User Reviews

More

User comment

63

CommentsWrite a review

2026-02-15 17:42

2026-02-15 17:42

2026-01-30 01:16

2026-01-30 01:16

Score

5-10 years

5-10 yearsRegulated in Australia

Market Making License (MM)

MT4 Full License

Global Business

High potential risk

Offshore Regulated

Benchmark

Influence

Add brokers

Comparison

Quantity 22

Exposure

Score

Regulatory Index8.13

Business Index7.27

Risk Management Index0.00

Software Index9.99

License Index7.97

Single Core

1G

40G

More

Danger

Danger

Warning

More

Company Name

PU Prime Ltd

Company Abbreviation

PU Prime

Platform registered country and region

Mauritius

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

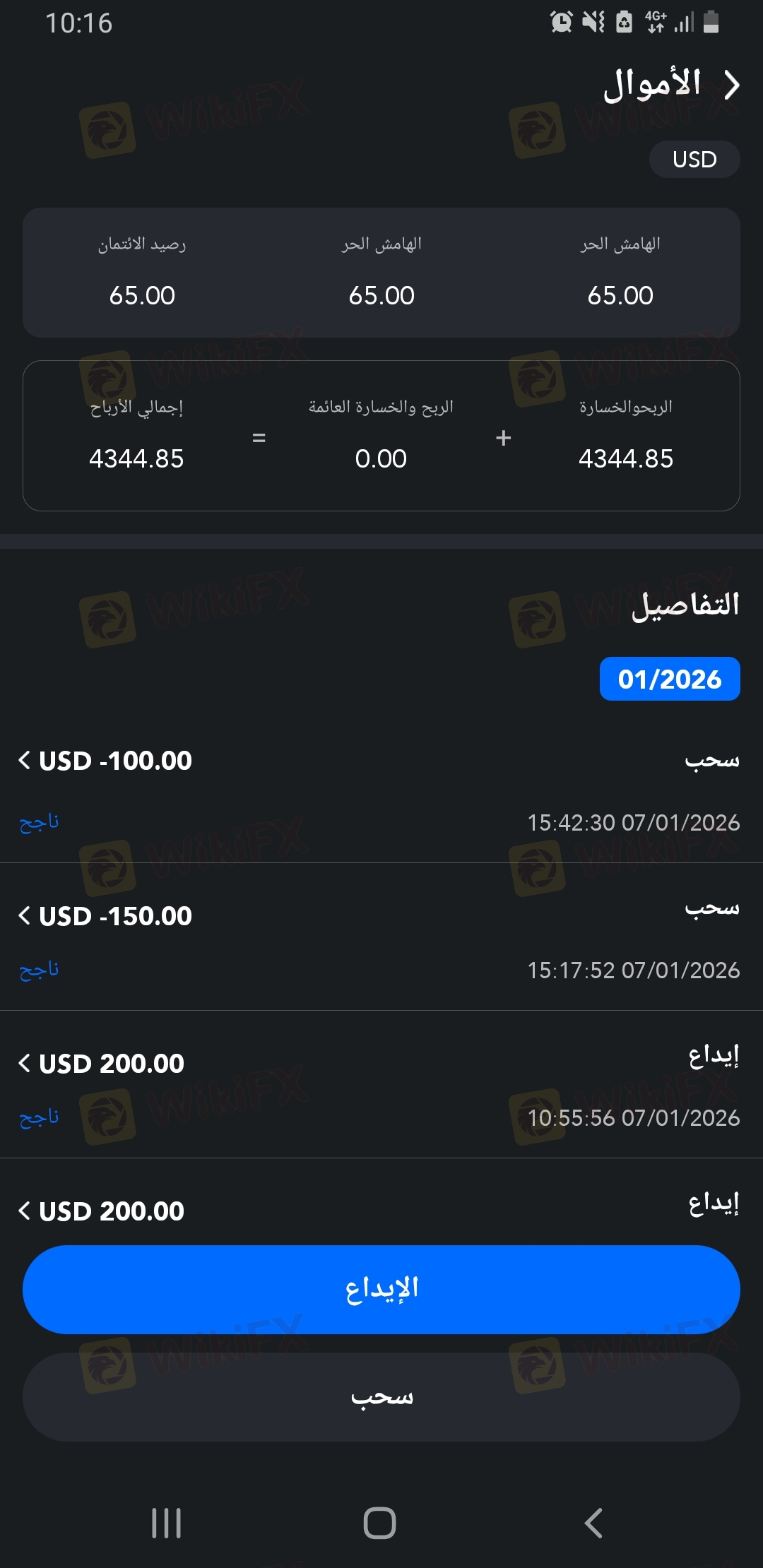

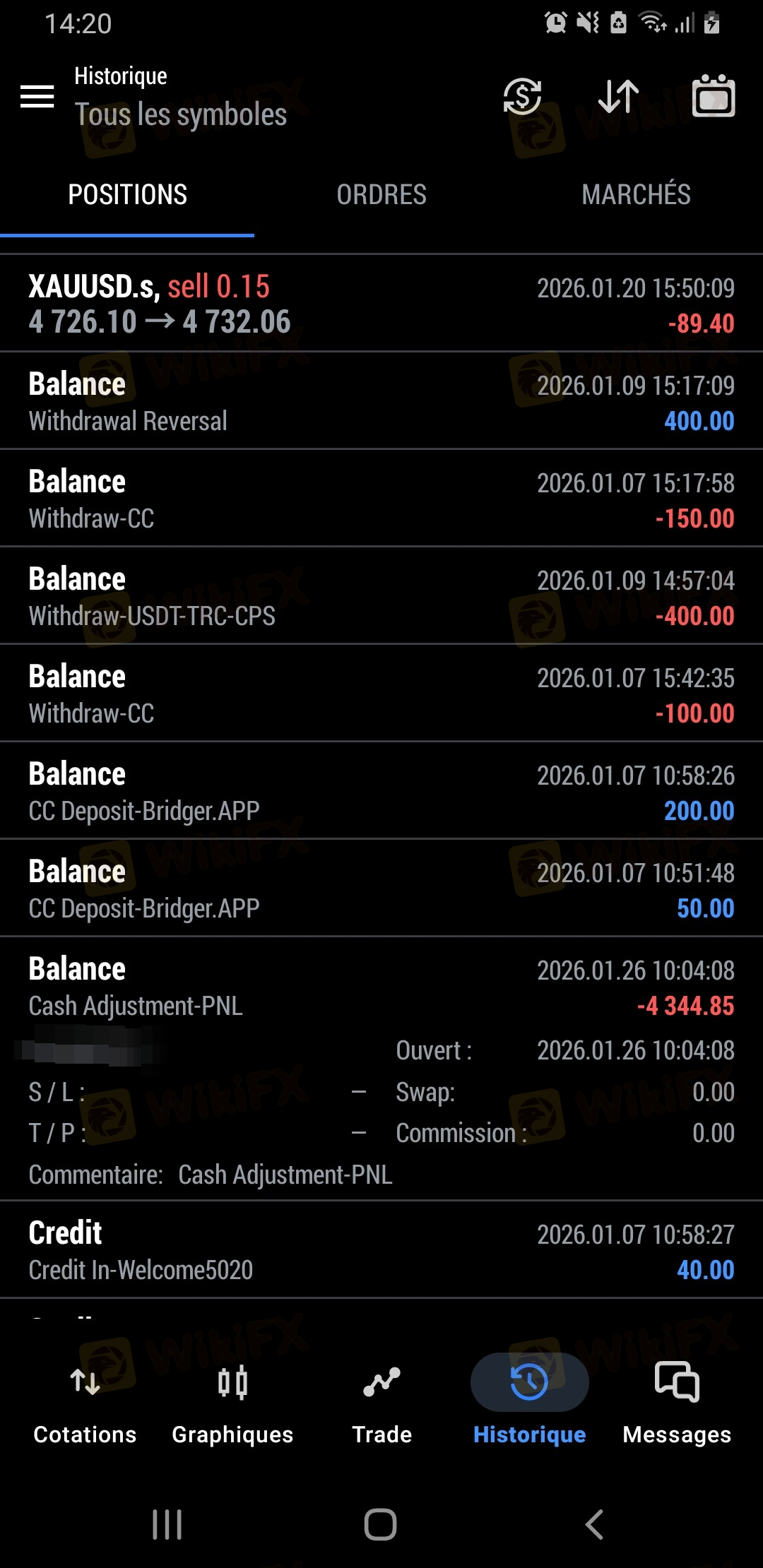

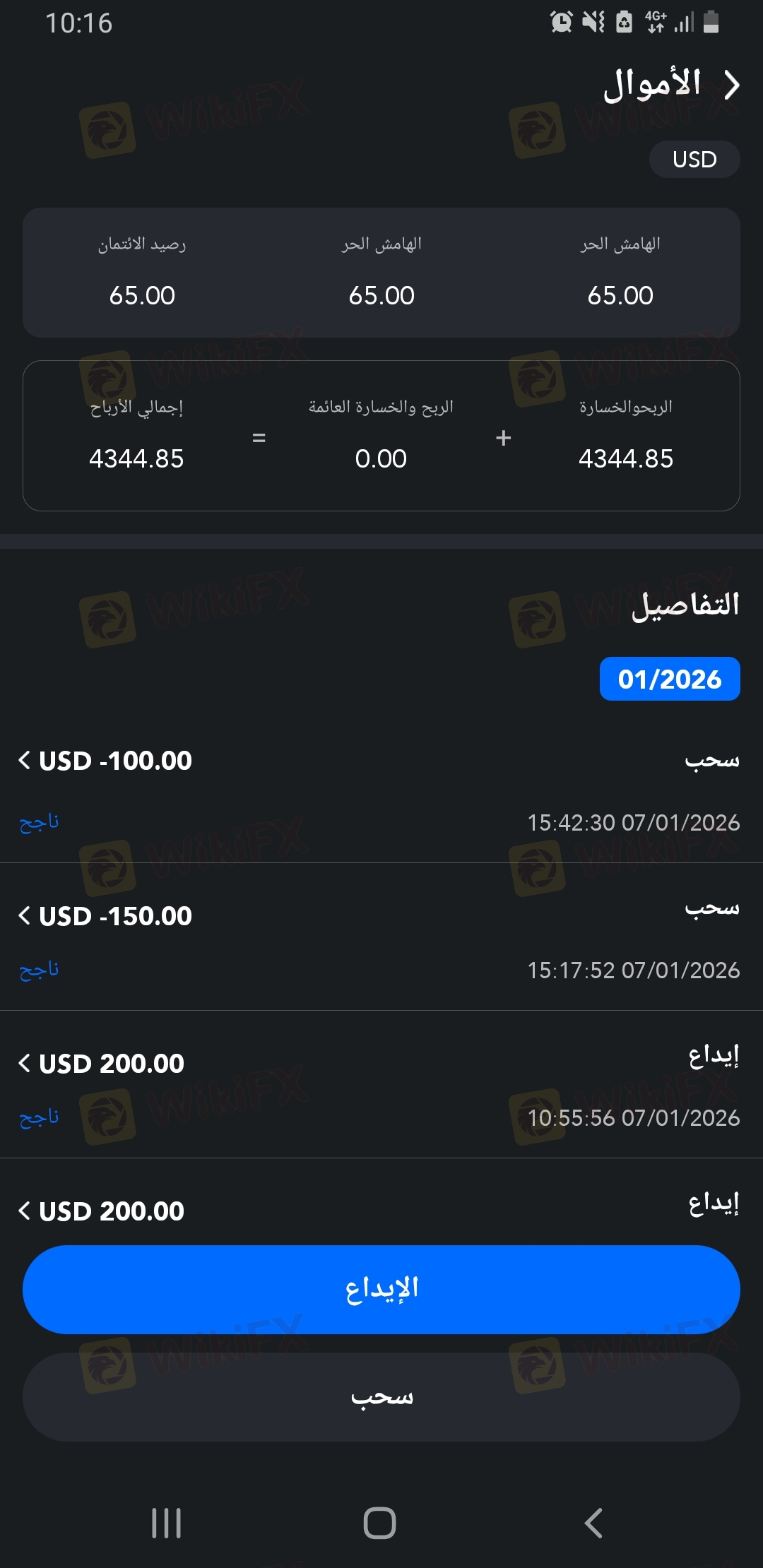

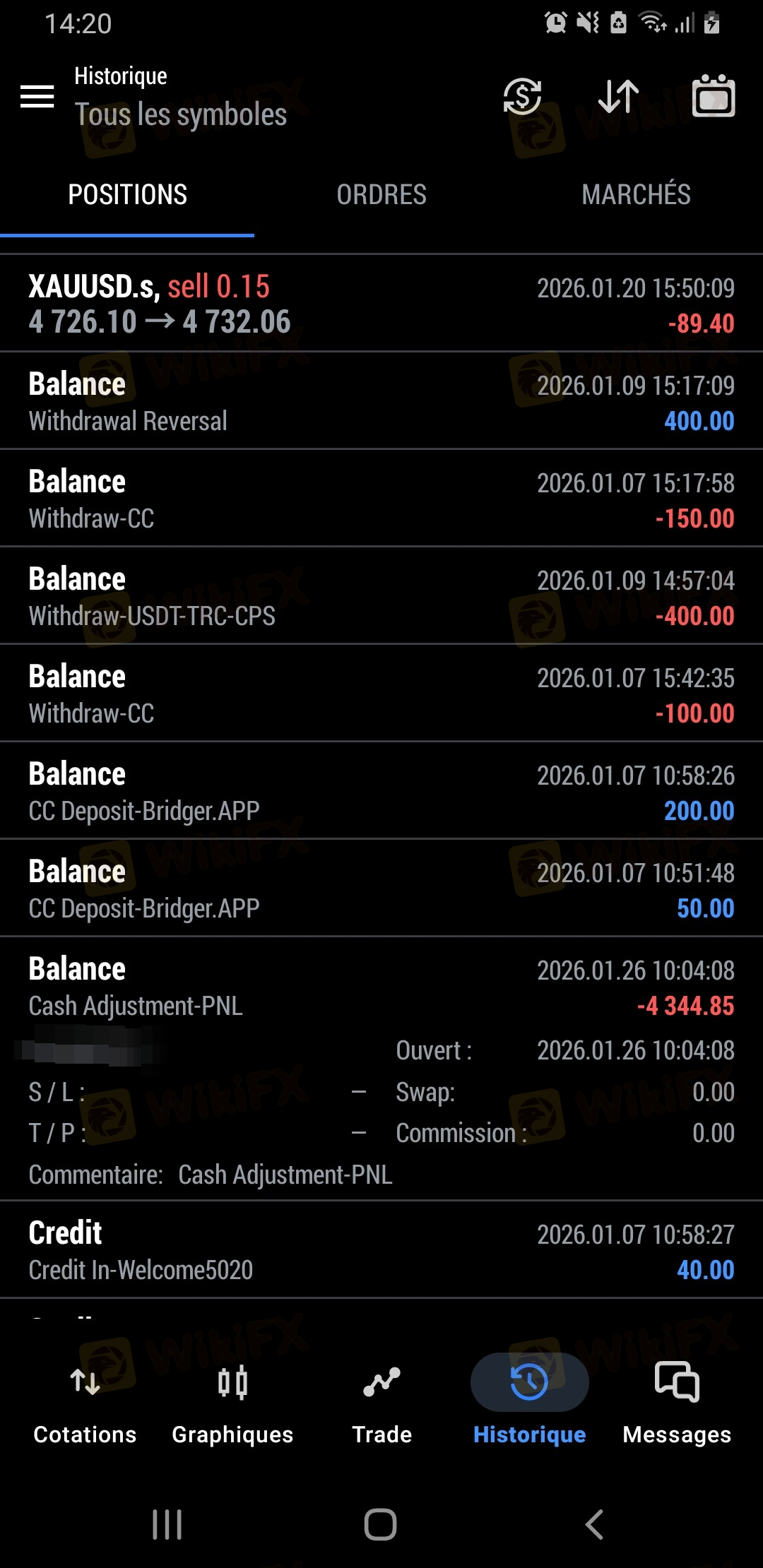

A pure scam platform that prevents withdrawals of profits.

Account 751119. Return my money. You have to have a decent reason to be a bandit. Don't you feel shame when you say management fees?

At 8:30 pm on August 4, 2023, when the United States released data, it took advantage of the violent market fluctuations to manipulate the actual price of the product. See the screenshot for details.

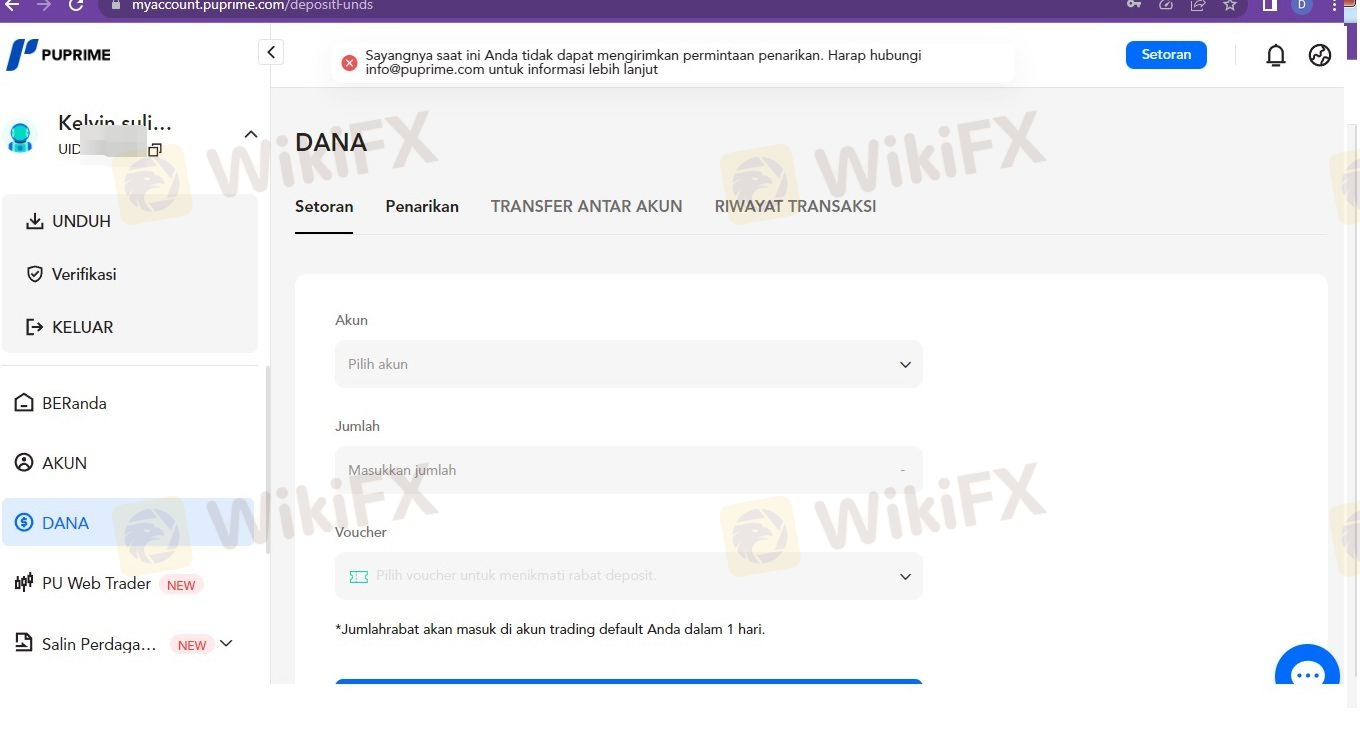

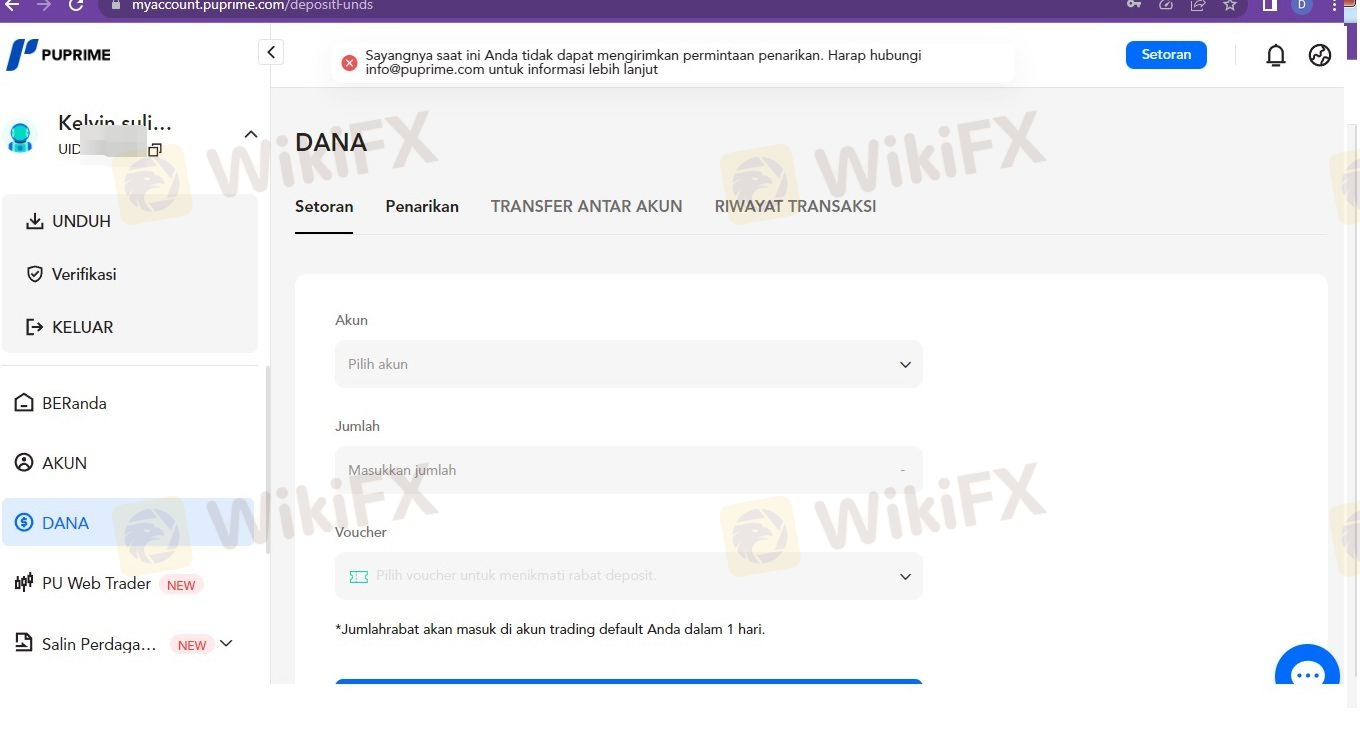

Unable to withdraw or deposit funds. When you make profits trading on the platform, they refuse to process withdrawals. They sent an email claiming I'm on their internal blacklist for no apparent reason. Contacted online customer service, who told me to reach out to other agents—no solutions offered, just endless buck-passing. I provided all documents requested by customer service as required, yet received no response. Classic scam platform. If you can't handle the consequences, stay away from this nonsense.

Robbery, it’s the first time I heard that there will be an account management fee of more than 500 US dollars

Fraudulent platforms refuse to process withdrawals, not allowing a single penny of profits to be withdrawn—only the principal amount is permitted.

My account number is 658445 and I have made a deposit transaction in Pacific. Now I can only withdraw the principal and there is an email to notify me of account termination and blocked my account. I can’t log in on the backstage, and I can’t place orders. It was a normal transaction, and I didn't reply to the email. I can only complain here. Please look at attached picture and stay away from this platform.

I do not want to trade at this small platform anymore. The withdrawal of 93 dollars deducts 20 dollar handling fees. It can only contact via email. I ask the customer serivce and it said that they have hint that withdrawal for less than 100 dollars has a 20 dollars handling fee. I check on the website and there is only small line for the hint. I can only blame myself for careless. I admit it. I ask other platform and they only charge 3 dollars at most. I remind everyone to stay away from this kind of small platform.

Scam platform—played for just one day and they won't let me withdraw my profits. Total rip-off, everyone stay away!

My withdrawal from PU Prime on June 13 has not arrived. They say that they already made the transfer, but I have not received it. They do not explain anything.

Unable to withdraw or deposit funds. The email indicates being on an internal blacklist. Contacting customer service only leads to delays with no solution provided. Reaching out to the official email still results in stalling, claiming there is an account manager to resolve the issue. However, neither the emails nor the feedback from customer service have shown any contact details for this so-called account manager.

I had traded for over two months and it did not have any problem before. Later, it deceives me to say that I traded illegally. Have you ever seen illegal trades where the account lost money? Then, they ask me to sign an agreement, saying that the cooperation will be terminated, the commission will be deducted, and the client in my name will lose money to you, and you will deduct my commission? There is still a problem with you losing money, and you still don't pay me a commission. It's too unreasonable and too dark! Looking for customer service to find sales anyway, it's too dark

Fraud platform. It is able to trade but cannot withdraw. It cannot withdraw even 1000 dollars. What kind of platform it is.

. After recharging and trading, the principal and profits cannot be withdrawn. The withdrawal window is closed and the text message shows a blacklist. What does it mean? Request resolution!

I have been trading on the platform for more than half a year, and everything has been normal. Later, when I made a profit, the platform restricted me from trading. Rather than withdrawing. I would like to ask if the platform is like this? Only make customers lose money. Is it illegal for customers to make money? Everyone should be careful when trading at this platform. Losing money is a normal transaction, and making a profit is illegal.

My trading account number is 693141. I opened an account in February and traded until June. I made a deposit with UnionPay. On June 13, I was rejected for withdrawing money with cryptocurrency. Then I could not submit a withdrawal application when I used UnionPay to withdraw money. The reason, contact the customer service, the customer service asked me to contact the customer manager, the customer manager sent me an email and only replied that I have a violation, and I have to deduct the profit before I can withdraw the money (the money is with you, if you think that the violation is a violation, I accept it), but They don't have anyone contact me now, they don't mention my list of violations, they don't reply to emails or emails, and they unbind my UnionPay card yesterday, thinking that my UnionPay card has expired (the UnionPay card needs to be bound to apply for withdrawal of gold) card), the account still cannot apply for withdrawal

| Broker Name | PU Prime |

| Registered Country | Australia |

| Founded in | 2015 |

| Regulation | FSA, FSC(Mauritius), ASIC |

| Market Instruments | Forex, Indices, Metals, Commodities, Shares, Cryptocurrencies, ETFs, and Bonds |

| Account Types | Standard, ECN, Cent and Prime |

| Demo Account | Yes ($100,000 virtual capital) |

| Maximum Leverage | 1:1000 |

| Trading Platform | MT4, MT5, PU Web Trader, or the PU Prime App |

| Minimum Deposit | $20 |

| Deposit & Withdrawal Method | Bank Transfer, MasterCard, VISA, Neteller, Skrill, BTC/USDT, AliPay, FasaPAY, UnionPay |

| Negative balance protection | Yes |

PU Prime is a forex and CFD broker that was founded in 2015 and is based in Australia, offering popular instruments, including Forex, Indices, Commodities, Cryptocurrencies, Metals, Shares, Bonds, ETFs. PU Prime provides five different account types including Cent, Standard, Prime, ECN, Islamic, with each account offering different features and benefits such as minimum deposit requirements, spreads, and leverage. Leverage offered by PU Prime ranges from 1:500 to 1:1000. The minimum deposit required to open an cent account with PU Prime is $20.

Regard trading software, PU Prime offers both the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms to its clients, known for its user-friendly interface and advanced trading tools.

PU Prime is regulated across multiple jurisdictions, including the Australian Securities and Investments Commission (ASIC) in Australia with a Market Making (MM) license, the Financial Services Authority (FSA) in Seychelles with an offshore Derivatives Trading License (EP), and the Financial Services Commission (FSC) with an active Securities Trading License (EP).

| Pros | Cons |

| / |

| |

| |

| |

| |

| |

| |

|

PU Prime offers some popular instruments, including popular currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs.

In addition to forex, PU Prime also provides access to a variety of indices, such as the S&P 500, FTSE 100, and NASDAQ, allowing traders to diversify their portfolios and take advantage of global market movements. Commodity trading is also available with PU Prime, featuring popular options such as gold, silver, crude oil, and natural gas.

Cryptocurrency enthusiasts can trade popular digital assets such as Bitcoin, Ethereum, Litecoin, and Ripple. PU Prime also offers metal trading, allowing clients to trade silver and gold, as well as stock trading, including a variety of shares from top companies such as Amazon, Apple, and Microsoft.

Furthermore, PU Prime provides bond trading and access to exchange-traded funds (ETFs) to offer even more investment opportunities.

| Trading Product | Available |

|---|---|

| Forex | ✅ |

| Metals | ✅ |

| Indices | ✅ |

| Commodities | ✅ |

| Shares | ✅ |

| ETFs | ✅ |

| Bonds | ✅ |

As for trading accounts, four options are available: Cent, Standard, Prime, and ECN.

All account types offer high leverage (up to 1000x), support MT4/MT5 platforms, and mobile apps, with most available as Islamic accounts. The Standard and Cent accounts are suitable for beginners and low-risk traders, with low minimum deposits and no commission fees. The Prime and ECN accounts cater to high-frequency traders, offering lower spreads and faster execution but requiring higher minimum deposits and charging commissions. The ECN account provides quotes directly from tier-1 liquidity providers but does not support Islamic accounts.

| Account Type | Standard Account | Prime Account | ECN Account | Cent Account |

|---|---|---|---|---|

| Minimum Deposit | $50 | $1,000 | $10,000 | $20 |

| Spreads | From 1.3 pips | From 0.0 pips | From 0.0 pips | From 1.3 pips |

| Commission | No | $3.5 per side/lot | $1 per side/lot | No |

| Leverage | Up to 1000 | Up to 1000 | Up to 1000 | Up to 1000 |

| Min. Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Conditions Apply To | All Products | Forex, Spot Metals, Crude Oil, Indices | Forex, Spot Metals, Crude Oil, Indices | All Products |

| Base Currencies | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | USD |

| Available as Islamic Account? | Yes | Yes | No | Yes |

PU Prime offers different fees based on account types (Standard, Prime, ECN).

For Forex trading, spreads range from 1.6 pips for Standard accounts to 0.2 pips for Prime accounts.

Commission fees are applied for Prime and ECN accounts, while Standard accounts have no commission.

Swaps vary by product, with positive or negative charges depending on the position (long or short).

| Fee Type | Details |

|---|---|

| Account Opening or Maintenance | None |

| Deposits | No handling fees, but some methods may incur charges. |

| Withdrawals | First withdrawal via bank transfer is free; others incur a $20 fee (or equivalent). |

| Rollover | Rollover fees apply on futures, credited back to maintain neutral position. |

| Administration Fee | Islamic accounts incur a variable administration fee. |

| Dividend Adjustments | Short positions on dividend stocks incur the dividend charge. |

PU Prime offers three choices of the most popular trading platforms in the industry: MT4, MT5, PU Web Trader, PU Prime App. Both platforms are available for desktop and mobile devices and come with advanced charting tools, technical indicators, and a wide range of customization options.

PU Prime offers over 10 deposit and withdrawal methods to its clients. The available methods include bank wire transfer, credit/debit cards (Visa and Mastercard), electronic payment systems (Skrill, Neteller, Fasapay, Sticpay, Bitwallet, America Express, VLoad, AstroPay, and more), and local payment methods. PU Prime does not charge any deposit fees, and the minimum deposit amount varies depending on the account type, starting from $10 for the Cent account.

Withdrawals are typically processed within 24 hours, and there are no withdrawal fees for most of the methods. However, some third-party payment providers may charge a fee, which will be deducted from the client's account balance. PU Prime requires clients to withdraw funds using the same payment method that was used for depositing, up to the deposited amount. If the withdrawal amount exceeds the deposited amount, clients can choose a different withdrawal method.

PU Prime's copy trading feature, facilitated through the PU Social app, can enhance the trading experience, especially for those new to the financial markets.

By using PU Social, users can easily select and follow master traders. This allows them to replicate the trading strategies and results of seasoned professionals directly in their own accounts. Simply choose a professional trader within the app, and start copying their trades to begin seeing similar results in your own trading activities.

This feature not only simplifies the learning curve but also provides a practical way to potentially increase trading success by leveraging the expertise of experienced traders.

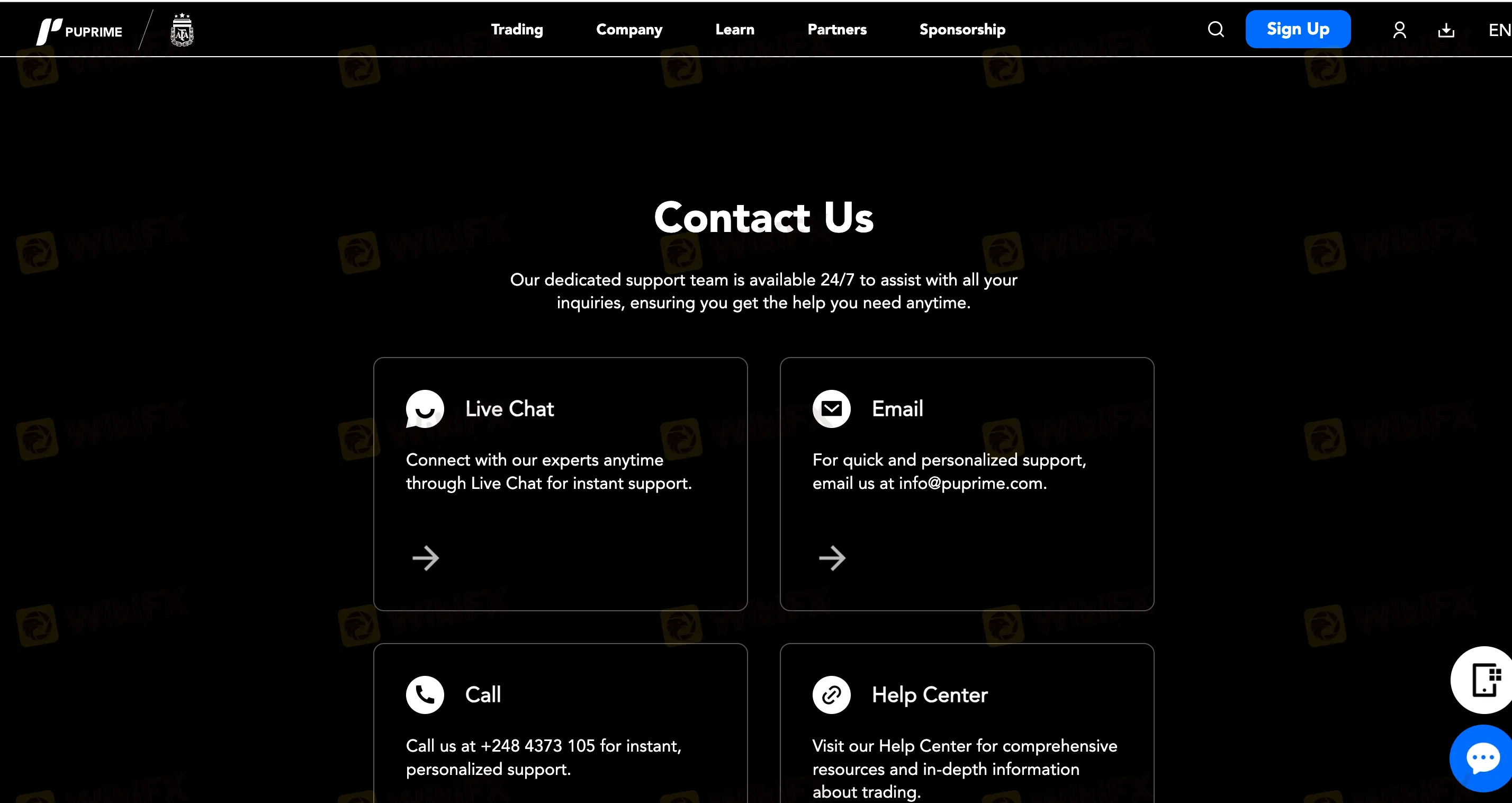

PU Prime provides customer support through multiple channels, including phone, email, and live chat. The customer support team is available 24/7. They are responsive and knowledgeable, and can assist with various account-related inquiries such as account opening, funding, and technical issues with the trading platform. In addition, the broker has a comprehensive FAQ section on its website that covers a wide range of topics, including account types, trading instruments, trading platforms, funding, and more.

PU Prime is a well-regulated Australian broker that offers a wide range of trading instruments, competitive spreads, and multiple account types to satisfy the needs of different traders. The broker's MetaTrader 4 and 5 platforms are user-friendly and customizable, and the availability of Autochartist is a valuable addition to technical analysis.

However, the minimum deposit required to open some account with PU Prime is relatively high, and the broker's non-trading fees can be quite steep.

What tradable instruments does PU Prime offer?

PU Prime offers access to popular trading instruments, including forex, indices, commodities, cryptocurrencies, metals, shares, bonds, and ETFs.

What is Autochartist and does PU Prime offer it?

Autochartist is a tool that helps traders analyze market data and identify potential trading opportunities. PU Prime offers Autochartist to its clients.

Is PU Prime good for beginners?

Yes, Pu Prime is a solid choice for beginners, as it is a strictly regulated broker that allows low-budget trading, and it also offers both MT4 and MT5 and solid educational contents.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Key Takeaways:Gold has firmed since Friday, supported by dollar softness and rising macro uncertainty.The tariff ruling has added fiscal uncertainty, indirectly boosting bullions appeal.Middle East te

WikiFX

WikiFX

Feb 16, 2026 – PU Prime, a global multi-licensed online brokerage, is proud to announce its achievement at the highly anticipated iFX Expo Dubai 2026. Marking a strong start to the year, PU Prime was

WikiFX

WikiFX

Feb 13, 2026 – PU Prime, a leading global multi-asset broker group, is proud to announce that its Dubai-based entity has officially been granted a licence by the Capital Market Authority (CMA) of the

WikiFX

WikiFX

A User from Pakistan filed a complaint against PU Prime recently, accusing the broker of “it is a Scammer and eating funds from clients' accounts very easily and openly.”

WikiFX

WikiFX

More

User comment

63

CommentsWrite a review

2026-02-15 17:42

2026-02-15 17:42

2026-01-30 01:16

2026-01-30 01:16