User Reviews

More

User comment

2

CommentsWrite a review

2024-07-10 10:15

2024-07-10 10:15

2024-05-29 16:01

2024-05-29 16:01

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.47

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| FAST TRADE Review Summary | |

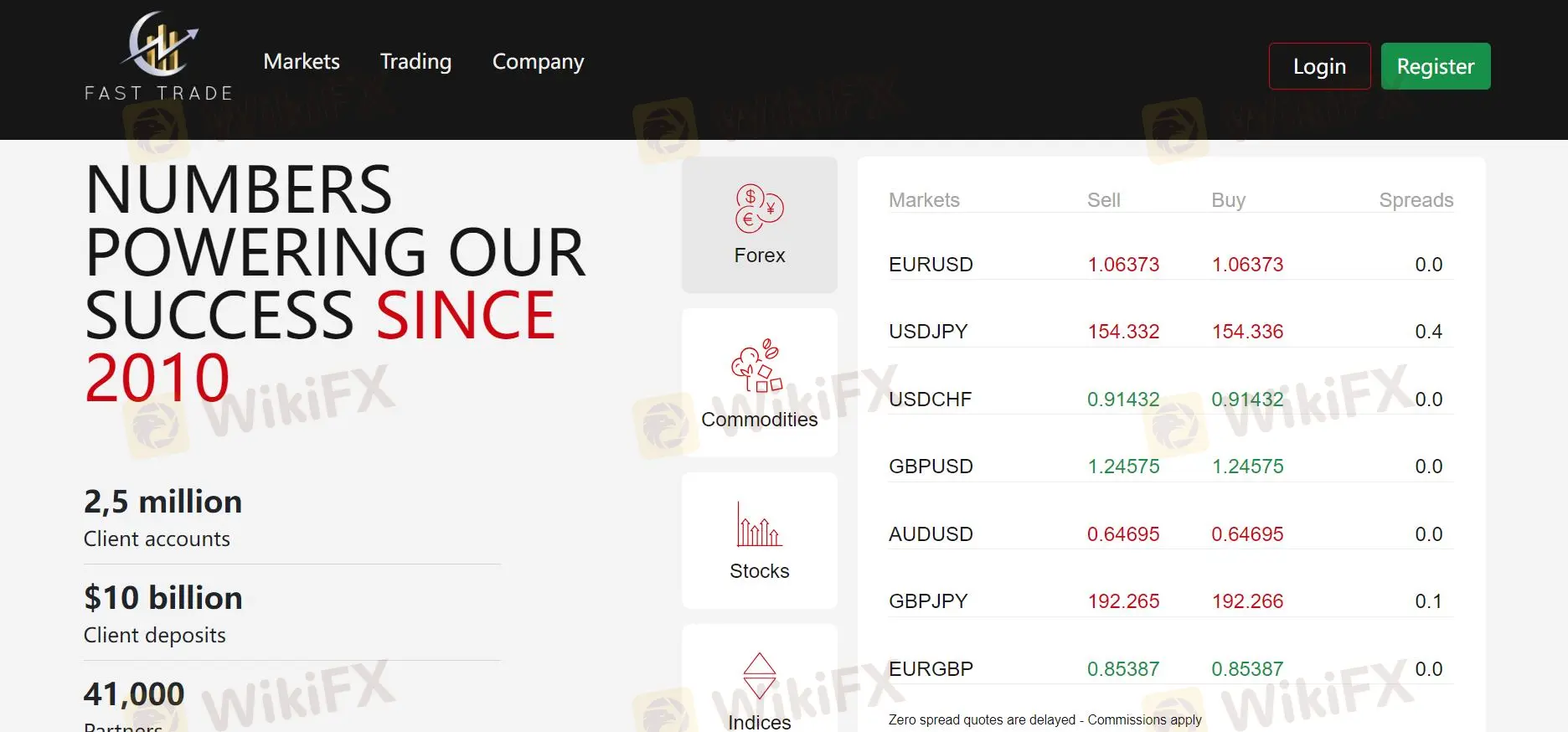

| Founded | 2010 |

| Registered Country/Region | United States |

| Regulation | NFA (Unauthorized) |

| Market Instruments | Forex, Commodities, Stocks, Indices, Cryptos, ETFs and Bonds |

| Demo Account | Available |

| Leverage | Up to 1:100 |

| Spread | From 1.2 pips (Cent Account) |

| Trading Platforms | Webtrader, and FAST TRADE APP |

| Minimum Deposit | Free |

| Swap-Free Trading | Available |

| Customer Support | Address: Empire State Building, 350 5th Avenue, New York, NY 10118, United States |

FAST TRADE is a broker founded in 2010. Headquartered in the United States, it provides access to Forex, Commodities, Stocks, Indices, Cryptos, ETFs, and Bonds. It boasts features like high leverage (up to 1:100), low spreads, a minimum deposit requirement of zero, and a mobile app. With a commitment to transparency and accessibility, FAST TRADE extends a free demo account option, allowing users to familiarize themselves with the platform before engaging in live trading.

However, the biggest concern is that the NFA regulation held by FAST TRADE is unauthorized in fact. This means it is not operating legally.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Wide Range of Instruments: FAST TRADE offers a diverse selection of financial instruments, including Forex, Commodities, Stocks, Indices, Cryptos, ETFs, and Bonds, providing ample trading opportunities.

Demo Account Availability: You can utilize a free demo account to practice and familiarize yourself with the platform's features and trading conditions before committing to real funds.

Multiple Trading Platforms: FAST TRADE offers a variety of trading platforms, including Webtrader, and the FAST TRADE APP, catering to different trading preferences and ensuring accessibility across devices.

No Minimum Deposit: The platform does not impose a minimum deposit requirement, making it accessible to traders of all levels, including those with limited initial capital.

Swap-Free Trading Available: FAST TRADE provides swap-free trading accounts, accommodating traders who require adherence to Shariah law or have other ethical considerations regarding interest-based transactions.

Unauthorized NFA Regulation: While FAST TRADE operates under NFA regulation, its current status as “Unauthorized” indicates risks regarding the level of oversight and protection afforded to funds.

Limited Customer Support Channels: There's a lack of information about contact methods (phone, email, live chat), response times, and support languages. This makes it difficult to gauge the quality and efficiency of their customer service.

FAST TRADE is a trading platform that presents itself as legitimate, offering a wide range of instruments and features while emphasizing the security of funds. The platform implements measures such as market-leading insurance, segregation of client funds, and accounts with major banks to safeguard client funds.

However, the absence of authorization by the National Futures Association (NFA) in the US is a significant issue. The NFA regulates futures and options trading, and without this authorization, FAST TRADE is likely to operate illegally in the US market. This raises questions about the overall legitimacy of its business practices.

FAST TRADE boasts a diverse selection of tradable instruments, allowing you to potentially spread your investments across various markets. Diversification is a key strategy to manage risk, but knowledge is essential for successful investing. It's wise to start with smaller investments to gain experience before committing larger sums.

Forex: This involves buying and selling currency pairs like EUR/USD (Euro vs. US Dollar), USD/JPY (US Dollar vs. Japanese Yen), etc. Forex offers high liquidity and 24-hour accessibility, making it a popular choice for active traders.

Commodities: You can trade contracts for physical commodities like oil, gold, silver, natural gas, etc.

Commodity prices are influenced by factors like supply and demand, global events, and weather patterns.

Stocks: You can buy and sell shares of ownership in individual companies like Apple, Google, or Amazon. Stock prices are determined by a company's performance, market sentiment, and overall economic conditions.

Indices: These represent baskets of stocks that reflect a particular market sector or a geographical region (e.g., S&P 500 for US large-cap stocks). Trading indices allows you to gain exposure to a broader market without picking individual stocks.

Cryptocurrencies: FAST TRADE offers trading in digital currencies like Bitcoin or Ethereum. Cryptocurrencies are highly volatile and speculative investments with uncertain long-term viability.

ETFs (Exchange-Traded Funds): ETFs are similar to stocks but represent a basket of assets like stocks, bonds, or commodities that trade on a stock exchange like a single security. ETFs offer diversification and potentially lower fees compared to actively managed funds.

Bonds: These are debt instruments issued by governments or corporations, where you essentially loan money and receive interest payments in return. Bonds offer lower volatility than stocks but generally provide lower returns.

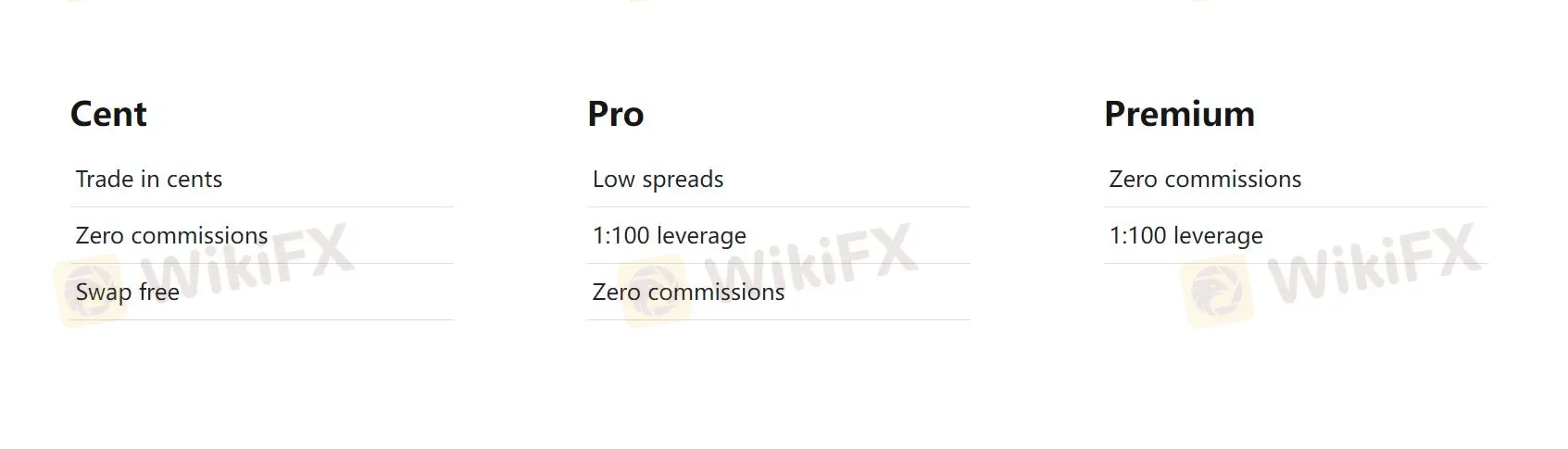

FAST TRADE offers three main types of trading accounts: Cent, Pro, and Premium, each catering to different trading needs and experience levels.

The Cent account is designed for novice traders who are transitioning from demo trading to live trading. It allows trading in cent lots, making it ideal for those who want to start with smaller trade sizes.

For experienced traders looking for advanced trading conditions, the Pro account offers ultra-low spreads. It also allows for a maximum total trade size of 60 Standard lots per position and a maximum of 500 simultaneous open orders, providing flexibility for traders with diverse trading styles.

The Premium account is tailored for retail traders seeking swap-free trading with no minimum deposit requirement and no commission charges. This account type offers market execution, ultra-low spreads starting from 1.2 pips, and a contract size of 1 lot = 100,000 units.

FAST TRADE offers leverage of up to 1:100 on all three of their account types (Cent, Pro, and Premium). This means you can control a position size up to 100 times your account balance. If your market predictions are accurate, you can make significantly larger profits due to leverage.

The biggest drawback is that leverage magnifies losses as well. A small price movement against your position can lead to substantial losses exceeding your initial investment. This is especially dangerous for beginners who may not fully understand the risks.

FAST TRADE stands out for its competitive spreads, zero commissions, and lack of swap fees across all account types (Cent, Pro, and Premium), making it an appealing choice for cost-conscious traders. Spreads start from 1.2 pips for Cent and Premium accounts and 0.6 pips for Pro accounts, offering competitive pricing compared to other brokers. This pricing structure allows traders to trade with confidence, knowing that they are getting a transparent and cost-effective trading experience.

FAST TRADE offers two main trading platforms for its users: Webtrader and the FAST TRADE App. These platforms are designed to provide a seamless trading experience with a range of features and tools to enhance the trading process.

Webtrader: The Webtrader platform is a web-based trading platform that allows traders to access the markets from any web browser. It offers a user-friendly interface, advanced charting tools, and real-time market data. Webtrader is ideal for traders who prefer a web-based platform and want the flexibility to trade from any device with internet access.

FAST TRADE App: The FAST TRADE App is a mobile trading platform designed for traders who prefer to trade on the go. The app is available on both Apple Store and Google Play and offers a modern and intuitive trading experience. It provides access to a wide range of trading instruments, customizable trading features, and a history of each trade. The FAST TRADE App has been recognized by Capital Finance as the Best Online Trading App, highlighting its excellence in the industry.

You can visit or mail to their address at the Empire State Building, 350 5th Avenue, New York, NY 10118, United States, to seek support. However, there is a lack of information available about FAST TRADE's other customer service contact details, such as phone numbers and email.

FAST TRADE entices new traders with a diverse instrument selection, a free trial through their demo account, and a convenient mobile app. The allure of tight spreads, zero commissions, and swap-free accounts is undeniable. But these perks can't overshadow the inherent risks associated with an unregulated platform. The most glaring red flag is the lack of authorization from the National Futures Association (NFA) in the US. This significantly impacts FAST TRADE's credibility and raises questions about how they handle your funds. Without proper regulation, there's no assurance of fair trading practices or protection for your hard-earned money.

There are numerous reputable and well-regulated brokers offering similar features, often with a broader range of trading platforms and dependable customer support. When it comes to your financial security, choosing a regulated broker over FAST TRADE is clearly better.

Q: Is FAST TRADE a legitimate broker?

A: FAST TRADE claims to be regulated, but currently lacks authorization from the National Futures Association (NFA) in the US. This indicates issues about their legitimacy.

Q: Does FAST TRADE provide a demo account?

A: Yes.

Q: What trading platforms does FAST TRADE offer?

A: FAST TRADE provides two main trading platforms: Webtrader (web-based) and the FAST TRADE App (mobile).

Q: Does FAST TRADE have a minimum deposit requirement?

A: No, FAST TRADE boasts a zero minimum deposit requirement.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

More

User comment

2

CommentsWrite a review

2024-07-10 10:15

2024-07-10 10:15

2024-05-29 16:01

2024-05-29 16:01