User Reviews

More

User comment

1

CommentsWrite a review

2023-09-21 18:46

2023-09-21 18:46

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.17

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

BTX+

Company Abbreviation

BTX+

Platform registered country and region

China

Company website

Company summary

Pyramid scheme complaint

Expose

| BTX+ Review Summary in 9 Points | |

| Founded | Within 1 year |

| Registered Country/Region | China |

| Regulation | Not regulated |

| Products & Services | Managed Portfolios, Crypto Investments, IPO, PAMM, Asset Management |

| Demo Account | Not available |

| Leverage | Up to 1:5 |

| Trading Platforms | BancdeLuxembourg platform |

| Minimum Deposit | €1000 |

| Customer Support | Email, Enquiry form |

BTX+ is a China-based financial service company that offers financial products and services including Managed Portfolios, Crypto Investments, IPO, PAMM, Asset Management to clients. However, it is important to note BTX+ is currently not regulated by any recognized financial authorities which raises concerns when trading.

In the following article, we will analyze the characteristics of this financial company from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the companys characteristics at a glance.

| Pros | Cons |

| • Wide range of financial products and services | • Not regulated |

| • Multiple account types | • Lack of transparency on commissions and account types |

| • Flexible leverage ratios | • High minimum deposit |

| • Limited customer support options | |

| • Commissions and overnight fees charged |

When considering the safety of a financial company like BTX+ or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a financial company:

Regulatory sight: It is not regulated by any major financial authorities,which means that there is no guarantee that it is a safe platform to trade with.

User feedback: Read reviews and feedback from other clients to get an understanding of their experiences with the company. Look for reviews on reputable websites and forums.

Security measures: BTX+ enforces a comprehensive Stop-Loss and Interruption Policy, which includes advanced encryption, multi-factor authentication, and real-time monitoring to enhance the security of client funds and trading activities.

Ultimately, the decision of whether or not to trade with BTX+ is a personal one. You should weigh the risks and benefits carefully before making a decision.

BTX+ offers a versatile selection of financial services tailored to meet various investment objectives:

Managed Portfolios: BTX+ provides the convenience of managed portfolios for investors looking to delegate their investment decisions. This service allows clients to entrust their assets to professional portfolio managers who actively oversee and adjust investments based on predefined strategies and risk tolerance.

Crypto Investments: In the rapidly evolving world of cryptocurrencies, BTX+ offers opportunities to invest in digital assets, providing exposure to this emerging market and its potential for growth. The company claims to store the vast majority of the digital assets in secure offline storage and the cryptocurrency stored on their servers is covered by their insurance policy.

IPO Participation: BTX+ facilitates participation in initial public offerings (IPOs), allowing investors to access newly issued shares of companies entering the stock market. This service can provide opportunities for early investments in promising ventures.

PAMM (Percentage Allocation Management Module): PAMM accounts allow investors to allocate funds to experienced traders or money managers who trade on their behalf. This approach enables diversification and professional management of investments.

Asset Management: BTX+ offers professional asset management services, where seasoned experts oversee portfolios, optimize asset allocation, and make strategic investment decisions on behalf of clients, aiming to achieve long-term financial goals.

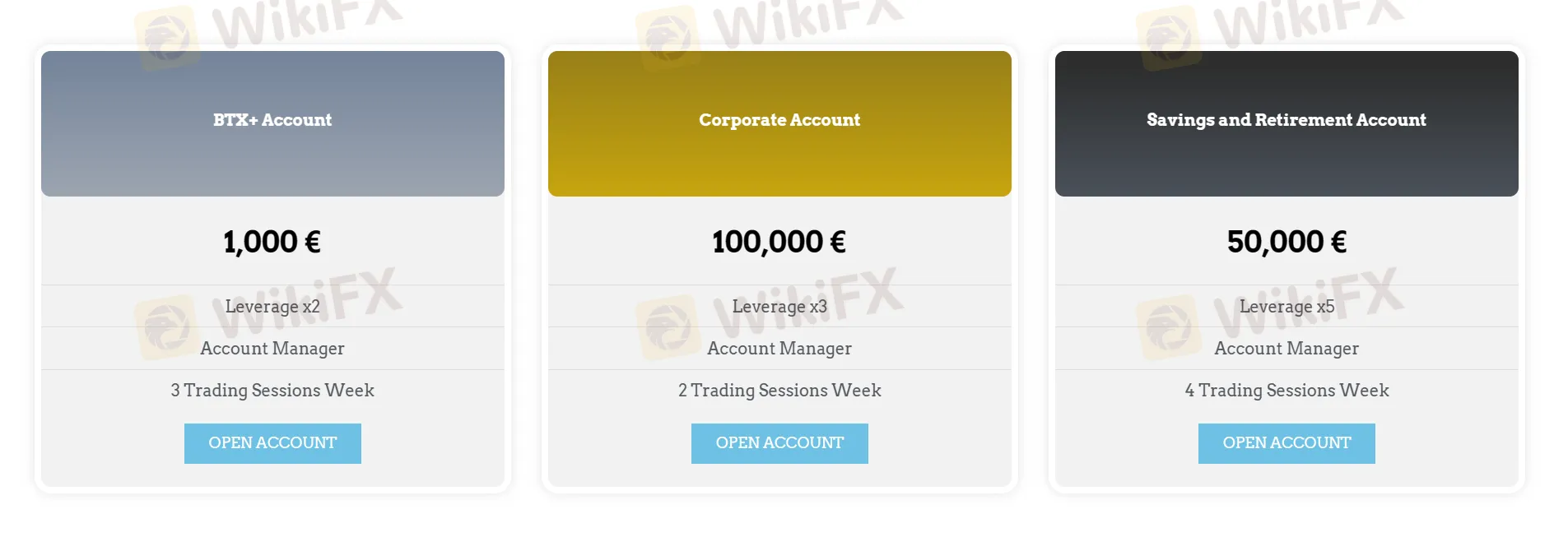

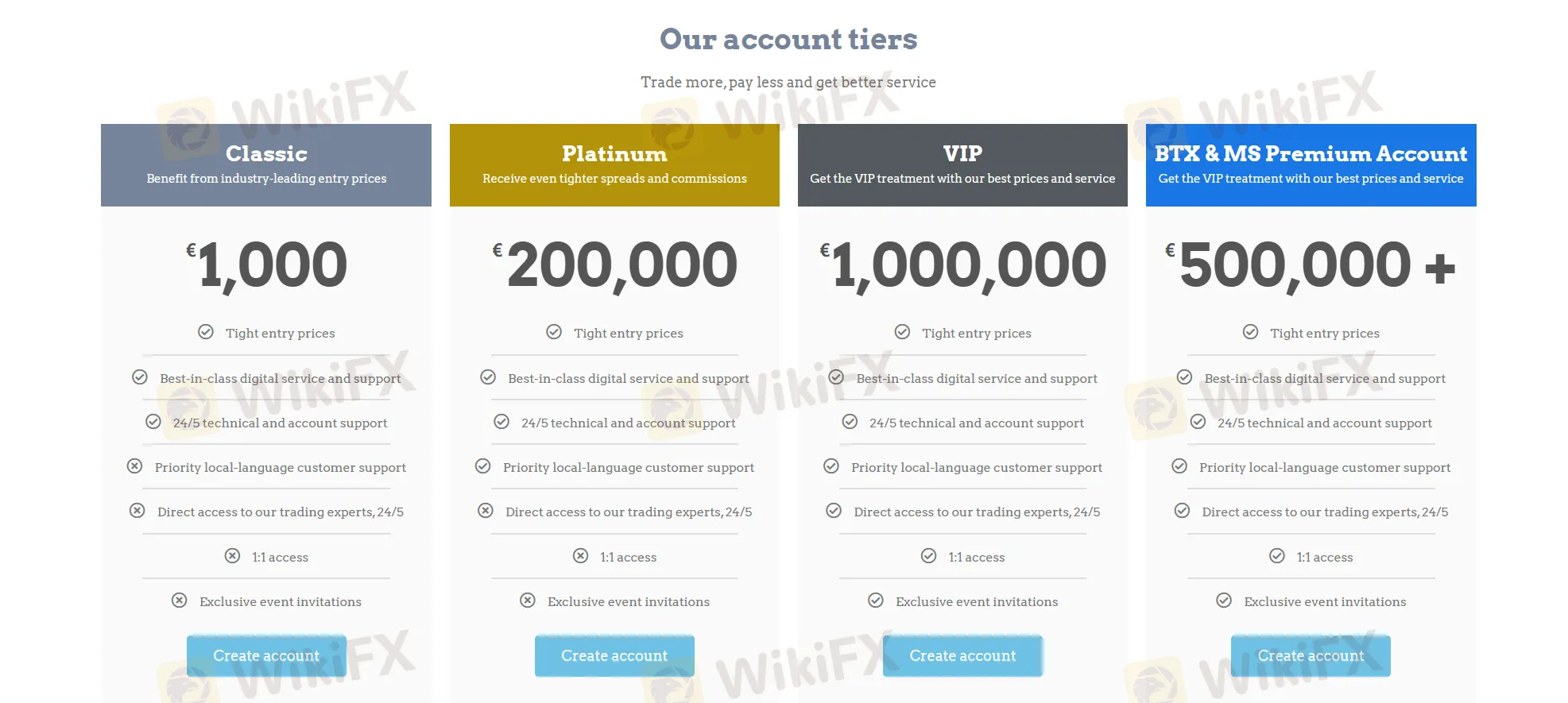

BTX+ offers a diversified range of accounts to cater to varying client needs and preferences including BTX+ Account, VIP Account and Saving and Retirement Account, each with tiered accounts with different deposit requests, features and functions

BTX+ Account:

Classic: Designed for traders looking to start with a minimum deposit of €1,000.

Platinum: Tailored for more seasoned traders, requiring a minimum deposit of €200,000.

VIP: The top-tier account option, requiring a substantial minimum deposit of €1,000,000.

BTX & MS Premium Account: The premium accounts are available for clients willing to invest a minimum of €500,000 or more, providing exclusive benefits and features.

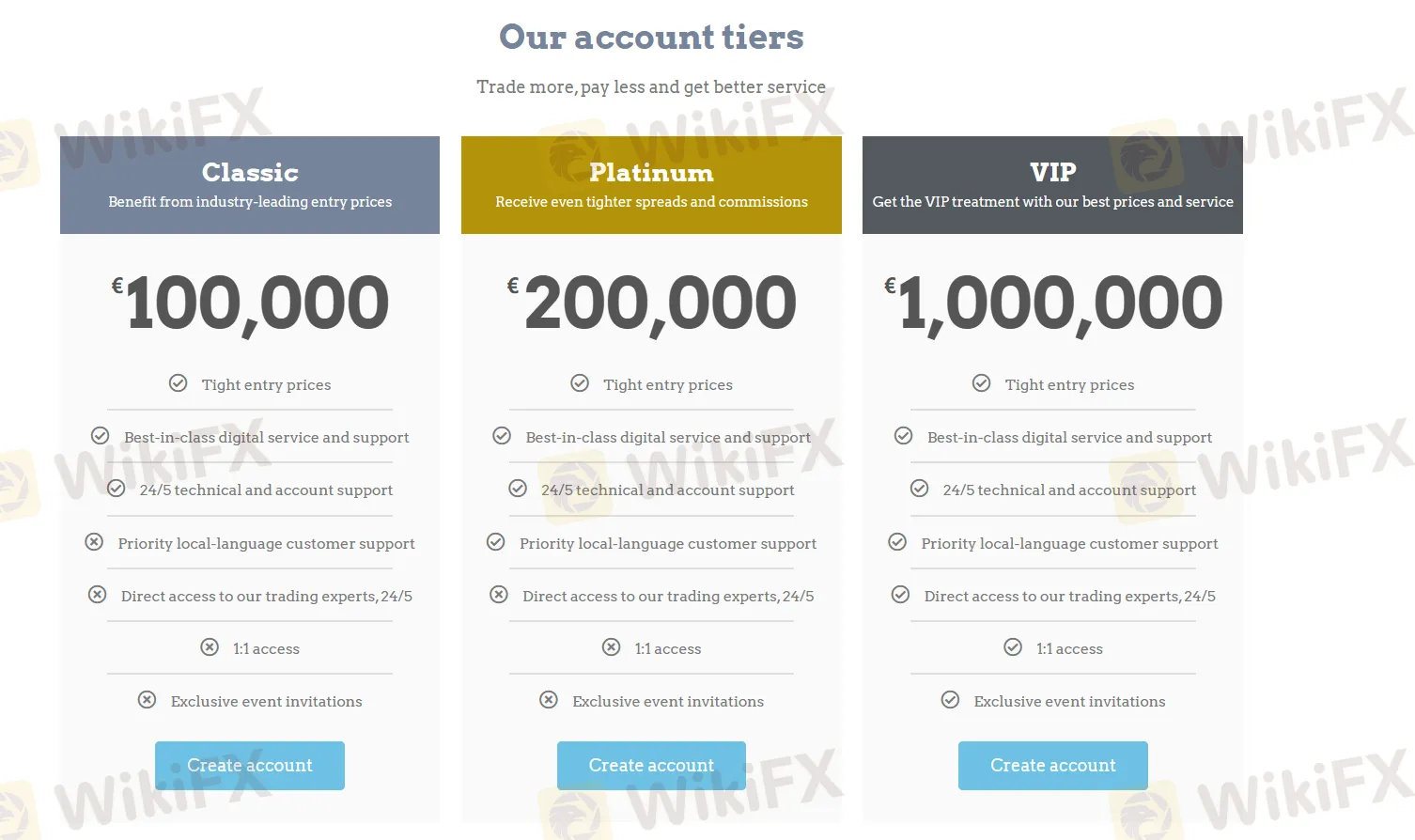

Corporate Account:

Classic: Ideal for corporate clients initiating their trading journey with a minimum deposit of €100,000.

Platinum: Catering to established corporate entities, requiring a minimum deposit of €200,000.

VIP: Designed for large corporate entities, with a minimum deposit requirement of €1,000,000.

For BTX+ Account and VIP Account, when you open an account, you are placed into a tier based on your initial funding within 30 days. After your first three months trading, you will automatically be moved to the tier that best reflects your volume - with no additional funding required.

Savings and Retirement Account:

Tailored for clients focused on long-term financial planning and retirement goals, although specific deposit requirements are not mentioned, interested traders can contact with the company directly for details.

BTX+ offers a range of account types, each with varying leverage options: BTX+ Account with 1:2 leverage, VIP Account with 1:3 leverage, and Savings and Retirement Account with 1:5 leverage.

While higher leverage can potentially amplify gains, it also significantly increases the level of risk involved in trading. Traders should approach leveraged trading with caution, as it can lead to both substantial profits and losses. It's crucial for traders to have a comprehensive understanding of leverage, employ risk management strategies, and only use leverage that aligns with their risk tolerance and trading experience. Responsible and informed trading is essential to mitigate the inherent risks associated with leveraged positions.

BTX+ provides traders with the BancdeLuxembourg platform, a versatile web-based trading solution that is also fully compatible with mobile devices. This platform offers traders the flexibility to access their accounts and execute trades seamlessly from any web browser, making it convenient for both desktop and on-the-go trading.

The BancdeLuxembourg platform features real-time trading with live asset price updates, , interactive charts, trading alerts, rapid order execution with risk management, trade tracking, fund transfers, and in-depth performance analysis, all seamlessly integrated for a comprehensive trading experience.

The presence of payment method icons on BTX+s webpage, such as Mastercard, Visa, Wire Transfer, and Maestro, suggests a variety of funding options; however, it's advisable for interested traders to contact the company directly for confirmation and detailed information regarding the availability and suitability of these payment methods for their specific needs. This ensures that traders can make informed choices about their preferred payment methods and proceed with confidence in their financial transactions with BTX+.

For PAMM service, BTX+ offers fee structure as below:

| Service | Fee Structure |

| Management Fees | None |

| Performance Fees | None |

| Volume Commissions | - Basic Volume Commission rate: 5 EUR per 1 EUR millions of traded volume (for currency pairs). |

| - Higher rate for precious metals, CFDs on commodities, bonds, and indexes: 30 EUR per 1 EUR million of traded volume (1.5 times the basic rate). | |

| - BTX+ reserves the right to adjust the Basic Volume Commission between 0 EUR and 25 EUR per 1 EUR million of traded volume at its discretion. | |

| Overnight Fees | Applicable for automated trade execution on client accounts. |

| Single Stock Commission | Not affected by changes in Basic Volume Commission; subject to modification by BTX+ with prior announcement. |

| MC PAMM Accounts | Historical log of applied Basic Commission Rate per 1 million traded volume commission is not applicable. |

BTX+ provides customer service options to assist its clients in different areas through email and enquiry form. Customers can reach out to BTX+ through the channels to address their queries and concerns:

Email: support@BTX+fx.com.

According to available information online, BTX+ is a China-based financial company offers services including Managed Portfolios, Crypto Investments, IPO, PAMM, Asset Management to traders.

However, the fact that it is non-regulated is an immediate red flag, as regulated financial companies are subject to oversight and compliance with established financial regulations, providing clients with a level of assurance and protection. The lack of proper regulation and oversight increases the potential risks for traders, leaving them vulnerable to potentially fraudulent activities or misconduct.

As such, individuals considering to trade with BTX+ should exercise caution and thoroughly research alternative, regulated options that prioritize transparency, security, and accountability.

| Q 1: | Is BTX+ regulated? |

| A 1: | No. It has been verified that this company currently has no valid regulation. |

| Q 2: | What kind of trading services does BTX+ offer? |

| A 2: | BTX+ is a China-based financial company that offers services including Managed Portfolios, Crypto Investments, IPO, PAMM, Asset Management to traders. |

| Q 3: | Is BTX+ a good platform for beginners? |

| A3: | No. It is not a good choice for beginners because its not properly regulated by any recognized financial authorities. |

| Q 4: | Does BTX+ offer demo accounts? |

| A 4: | No. |

| Q 5: | What is the minimum deposit for BTX+? |

| A 5: | The minimum initial deposit to open an account is €1000. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

1

CommentsWrite a review

2023-09-21 18:46

2023-09-21 18:46