User Reviews

More

User comment

5

CommentsWrite a review

2025-04-05 21:25

2025-04-05 21:25

2025-01-22 13:17

2025-01-22 13:17

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index6.51

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

Danger

More

Company Name

Imermarket (PTY) LTD

Company Abbreviation

InvesaCapital

Platform registered country and region

South Africa

Company website

Company summary

Pyramid scheme complaint

Expose

| InvesaCapital Review Summary | |

| Founded | 2021 |

| Registered Country/Region | South Africa |

| Regulation | CYSEC/FSCA (Suspicious clone) |

| Market Instruments | Forex, Commodities, Shares, Indices, Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | From 3.0 pips (Basic account) |

| Trading Platform | WebTrader |

| Minimum Deposit | $250 |

| Customer Support | Email: info@invesacapital.com |

| Tel: +27101571933 | |

| Regional Restrictions | the USA, British Columbia, Canada and some other regions |

InvesaCapital is an innovative CFD trading platform founded in 2021. It provides multiple flexible trading options, with various trading products such as forex, commodities, shares, indices, and cryptos. There are many useful digital tools to help you improve the overall trading experience.

| Pros | Cons |

| Demo account avaialble | Suspicious clone licenses |

| Various trading products | Withdrawal fees charged |

| Multiple account types with no commissions | Regional restrictions |

| No MT4 or MT5 |

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Cyprus Securities and Exchange Commission (CYSEC) | Suspicious clone | Cyprus | Market Maker | 217/13 |

| Financial Sector Conduct Authority (FSCA) | Suspicious clone | South Africa | Financial Service Corporate | 640 |

InvesaCapital offers a wide range of financial assets.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

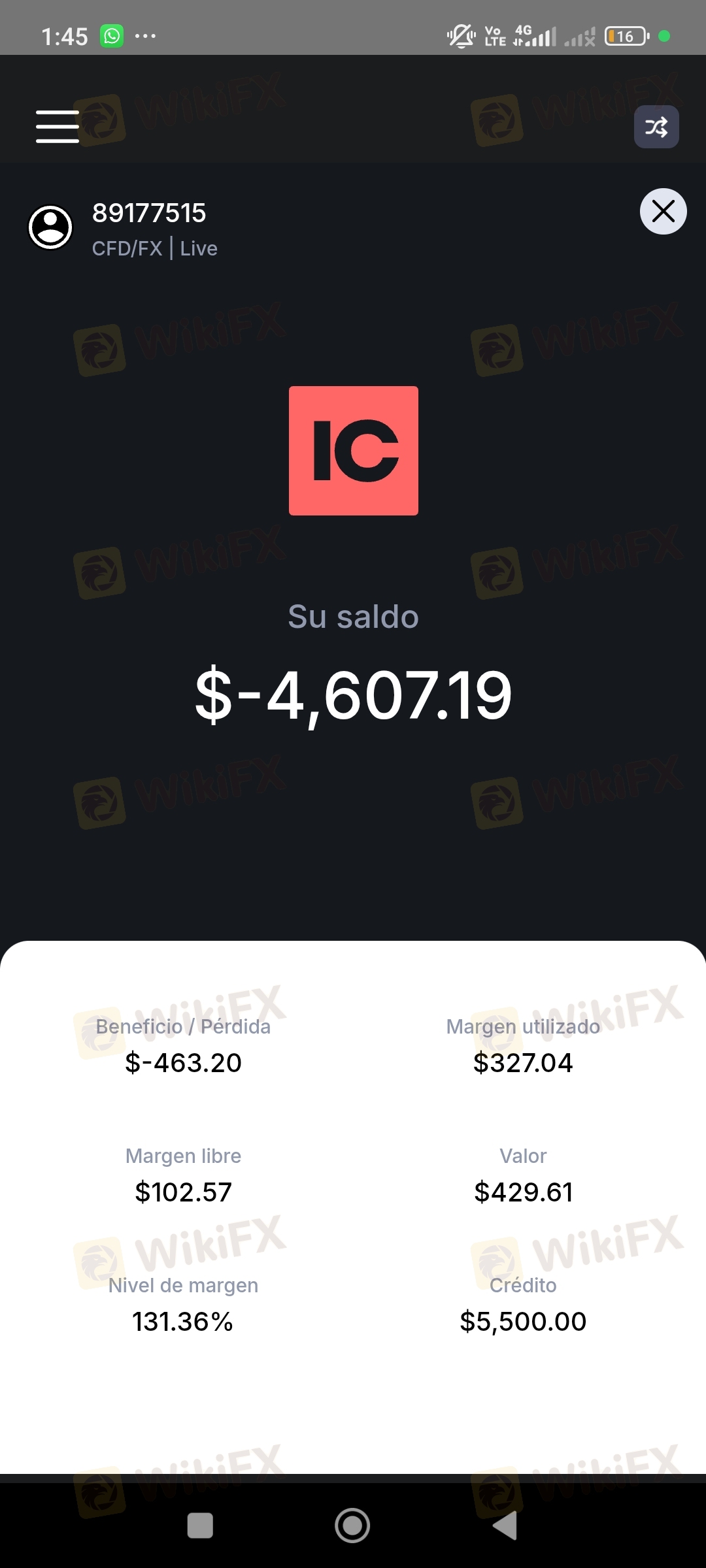

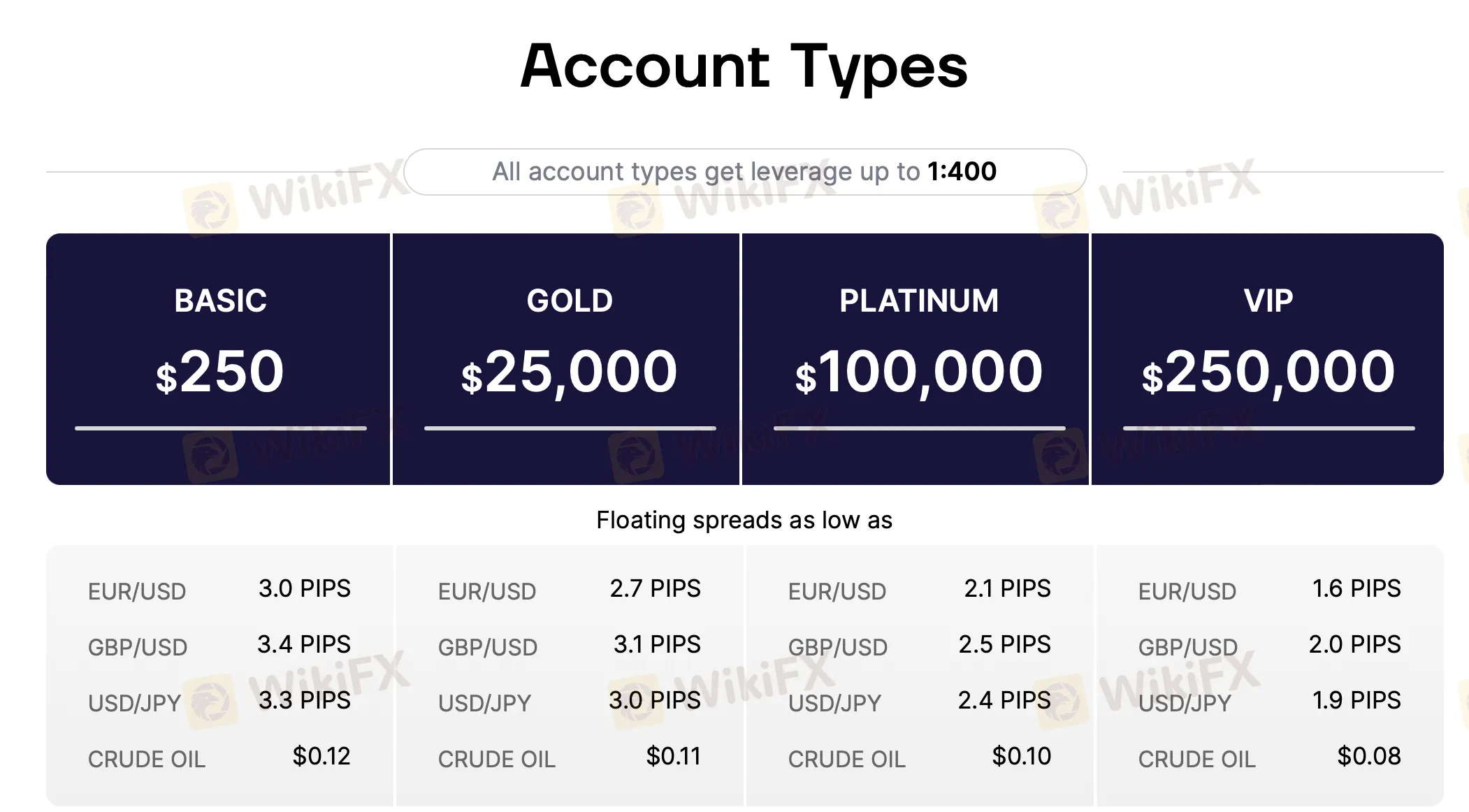

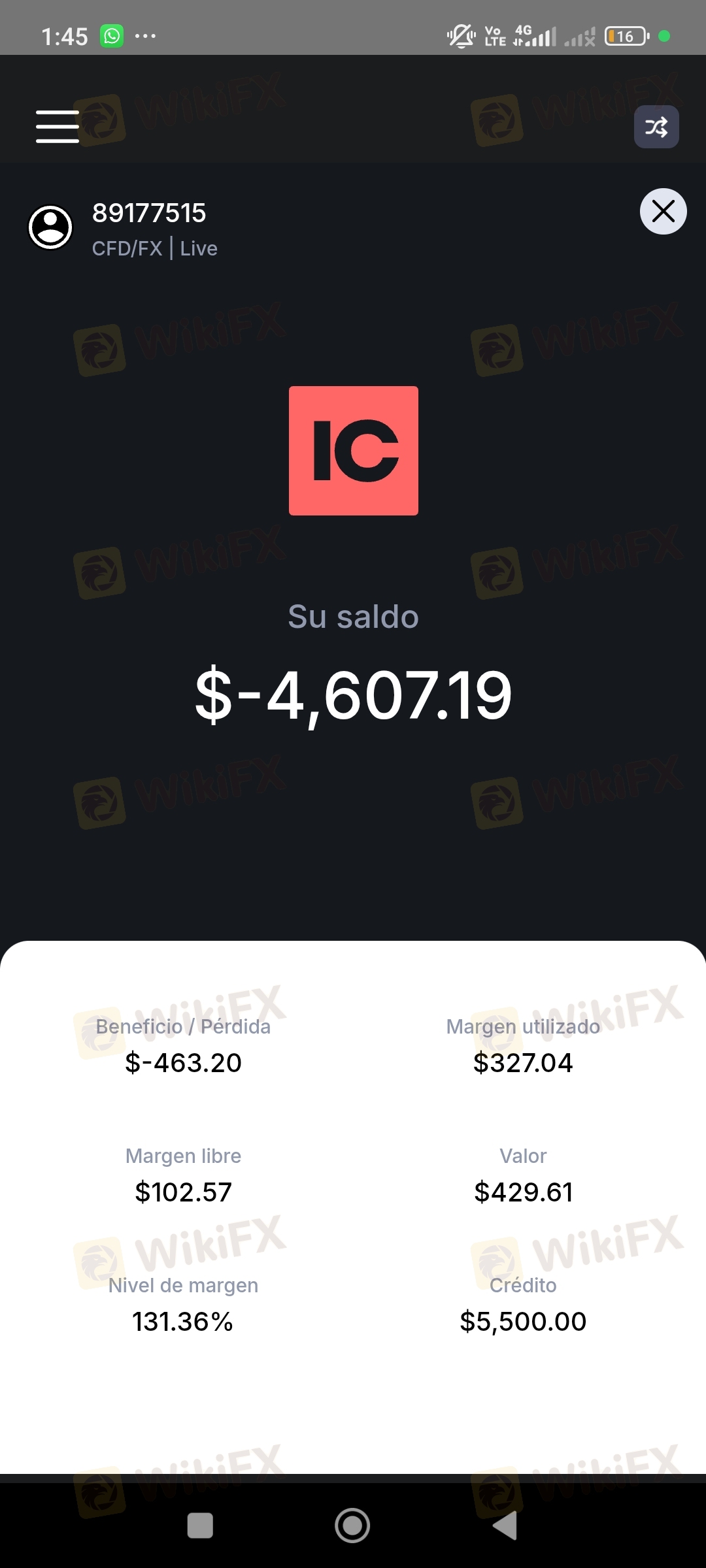

InvesaCapital offers 4 types of live trading accounts, each tailored to different trading styles and account size. In addition, InvesaCapital provides demo accounts for practice which is suitable for beginners. The accounts differ mainly in their spread structure, allowing traders to choose the best fit based on cost preference and strategy.

| Account Type | Spread | Commission | Account Size |

| BASIC | From 3.0 pips | Free | $250 |

| GOLD | From 2.7 pips | Free | $25,000 |

| PLATINUM | From 2.1 pips | Free | $100,000 |

| VIP | From 1.6 pips | Free | $250,000 |

InvesaCapital offers leverage of up to 1:400. A high leverage ratio brings high returns along with high risks.

Overall, InvesaCapital's trading fees vary from different account types with no commission fee.

Spreads: Start as low as 1.6 pips on the VIP account, and up to 3.0 pips on the basic account.

Commissions: Free.

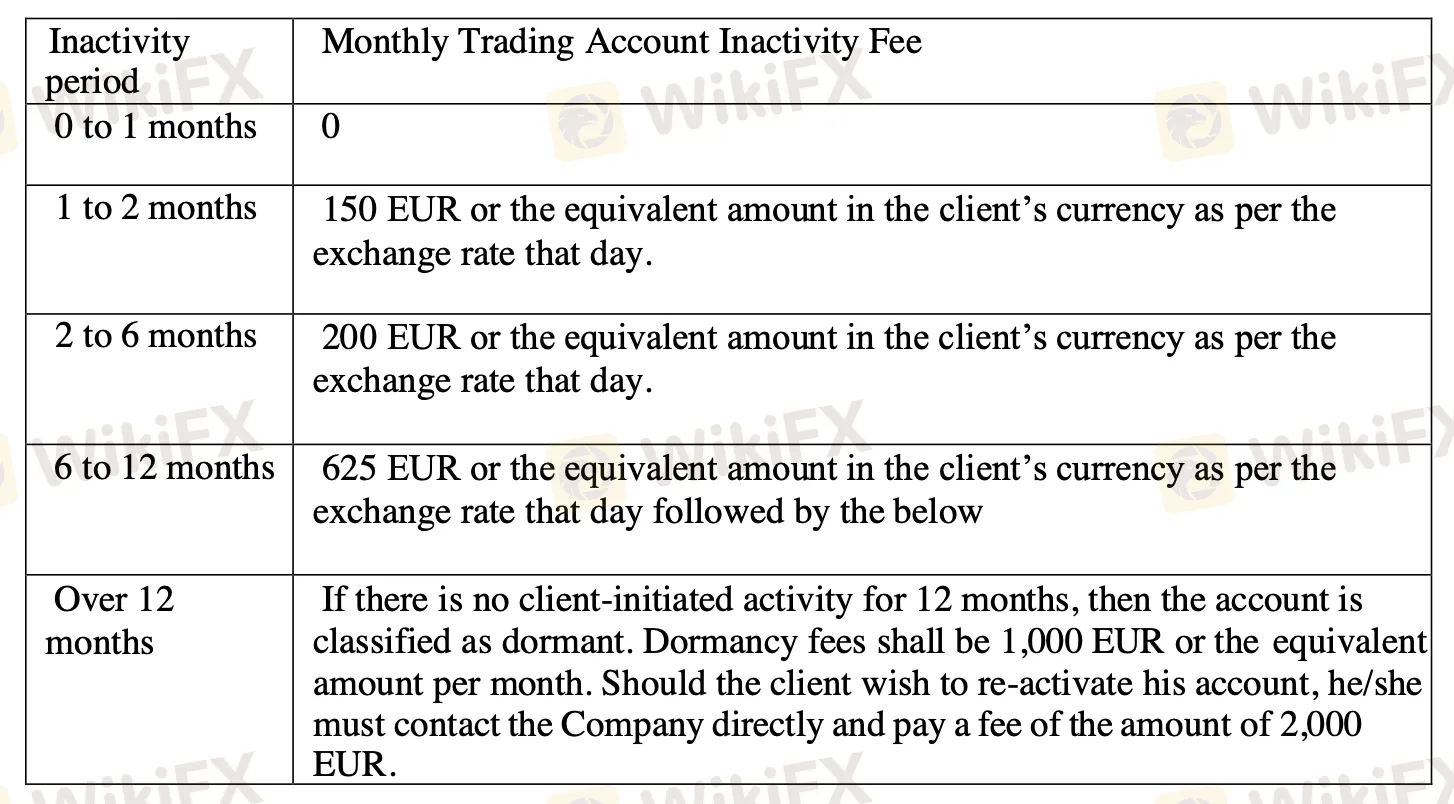

| Non-Trading Fees | Details |

| Deposit Fee | $0 (Free) |

| Withdrawal Fee | BASIC: 1 Free Withdrawal |

| GOLD: 1 Monthly Free Withdrawal | |

| PLATINUM: 3 Monthly Free Withdrawals | |

| VIP: No Fees | |

| Inactivity Fee | 0-1 months: 0 |

| 1-2 months: EUR 150/ per month | |

| 2-6 months: EUR 200/ per month | |

| 6-12 months: EUR 625/ per month | |

| Over 12 months: EUR 1,000/ per month |

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| WebTrader | ✔ | Desktop, mobile | / |

| MetaTrader 4 (MT4) | ❌ | / | Beginners |

| MetaTrader 5 (MT5) | ❌ | / | Experienced traders |

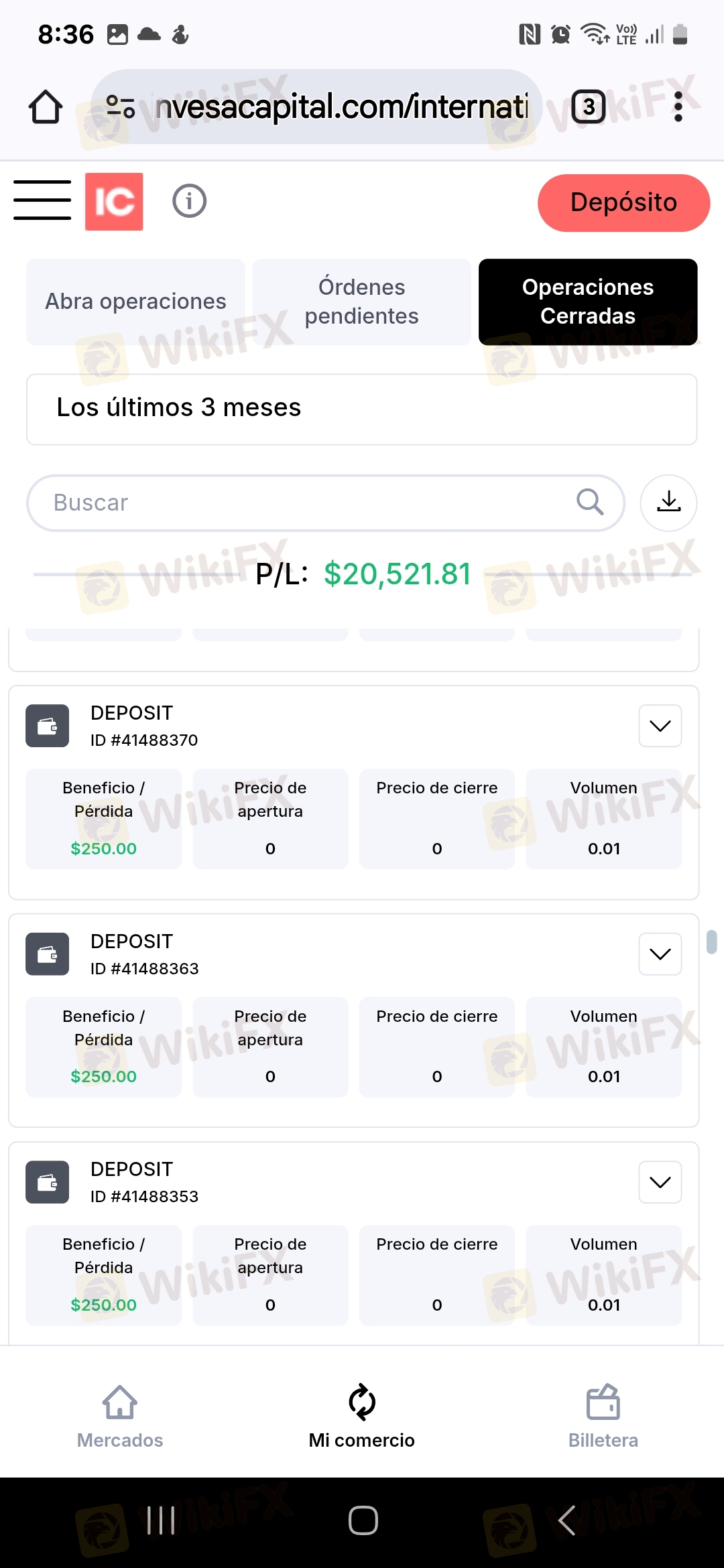

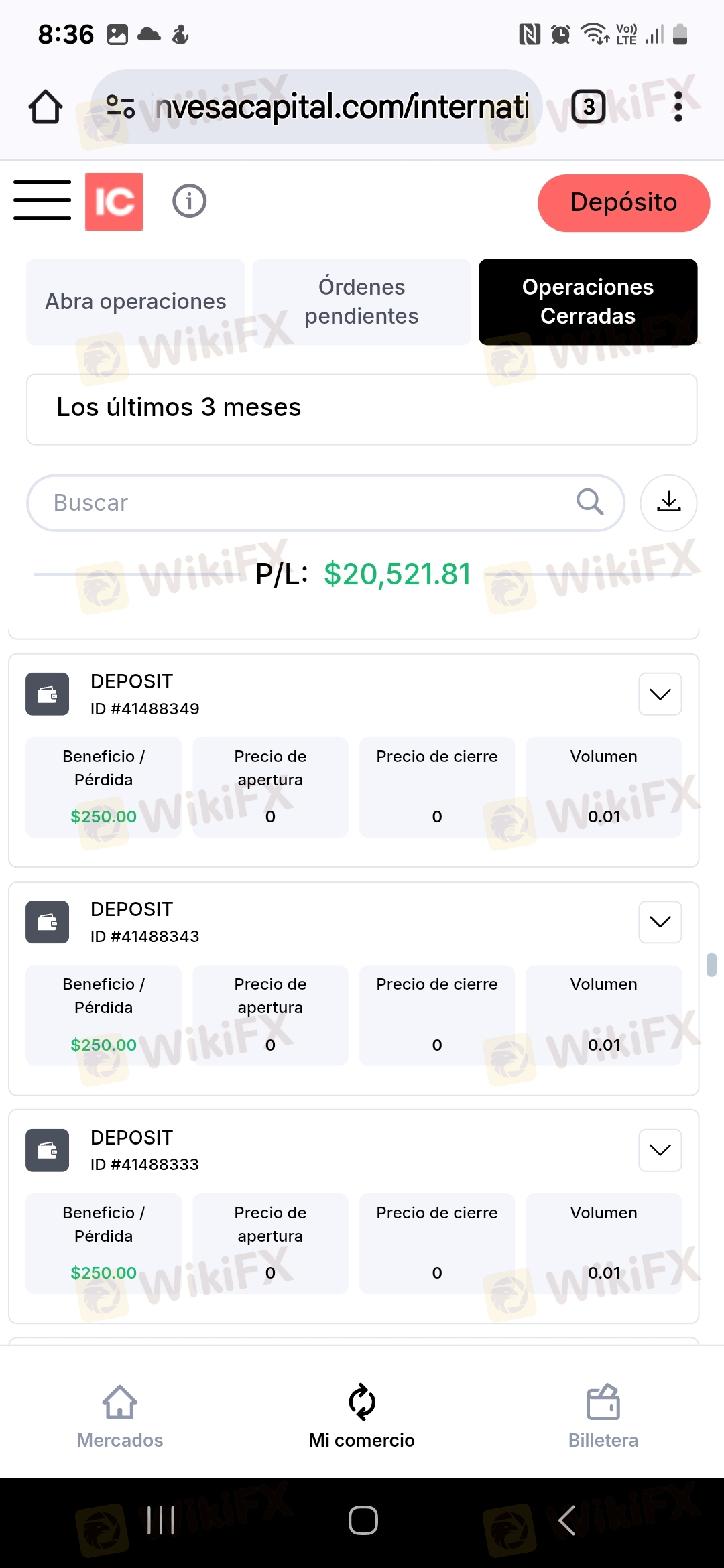

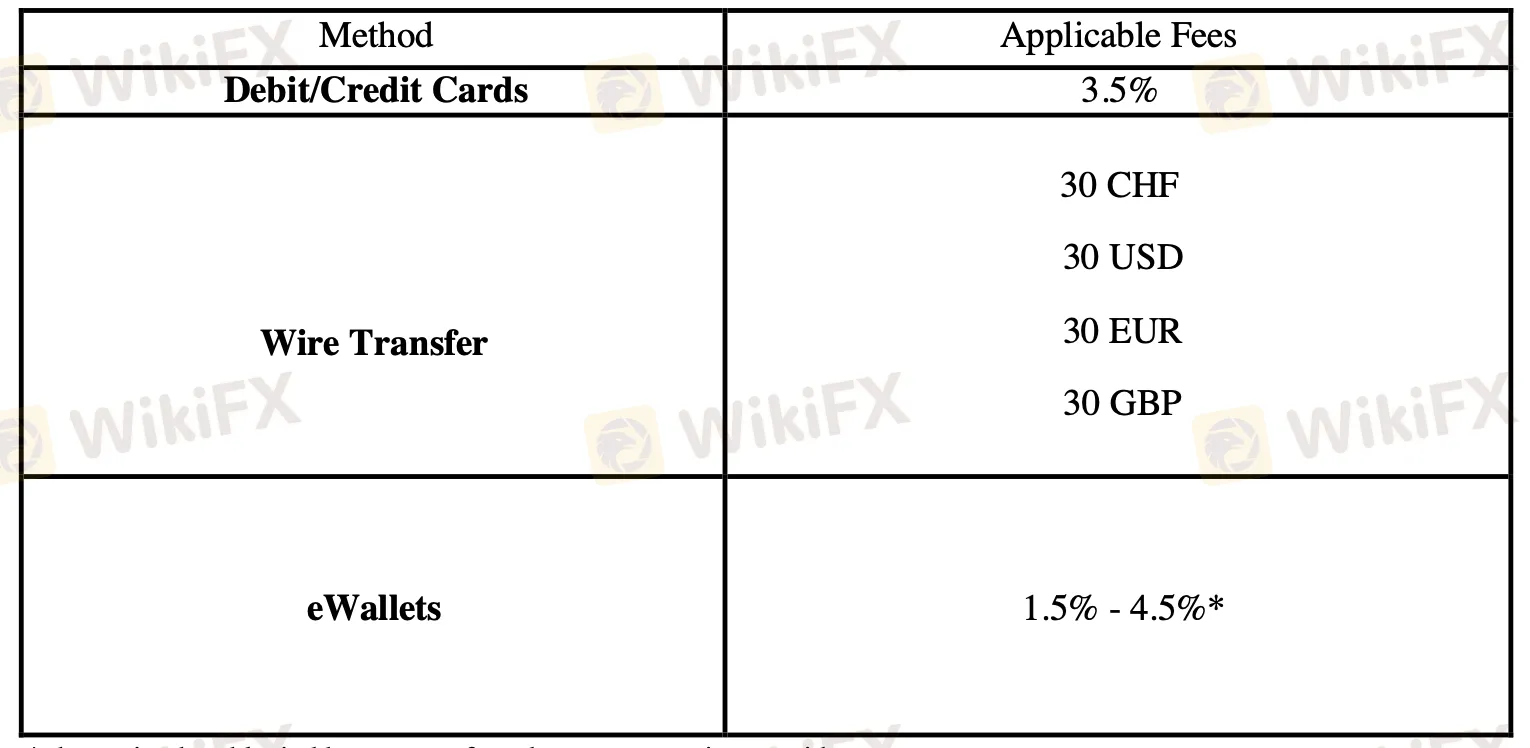

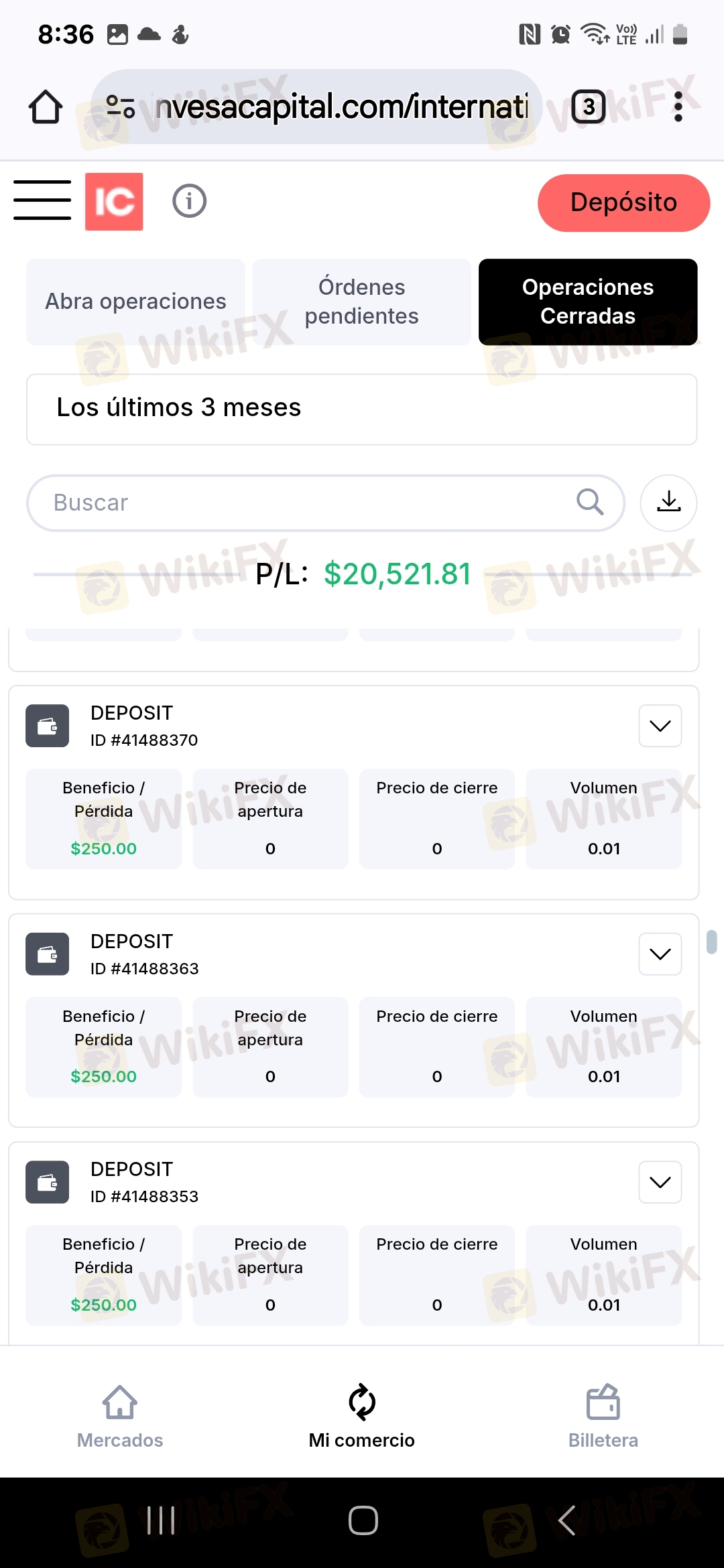

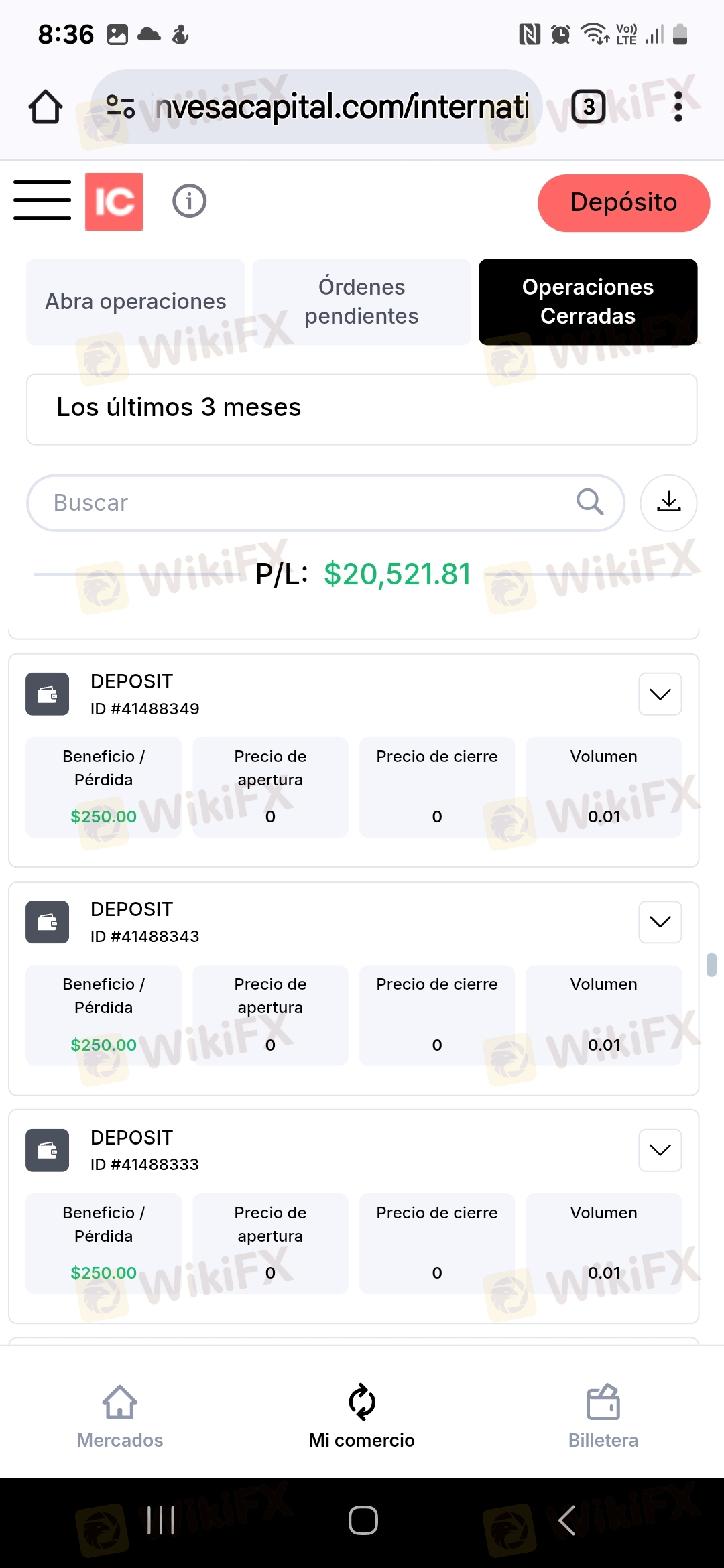

InvesaCapital only charges withdrawal fees, according to account types and withdrawal methods. The minimum deposit required is changing up to date.

| Deposit Options | Minimum Deposit | Fees | Processing Time |

| Credit Card, Electronic Payment, Wire Transfer | Up-to-date change | Free | Not mentioned |

| Withdrawal Options | Minimum Withdrawal | Fees | Processing Time |

| Debit/Credit Cards | None | 3.5% | Requests are processed within 24 business hours; Up to 5 business days to the withdrawal source. |

| Wire Transfer | ₣100, $120, €100, £80, ₽7,000 | 30 CHF/USD/EUR/GBP | |

| eWallets | None | 1.5% - 4.5% |

More

User comment

5

CommentsWrite a review

2025-04-05 21:25

2025-04-05 21:25

2025-01-22 13:17

2025-01-22 13:17