User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

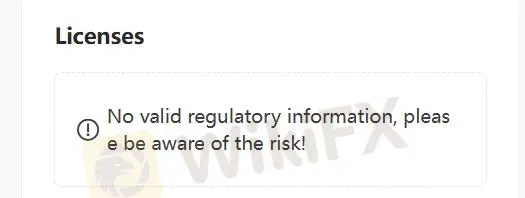

Regulatory Index0.00

Business Index7.23

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Note: GTFMarkets' official site - https://gtfmarkets.org/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| GTFMarkets Review Summary | |

| Registered Country/Region | Saint Lucia |

| Regulation | No Regulation |

| Market Instruments | +77 currency pairs, CFD, Metals, Commodities, Indices |

| Demo Account | Available |

| Leverage | 1:1000 |

| Spread | From 1.6 pips (Pro-Cent Account), From 0.1 pips (PRIME-ECN Account), From 1.4 pips (Pro-ECN Account), From 1.6 pips (Pro-Classic Account) |

| Trading Platforms | N/A |

| Minimum Deposit | $10 |

| Customer Support | Phone Number: +44 (131) 507-09-05, +7 (495) 128-49-63 |

| Email: support@gtfmarkets.org | |

GTFMarkets is an unregulated trading platform that offers its clients access to a comprehensive suite of financial instruments across various asset classes, such as CFD, Metals, Commodities, and Indices. It provides several account types with varying spreads and minimum deposit requirements to cater to different investor needs and styles. The platform also provides multiple customer support channels for added convenience.

| Pros | Cons |

|

|

|

|

Multiple Market Instruments: The platform offers diverse Market Instruments, including CFD, Metals, Commodities, and Indices, catering to various trading needs and experience levels.

Multiple Account Types: The platform offers diverse account types, including the Pro-Cent, PRIME-ECN, Pro-ECN, and Pro-Classic, catering to various trading needs and experience levels.

No Regulation: The lack of valid regulation raises significant safety and trust concerns, as regulatory oversight is crucial for ensuring customer protection and platform transparency. There are also reports of being unable to withdraw and scams, adding to the cons of the platform.

Lack of Information: The company's website is non-functional, suggesting a lack of transparency and reliability. The lack of comprehensive information about trading instruments, fees, and account details hinders informed decision-making and fuels suspicion.

GTFMarkets currently lacks valid regulation, which raises significant concerns about its safety and legitimacy. Regulatory oversight is crucial for ensuring that a financial services provider operates within established standards and adheres to specific rules and requirements designed to protect investors and clients. Without proper regulation, there is an increased risk of fraudulent activities, scams, and inadequate consumer protection.

GTFMarkets provides an extensive range of trading instruments spanning various asset classes. These include over 77 currency pairs, CFDs, metals, commodities, and indices. With such diverse offerings, GTFMarkets caters to the trading needs and preferences of a wide range of investors, allowing them to access multiple financial markets and capitalize on various trading opportunities.

Pro-Cent Account: This account type offers a low entry barrier with a minimum deposit requirement of just $10. It is ideal for beginner traders or those looking to test their trading strategies with smaller amounts.

PRIME-ECN Account: With a minimum deposit of $5000, the PRIME-ECN Account is designed for more experienced traders seeking direct access to the market through Electronic Communication Network (ECN) technology. This account type offers tight spreads and fast execution, suitable for active traders and scalpers.

Pro-ECN Account: The Pro-ECN Account requires a minimum deposit of $300, making it a mid-tier option suitable for traders looking for competitive trading conditions with tighter spreads and faster execution compared to standard accounts.

Pro-Classic Account: For traders seeking a balance between affordability and trading features, the Pro-Classic Account offers a minimum deposit requirement of $100. This account type provides access to a wide range of trading instruments and features, making it suitable for both novice and intermediate traders.

GTFMarkets provides traders with the opportunity to utilize significant leverage, offering a maximum leverage of up to 1:1000. This high leverage enables traders to amplify their trading positions and magnify their profits, but it also comes with increased risk. Therefore, traders should employ proper risk management strategies when utilizing high leverage to ensure prudent trading practices.

| Account Type | Minimum Position | Spreads |

| Pro-Cent | 0.1 | from 1.6 pips |

| PRIME-ECN | 0.01 | from 0.1 pips |

| Pro-ECN | 0.01 | from 1.4 pips |

| Pro-Classic | 0.01 | from 1.6 pips |

GTFMarkets provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Phone Number: +44 (131) 507-09-05, +7 (495) 128-49-63

Email:support@gtfmarkets.org

In conclusion, GTFMarkets offers an extensive range of trading instruments, various account types, a high maximum leverage, and a wide range of customer support channels, making it an advantageous platform for various investors with varying investment styles and goals. However, the lack of valid regulation and its inaccessible website raise significant concerns about the safety and trustworthiness of the platform.

| Q 1: | Is GTFMarkets regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does GTFMarkets offer demo accounts? |

| A 2: | Yes. |

| Q 3: | What is the minimum deposit for GTFMarkets? |

| A 3: | The minimum initial deposit to open an account is $10. |

| Q 4: | What is the maximum leverage available at GTFMarkets? |

| A 4: | 1:1000. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment