User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index6.92

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Company name | FOTM |

| Registered in | China |

| Regulated | Unregulated |

| Years of establishment | 2-5 years |

| Trading instruments | Currency pairs only |

| Account Types | Standard, VIP |

| Minimum Initial Deposit | $250 |

| Maximum leverage | 1:1000 |

| Deposit and withdrawal method | Credit card, debit card, wire transfer, Skrill |

| Complaint Exposure | Many Complaints |

FOTM is an online broker based in China with an uncertain regulatory status, making it unregulated and lacking transparent licensing information. This raises concerns about client fund safety and overall legitimacy. It offers trading in currency pairs only and provides two account types (Standard and VIP) with a minimum deposit requirement of $250. High leverage levels of up to 1:1000 are available, but they come with increased risk.

Deposits and withdrawals can be made using various methods, including credit cards, debit cards, wire transfers, and Skrill. Despite offering customer support through email and live chat, numerous complaints suggest a lack of satisfactory service. Traders should exercise caution and consider regulated alternatives to protect their investments and trading experience.

FOTM is a scam broker, and there are several red flags that raise suspicions about its legitimacy. Firstly, the lack of regulatory license information on their website is a major concern. A regulated broker is required to provide transparency and adhere to certain standards to protect client funds and ensure fair trading practices. The absence of such information indicates that FOTM is not subject to any regulatory oversight, making it a risky choice for traders.

FOTM offers several advantages that may attract some traders. Firstly, the absence of a minimum deposit requirement allows individuals with limited funds to explore trading opportunities without a significant financial commitment. Additionally, the availability of high leverage levels, with a maximum of 1:1000, can be appealing to risk-tolerant traders seeking the potential for amplified profits. Moreover, the presence of educational resources provides beginners with valuable learning materials to enhance their understanding of the financial markets.

However, despite these benefits, FOTM is fraught with critical drawbacks. The most significant red flag is its status as an unregulated broker. The lack of regulatory oversight exposes clients to considerable risk, with no safeguards to protect their funds or ensure fair trading practices. Reports of poor customer support indicate difficulties in receiving timely assistance when facing issues or inquiries. Moreover, FOTM's limited range of market instruments restricts traders' opportunities for diversification and optimal portfolio management.

| Pros | Cons |

| No minimum deposit requirement | Unregulated broker |

| High leverage levels available | Poor customer support |

| Some educational resources available | Limited market instruments |

FOTM offers limited trading options, focusing only on currency pairs. The absence of other popular trading assets like indices, commodities, stocks, and metals narrows down the trading opportunities available to clients. This limitation might not suit traders who seek diversification and exposure to various financial markets.

FOTM offers two account types: Standard and VIP. The Standard account requires a minimum deposit of $250, while the VIP account demands a significantly higher minimum deposit of $5,000. The VIP account offers access to higher leverage levels and a dedicated account manager, but this might not justify the significant deposit requirement, considering the broker's overall suspicious nature.

Opening an account with FOTM requires providing basic personal information and submitting documents such as ID and proof of address. While this process is standard for most brokers, the lack of regulatory oversight further accentuates the risk associated with sharing sensitive information with FOTM.

FOTM's offer of leverage levels up to 1:1000 is excessively high and poses a considerable risk to traders. While it might attract those seeking quick gains, the potential for large losses is equally significant. Responsible brokers typically offer more conservative leverage levels to protect their clients from the adverse effects of extreme market volatility.

The lack of information about spreads and commissions on FOTM's website is highly concerning. Transparent brokers are expected to provide detailed information about trading costs, including spreads and commissions, to help traders assess the overall expenses involved in their trading activities.

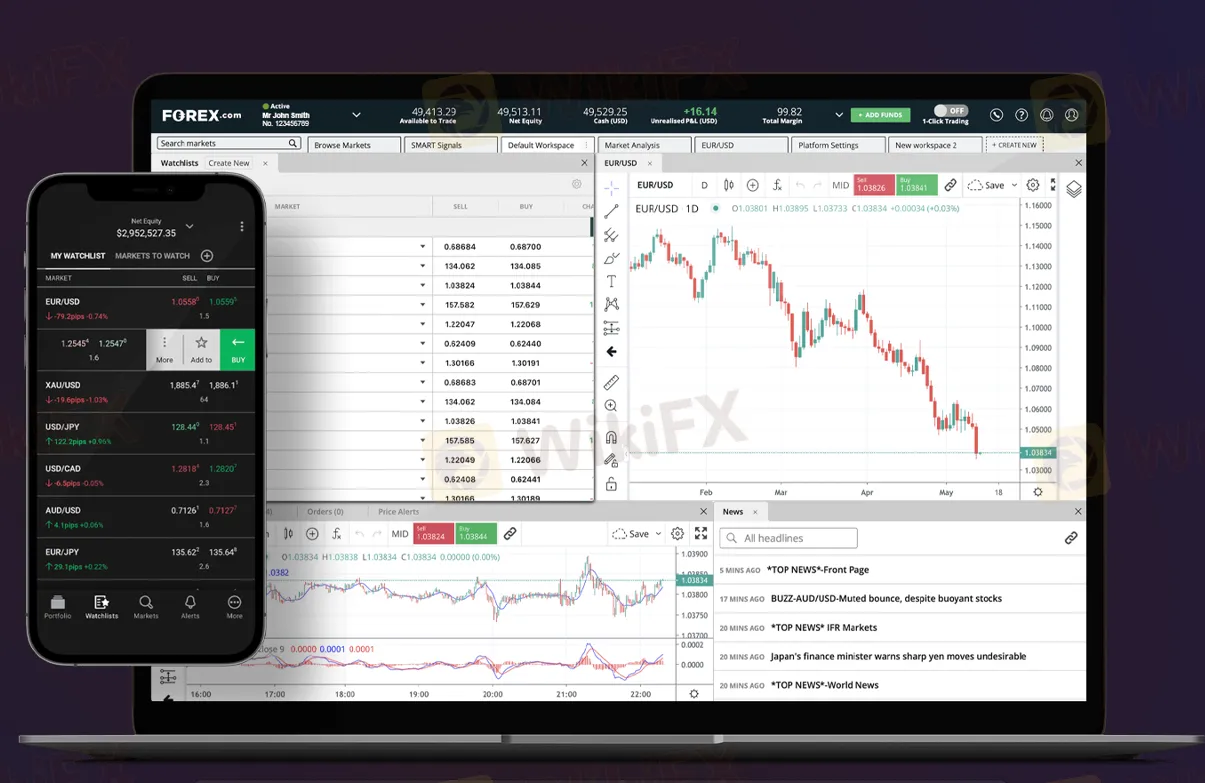

The absence of the popular MT4 or MT5 trading platforms raises doubts about the stability and reliability of FOTM's trading infrastructure. These platforms are widely recognized for their security, functionality, and wide range of features, making them a preferred choice for traders worldwide. Using an undisclosed or less reputable trading platform is a significant red flag.

FOTM accepts deposits through credit cards, debit cards, and wire transfers. Withdrawals can be made through similar methods, along with Skrill. However, the absence of more diverse payment options and the lack of trustworthiness associated with the broker may discourage potential clients from conducting financial transactions with FOTM.

FOTM's customer support has received mixed reviews, with some traders reporting difficulties in receiving assistance. Inconsistent customer support raises concerns about the broker's commitment to resolving client issues promptly and efficiently. Reliable customer support is crucial for traders, especially when dealing with financial matters.

FOTM offers some educational resources, such as a forex trading tutorial and a list of trading articles. However, the quality and depth of these resources remain uncertain. The lack of transparency and regulation overall cast doubt on the credibility of the educational materials provided by FOTM.

Considering the numerous red flags, FOTM should be considered a scam broker, and traders should avoid doing business with them. Engaging with an unregulated broker poses significant risks, including the potential loss of funds and lack of recourse for disputes. Traders should prioritize working with regulated and reputable brokers to ensure a safe and secure trading experience. It is essential to conduct thorough research and due diligence before entrusting any broker with your funds and personal information.

Q: Is FOTM a regulated broker?

A: No, FOTM is an unregulated broker.

Q: Does FOTM offer high leverage levels?

A: Yes, FOTM provides high leverage levels up to 1:1000.

Q: What market instruments are available at FOTM?

A: FOTM offers trading in currency pairs only.

Q: What payment methods are accepted by FOTM?

A: FOTM accepts credit card, debit card, wire transfer, Skrill.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment