User Reviews

More

User comment

1

CommentsWrite a review

2024-03-08 15:42

2024-03-08 15:42

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.82

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

Danger

More

Company Name

Unlimited LTD

Company Abbreviation

SydneyFX

Platform registered country and region

Cyprus

Company website

Company summary

Pyramid scheme complaint

Expose

| SydneyFX | Basic Information |

| Company Name | SydneyFX |

| Founded | 2023 |

| Headquarters | United Kingdom |

| Regulations | Not regulated |

| Tradable Assets | Cryptocurrencies, Forex, Indices, Stock, Energy, Commodities |

| Account Types | BASIC, BRONZE, SILVER, GOLD, VIP, PLATINUM |

| Minimum Deposit | Not specific |

| Maximum Leverage | Up to 1:200 |

| Spreads | Tight spreads |

| Commission | 0% commission |

| Deposit Methods | Credit Card, Bitcoin Transfers |

| Trading Platforms | WebTrader |

| Customer Support | Email (support@sydneyfx.io)Phone (+61251108310/+61251108310) |

| Education Resources | 24/7 support via Email, Telegram, Facebook |

| Bonus Offerings | None |

Overview of SydneyFX

SydneyFX is a financial services provider founded in 2023, operating out of the United Kingdom, and offering a variety of tradable assets including cryptocurrencies, forex, stocks, and commodities. The company presents a range of account types to accommodate different traders, from basic to premium levels like PLATINUM, and operates with a maximum leverage of 1:200. Despite not being regulated, SydneyFX asserts zero commission on trades, promotes tight spreads, and accepts deposits via credit cards and Bitcoin. Its trading operations are conducted through the WebTrader platform. Additionally, SydneyFX emphasizes customer service and forex education, providing round-the-clock support through multiple channels.

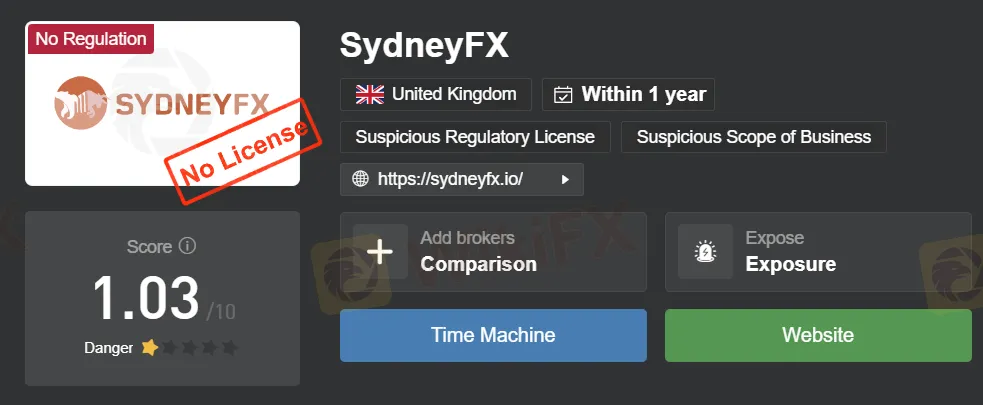

Is SydneyFX Legit?

SydneyFX is not regulated. It is important to note that this broker does not have any valid regulation, which means it operates without oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like PURECAPITALS, as there may be limited avenues for dispute resolution, potential safety and security concerns regarding funds, and a lack of transparency in the broker's business practices. It is advisable for traders to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

SydneyFX offers a diverse asset portfolio and leverage up to 1:200, all with the benefit of no commission fees. However, its lack of regulatory oversight and unspecified minimum deposit could concern traders seeking security and clarity in their trading platform choice.

| Pros | Cons |

|

|

|

|

|

|

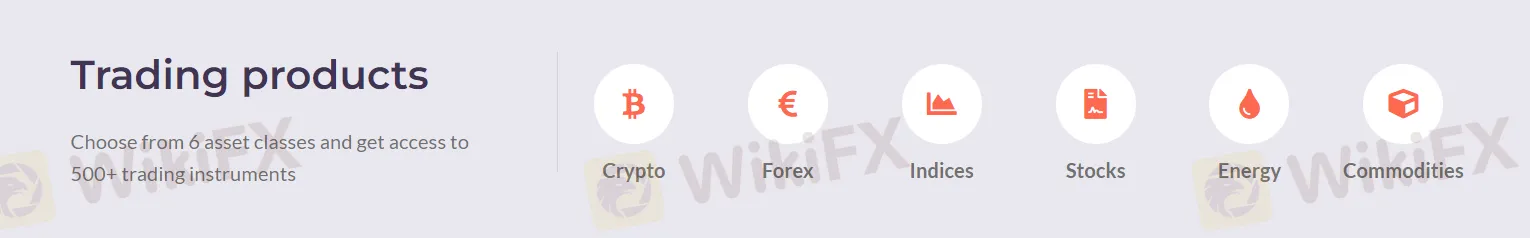

Trading Instruments

SydneyFX offers a broad range of trading instruments across six asset classes, providing access to over 500 trading instruments. These include cryptocurrencies, Forex, indices, stocks, energy, and commodities.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| SydneyFX | Yes | Yes | Yes | Yes | Yes | Yes | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

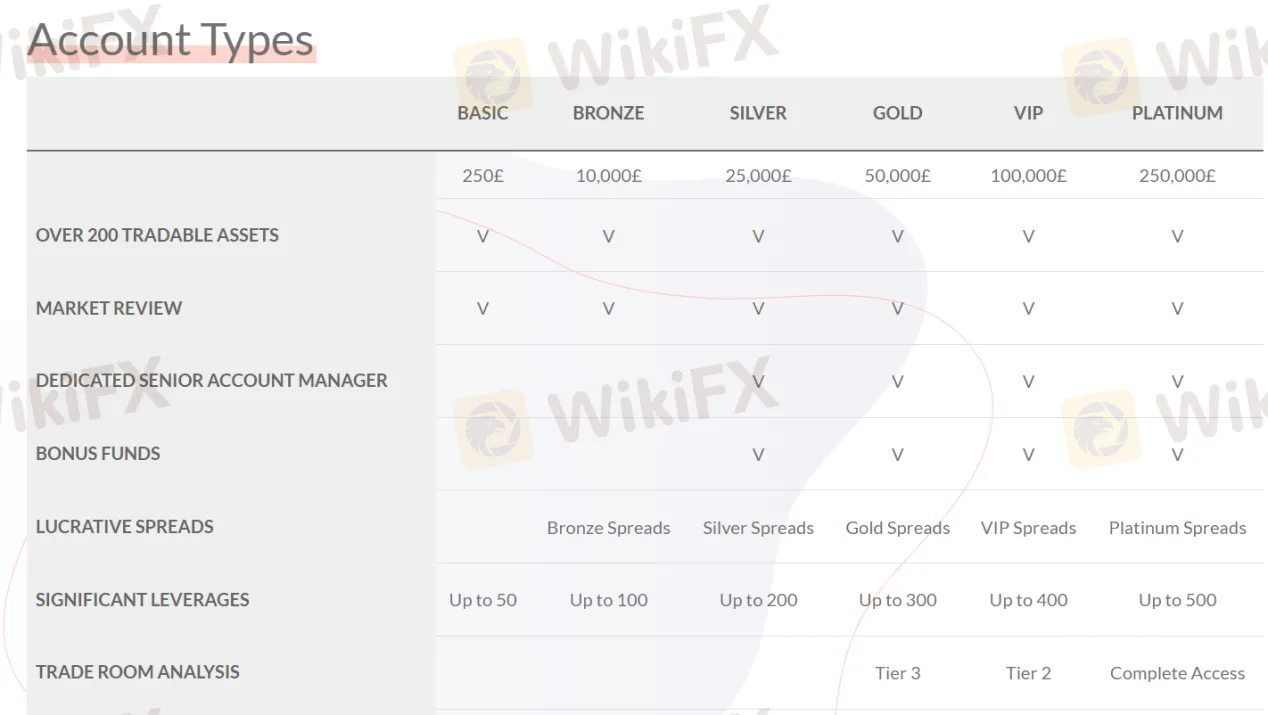

Account Types

SydneyFX offers a range of account types, including BASIC, BRONZE, SILVER, GOLD, VIP, and PLATINUM. These accounts feature a tiered structure with increasing benefits such as access to over 200 tradable assets, market reviews, and the assistance of a dedicated senior account manager. Additional perks include bonus funds and varying levels of spreads and leverages, with higher account tiers offering more advantageous spreads and greater leverage, up to 1:500 for PLATINUM.

Leverage

SydneyFX offers up to 200x leverage for trading, aiming to enhance profitability through ultra-fast execution, tight spreads, and advanced platform features.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | SydneyFX | Libertex | XM | RoboForex |

| Maximum Leverage | 1:200 | 1:30 | 1:888 | 1:2000 |

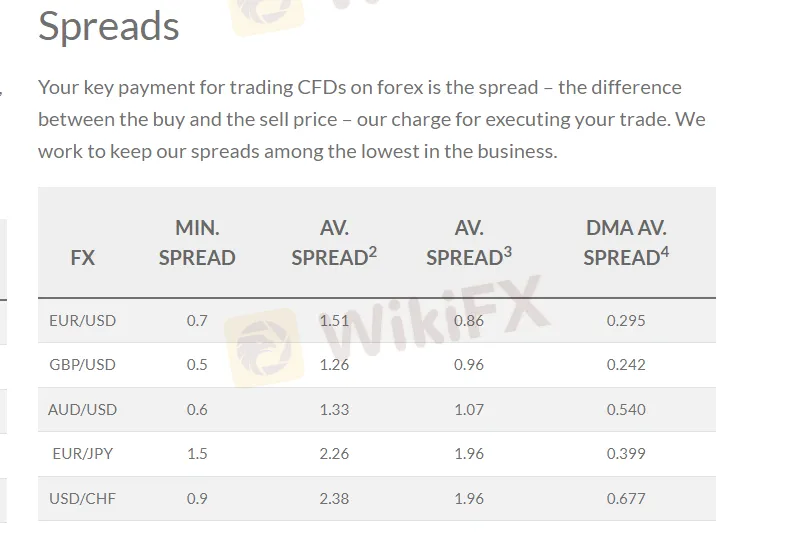

Spreads and Commissions

The leverage offered by SydneyFX is 200x, which means traders can control a large position with a relatively small amount of capital. They also highlight ultra fast execution, tight spreads, and advanced platform features aimed at increasing profitability. Additionally, they offer 0% commission on trades.

Deposit & Withdraw Methods

SydneyFX offers two methods for deposit and withdrawal:

Credit Card: Withdrawals are made to the same credit card used for deposit, applied only to the deposit amount, excluding profits and bonuses.

Bitcoin: Deposits and withdrawals can be made with Bitcoin, with the exchange rate determined at the time of transfer.

Trading Platforms

The trading platform offered by SydneyFX is WebTrader, which is a web-based platform allowing users to trade directly through a browser without the need for downloading any software.

Customer Support

The customer support details for SydneyFX are as follows:

Operating hours:

Monday to Thursday: 08:00 AM – 08:00 PM GMT

Friday: 08:00 AM – 04:00 PM GMT

Contact numbers:

Australia: +61251108310

United Kingdom: +442030317771

Email support:

support@sydneyfx.io

Educational Resources

The educational resources offered by SydneyFX are highlighted by their commitment to forex education:

Provides support round-the-clock via email, Telegram, and Facebook.

The support team is available at any time, including weekends and holidays.

Conclusion

SydneyFX offers a diverse portfolio of tradable assets and attractive trading conditions with high leverage and low costs due to zero commission fees. However, its disadvantages include the absence of widely-used platforms like MT4/MT5 and a lack of regulatory oversight, which may concern potential users about its security and credibility. Additionally, the unspecified minimum deposit could be a barrier for new traders looking to understand the financial commitment required to start trading.

FAQs

Q: What kind of assets can I trade with SydneyFX?

A: SydneyFX provides access to a broad spectrum of assets, including cryptocurrencies, forex, indices, stocks, energy, and commodities.

Q: How does SydneyFX stand out in terms of trading leverage?

A: Traders at SydneyFX can benefit from competitive leverage options, offering up to a 1:200 ratio.

Q: Are there any trading fees or commissions charged by SydneyFX?

A: SydneyFX promotes cost-efficient trading by offering zero commission on trades.

Q: What platforms are available for trading with SydneyFX?

A: SydneyFX utilizes its WebTrader platform to facilitate trading activities for its clients.

Q: What are the deposit methods accepted by SydneyFX?

A: SydneyFX accommodates various deposit methods, including credit cards and Bitcoin transfers.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Saxo has collaborated with Novo Banco, a Portuguese bank to offer Novobanco clients access to Saxo's trading platform. Henrik Alsøe, Global Head of Saxo Institutional, Henrik commented, “As a leading digital trading and investment services provider, Saxo is thrilled to expand the relationship with the novobanco Group and contribute to their drive towards improved customer centricity,”

WikiFX

WikiFX

WARNING! One of the most prominent regulators, the Financial Conduct Authority (FCA), issued a warning against unauthorised broker Sydney FX. Be alert.

WikiFX

WikiFX

More

User comment

1

CommentsWrite a review

2024-03-08 15:42

2024-03-08 15:42