User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsRegulated in China

Derivatives Trading License (AGN)

Suspicious Scope of Business

Medium potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index7.51

Risk Management Index8.90

Software Index7.05

License Index7.83

Single Core

1G

40G

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

| QISHENG FUTURES Review Summary | |

| Founded | 1993 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Market Instruments | futures |

| Demo Account | Available |

| Customer Support | telephone, wechat |

QISHENG FUTURES is a large-scale domestic futures company approved by the China Securities Regulatory Commission, the company was founded in 1993, with a registered capital of 105 million yuan, headquartered in Zibo, Shandong Province, is one of the first batch of futures companies established in China, and China's futures market has experienced the pilot, the governance of the reorganization and standardization of the development of the course, and the gradual refinement and growth. The company has branches in Shanghai, Wuhan, Jinan, Shenzhen, Ningbo, Xiamen, etc., and business departments in Beijing, Dalian, Jinjiang, Linyi, Dongying, Zhaoyuan, etc. It is qualified for commodity futures brokerage, financial futures brokerage, futures investment consulting and asset management business.

| Pros | Cons |

| • Regulated by CFFEX | • No live chat support |

| • Diverse range of trading instruments | • Limited payment options |

| • Many years' industry experience | |

| • Demo accounts available | |

| • Multiple trading paltforms |

There are many alternative future-brokers to QISHENG FUTURES depending on the specific needs and preferences of the trader. Some popular options include:

Huishang Futures - A well-established futures-brokerage firm that operates in the financial sector. With a strong presence in the industry, Huishang Futures offers a diverse range of trading services and instruments across different asset classes.

Bohai Futures - A reputable and established futures-brokerage firm operating in the financial market. With a focus on innovation and client-centered solutions, the company provides traders and investors with access to a wide range of futures markets, enabling them to make informed decisions and manage their investments effectively.

GF Futures - A prominent futures-brokerage firm that operates in the financial industry. As a reputable entity, GF Futures offers a wide range of trading services and instruments, catering to various asset classes and investment needs.

A credible and well-known financial regulatory body in China, CFFEX (China Financial Futures Exchange) oversees QISHENG FUTURES. It is important to keep in mind, nevertheless, that while the existence of regulation and a variety of trading instruments are advantageous features, they do not ensure that QISHENG FUTURES is 100 percent secure. It is crucial to undertake careful study, take into account all available information, and use caution when dealing with any financial service provider if you want to determine whether QISHENG FUTURES is secure or maybe a hoax. Additional information can be obtained by speaking with financial professionals or regulatory authorities.

Investors and traders can capitalize on opportunities in precious metals, such as gold, silver, platinum, and palladium futures, allowing them to participate in the dynamic and lucrative precious metals market.

For those looking to tap into the energy sector, QISHENG FUTURES provides access to crude oil futures. With global demand for crude oil constantly fluctuating, these contracts enable traders to speculate on price movements and hedge against volatility in the oil market.

In addition to the precious metals and energy sectors, QISHENG FUTURES also offers trading opportunities in the chemical market. Traders can engage in contracts related to various chemical commodities, including industrial chemicals or agricultural chemicals, catering to industries with a need to manage price risk.

For investors seeking exposure to financial markets, QISHENG FUTURES presents an array of financial futures products. These may include stock index futures, allowing traders to speculate on the performance of specific stock market indices, interest rate futures, which enable hedging against fluctuations in interest rates, and foreign exchange futures, facilitating speculation on currency exchange rate movements.

Moreover, QISHENG FUTURES offers unique “black futures” products, which appear to be proprietary to the firm and could represent specialized contracts tailored to specific market niches or novel financial instruments designed to meet the needs of sophisticated investors.

Agricultural futures are also available on the QISHENG FUTURES platform, providing traders with exposure to the agriculture sector. Contracts related to agricultural commodities like wheat, corn, soybeans, coffee, sugar, and more allow participants to navigate the ever-changing landscape of agricultural markets and seize opportunities based on supply and demand dynamics.

Lastly, for traders seeking more complex strategies, QISHENG FUTURES caters to their needs with options futures. These contracts combine features of both options and futures, granting traders the right to buy or sell an underlying asset at a predetermined price, while also providing an avenue to speculate on the future price movements of the asset.

QISHENG FUTURES offers several trading platforms for its clients, including Qisheng Futures-Yingshun Cloud Market Trading Software Penetrating HD Version CTP, Fast Futures Trading Terminal-V3-Penetrating Formal Version, Qisheng Futures Boyi Cloud + Lightning King Penetrating Version (support IPV6), Fast Futures Trading Terminal-V2-Penetrating Formal Version, TB Trading Pioneer Platform, Pyramid Quantitative Trading System, Quick V2 transaction (commercial secret version), Qisheng Futures Unlimited Easy, Qisheng Futures - Yingshunyun market trading software penetrating HD version CTP (support IPV6). By offering such an extensive selection of trading platforms, QISHENG FUTURES empowers its clients with the flexibility to choose the tools that best suit their individual trading styles and preferences. Whether seeking advanced features, simplicity, speed, or quantitative analysis capabilities, traders can find a platform that aligns with their unique needs and goals.

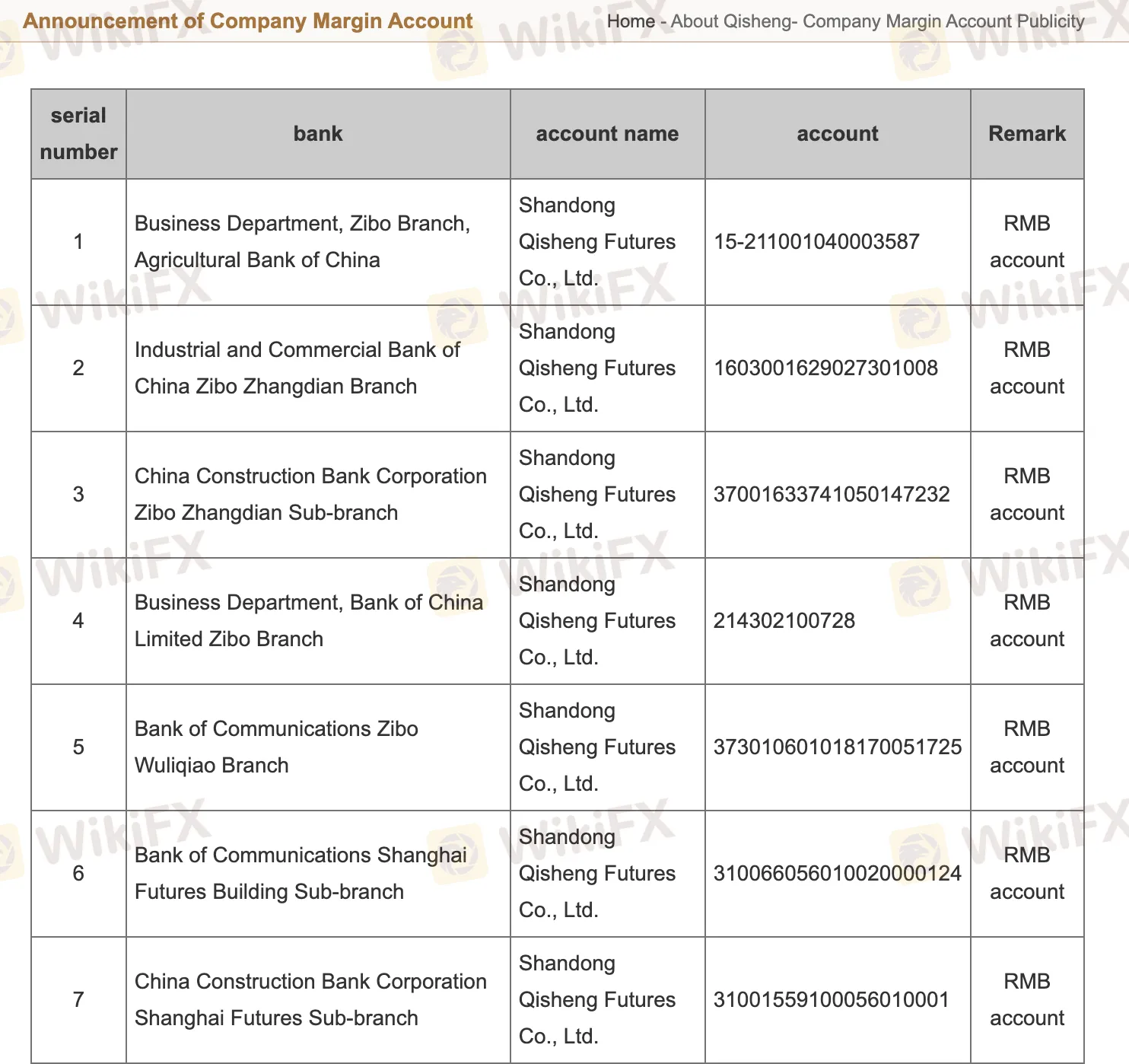

The deposit and withdrawal process at QISHENG FUTURES is facilitated through various banks, including the Business Department Zibo Branch of Agricultural Bank of China, Industrial and Commercial Bank of China Zibo Zhangdian Branch, and China Construction Bank Corporation Zibo Zhangdian Sub-branch, etc.

To deposit funds into their trading accounts, clients can transfer money to QISHENG FUTURES through the designated bank accounts. The brokerage likely provides clients with the necessary bank account details, including account numbers and relevant information for each of the affiliated banks. Clients can use traditional methods like bank transfers or other payment methods, depending on what QISHENG FUTURES supports.

QISHENG FUTURES provides comprehensive customer support and services to ensure a smooth trading experience for its clients. For inquiries related to the settlement department during night hours, clients can reach the on-duty personnel by calling 0533-2160548. The settlement department is responsible for handling various aspects of transaction settlement, ensuring accuracy and efficiency in the process.Address: 5th Floor, No. 3, A3, No. 45, Liuquan Road, Zhangdian District, Zibo City, Shandong Province Customer service consultation telephone: 400- 632-9997

WeChat ID “ zjfco4006329997 ”

In conclusion, QISHENG FUTURES appears to be a brokerage firm that provides a broad array of trading opportunities to investors and traders. Their diverse offering of trading instruments across different asset classes, such as precious metals, crude oil, financial futures, and agricultural futures, reflects their commitment to meeting various client needs.

The availability of multiple trading platforms allows clients to choose options that suit their preferences and expertise, promoting seamless and efficient trading experiences. Moreover, the presence of customer service channels, including phone and WeChat support, indicates a dedication to providing accessible and prompt assistance.

However, it's crucial to consider potential areas of concern, such as the lack of additional regulatory information beyond CFFEX and the limited details about “black futures,” which may warrant further clarification.

As with any financial engagement, conducting due diligence, reviewing client feedback, and verifying regulatory compliance are crucial steps in assessing the safety and legitimacy of QISHENG FUTURES. Clients should exercise caution and consult with financial experts or relevant authorities to make informed decisions regarding their trading activities with the firm.

Q1: What types of trading instruments does QISHENG FUTURES offer?

A1: QISHENG FUTURES provides a variety of trading instruments across different asset classes, including precious metals, crude oil futures, financial futures, agricultural futures, and potentially other specialized products like “black futures” (further details required for clarification).

Q2: Is QISHENG FUTURES regulated?

A2: QISHENG FUTURES operates under the regulation of CFFEX (China Financial Futures Exchange).

Q3: What trading platforms are available at QISHENG FUTURES?

A3: QISHENG FUTURES offers multiple trading platforms to cater to different trader preferences. Some of the platforms include Qisheng Futures-Yingshun Cloud Market Trading Software Penetrating HD Version CTP, Fast Futures Trading Terminal-V3-Penetrating Formal Version, and Quick V2 transaction (commercial secret version).

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment