User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.54

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| ICE Markets Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Comoros |

| Regulation | LFSA (Revoked) |

| Market Instruments | Forex, metals, commodities and cryptocurrencies |

| Demo Account | / |

| Leverage | Up to 1:300 |

| Spread | From 0.0 pip |

| Trading Platform | MT4 |

| Minimum Deposit | $30 |

| Customer Support | Live chat |

| Email: support@ice-markets.com | |

| Phone: +44 20 8089 7867 | |

| Regional Restriction | the United States of America, Canada, Israel, New Zealand, Iran and North Korea |

ICE Markets Limited, which does its business from the Comoros, started its website in 2017. It calls itself a 100% A-book broker that does deals with other parties and lets you trade forex, metals, commodities, and cryptocurrencies using MetaTrader 4. It is regulated by LFSA in Malaysia, but the status is revoked.

| Pros | Cons |

| Access to multiple markets | Revoked regulation status |

| MetaTrader 4 available | Regional restriction |

| Popular payment options | |

| Promotions offered |

ICE Markets was previously regulated by the Labuan Financial Services Authority (LFSA) in Malaysia, with License No. MB/15/0007 and a Straight Through Processing (STP) license. However, its regulatory status is been revoked.

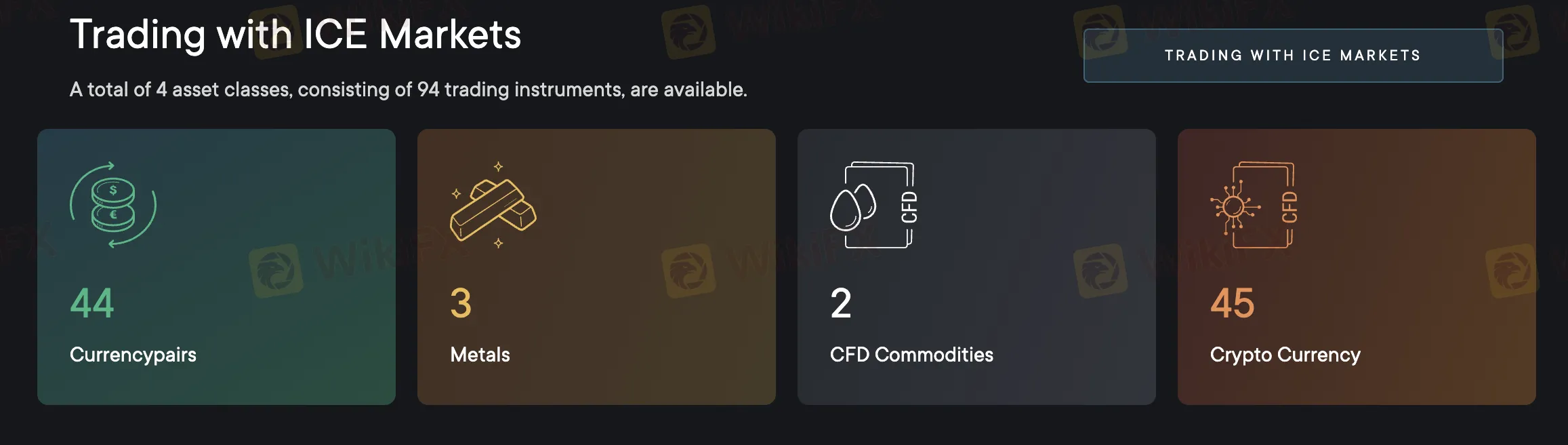

ICE Markets offers self-trading in five asset classes with 94 products. These comprise 44 currency pairings, three metals (e.g., gold, silver), two CFD commodities (most likely oil products), and 45 cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Indices | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

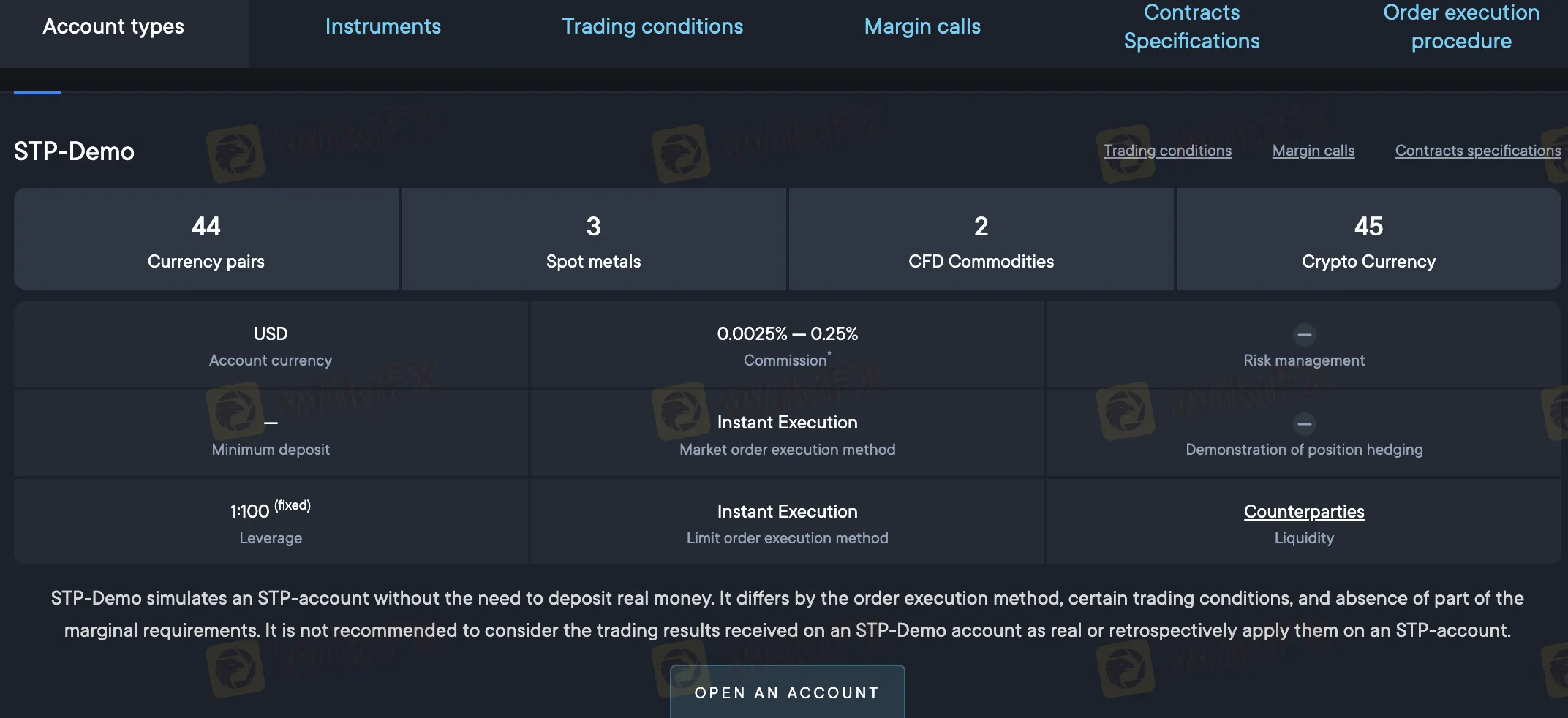

The ICE Markets website offers two real account types and a practice account. There is no mention of an Islamic (swap-free) account.

| Account Type | Commission | Minimum Deposit | Leverage |

| STP | 0.0025 %–0.25 % per side | $30 | Up to 1:300 |

| STP‑MA | 0.004 %–0.006 % per side | $300 | Up to 1:100 |

| STP‑Demo | 0.0025 %–0.25 % per side | None (demo) | Fixed 1:100 |

ICE Markets uses a Straight-Through-Processing (STP) mechanism to provide leverage on live accounts. The STP account offers floating leverage from 1:1 up to 1:300, while the STP-MA managed account offers 1:1 up to 1:100. The STP Demo account is fixed at 1:100. High leverage allows traders to handle larger positions with a relatively modest capital outlay, amplifying possible profits. However, it also amplifies losses.

ICE Markets provides affordable trading fees, particularly for FX and cryptocurrency assets. Commission rates are relatively modest as compared to industry standards, ranging from 0.0025% to 0.25%.

| Account | Commission (per side) |

| STP | 0.0025 %–0.25 % |

| STP‑MA | 0.004 %–0.006 % |

| STP‑Demo | 0.0025 %–0.25 % |

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Windows/macOS/mobile | Beginners |

| MetaTrader 5 (MT5) | ❌ | / | Experienced traderes |

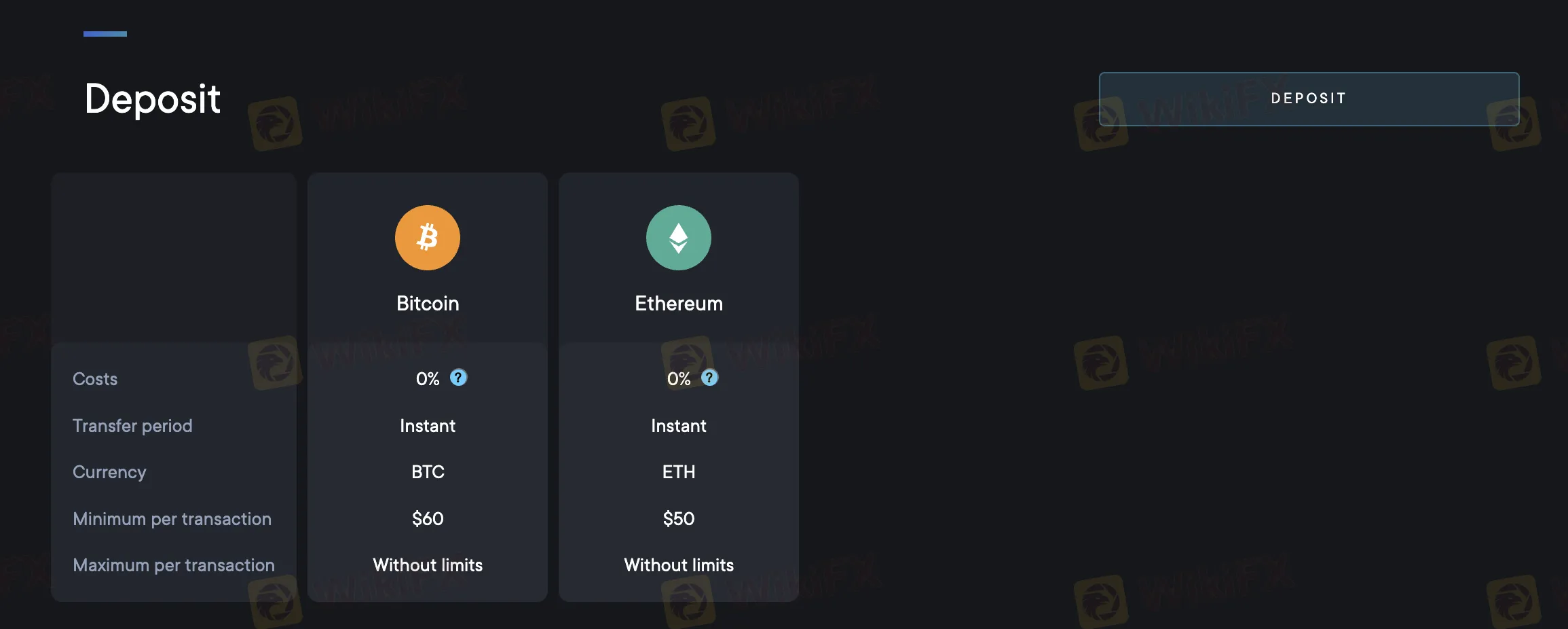

ICE Markets does not impose fees for deposits and often reimburses payment system expenses (e.g., for cryptocurrency deposits). The minimum deposit for a live STP account is $30, whereas a STP-MA account requires $300.

| Deposit Method | Minimum Withdrawal | Fees | Processing Time |

| USDT (ERC‑20/BEP20) | No stated minimum | 0 % (network fee only) | 1 business day |

| Bitcoin (BTC) | $60 | 0 % (3 % payment‑system fee reimbursed) | Instant |

| Ethereum (ETH) | $50 | 0 % (3 % payment‑system fee reimbursed) | Instant |

| Withdrawal Method | Minimum Withdrawal | Fees | Processing Time |

| USDT (ERC‑20) | $105 | 1 % (min $25) | Up to 3 business days |

| Skrill | $10 | 1 % (min €6) | Up to 3 business days |

| NETELLER | $10 | 1 % (min $1) | Up to 3 business days |

| Payeer | $10 | 1.5 % | Up to 3 business days |

| Perfect Money | $10 | 2.5 % | Up to 3 business days |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment