User Reviews

More

User comment

63

CommentsWrite a review

2025-12-24 15:09

2025-12-24 15:09

2025-08-24 00:59

2025-08-24 00:59

Score

2-5 years

2-5 yearsSuspicious Regulatory License

White label MT5

High potential risk

Influence

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index6.50

Risk Management Index0.00

Software Index8.52

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Z Forex Capital Market LLC

Company Abbreviation

Z FOREX

Platform registered country and region

Bulgaria

Company website

X

YouTube

447853208706

Company summary

Pyramid scheme complaint

Expose

| Z Forex Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Bulgaria |

| Regulation | Unregulated |

| Market Instruments | Forex, Stocks, Indiices, Commodities, Metals, |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0 pips |

| Trading Platform | cTrader, MT5 |

| Minimum Deposit | $10 |

| Customer Support | Live Chat, Contact Form |

| Phone: +44 744 147 7121, | |

| Email: info@zforex.com | |

| Company Address: Sofia, Olimpiyska str., SiteGround, Sofia Park, fl. 4, No: 2, post code: 1756, Bulgaria | |

| Social Media: Telegram, Twitter, YouTube, WhatsApp, Instagram | |

| Regional Restriction | Democratic People's Republic of Korea, Iran, Myanmar, United States of America, Turkey |

Registered in 2006, Z Forex is an unregulated online broker based in Bulgaria, offering trading in market instruments such as forex, metals, indices, commodities, and stocks. With a minimum deposit of $10, Z Forex offers one demo account and three types of live accounts. The leverage is up to 1:1000 on this platform. Z Forex does not accept clients from the Democratic People's Republic of Korea, Iran, Myanmar, the United States of America, or Turkey.

| Pros | Cons |

| Three account types | Commission charged |

| MT5 supported | No regulation |

| Multiple contact channels | Regional Restrictions |

| Low minimum deposit requirement | |

| Demo accounts available | |

| Various payment methods |

Z Forex has not been regulated, which means activities on this platform are operated without regulatory oversight.

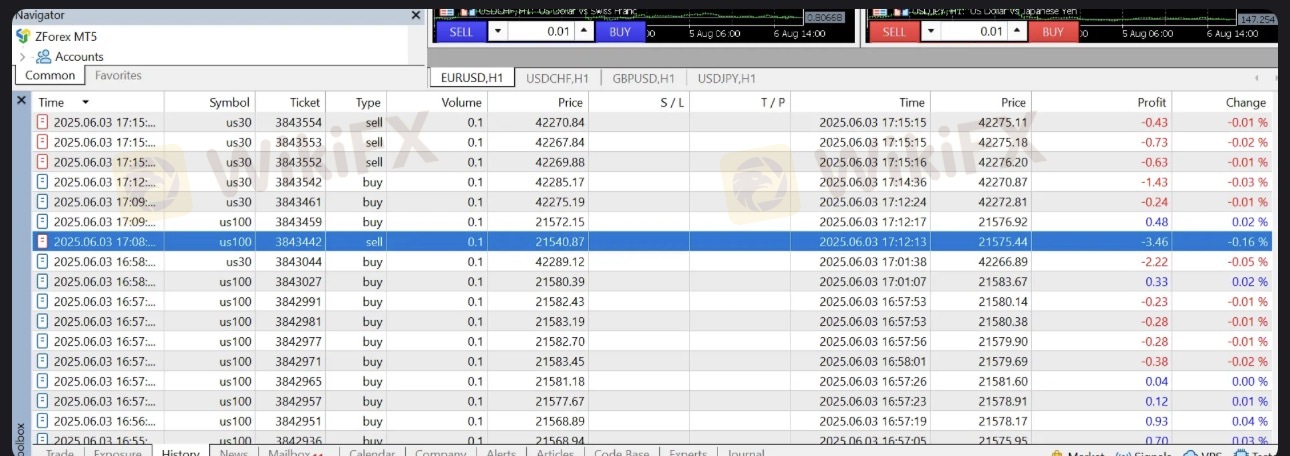

Traders on Z Forex get access to tradable instruments, including forex, stocks, indices, commodities, and metals.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| commodities | ✔ |

| indices | ✔ |

| stocks | ✔ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

Z Forex offers a demo account for traders to test this platform without risking real money.

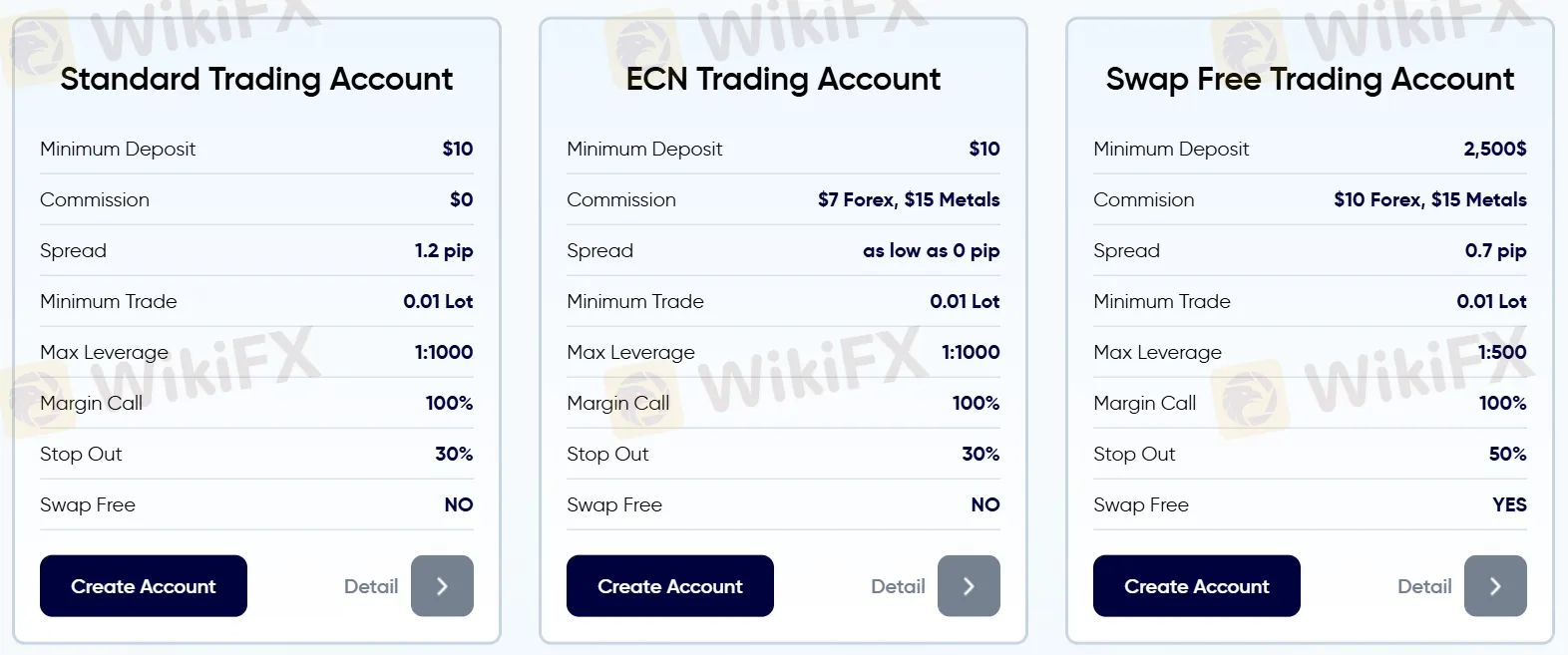

Apart from the demo account, ZForex offers three types of live accounts: Standard, ECN, and Swap Free (Islamic).

| Trading Platform | Standard | ECN | Swap Free |

| Minimum Deposit | $10 | $10 | $2,500 |

| Maximum Leverage | 1:1000 | 1:500 | |

| Commission | $0 | $7 Forex, $15 Metals | $10 Forex, $15 Metals |

| Spread | 1.2 pips | from 0 pips | 0.7 pips |

| Minimum Trade | 0.01 lot | ||

| Margin Call | 100% | ||

| Stop Out | 30% | ||

This platform offers leverage up to 1:1000. However, higher leverage significantly increases risk exposure. Traders should exercise caution.

ZForex also offers dynamic leverage, which is a feature that automatically adjusts traders' maximum leverage based on their account equity. zForex claims to employ transparent equity tiers to set your maximum leverage. The table below outlines how leverage adjusts automatically based on traders' account equity:

| Account Equity | Maximum Leverage |

| $0 – 999 | 1:1000 |

| $1,000 – 2,499 | 1:800 |

| $1,500 – 7,999 | 1:500 |

| $8,000 – 19,000 | 1:400 |

| $20,000 – 39,999 | 1:300 |

| $40,000 – 74 999 | 1:200 |

| $75,000 and above | 1:100 |

Z Forex provides distinct spreads for each account: For the Standard account, the spread is 1.2 pips; for the ECN account, the spread can be as low as 0 pips; when it comes to the Swap Free account, it's 0.7 pips.

In terms of commission, Z Forex charges 0 commission for Standard accounts. However, when it comes to ECN account users, Z Forex does charge $7 for forex trading and $15 for metals trading. For Swap Free account users, the commission is $10 for forex trading, $15 for metal trading.

| Trading Platform | Standard | ECN | Swap Free |

| Maximum Leverage | 1:1000 | 1:500 | |

| Commission | $0 | $7 Forex, $15 Metals | $10 Forex, $15 Metals |

Z Forex provides access to two popular trading platforms for traders to choose from: cTrader and MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| cTrader | ✔ | Desktop, Mobile, Web | / |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | Desktop, Mobile, Web | Beginners |

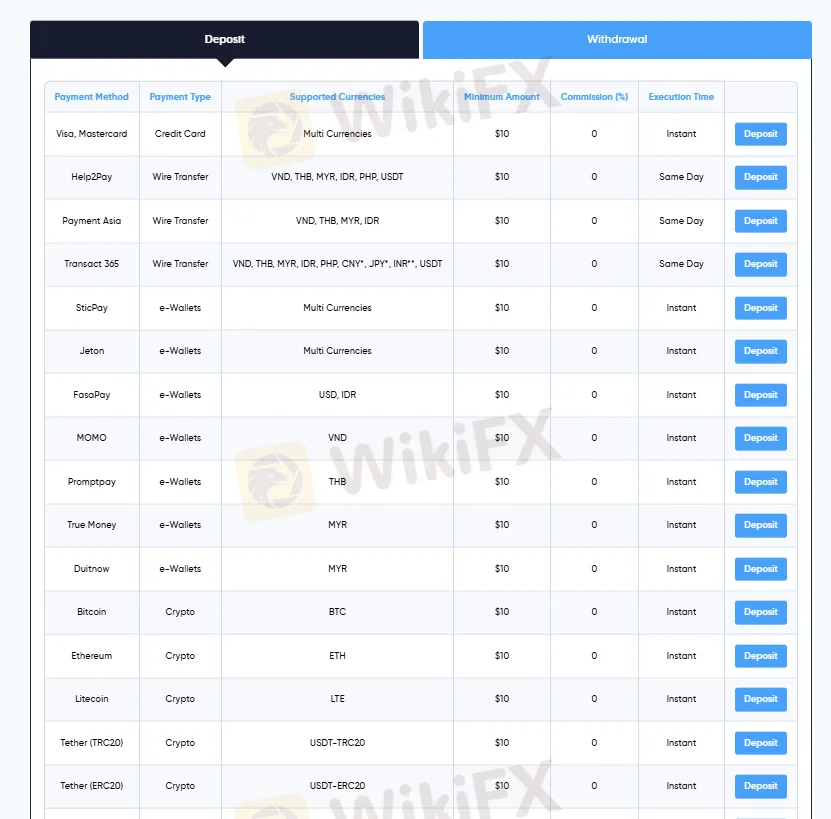

Credit Card, Wire Transfer, e-Wallets, and Crypto are available payment types on Z Forex, each has distinct methods and conditions.

| Payment Types | Methods |

| Credit Card | Visa, MasterCard |

| Wire Transfer | Help2Pay, Payment Asia, Transact 365 |

| e-Wallets | SticPay, Jeton, Fasapay, MOMO, Promptpay, True Money, Duitnow |

| Crypto | Bitcoin, Ethereum, Litecoin, Tether (TRC20), Tether (ERC20), USD Coin |

Deposit Options

| Deposit Options | Minimum Deposit | Deposit Fees | Deposit Time |

| Credit Card | $10 | 0 | Instant |

| Wire Transfer | Same Day | ||

| e-Wallets | Within 1 working day | ||

| Cryptos |

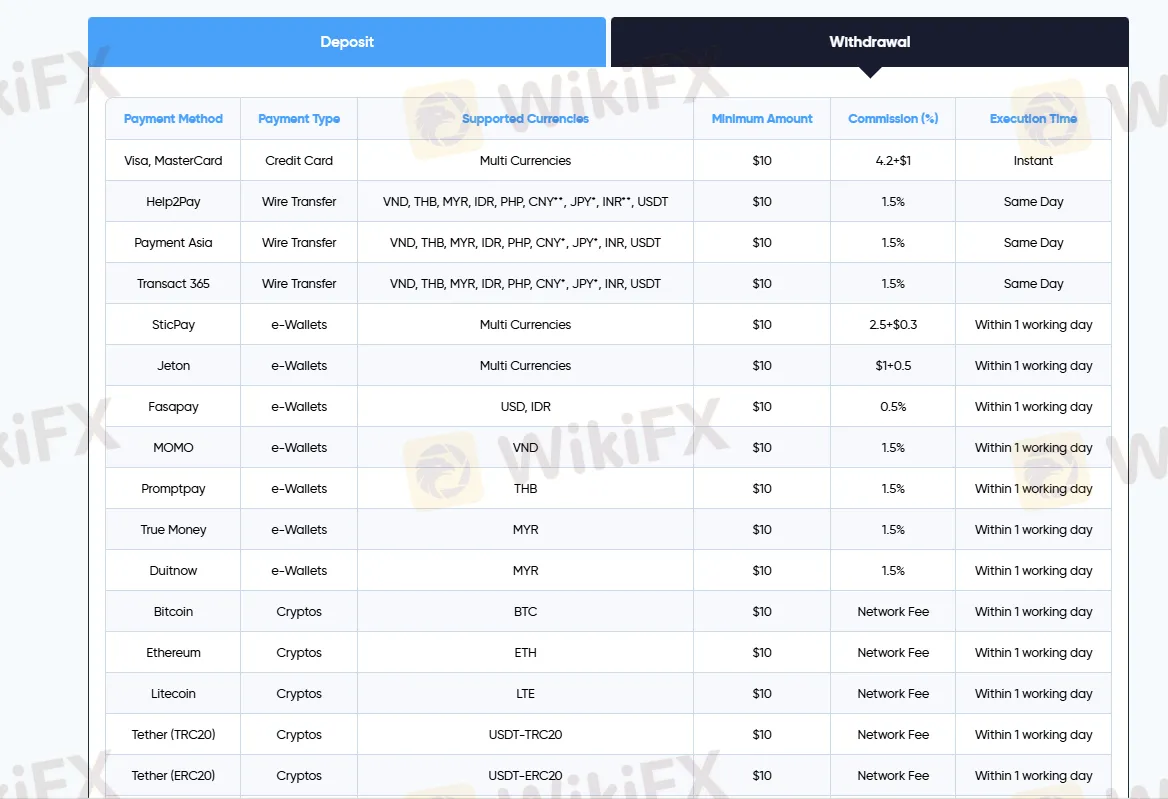

Withdrawal Options:

| Withdrawal Options | Minimum Withdrawal | Withdrawal Fees | Withdrawal Time |

| Credit Card | $10 | 4.2+$1 | Instant |

| Wire Transfer | 1.5% | Same Day | |

| e-Wallets | 1.5% | Within 1 working day | |

| SticPay: 2.5+$0.3 | |||

| Jeton: $1+0.5 | |||

| Fasapay: 0.5% | |||

| Cryptos | Network Fee |

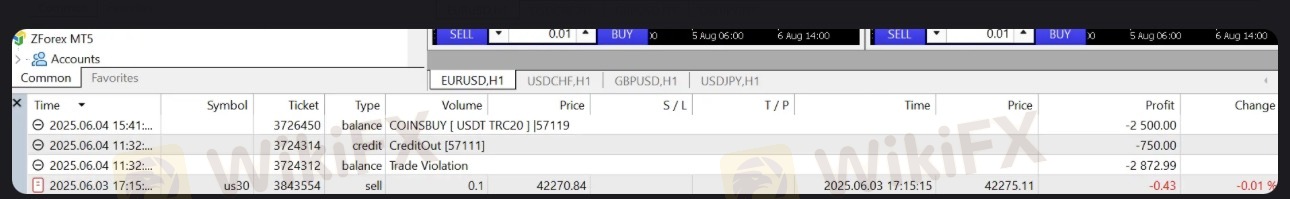

ZForex Review highlights the lack of regulation, risky leverage, and withdrawal issues reported by traders worldwide.

WikiFX

WikiFX

ZForex Capital Market LLC (zforex.com) claims to be regulated by the Mwali International Services Authority (MISA), holding Brokerage License number T2023321. However, this level of regulation is not considered as reliable or secure as that provided by top-tier regulatory bodies such as the FCA (UK), ASIC (Australia), or SEBI (India). Therefore, traders are advised to exercise caution due to the weaker regulatory oversight.

WikiFX

WikiFX

This article is about to give you a comprehensive understanding of a broker called Z Forex. We analyze this broker based on various aspects, and you should not miss it.

WikiFX

WikiFX

More

User comment

63

CommentsWrite a review

2025-12-24 15:09

2025-12-24 15:09

2025-08-24 00:59

2025-08-24 00:59