User Reviews

More

User comment

4

CommentsWrite a review

2024-03-29 14:26

2024-03-29 14:26

2024-02-06 17:30

2024-02-06 17:30

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

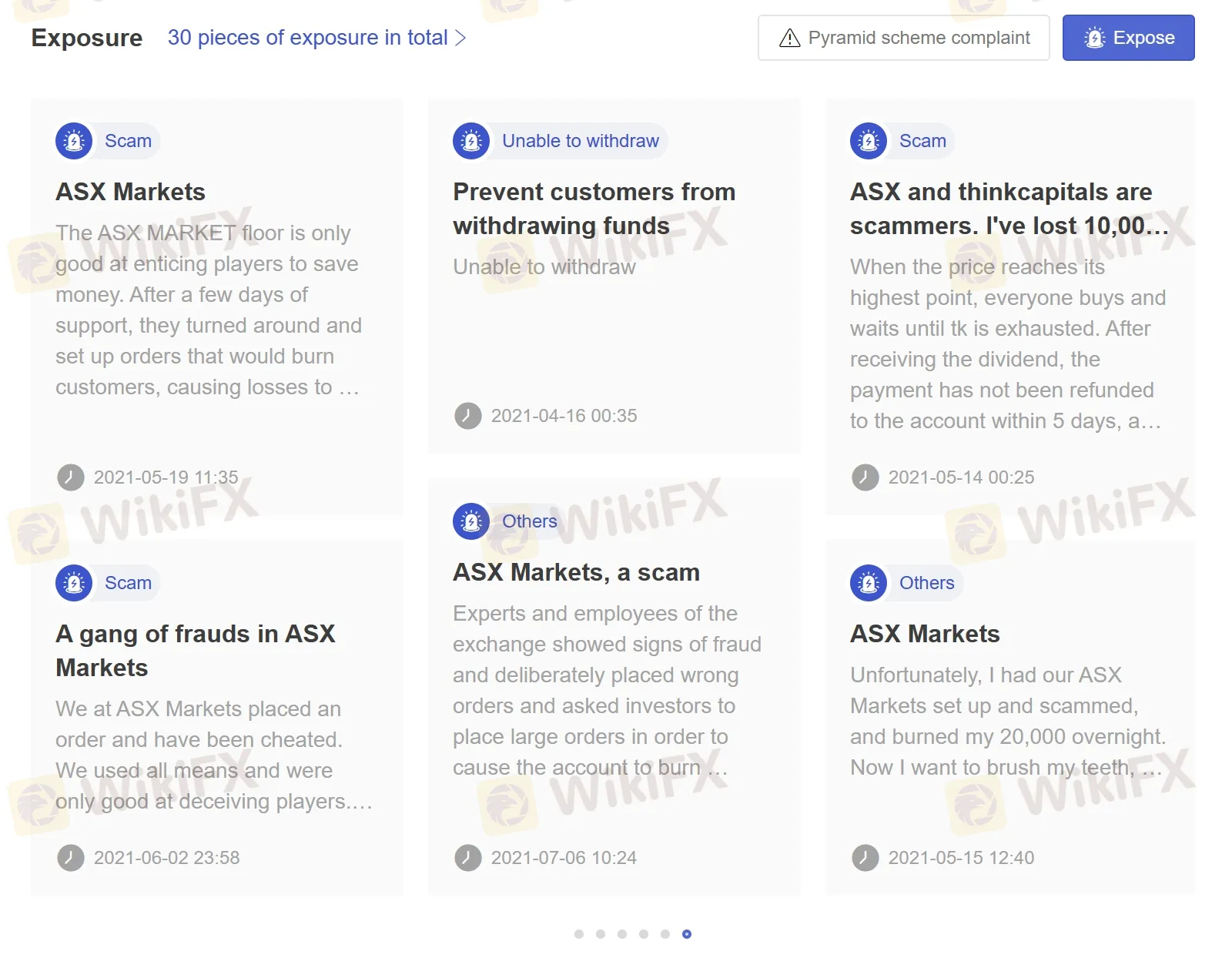

Quantity 30

Exposure

Score

Regulatory Index0.00

Business Index7.27

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

ASX Markets

Company Abbreviation

ASX Markets

Platform registered country and region

Saint Vincent and the Grenadines

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

Induced Fraud

Avoidi nvesting with this broker

I don't see any profit, but I lost half of my capital after a week of burning, then tk 7000 USD now without any explanation, ask the expert who is only considering, if I do not say many words on the first day, I will not enter a high order like So, nt asked, no one answered, no explanation, anyone help me please

The Asx market cheats for fraudulent orders, corrects orders to burn accounts, and reports deliberately trapping players and the scale of the accounts is too large compared to the accounts, and then said within 1 night that the orders are full of words. But it became negative at 13,000, then the negative silver order was corrected at 7000, and my 20,000 accounts were burned. I have all the proofs, pictures, bait and YC are all important

Induced fraud

Wipe out customers' positions deliberately.

Encourage traders to deposit money over and over again. When loading, all orders are negative until they want to withdraw money. This makes it difficult to tell the order how much profit with the bait, but it made $13,000, and then deliberately fixed the order To burn the account within 1 night, but when I reflect on it, I remove my hand from the contact

Our ASX Markets set up and scammed, and burned my 20,000 overnight. Now I’m slashing my hands, telling me to order more than 13,000 negative words, and then modify the silver order to make another negative number 7000, burning my account, there is no People call and send text messages to pick up the phone or respond, irresponsible people, sick and sick, I am in Hanoi, anyone who needs information, I am in the afternoon, if you are unlucky, please stay away from two support staff: Tan Tai, MRrin, better resist and find a live credit game with a good reputation!

Suspend my orders.

Scam! Make your accounts forced liquidation to earn profits

The ASX MARKET floor is only good at enticing players to save money. After a few days of support, they turned around and set up orders that would burn customers, causing losses to customers. At the same time, they corrected orders that were too negative to burn customer accounts. I There is enough evidence that no one can listen to the current call support, and the text messages are not responding. Blatant liar

We at ASX Markets placed an order and have been cheated. We used all means and were only good at deceiving players. We burned me 20,000 in one night. Now we swipe my hand and tell me to command more than 13,000 negative characters, and then correct the silver order to make more negative 7000 and burn the account. Now play No one answers or responds to text messages on the phone, irresponsible person, sick, I am in Hanoi, anyone who needs information, please pm me, if you are not lucky, please stay away from 2 support staff to support: Tan Tai, MRrin out , It is best to resist, find a reputable floor to play!

Unable to withdraw

Experts and employees of the exchange showed signs of fraud and deliberately placed wrong orders and asked investors to place large orders in order to cause the account to burn properly.

When the price reaches its highest point, everyone buys and waits until tk is exhausted. After receiving the dividend, the payment has not been refunded to the account within 5 days, and it is indicated that the payment will be made in sequence, please wait a moment. Finally, when the account was burned, he told me to add more money. Everyone is careful not to be led by someone like me. You can't believe these people are in this world.

Unfortunately, I had our ASX Markets set up and scammed, and burned my 20,000 overnight. Now I want to brush my teeth, tell me to order more than 13,000 negative words, and then correct the silver order so that it becomes minus 7000, burning my account , Now call and send text messages. Whether alone answering the phone or responding, irresponsible people, sick and sick, I am in Hanoi, anyone who needs information, I am in the afternoon, if you are unlucky, please stay away from 2 support staff : Tan Tai, MRrin, it is better to resist to find the credit game of the credit floor! Or anyone who knows how to sue, please help me! avoid

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| ASX Markets Review Summary in 10 Points | |

| Founded | 2021 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No license |

| Market Instruments | Currency pairs, indices, commodities, equity CFD, cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | From 1.8 pips (FIX), 1.1 pips (VARIABLE) |

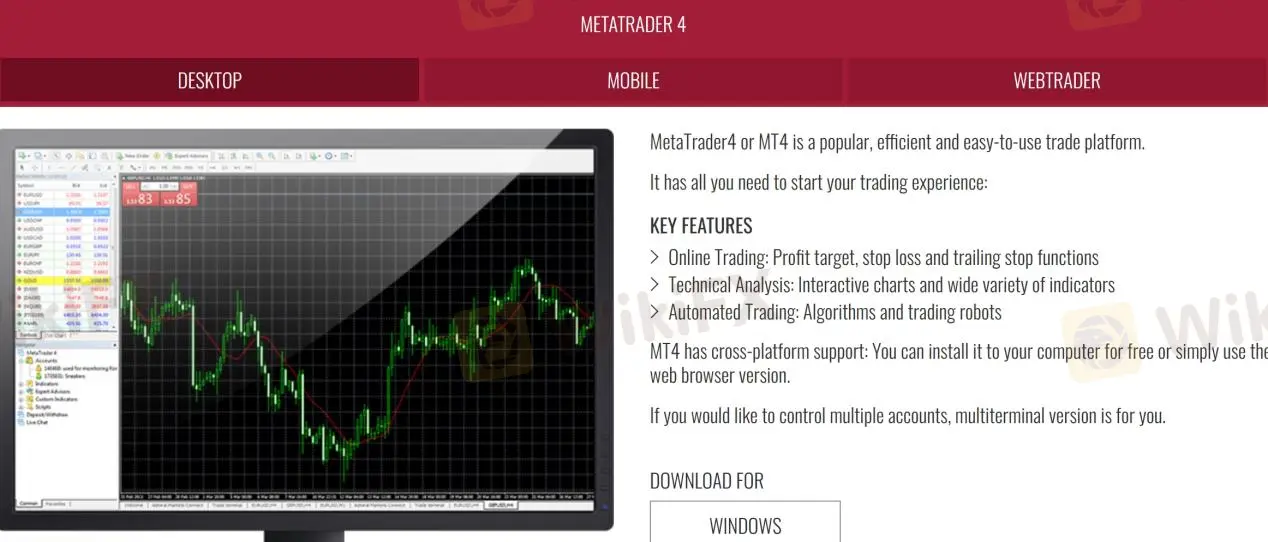

| Trading Platforms | MT4 |

| Minimum deposit | $0 |

| Customer Support | 24/5 multilingual phone, email, online messaging |

ASX Markets is an unregulated online broker registered in Saint Vincent and the Grenadines, offering various financial products such as currencies, commodities, indices, equities, and cryptocurrencies through the MT4 platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

ASX Markets offers a variety of advantages such as a wide range of tradable instruments, flexibility in account types, no minimum deposit requirement, and the leading MT4 platform.

However, it is important to note the potential risks associated with the lack of clear regulation and reports of difficulties in fund withdrawals. The limited transparency on deposit/withdrawal, as well as the company's background, may require further investigation.

| Pros | Cons |

| • Availability of a wide range of tradable instruments | • Lack of clear regulation and oversight from reputable financial authorities |

| • Various live account types available | • Reports and concerns about difficulties in withdrawing |

| • Free demo accounts available | • Limited information provided on deposit/withdrawal |

| • No minimum deposit | • Limited educational resources and tools |

| • MT4 supported | |

| • 24/5 multilingual customer support |

There are many alternative brokers to ASX Markets depending on the specific needs and preferences of the trader. Some popular options include:

Admiral Markets - A reputable broker with a wide range of trading instruments and platforms, suitable for both beginner and advanced traders.

LiteForex - A broker offering a variety of trading accounts and competitive spreads, suitable for traders of all experience levels.

Windsor Brokers - A well-established broker with a strong regulatory framework, providing access to multiple trading instruments and platforms for a comprehensive trading experience.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

ASX Markets not having valid regulation raises concerns about its legitimacy and the safety of trading with them. Regulation provides oversight and accountability, ensuring that brokers adhere to certain standards and protect the interests of their clients. Without proper regulation, there is an increased risk of potential scams or fraudulent activities. It's important for traders to carefully evaluate the risks associated with trading on an unregulated platform and consider alternative options that are regulated by reputable authorities.

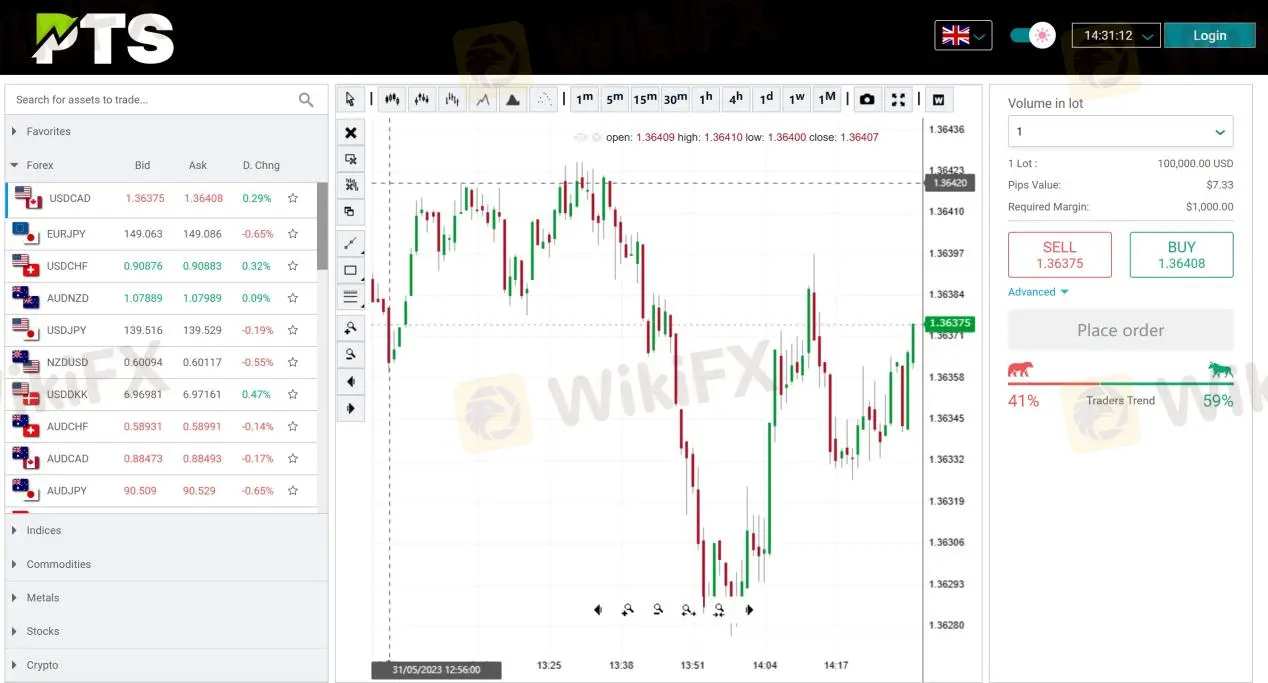

ASX Markets offers a diverse range of tradable financial instruments on its platform. Traders have access to various currency pairs, allowing them to engage in the foreign exchange market. Additionally, ASX Markets provides the opportunity to trade indices, enabling investors to speculate on the performance of stock market indexes from around the world.

The platform also supports the trading of commodities, including precious metals, energies, and agricultural products. Equity CFDs allow traders to participate in the price movements of individual stocks without owning the underlying assets. Furthermore, ASX Markets offers cryptocurrencies for trading, allowing investors to take advantage of the growing popularity and volatility of digital assets.

ASX Markets provides traders with a variety of live account options to cater to different trading preferences. The FIX account offers fixed spreads, providing stability and predictability in trading costs. The VARIABLE account features variable spreads, allowing for potential tighter spreads during certain market conditions. The VIP account is designed for high-volume traders, offering additional benefits such as dedicated support and personalized services. The RAW ZERO account provides access to raw spreads with zero markups, ideal for traders seeking direct market access and competitive pricing.

One advantage of ASX Markets is that it does not have a minimum deposit requirement, making it accessible for traders with various budget sizes. Additionally, the broker offers free demo accounts, allowing traders to practice their strategies and explore the platform with virtual capital of $100,000.

The maximum leverage you can get with ASX Markets is 1:400. Leverage is a tool that enables traders to amplify their trading positions by borrowing funds from the broker. With a leverage ratio of 1:400, traders can control a larger position in the market with a smaller amount of capital. This can potentially lead to increased profits if trades are successful.

However, it is important to note that leverage also magnifies the risk of losses, as losses can exceed the initial investment. Traders should exercise caution and carefully manage their risk when utilizing high leverage.

ASX Markets offers competitive spreads across its various account types. The FIX account has a starting spread of 1.8 pips, which is a measure of the difference between the bid and ask price of a currency pair. The VARIABLE account offers tighter spreads starting from 1.1 pips, providing potentially lower trading costs for traders. The VIP account further reduces the spreads, starting from 0.6 pips, making it an attractive option for traders seeking tighter pricing.

The RAW ZERO account stands out with its commission-based structure, where traders pay a fixed commission of $10 per trade but enjoy spread starting from 0.0 pips. This account type may be suitable for traders who prefer a transparent fee structure and require access to the tightest spreads. ASX Markets' offering of different spreads and commission structures provides flexibility for traders to choose an account that aligns with their trading style and preferences.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| ASX Markets | 1.8 pips (FIX), 1.1 pips (VARIABLE) | Variable |

| Admiral Markets | 0.8 pips | Variable |

| LiteForex | 1.1 pips | Variable |

| Windsor Brokers | 2.0 pips | Variable |

Please note that the spreads and commissions provided above are for informational purposes and may vary depending on market conditions and account types offered by each broker. It is always recommended to check with the broker directly for the most up-to-date and accurate information.

ASX Markets provides traders with the popular and widely recognized MetaTrader4 (MT4) trading platform. The MT4 platform is available for desktop, mobile, and web, offering flexibility and accessibility for traders to access their accounts and execute trades from anywhere and at any time.

The desktop version of MT4 provides a comprehensive set of tools and features, allowing traders to analyze markets, place orders, and manage their positions efficiently. The mobile version of MT4 enables traders to monitor the markets and trade on the go using their smartphones or tablets. The web-based version, known as Webtrader, allows traders to access their accounts directly through a web browser without the need to download or install any software.

With its user-friendly interface, advanced charting capabilities, and a wide range of technical indicators, ASX Markets' MT4 trading platforms cater to the needs of both beginner and experienced traders, providing them with a reliable and robust trading environment.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| ASX Markets | MetaTrader 4 (MT4) |

| Admiral Markets | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| LiteForex | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Windsor Brokers | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

While ASX Markets does not provide detailed information about deposit and withdrawal methods on their website, they do display icons of various payment methods, indicating the available options for funding and withdrawing from trading accounts. The payment methods include popular options such as Visa, MasterCard, WebMoney, UnionPay, Bank Wire, Neteller, Skrill, and more.

| ASX Markets | Most other | |

| Minimum Deposit | $0 | $100 |

ASX Markets provides customer support services to traders, offering assistance and guidance in multiple languages 24/5 from Monday to Friday. Traders can reach out to the broker's support team through various channels, including phone, email, and online messaging. This allows clients to choose the most convenient method for their inquiries or concerns.

Additionally, ASX Markets maintains a presence on popular social networking platforms such as Facebook, Instagram, YouTube, and LinkedIn, which can be a convenient way for traders to stay updated with the broker's latest news, educational content, and announcements.

With their multilingual support and active online presence, ASX Markets aims to ensure that traders have access to timely and responsive customer service to address their needs effectively.

| Pros | Cons |

| • 24/5 multilingual support | • No 24/7 customer support |

| • Multiple contact channels | • No live chat support |

| • Social media presence |

Note: These pros and cons are subjective and may vary depending on the individual's experience with ASX Markets' customer service.

On our website, you can see that reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

ASX Markets aims to support the education and knowledge development of its traders by providing educational resources such as a CFD E-Book and CFD Glossary. These resources can be valuable for both beginner and experienced traders looking to enhance their understanding of CFD trading.

The CFD E-Book likely covers essential concepts, strategies, and risk management techniques related to CFD trading, helping traders make informed decisions. Additionally, the CFD Glossary provides a comprehensive list of key terms and definitions specific to CFD trading, assisting traders in familiarizing themselves with industry terminology.

By offering these educational materials, ASX Markets demonstrates its commitment to empowering traders with the necessary knowledge and tools to make informed trading decisions.

ASX Markets is a brokerage firm that offers a range of financial instruments for trading, including currencies, indices, commodities, equity CFDs, and cryptocurrencies. While the broker provides different account types, free demo accounts, and the industry-standard MT4 platform, it is important to consider the lack of regulatory oversight and reports of issues related to fund withdrawals.

The transparency regarding deposit/withdrawal is also limited, which may raise concerns for some traders. The availability of multilingual customer support and educational resources is a positive aspect. However, due diligence is necessary to assess the credibility and reliability of ASX Markets before engaging in any trading activities with them.

| Q 1: | Is ASX Markets regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does ASX Markets offer demo accounts? |

| A 2: | Yes. It offers free demo accounts with virtual capital of $100,000. |

| Q 3: | Does ASX Markets offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT4. |

| Q 4: | What is the minimum deposit for ASX Markets? |

| A 4: | There is no minimum deposit requirement. |

| Q 5: | Is ASX Markets a good broker for beginners? |

| A 5: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its lack of transparency. |

More

User comment

4

CommentsWrite a review

2024-03-29 14:26

2024-03-29 14:26

2024-02-06 17:30

2024-02-06 17:30