User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

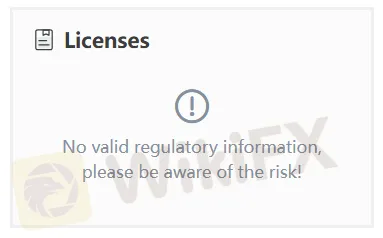

Regulatory Index0.00

Business Index7.21

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Standard Bank

Company Abbreviation

Standard Bank

Platform registered country and region

South Africa

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Standard BankReview Summary | |

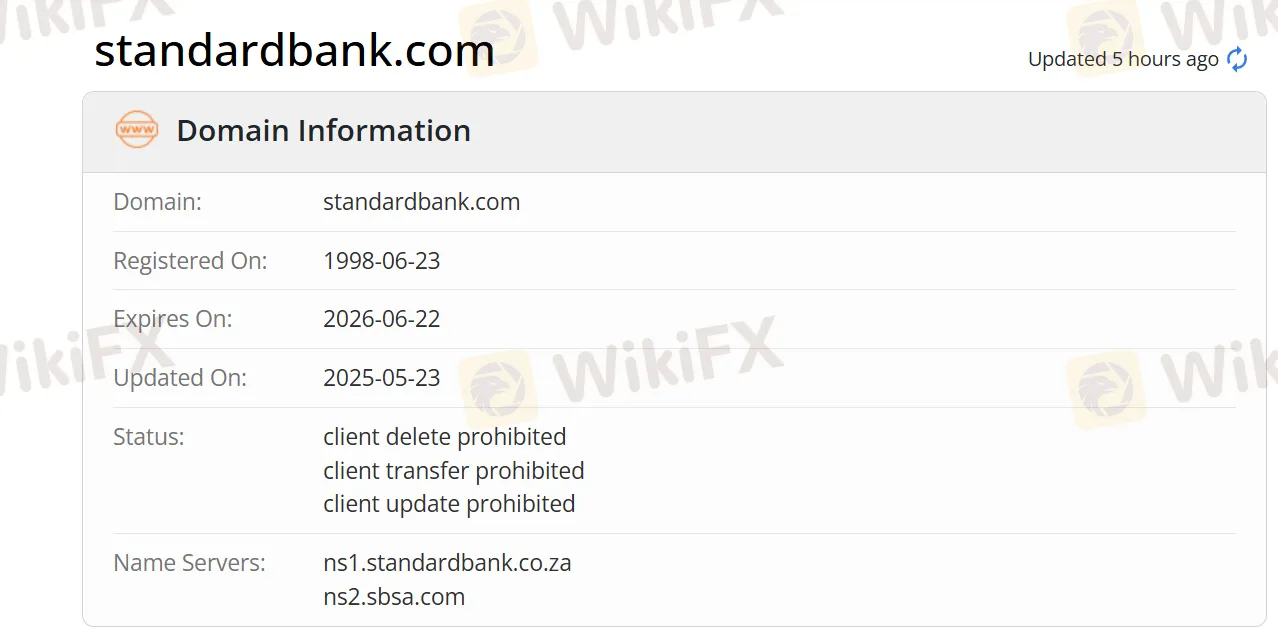

| Founded | 1998 |

| Registered Country/Region | South Africa |

| Regulation | No Regulation |

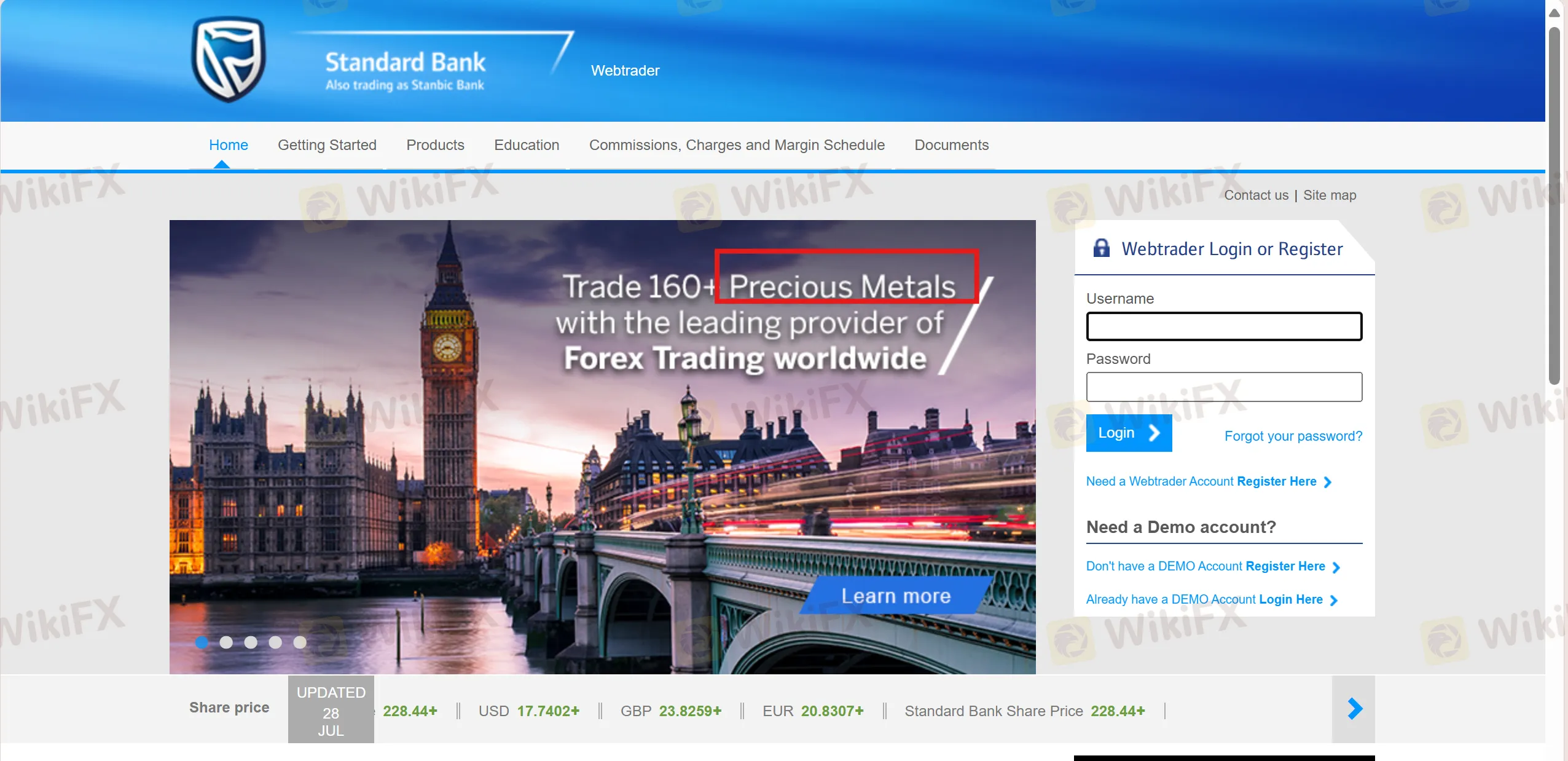

| Market Instruments | CFDs, ETFs, Indices, Forex, Shares, and Metals |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Standard Bank Webtrader |

| Minimum Deposit | / |

| Customer Support | Email: securities@standardbank.co.za |

| Tel: 0860 121 555 (South Affrica) | |

| Tel: +27 11 415 6555 (International) | |

| Social Media: Facebook, YouTube, LinkedIn, Twitter, Blogger | |

Standard Bank was established in 1998 and was registered in South Africa. It offers over 20,275 tradable instruments, including CFDs, ETFs, indices, forex, stocks, and metals, and supports trading through the Standard Bank Webtrader platform. Although it offers a variety of financial products and services without charging transaction fees, the company is unregulated and lacks detailed information about account features. Investors should exercise caution regarding its legitimacy and transparency. Additionally, deposits incur a US$0.05 fee, and settlements typically take two business days to complete.

| Pros | Cons |

| A variety of financial products | No regulation |

| Long operation history | Limited info on trading details |

| Various contact channels | Deposit fees charged |

Standard Bank is not regulated, so traders need to exercise caution when trading.

Standard Bank offers a wide range of over 20,275 trading instruments, including CFDs, ETFs, Indices, Forex, Shares, and Metals.

| Tradable Instruments | Supported |

| CFDs | ✔ |

| ETFs | ✔ |

| Indices | ✔ |

| Forex | ✔ |

| Funds | ✔ |

| Shares | ✔ |

| Metals | ✔ |

| Bonds | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

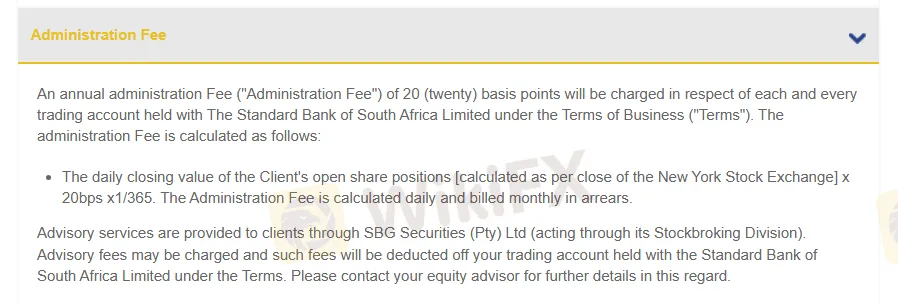

Administration Fee: 20 basis points will be charged.

Standard Bank supports trading on the Standard Bank Webtrader platform. The platform does not charge transaction fees, and settlement is completed within two business days.

| Trading Platform | Supported | Available Devices | Suitable for |

| Standard Bank Webtrader | ✔ | Mobile, Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

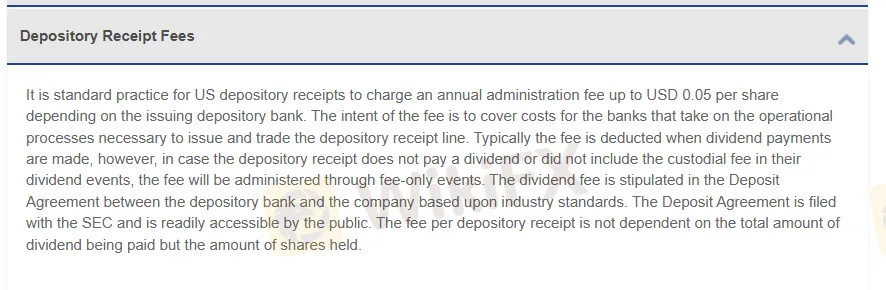

Customers can deposit and withdrawal mainly through bank transfer, and a fee of US$0.05 will be charged for deposits.

The Isle of Man Financial Services Authority says Standard Bank Isle of Man acted in breach of an order issued by the Island's courts.

WikiFX

WikiFX

South Africa’s biggest bank by total assets, Standard Bank is warning customers of a new tax-related scam doing the rounds as tax season gets into full swing.

WikiFX

WikiFX

Africa’s biggest bank by assets, Standard Bank Group, has retained its seat at the top of the banking pack in Africa.

WikiFX

WikiFX

Standard Bank has launched Africa Trade Barometer, which is expected to become Africa’s leading trade index.

WikiFX

WikiFX

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment