User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.25

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

| Aspect | Information |

| Company Name | Tradernet |

| Registered Country/Area | Cyprus |

| Founded Year | 2020 |

| Regulation | CYESC |

| Minimum Deposit | €10 |

| Spreads | 3.1%commissions |

| Trading Platforms | MT4 |

| Tradable Assets | Forex,indices,commodities,stocks |

| Account Types | Personal account |

| Demo Account | Available |

| Customer Support | Phone, email, and social media |

| Deposit & Withdrawal | Credit/diebit card,bank transfer |

| Educational resource | News |

Tradernet, established in 2020 and registered in Cyprus, operates under the regulation of the Cyprus Securities and Exchange Commission (CYSEC). With a minimum deposit set at €10, the company offers trading on the widely used MetaTrader 4 (MT4) platform, accommodating trades in various assets including forex, indices, commodities, and stocks.

Their pricing model entails a 3.1% commission on spreads and provides different account types, notably a personal account, alongside the availability of a demo account for practice purposes. Tradernet emphasizes accessible customer support through phone, email, and social media, and facilitates fund transactions via credit/debit cards and bank transfers.

Additionally, the platform offers educational resources, such as news, to aid traders in making informed decisions.

Tradernet purports to be regulated by the Cyprus Securities and Exchange Commission (CYSEC) under the license number 219/13; however, there are alarming indications that the broker may be using cloned or fictitious regulatory details, as it has been verified that it currently does not hold valid regulation.

Prospective traders and clients are urged to exercise heightened caution due to the identified risk associated with this platform. Engaging in trading or other financial activities with a broker lacking genuine regulation can expose investors to unwarranted risks, including potential difficulties in withdrawing funds and the absence of recourse in dispute situations. Hence, potential investors should approach Tradernet with prudence and consider alternative brokers with transparent and verifiable regulatory adherence.

Pros:

Variety of Tradable Assets: Tradernet provides a wide array of tradable assets, including forex, indices, commodities, and stocks, offering diverse investment opportunities to traders.

Accessible Trading Platform: Utilizing the well-known MetaTrader 4 platform, Tradernet allows traders to leverage a platform that is recognized and used globally, offering various tools and resources for trading.

Low Minimum Deposit: With a minimum deposit of €10, Tradernet provides an accessible entry point for novice traders or those with limited capital to start trading.

Demo Account Availability: The availability of a demo account allows potential traders to practice and familiarize themselves with the trading platform without risking real capital.

Educational Resources: Offering news and potentially other educational resources indicates a level of commitment to providing traders with information to guide their trading activities.

Cons:

Regulatory Concerns: The foremost red flag regarding Tradernet is the notable concern regarding its regulatory status, as it has been indicated that it may be utilizing cloned or invalid regulatory information, thereby posing significant risks to investors.

Pricing Transparency: A commission rate of 3.1% on spreads might be considered high or uncompetitive, depending on the asset and market conditions, and may not be transparently detailed for traders to fully comprehend their cost implications.

Customer Support Quality: While various customer support channels are available, the quality, responsiveness, and efficacy of the support provided to traders remain crucial and are not detailed in the provided information.

Withdrawal and Deposit Issues: Often, brokers with questionable regulatory adherence might present challenges or inconsistencies in processing withdrawals and deposits smoothly and in a timely manner.

Platform Security: Without verified regulation and assuming the potential use of falsified regulatory details, concerns regarding the security of the trading platform, and consequently, the security of trader's funds and data, become prevalent.

| Pros | Cons |

| Variety of Tradable Assets | Regulatory Concerns |

| Accessible Trading Platform | Pricing Transparency |

| Low Minimum Deposit | Customer Support Quality |

| Demo Account Availability | Withdrawal and Deposit Issues |

| Educational Resources | Platform Security |

Tradernet offers a range of market instruments across various asset classes, through which traders can engage in financial markets. Below are the market instruments accessible on Tradernet:

Forex

Currency Pairs: Traders can engage in the foreign exchange market by trading various currency pairs, including majors, minors, and exotic pairs. Forex trading involves the simultaneous buying of one currency and selling of another.

Indices

Market Indices: Tradernet allows traders to speculate on the price movements of major global market indices, such as the S&P 500, Dow Jones, FTSE 100, and others, which are indicators of the overall performance of a country's stock market.

Commodities

Hard and Soft Commodities: This includes trading in physical goods such as metals (e.g., gold, silver, and copper) and agricultural products (e.g., wheat, coffee, and sugar). Traders can speculate on the price fluctuations of these commodities without having to physically own them.

Stocks

Equities: Tradernet provides access to the stock market, enabling traders to buy and sell shares of public companies. This could encompass a variety of sectors and industries, providing opportunities for traders to diversify their portfolios.

Keep in mind that trading in these market instruments comes with its own set of risks and opportunities. Therefore, understanding each instrument, its market conditions, and developing a robust trading strategy is pivotal, especially in a platform where regulatory adherence is in question.

Tradernet appears to offer at least one type of trading account. However, specific details regarding various account types, their features, and requirements were not provided in the initial data. Below is an overview of the mentioned account type:

Personal Account

Accessibility: With a minimum deposit of €10, the personal account offers a low barrier of entry for traders wishing to engage in the financial markets.

Trading Platform: Utilizing the MetaTrader 4 platform, traders can engage in various market activities and utilize multiple trading tools and resources available on the platform.

Tradable Assets: Users can trade a variety of assets, including forex, indices, commodities, and stocks, providing an opportunity for diversified trading.

Demo Account: Tradernet offers a demo account, which suggests that traders can practice and test their trading strategies without risking actual capital before engaging in live trading.

Customer Support: Available customer support channels include phone, email, and social media, aiming to provide traders with assistance during their trading journey.

Opening an account with Tradernet can be achieved through a few clear steps, crafted to streamline the process for aspiring traders:

Visit the Official Website:Navigate to the official Tradernet website.Locate and click on the “Open Account” or “Register” button, typically found on the homepage.

Complete the Registration Form:Fill out the registration form with the required personal details, such as name, email address, phone number, and possibly other identifying information.Create a username and a strong, secure password.Confirm that you agree with the terms and conditions and privacy policy (after reading them thoroughly).

Verify Your Identity:Submit identification documents for account verification, typically involving a government-issued ID, proof of residence (like a utility bill), and potentially additional documents depending on local regulations and the platforms policy.Wait for the platform to verify your documents, a process which can vary in duration depending on the platform.

Deposit Funds: Once verified, log in to your account and navigate to the deposit section.Choose your preferred deposit method (e.g., credit/debit card, bank transfer) and enter the relevant details.Specify the amount you wish to deposit, ensuring it meets or exceeds the platforms minimum deposit requirement.

Start Trading:Access the trading platform (like MT4) and explore the available tradable assets.Before engaging in live trading, consider practicing with a demo account to familiarize yourself with the platform and test your trading strategies.When ready, select your desired market instrument, determine your position size, set stop-loss and take-profit levels, and execute your trade.

Tradernet features a variety of financial transaction methods, each coming with its specific fee structure and processing time. Deposits via credit or debit card (Visa or MasterCard) entail a 3.1% commission with instant funding, while bank transfers are subject to your bank's fees and take 2-3 business days to process, supporting multiple currencies like EUR, USD, GBP, JPY, KZT, and RUB.

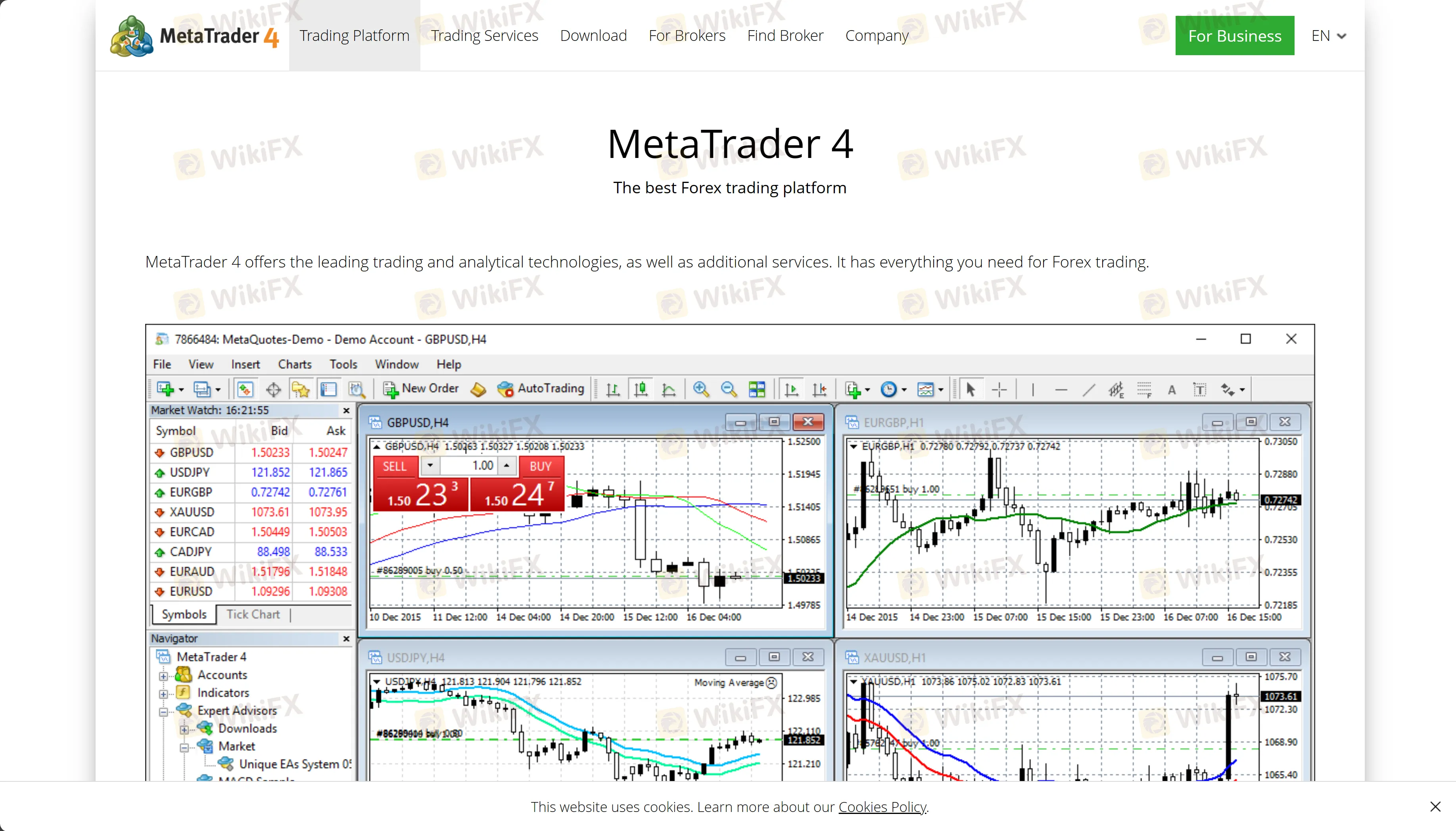

Tradernet utilizes MetaTrader 4 (MT4), one of the most popular and widely used trading platforms in the forex and CFD trading community. MT4 is known for its user-friendly interface, technical and fundamental analysis capabilities, algorithmic trading options, and the ability to host Expert Advisors (EAs) for automated trading strategies.

Traders can access a plethora of charting tools, indicators, and other resources to analyze price dynamics and predict future movements in the financial markets. The platform also offers a secure trading environment, with data transmission encrypted for protection against unauthorized access. MT4 is available in various forms, including desktop applications for Windows and macOS, web-based platforms accessible through browsers, and mobile applications for trading on the go via smartphones and tablets.

However, considering engaging with Tradernet and MT4, it is crucial to note the aforementioned regulatory concerns and prioritize performing thorough due diligence or exploring alternative brokers with transparent and verifiable regulatory compliance.

Tradernet facilitates a relatively straightforward deposit and withdrawal process, albeit with varied fees and processing times according to the provided details:

Deposit Options

Credit/Debit Card (Visa or MasterCard)

Commission: 3.1%

Processing Time: Instant

Processing Bank: Rietumu Banka, regulated by the Financial and Capital Market Commission of Republic of Latvia

Bank Transfer

Fees: Determined by your bank

Processing Time: 2-3 business days

Supported Currencies: EUR, USD, GBP, JPY, KZT, RUB

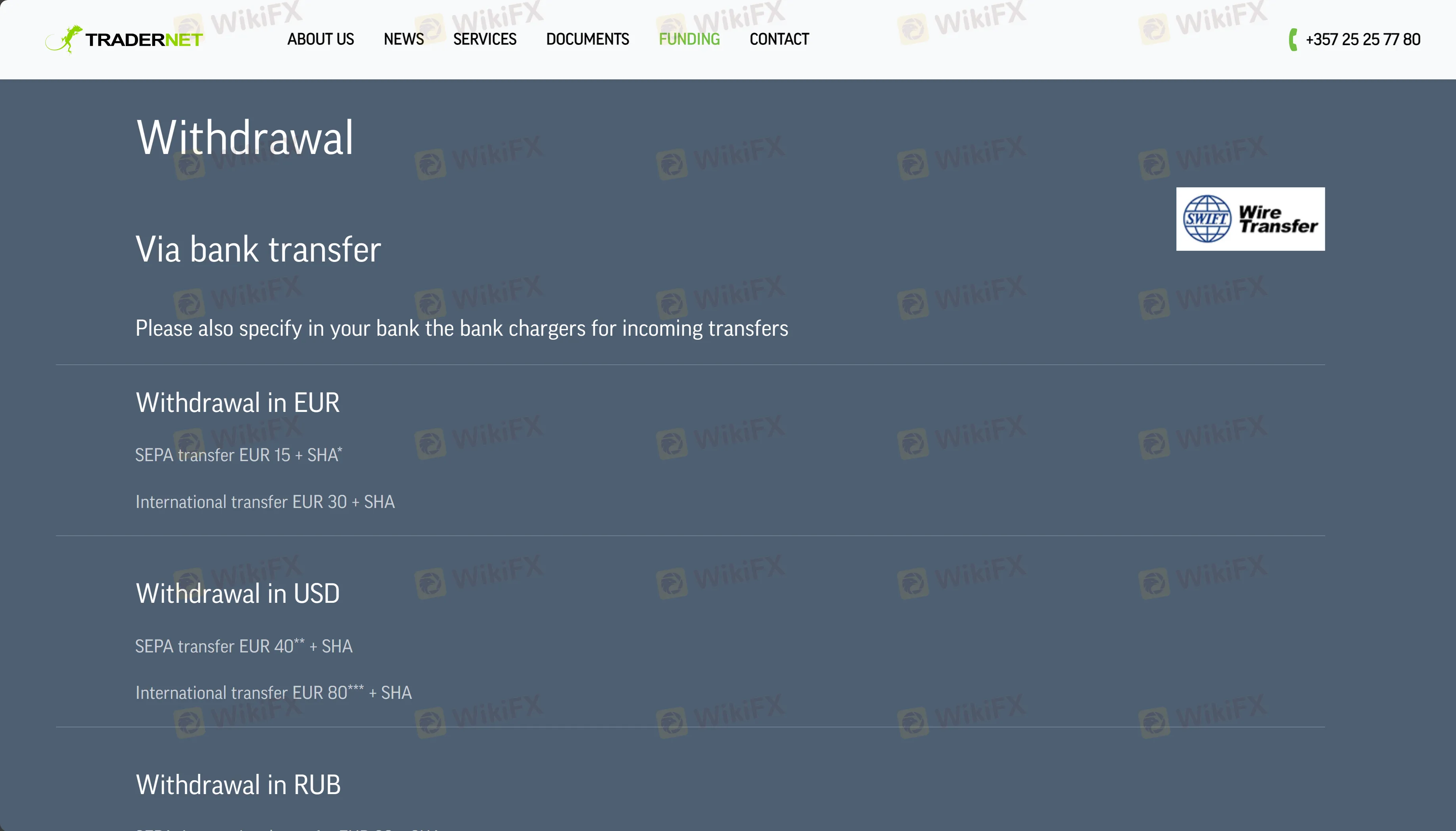

Withdrawal Options

Bank Transfer with distinct fees based on currency and type of transfer:

EUR Withdrawals

SEPA Transfer: EUR 15 + SHA*

International Transfer: EUR 30 + SHA*

USD Withdrawals

SEPA Transfer: EUR 40** + SHA*

International Transfer: EUR 80*** + SHA*

RUB Withdrawals

SEPA & International Transfer: EUR 30 + SHA*

SHA (Shared) implies that the customer pays Tradernet's fees, while the recipient covers the fees related to intermediary banks and the beneficiary bank. ** This fee applies to customers in specific regions, including the European Union, the CIS, OECD countries, and some others. *** This rate applies to customers in other countries and those with a legal form Partnership.

Ensuring a clear understanding of all related fees and processing times is pivotal for traders to manage their trading capital effectively. Considering the regulatory concerns with Tradernet, traders should proceed with caution, possibly exploring platforms with transparent and verifiable regulatory adherence to safeguard their financial dealings.

| Transaction Type | Method | Currency | Commission/Fee | Processing Time | Additional Notes |

| Deposit | Credit/Debit Card | N/A | 3.1% | Instant | Visa or MasterCard, processed by Rietumu Banka |

| Bank Transfer | Various | Your bank's fee | 2-3 business days | EUR, USD, GBP, JPY, KZT, RUB | |

| Withdrawal | Bank Transfer (EUR) | EUR | SEPA: EUR 15 + SHA* | Subject to bank policies | - |

| International: EUR 30 + SHA* | - | ||||

| Bank Transfer (USD) | USD | SEPA: EUR 40** + SHA* | - | ||

| International: EUR 80*** + SHA* | - | ||||

| Bank Transfer (RUB) | RUB | EUR 30 + SHA* | - |

Tradernet extends its customer support through various channels to address the queries and concerns of its clientele. Situated at Vasileos Georgiou A, 35-35R, Y&K PAPAS, Office 35E, 4040, Limassol, Cyprus, the broker offers telephonic assistance via +357 25257780, providing a direct line for immediate inquiries and urgent support. Additionally, customers can communicate through email at customers@tradernet.com.cy for general queries, documentation submission, and non-immediate concerns.

Moreover, a complaint form is available for structured grievance reporting, although further details or a direct link weren't provided. While these channels offer varying levels of assistance and convenience, it's crucial to approach communications and financial interactions with Tradernet cautiously and document all correspondences meticulously, given the previously noted regulatory concerns.

Tradernet's educational resource appears to be somewhat limited and primarily focuses on company updates and essential notifications for its clients. With messages typically addressing subjects such as notifications regarding their website address and domain name, ensuring clients are engaging with their legitimate online platform, and updates about their commission structures for trading and withdrawals, it may serve more as a channel for keeping traders informed about internal updates rather than providing an extensive educational base.

This might include updates on commissions for various trading activities and derivative markets, such as a noted update about the introduction of a new commission on the futures market FORTS, and relevant adjustments in withdrawal fees.

As it is pivotal for traders to have access to comprehensive educational resources, especially for those who are relatively new to trading, potential users may need to seek additional educational resources externally to enhance their trading knowledge and strategies, especially considering the regulatory concerns previously mentioned regarding Tradernet.

Tradernet, a trading platform based in Cyprus and established in 2020, offers its clients access to various market instruments through the widely-used MetaTrader 4 platform, albeit with notable regulatory concerns given that the claimed CYSEC license is suspected to be cloned. With a seemingly limited educational resource, primarily providing company updates and new commission structures, traders, especially novices, might find the educational support somewhat lacking.

Depositing and withdrawing funds involve various fees, and while customer support is accessible through different channels, cautious engagement and meticulous documentation of interactions are advised due to aforementioned regulatory uncertainties. Prospective users are encouraged to conduct thorough due diligence and potentially explore alternative platforms with verifiable regulatory compliance to navigate their trading journey securely and proficiently.

Q: What is the minimum deposit required to open an account with Tradernet?

A: The minimum deposit requirement starts from €10.

Q: What trading platforms does Tradernet provide?

A: Tradernet offers the MetaTrader 4 (MT4) trading platform, which is widely recognized for its user-friendly interface, comprehensive analytical tools, and capabilities to facilitate automated trading strategies through Expert Advisors (EAs).

Q: What types of tradable assets are available on Tradernet ?

A: Tradernet offers a varied selection of assets for trading, including Forex, commodities, indices, and cryptocurrencies.

Q: Is Tradernet regulated?

A: Yes, Tradernet purports to be regulated by the Cyprus Securities and Exchange Commission (CYSEC) under the license number 219/13; however, there are alarming indications that the broker may be using cloned or fictitious regulatory details.

Q: How can traders contact Tradernet for support or inquiries?

A: Traders can reach out to Tradernet through their customer service phone number +357 25257780 or via email at customers@tradernet.com.cy.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment