User Reviews

More

User comment

2

CommentsWrite a review

2024-01-16 12:28

2024-01-16 12:28

2023-12-28 12:08

2023-12-28 12:08

Score

2-5 years

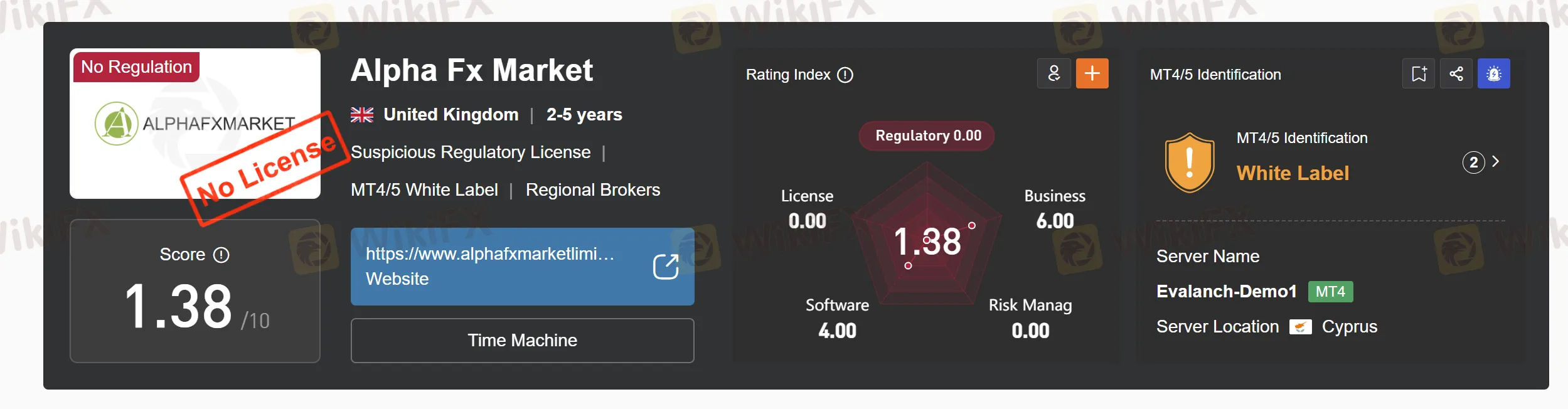

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.80

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Alpha Fx Market Limited

Company Abbreviation

Alpha Fx Market

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Company Name | Alpha Fx Market Limited |

| Minimum Deposit | Varies depending on account type (check website for details) |

| Maximum Leverage | 1:500 |

| Spreads | Variable, starting from 0.75 pips for large diamonds |

| Tradable Assets | Forex, commodities, equities, indices (cryptocurrency availability might be limited) |

| Account Types | Standard, ECN, STP, Islamic |

| Islamic Account | Yes |

| Customer Support | Email, live chat, phone support |

| Payment Methods | Bank transfers, credit/debit cards, e-wallets (specific options might vary) |

| Educational Tools | Tutorials, webinars, articles, live training sessions, e-books, written guides (availability and scope might vary) |

Alpha Fx Market Limited, based in the United Kingdom, presents itself as a versatile trading platform offering a range of account types to cater to diverse trading preferences. The company operates with a maximum leverage of 1:500, allowing traders the potential for amplified positions. While the minimum deposit varies depending on the chosen account type, the platform emphasizes flexibility by accommodating traders with different risk tolerances.

Traders on Alpha Fx Market have access to an array of tradable assets, including Forex, commodities, equities, and indices, providing opportunities for diversified investment portfolios. The availability of Islamic accounts adds to the inclusivity of the platform, catering to those who adhere to Islamic principles that prohibit interest payments.

The platform is supported by a customer-centric approach, offering customer support through email, live chat, and phone channels. Moreover, Alpha Fx Market aims to empower traders through educational resources such as tutorials, webinars, articles, live training sessions, e-books, and written guides. However, it's essential for users to verify the specific details of these offerings on the platform's website, as availability and scope might vary. As with any trading decision, prospective users are encouraged to conduct thorough research, considering factors like spreads, account types, and regulatory compliance, to make informed choices aligned with their individual trading goals.

Alpha Fx Market is not currently regulated by any major financial authority.It's crucial to exercise caution when dealing with unregulated brokers like Alpha Fx Market. The lack of regulatory oversight significantly increases the risk of encountering issues such as:

Fund safety concerns: Without regulatory protection, your deposited funds might not be adequately safeguarded.

Unfair trading practices: Unregulated brokers may engage in manipulative practices or distort market prices.

Limited dispute resolution: Resolving any disputes with an unregulated broker can be challenging and often ineffective.

Therefore, we strongly advise against engaging with Alpha Fx Market or any other unregulated broker. Instead, consider choosing a broker regulated by a reputable authority like the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, or the Australian Securities and Investments Commission (ASIC).

Alpha Fx Market presents traders with a range of potential advantages, including diverse asset options allowing for varied investment strategies. The platform is designed with user-friendliness in mind, offering an interface that is accessible for traders at different experience levels. Competitive spreads enhance the appeal of Alpha Fx Market, providing cost-effective trading opportunities. Additionally, the platform boasts responsive customer support to address inquiries and concerns promptly, while advanced trading tools contribute to a comprehensive trading experience.

However, some drawbacks need to consider as well. The platform may have limited information available publicly, making it challenging for potential users to access comprehensive details about its offerings. The absence of regulatory information raises concerns about the platform's adherence to industry standards. While Alpha Fx Market offers some educational resources, they may be limited in comparison to other platforms. Traders should also be mindful of potential minimum deposit requirements that might impact accessibility. Furthermore, the platform may lack certain features that traders commonly seek in a comprehensive trading environment. As with any financial platform, careful consideration of these pros and cons is crucial for traders to make informed decisions aligned with their individual preferences and trading goals.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Forex (Foreign Exchange): Trading currency pairs to capitalize on changes in exchange rates.

Commodities: Trading commodities like gold, silver, oil, etc., allowing investors to speculate on commodity price movements.

Stocks (Equities): Buying and selling shares of publicly-listed companies.

Indices: Trading on the performance of a group of stocks representing a particular market or sector.

Cryptocurrencies: If the platform is modern, it might offer trading in digital assets like Bitcoin, Ethereum, etc.

Bonds: Fixed-income securities representing a loan made by an investor to a borrower.

Standard Account:

Often the most basic account type.

Suitable for beginners or those with moderate trading experience.

Offers standard spreads and trading conditions.

May have a minimum deposit requirement.

ECN (Electronic Communication Network) Account:

Provides direct access to the interbank market.

Offers tighter spreads and faster execution.

Typically requires a higher minimum deposit.

May charge a commission per trade.

STP (Straight Through Processing) Account:

Offers direct market access without intervention from the broker.

Provides transparent execution and competitive spreads.

Usually has a lower minimum deposit requirement than ECN accounts.

Islamic Account (Swap-Free Account):

Designed for traders who adhere to Islamic principles that prohibit interest payments.

Does not charge or receive interest on overnight positions.

May have different trading conditions or fees compared to other account types.

Demo Account:

A risk-free simulated account.

Allows traders to practice trading strategies and familiarize themselves with the platform.

Does not involve real funds.

Starting your futures trading journey with Alpha Fx Market is a straightforward process. Here's a step-by-step guide:

Visit the Alpha Fx Market Website:

Navigate to TFL's official website.

Choose Your Account Type:

Select the account that best suits your needs and risk tolerance. Refer to my previous response for a quick overview of Alpha Fx Market's account types.

Click “Open Account”:

Locate the prominent “Open Account” button on the homepage or account page.

Fill Out the Online Application:

The application form will request personal information, financial details, and trading experience. Be sure to have your identification documents readily available.

Fund Your Account:

Choose your preferred funding method from various options like bank transfers, debit/credit cards, or e-wallets. Each method may have different processing times and fees.

Complete Verification:

Alpha Fx Market requires identity and residency verification for regulatory compliance. Upload scanned copies of relevant documents as instructed.

Congratulations!

Once your application and verification are complete, you'll receive confirmation and be able to access your Alpha Fx Market trading platform.

Leverage is a powerful tool that can amplify both profits and losses, and it's crucial to use it responsibly. Regulated brokers typically have stricter leverage limits in place to protect their clients from excessive risk.

Leverage is a ratio: It allows you to control a larger position than your initial deposit. For example, 100:1 leverage means you can control $100,000 with only a $1,000 deposit.

Higher leverage increases potential profits and losses: A small price movement in your favor can lead to significant gains, but it can also result in substantial losses if the price goes against you.

Leverage is not recommended for beginners: It's a complex tool that requires experience and risk management skills.

Spreads and commissions are crucial cost factors in forex trading, directly impacting your profits and losses. Regulated brokers typically have competitive spreads and transparent fee structures, allowing you to make informed trading decisions.

If you're still interested in learning about spreads and commissions in forex trading, I can offer some general information:

Spreads: The difference between the bid (buy) and ask (sell) price of a currency pair. Tighter spreads translate to lower trading costs.

Commissions: Fees charged by the broker for each trade. Some brokers offer commission-free trading, while others charge a fixed or variable fee based on the trade size.

Overnight interest fees: Charged on open positions held over the night. The fee depends on the currency pair, interest rates, and your position size.

Deposit and withdrawal fees: Some brokers charge fees for depositing or withdrawing funds. These fees can vary depending on the payment method and broker.

Inactivity fees: Some brokers charge a fee if your account remains inactive for a certain period.

Web Platform: Accessible through any web browser, offering convenience and portability.

Desktop Platform: Downloadable software with more advanced features and functionalities.

Mobile App: Trade on the go with a user-friendly and intuitive mobile app.

Key Features:

Trading Tools: Highlight available technical analysis tools, charting options, and order types.

Market Data: Explain the platform's access to real-time market data, news feeds, and analysis tools.

Educational Resources: Mention any educational materials, tutorials, or webinars offered by the platform.

Security Features: Describe the platform's security measures to protect your funds and personal information.

Available deposit methods: This could include bank transfers, credit/debit cards, e-wallets, etc.

Minimum and maximum deposit amounts: Some brokers have minimum deposit requirements, while others allow flexible amounts.

Processing times for deposits: Knowing how quickly your funds will be available is crucial.

Withdrawal methods: Similar to deposits, options like bank transfers, e-wallets, or internal transfers might be available.

Minimum and maximum withdrawal amounts: Certain limitations might apply.

Processing times for withdrawals: Understanding how long it takes to receive your funds is important.

Any associated fees: Be aware of potential charges for deposits or withdrawals.

Alpha Fx Market provides customer support through both telephone and email channels. For telephone support, clients can reach the platform at +13144723161, offering a direct and accessible means of communication for immediate assistance. Additionally, users can utilize email support through the addresses support@swisscapitalfx.com and info@alphafxmarketlimited.com. These email channels serve as avenues for addressing inquiries, resolving issues, and seeking information.

Alpha Fx Market is committed to fostering a supportive and informed trading community by offering a range of educational resources designed to empower traders at different skill levels. These resources typically include comprehensive tutorials, insightful articles, and webinars that cover a variety of topics such as market analysis, trading strategies, and risk management. Whether you are a novice trader looking to build foundational knowledge or an experienced investor seeking to refine your strategies, Alpha Fx Market's educational materials aim to cater to diverse learning needs.

Moreover, the platform may provide live training sessions conducted by seasoned experts in the field, offering participants the opportunity for real-time engagement, interactive discussions, and practical insights into market dynamics. Additionally, traders may have access to written guides and e-books, further enriching their understanding of the financial markets.

In conclusion, Alpha Fx Market emerges as a trading platform with both strengths and considerations. The platform offers a diverse array of assets, catering to traders with varying investment preferences. Its user-friendly interface enhances accessibility, ensuring a seamless experience for traders at different skill levels. Competitive spreads contribute to cost-effective trading, and the availability of advanced tools enriches the overall trading environment.

However, caution is warranted due to certain limitations. The platform's limited public information and absence of regulatory details may raise transparency concerns among potential users. While Alpha Fx Market provides some educational resources, there is room for enhancement, and traders may find more comprehensive offerings on other platforms. Additionally, potential minimum deposit requirements could impact accessibility for certain traders. It's crucial for users to weigh these factors carefully and align their choices with individual preferences and risk tolerance.

As the financial landscape evolves, traders should stay vigilant for updates and changes to Alpha Fx Market's offerings. Conducting thorough research and remaining informed about market conditions will empower traders to make well-informed decisions that align with their financial goals and trading strategies.

Q: What assets can I trade on Alpha Fx Market?

A: Alpha Fx Market provides a diverse range of trading options, including forex, commodities, equities, and indices, allowing traders to build diversified portfolios.

Q: Is Alpha Fx Market regulated?

A: Regulatory information for Alpha Fx Market is not readily available. It's recommended to check the official website or contact customer support for the latest details on regulatory status.

Q: What trading platforms does Alpha Fx Market offer?

A: Alpha Fx Market's trading platform information is not provided. Visit the official website or contact customer support for details on available trading platforms.

Q: How can I contact customer support at Alpha Fx Market?

A: Alpha Fx Market offers multichannel customer support, including options like email, live chat, and phone support, ensuring assistance for various inquiries and concerns.

Q: Are there educational resources available on Alpha Fx Market?

A: Alpha Fx Market is known to offer educational resources such as tutorials, webinars, articles, live training sessions, e-books, and written guides to support traders at different skill levels.

Q: What are the minimum deposit requirements on Alpha Fx Market?

A: Minimum deposit requirements on Alpha Fx Market vary and depend on the specific account type. Traders should check the details for each account option.

Q: Does Alpha Fx Market have a demo account?

A: Details about a demo account on Alpha Fx Market are not provided. It's advisable to check with the platform or customer support for information on the availability of demo accounts.

Q: Can I access Alpha Fx Market on a mobile device?

A: Information about mobile accessibility on Alpha Fx Market is not provided. Traders should check with the platform or customer support for details on using mobile devices for trading.

More

User comment

2

CommentsWrite a review

2024-01-16 12:28

2024-01-16 12:28

2023-12-28 12:08

2023-12-28 12:08