User Reviews

More

User comment

6

CommentsWrite a review

2024-12-03 23:58

2024-12-03 23:58

2024-12-02 20:23

2024-12-02 20:23

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT4 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Quantity 4

Exposure

Score

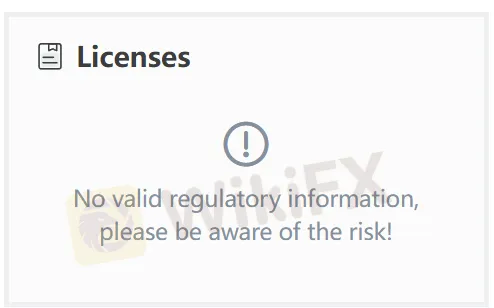

Regulatory Index0.00

Business Index7.03

Risk Management Index0.00

Software Index8.42

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Danger

Warning

Danger

More

Company Name

PO TRADE LTD

Company Abbreviation

PO Trade

Platform registered country and region

Saint Lucia

Company website

X

instagram.com/pocketbrokerglobal/

YouTube

Company summary

Pyramid scheme complaint

Expose

| PO TRADE Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Saint Lucia |

| Regulation | No regulation |

| Market Instruments | 100+, Forex, Commodities, Indices, Stocks, Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Contact Form |

| Company Address: Tbilisi, Georgia, 45 Tabukashvili Street, N 7, 0105 | |

| Social Media: Facebook, Telegram, Instagram, Twitter, YouTube, Discord, Tiktok | |

| Regional Restrictions | EEA countries, the USA, UAE, Israel |

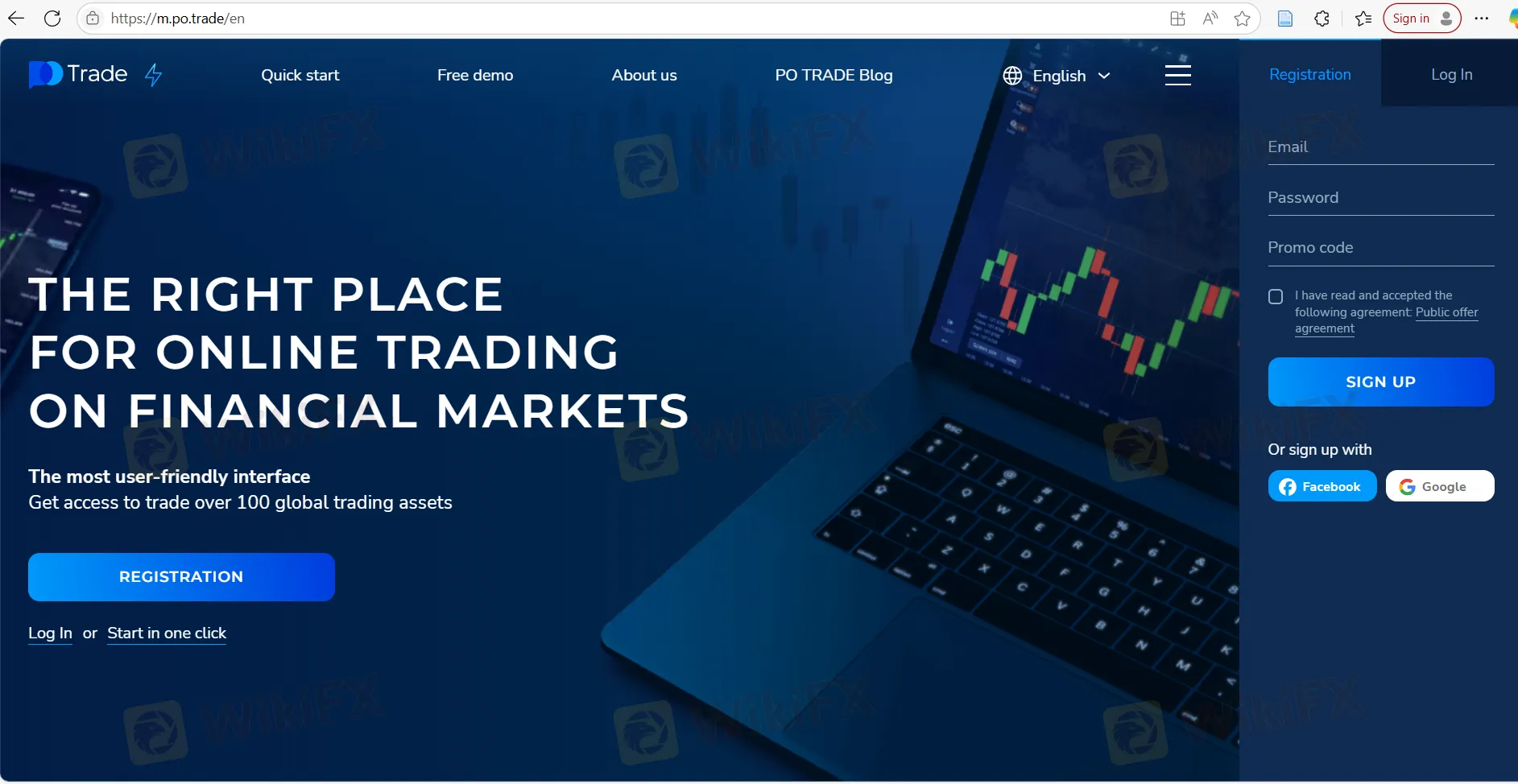

PO TRADE is an online trading platform based in Saint Lucia. It claims to offer 100+ tradable products such as Forex, Commodities, Indexes, Stocks, and Cryptocurrencies. PO TRADE currently operates without regulation. It does not provide services to residents of EEA countries, the USA, UAE, Israel, and other specified countries. The full list of restricted countries can be found in Section 11 of the Terms and Conditions.

| Pros | Cons |

| Wide range of market offerings | No regulation |

| No commission on deposits and withdrawals | Unclear fee structure |

| Various payment methods | Regional restrictions |

PO TRADE has not been regulated by any notable authorities, which indicates that operating trading on this platform can be risky.

PO TRADE asserts to offer 100+ market instruments such as Forex, Commodities, Indices, Stocks, and Cryptocurrencies.

| Trading Asset | Available |

| forex | ✔ |

| commodities | ✔ |

| indices | ✔ |

| stocks | ✔ |

| cryptocurrencies | ✔ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

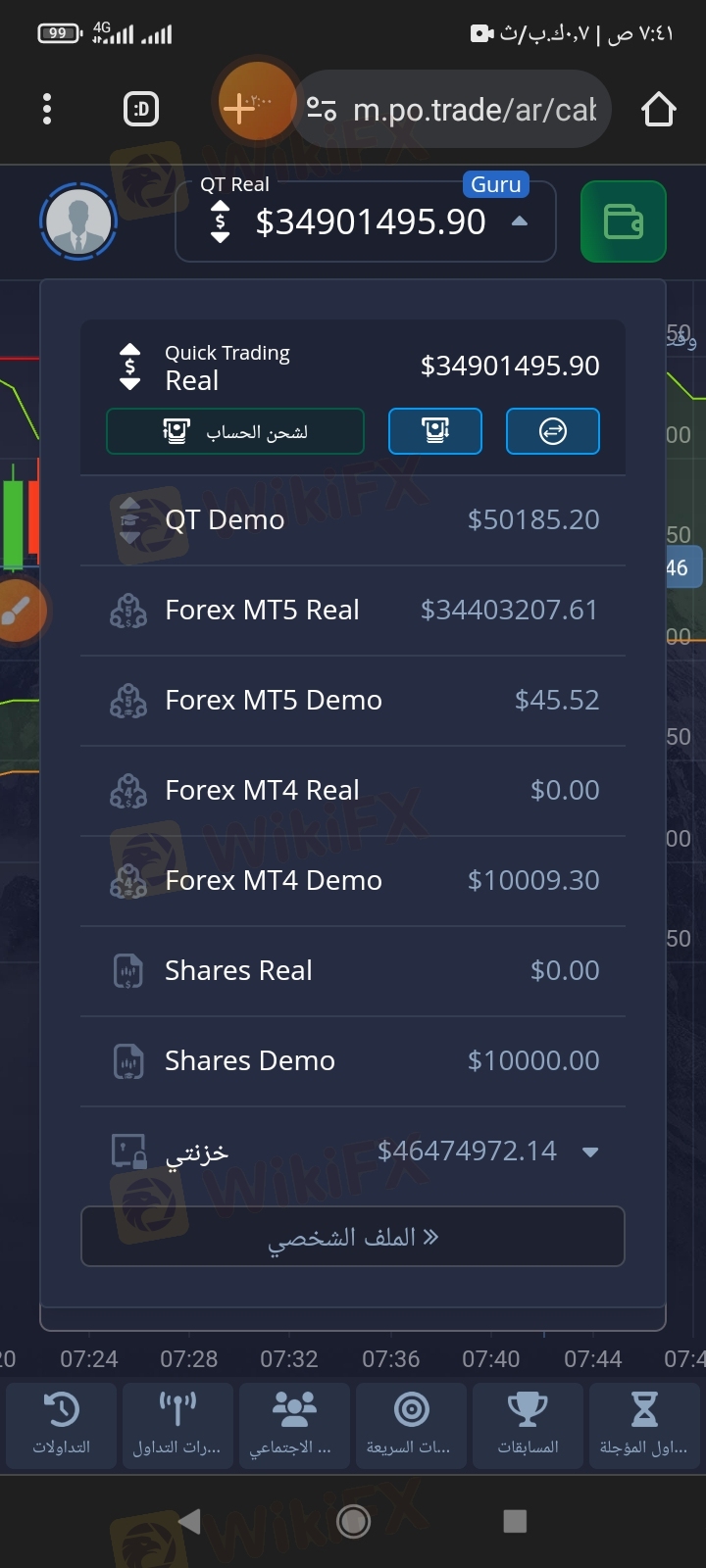

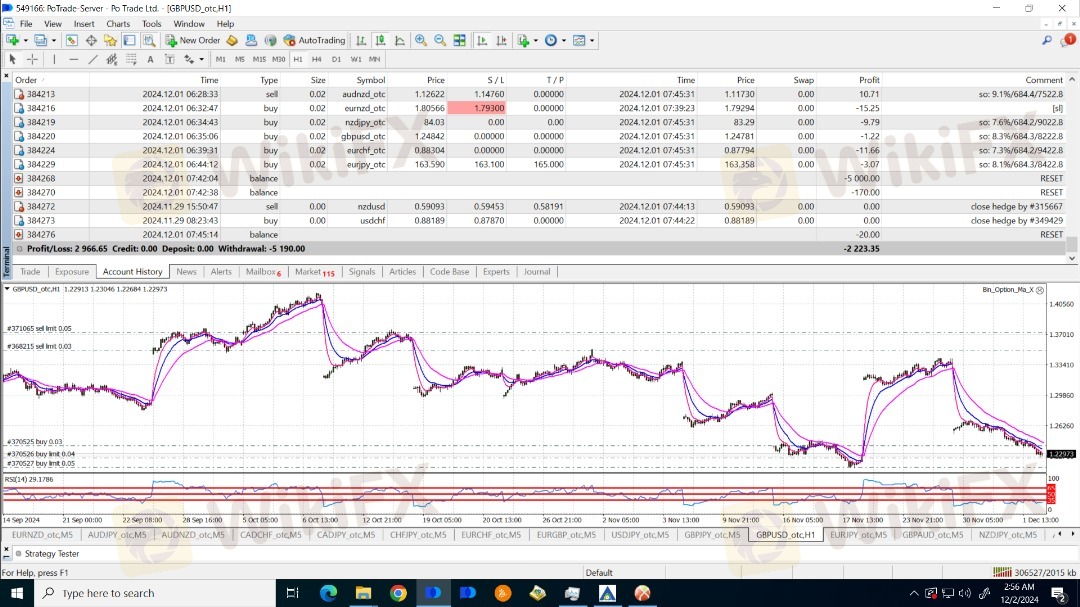

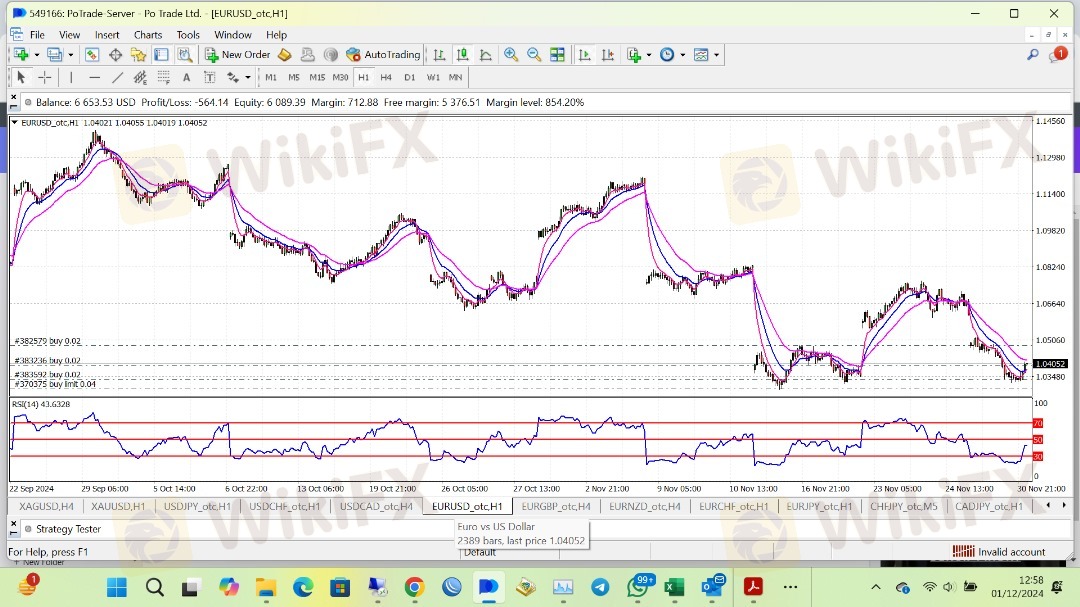

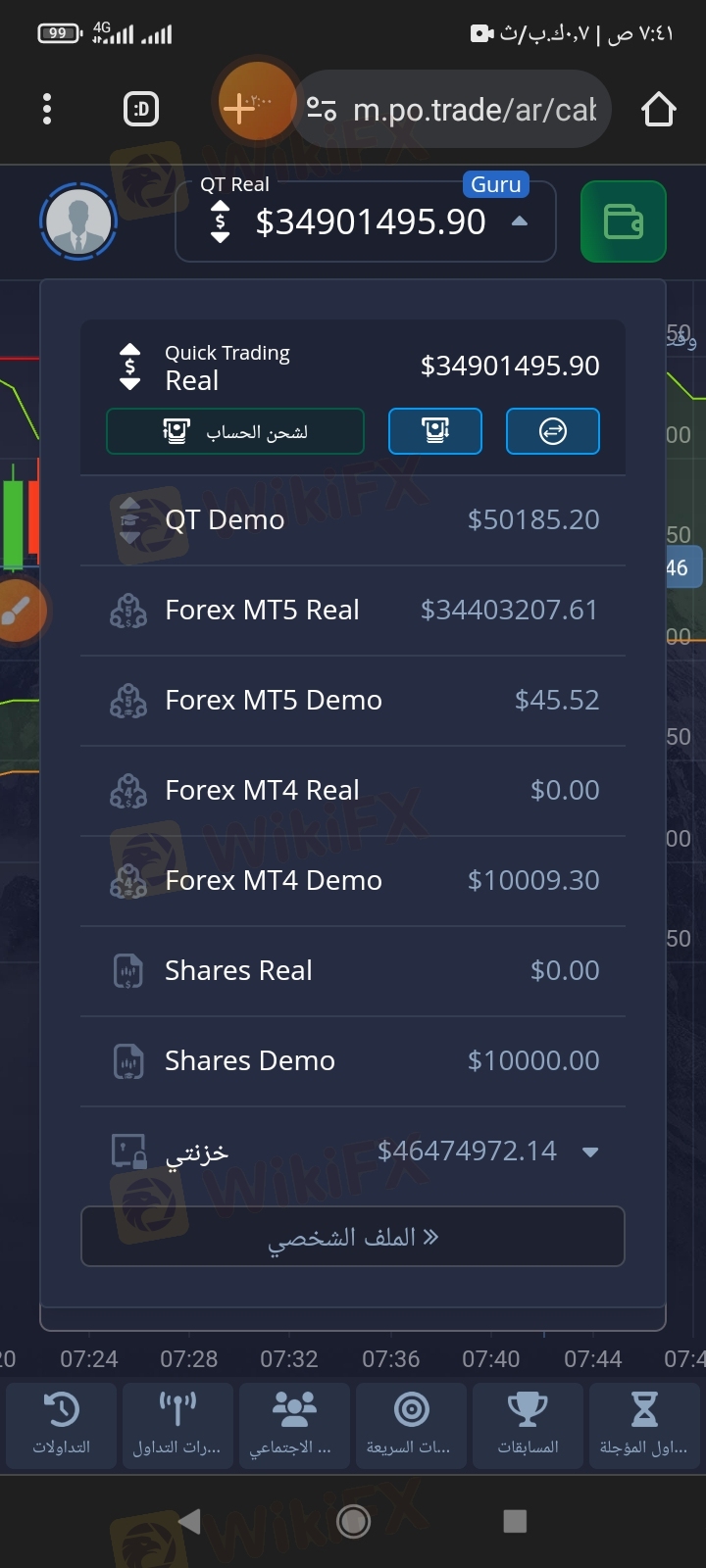

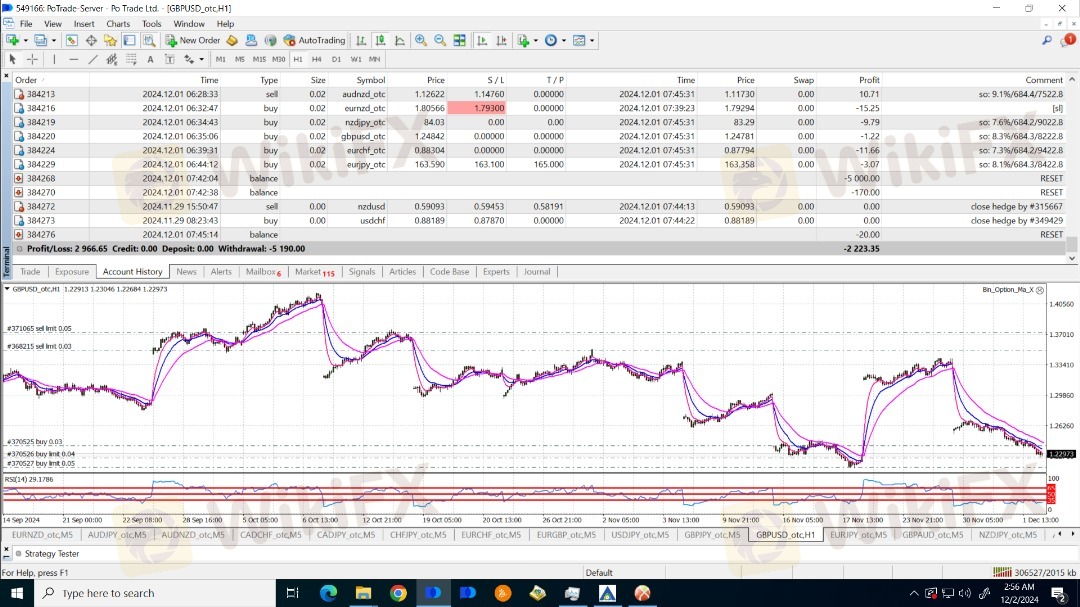

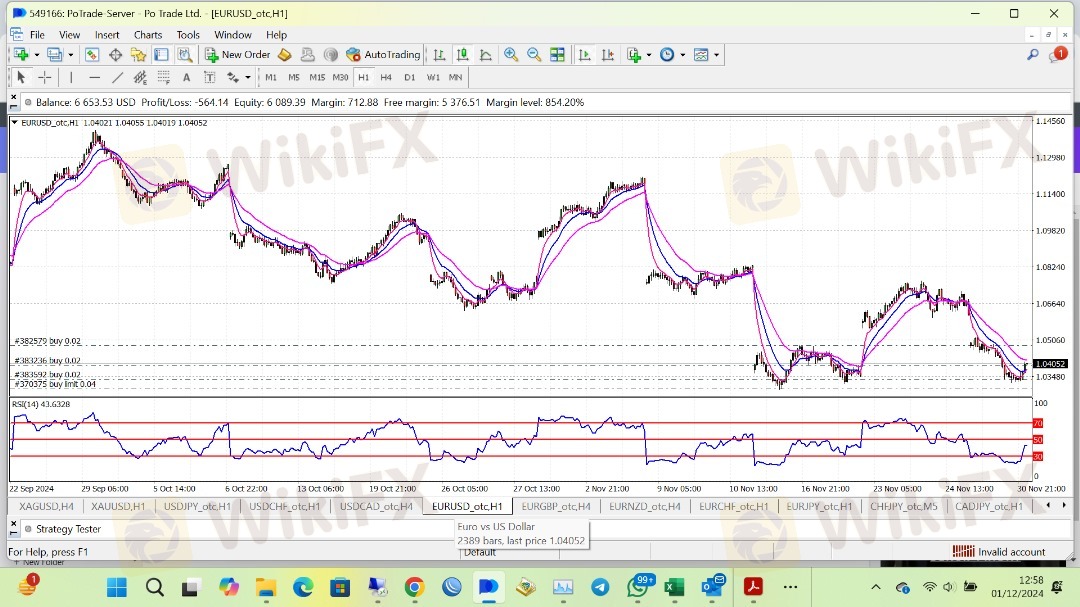

PO TRADE offers a self-developed trading platform called Pocket Broker Trading, available on web, mobile and desktop.

| Trading Platform | Supported | Available Devices | Suitable for |

| Pocket Broker Trading App | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | Desktop, Mobile, Web | Beginners |

| Trading View | ❌ | Desktop, Mobile, Tablets, Web | Beginners |

PO TRADE accepts a variety of payment methods, including 35 E-payments, 39 Cryptocurrencies, 17 Credit Cards, 23 Bank Transfers, 18 Mobile Payments, and 7 Others.

Here are five examples of each payment type.

| Payment Types | Methods |

| E-payments | FasaPay, Binance Pay, PIX, JazzCash, Easypaisa |

| Cryptos | Bitcoin, Ethereum, Tether, Ripple, Cardano |

| Credit Cards | Visa, Mastercard (USD), Visa, Mastercard (EUR), Visa, Mastercard (ZAR), Visa, Mastercard (KZT), Visa, Mastercard, Verve (NGN) |

| Bank Transfers | SPEI, Wise, SEPA Instant, Revolut, SOFORT |

| Mobile Payments | M-Pesa, Airtel, Equitel, Telkom, MTN |

| Others | FAST Havale, Nequi, CoDi, QafPay, CashMaal |

Does your PO TRADE account often witness losses? And as you win trades and earn profits, does the broker block your withdrawal access? Have you faced losses due to manipulative trade practices by the broker? Several traders have reported these experiences online, making us investigate the Saint Lucia-based forex broker. While investigating, we minutely screened these trader reviews of PO TRADE. In this article, we have shared their complaints. Take a look.

WikiFX

WikiFX

Be careful with the brokers you trust with your money. They won’t tell you the risks involved, but it’s important to stay informed and protect your hard-earned savings. This is a SCAM Alert article about PO Trader your funds could be at risk. Stay alert and know the truth.

WikiFX

WikiFX

In the competitive world of forex trading, protecting the rights and interests of traders is paramount. Unfortunately, there are brokers who exploit traders' trust, leading to significant financial losses. One such case involves PO Trade, a forex broker that has come under scrutiny for allegedly defrauding its clients. This article highlights the experience of a victim, Abdel, who claims to have lost over $115 million in profits due to PO Trade’s unethical practices.

WikiFX

WikiFX

The naira confronts a greater degree of economic reduction than the country has witnessed in recent decades as a result of reduced foreign exchange, dwindling foreign capital, rising political risk, and reported poor performance.

WikiFX

WikiFX

More

User comment

6

CommentsWrite a review

2024-12-03 23:58

2024-12-03 23:58

2024-12-02 20:23

2024-12-02 20:23