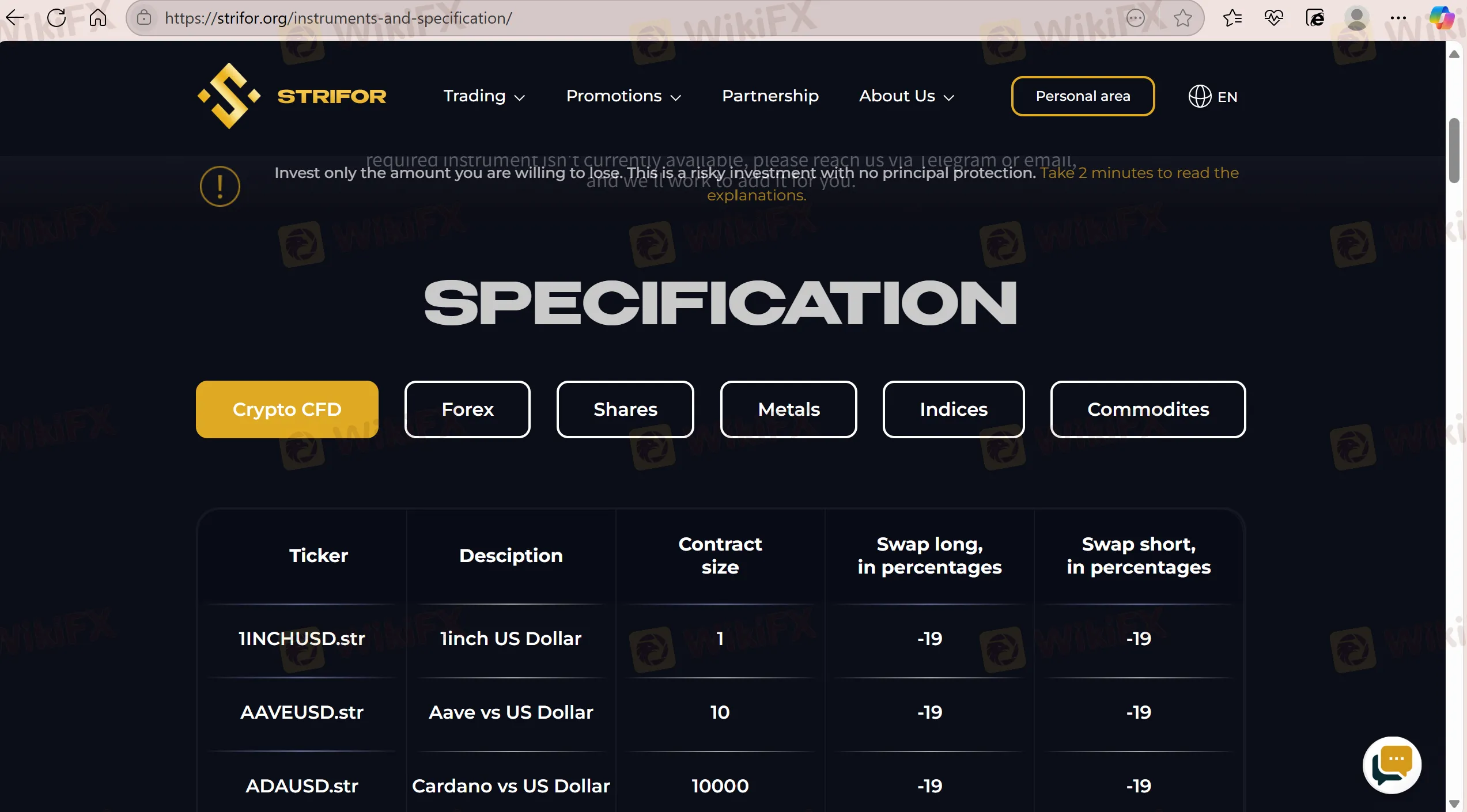

Strifor offers traders the opportunity to trade crypto CFD, forex, shares, metals, indices, commodities.

| Tradable Instruments | Supported |

| Cryptos | ✔ |

| Shares | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Futures | ❌ |

| Options | ❌ |

Strifor offers 4 different types of accounts to traders, which are Basic Account, Advanced Account, Professional Account, Islamic Account.

| Account Type | Basic Account | Advanced Account | Professional Account | Islamic Account |

| Minimum deposit | 0 | 10000 | 20000 | 2000 |

| Spreads | From 0.1 pips | From 0 pip | From 0 pip | From 0.1 pips |

Strifor claims to offer low spreads from 0. For Basic Account, it charges $9 for currency pairs, $9 for metals, 0.005% for indices and 0.5% for crypto CFD.

| Account Type | Basic Account | Advanced Account | Professional Account | Islamic Account |

| Spreads | From 0.1 pips | From 0 pip | From 0 pip | From 0.1 pips |

| Swap | ✔ | ✔ | ✔ | / |

| Commissions | Сurrency pairs: 9$ | Сurrency pairs 8$ | Сurrency pairs 6$ | Сurrency pairs 13$ |

| Metals: 9$ | Metals: 8$ | Metals: 6$ | Metals: 13$ | |

| Indices: 0.005% | Indices: 0.004% | Indices: 0.003% | Indices: 0.016% | |

| Cryptos: 0.5% | Cryptos: 0.4% | Cryptos: 0.35% | / | |

| / | Commodities: 0.02% | Commodities: 0.01% | / | |

| / | Stocks: 0.25% | Stocks: 0.15% | / |

Strifor's trading platform is MT5, which supports traders on PC and mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, Web, Mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

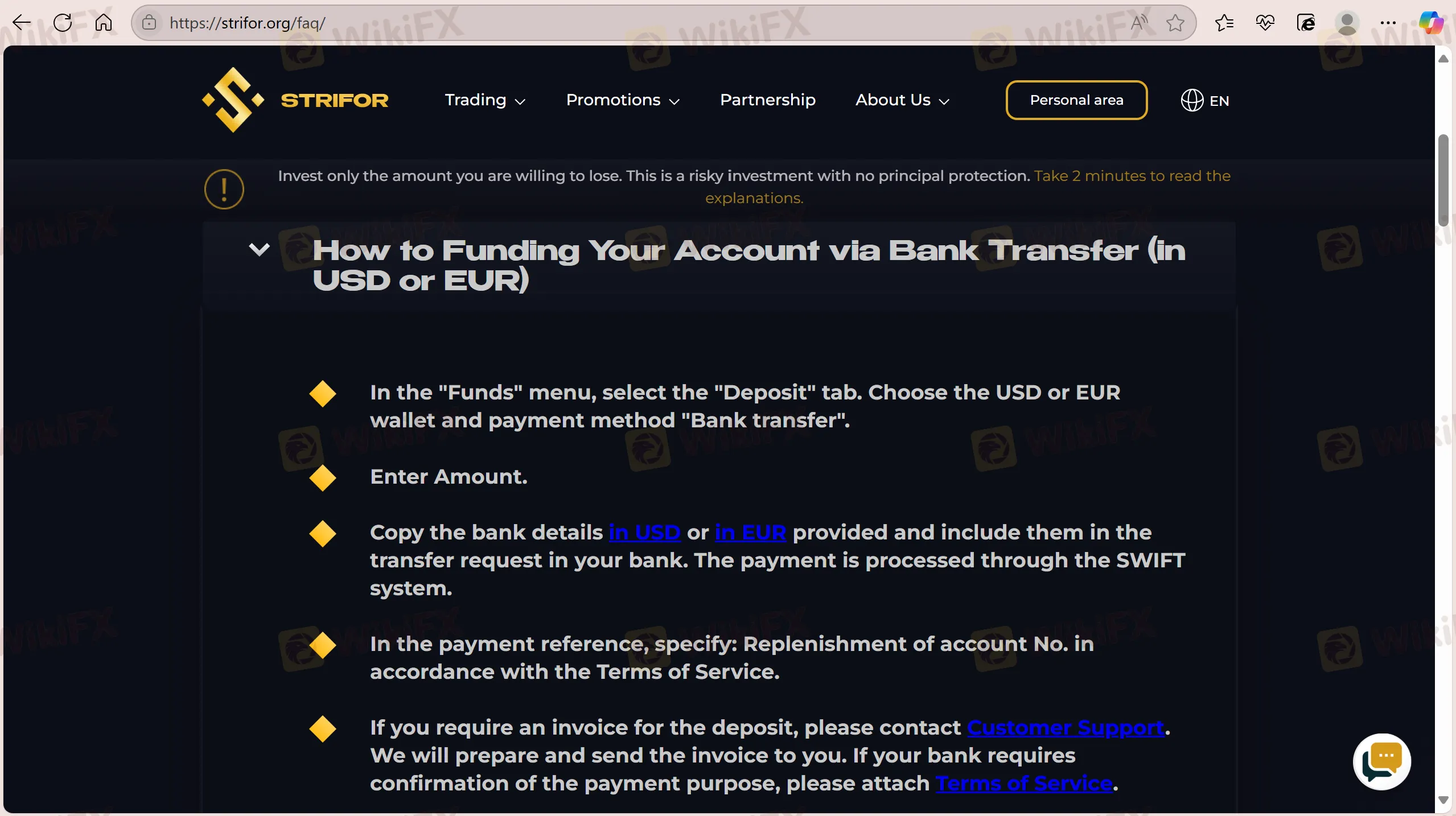

Strifor accepts payments done via bank transfer, credit cards, and cryptocurrencies. However, in terms of other details such as the processing time and fees, its official website does not reveal it.

Evaluating a broker’s safety requires a close look at its regulatory status, trading environment, and user feedback. Strifor is a brokerage firm established in 2022 with its headquarters in Mauritius. While it offers digital account opening and the popular MT5 platform, its low WikiFX score of 1.99 and regulatory status raise significant concerns.

WikiFX

WikiFX

Ensuring Client Security: A Top PriorityThe past year, 2024, marked a significant milestone for Strifor in safeguarding client interests and ensuring the transparency of financial operations. Through

WikiFX

WikiFX

To mark our 5th anniversary, were excited to offer clients the chance to double their trading balance with a 100% deposit bonus! This exclusive bonus comes with simplified processing terms:Execute 200

WikiFX

WikiFX

Strifor Launches New Year Promotion: Double Your Deposit!From December 16 to December 30, 2024, Strifor offers traders a unique opportunity to boost their capital with a 100% trading bonus for deposit

WikiFX

WikiFX

More

User comment

100

CommentsWrite a review

2026-01-24 15:13

2026-01-24 15:13

2026-01-22 16:49

2026-01-22 16:49