User Reviews

More

User comment

7

CommentsWrite a review

2024-06-12 05:30

2024-06-12 05:30 2024-05-27 19:24

2024-05-27 19:24

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.27

Risk Management Index0.00

Software Index7.40

License Index0.00

Single Core

1G

40G

More

Company Name

ATM Capital Ltd

Company Abbreviation

ATM Capital Ltd

Platform registered country and region

Saint Lucia

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| ATM Capital Pro Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (offshore) |

| Market Instruments | Forex, energy, metals, stocks, indices, crypto CFDs, cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips (ECN, Pro account) |

| From 1.5 pips (Standard account) | |

| Trading Platform | MT5, web trader |

| Min Deposit | $50 |

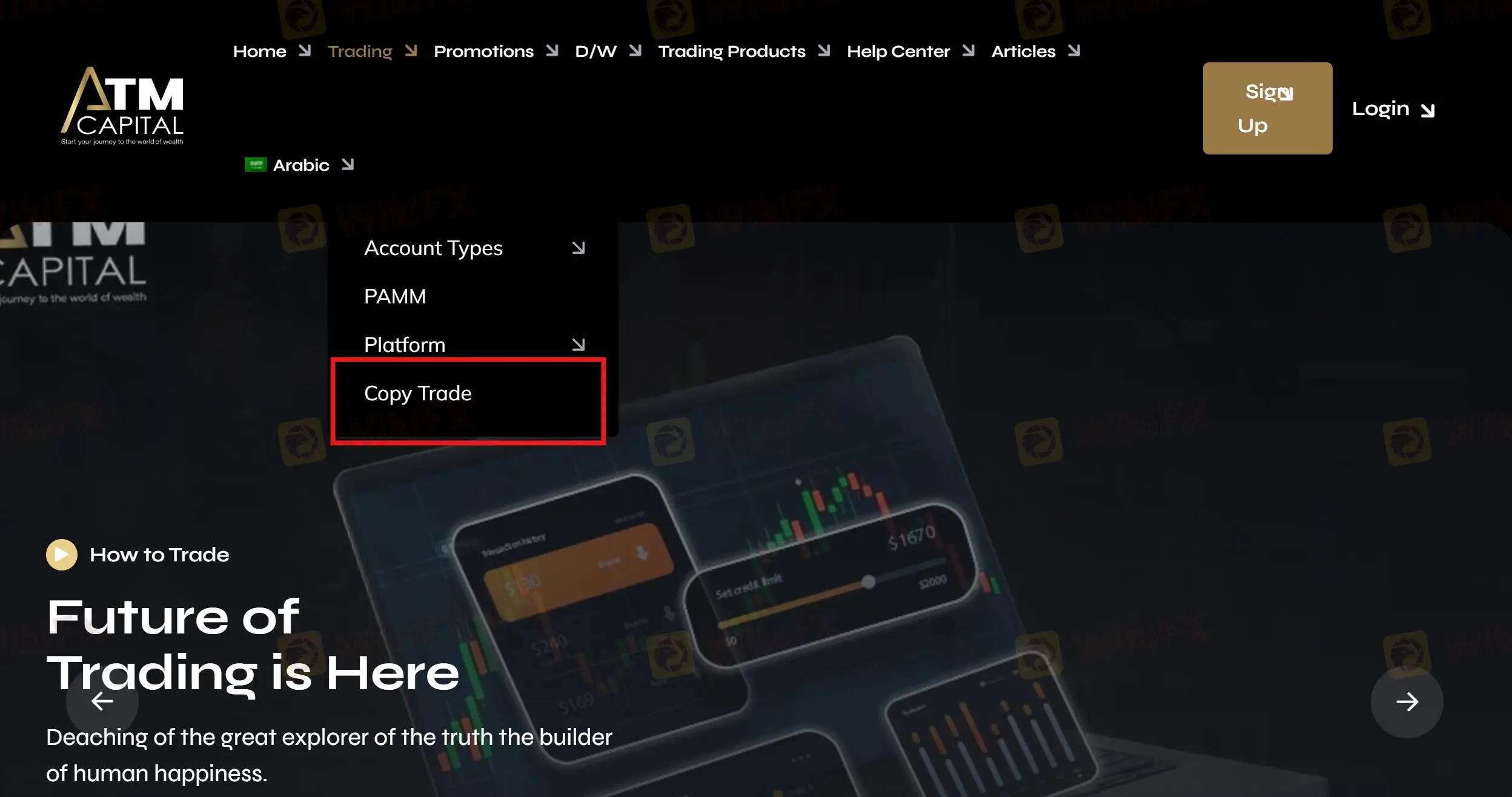

| Copy Trading | ✅ |

| Customer Support | Contact form |

| Tel: +44 7723 488030 | |

| Email: Info@atmcapitalltd.com | |

| Social media: Facebook, Instagram, Twitter, Linkedin | |

ATM Capital Pro was founded in 2022, which is a broker specializing in forex, energy, metals, stocks, indices, and crypto trading. It offers 3 types of accounts, with a minimum deposit of $50 and a maximum leverage of 1:500. Besides, it also provides copy trading services and promotions. However, it is offshore regulated, which means potential risks may exist.

| Pros | Cons |

| Diverse tradable instruments | Offshore regulation risks |

| Demo accounts and Islamic accounts | No live chat support |

| Commission-free accounts offered | |

| Multiple account types | |

| MT5 supported | |

| Copy trading services | |

| Promotions offered | |

| Low minimum deposit | |

| No fees charged for deposit and withdrawal | |

| Popular payment options |

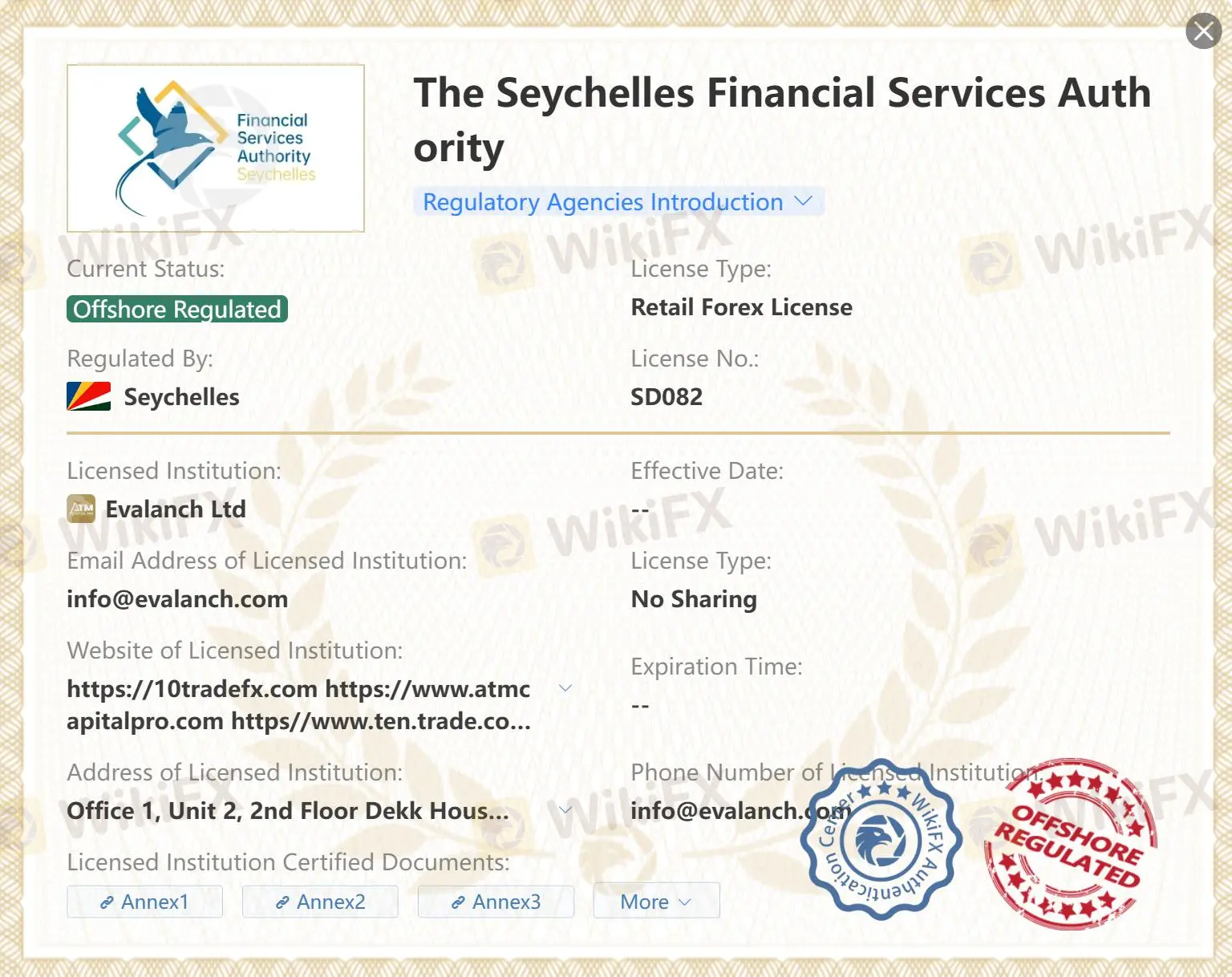

ATM Capital Pro is offshore regulated by The Seychelles Financial Services Authority (FSA). It should be made clear that offshore regulation means that potential risks may exist, and please be aware of that.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| The Seychelles Financial Services Authority (FSA) | Offshore Regulated | Seychelles | Retail Forex License | SD082 |

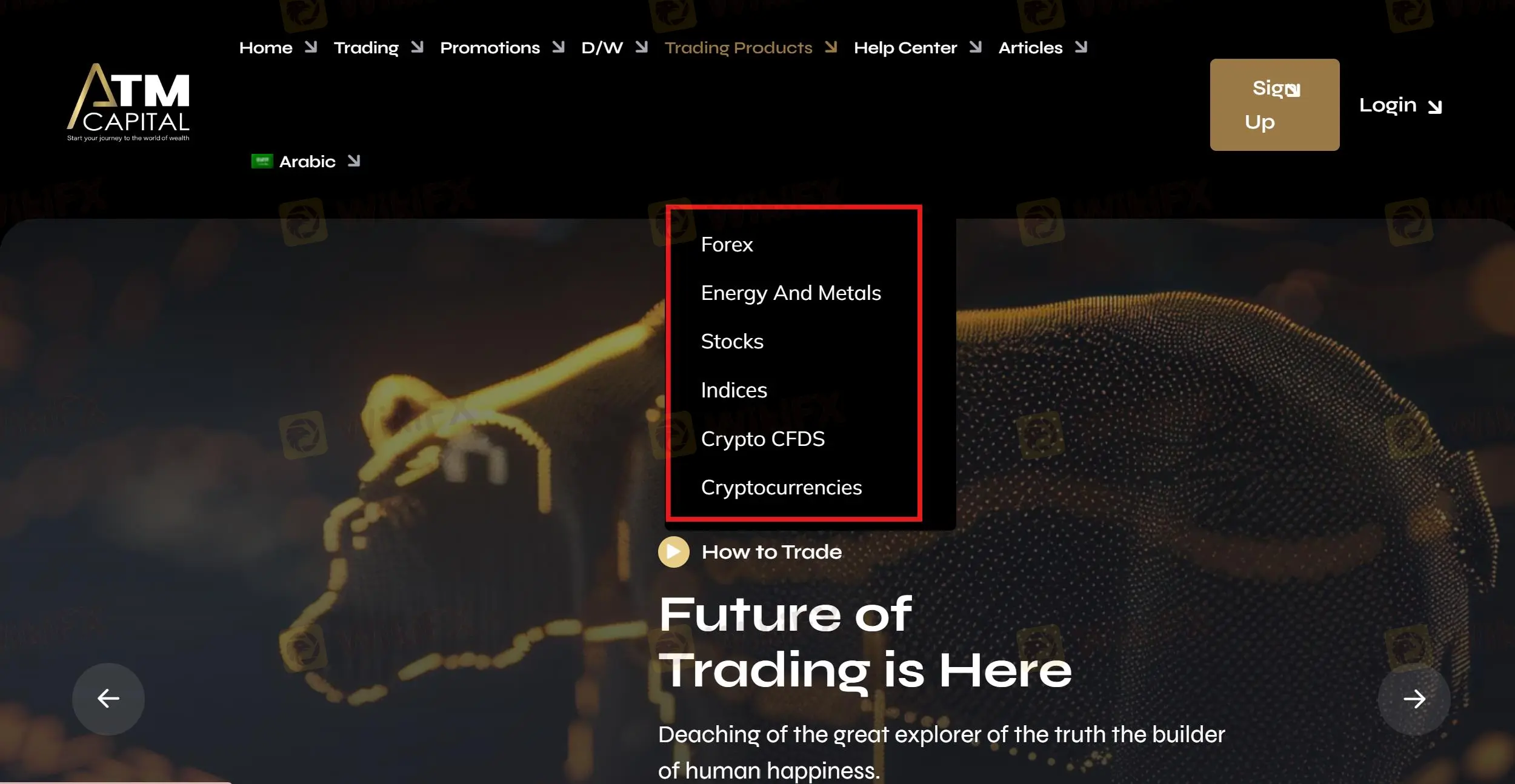

ATM Capital Pro offers different types of products, including forex, energy, metals, stocks, indices, crypto CFDs, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energy | ✔ |

| Metals | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Crypto CFDs | ✔ |

| Crypto Currencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

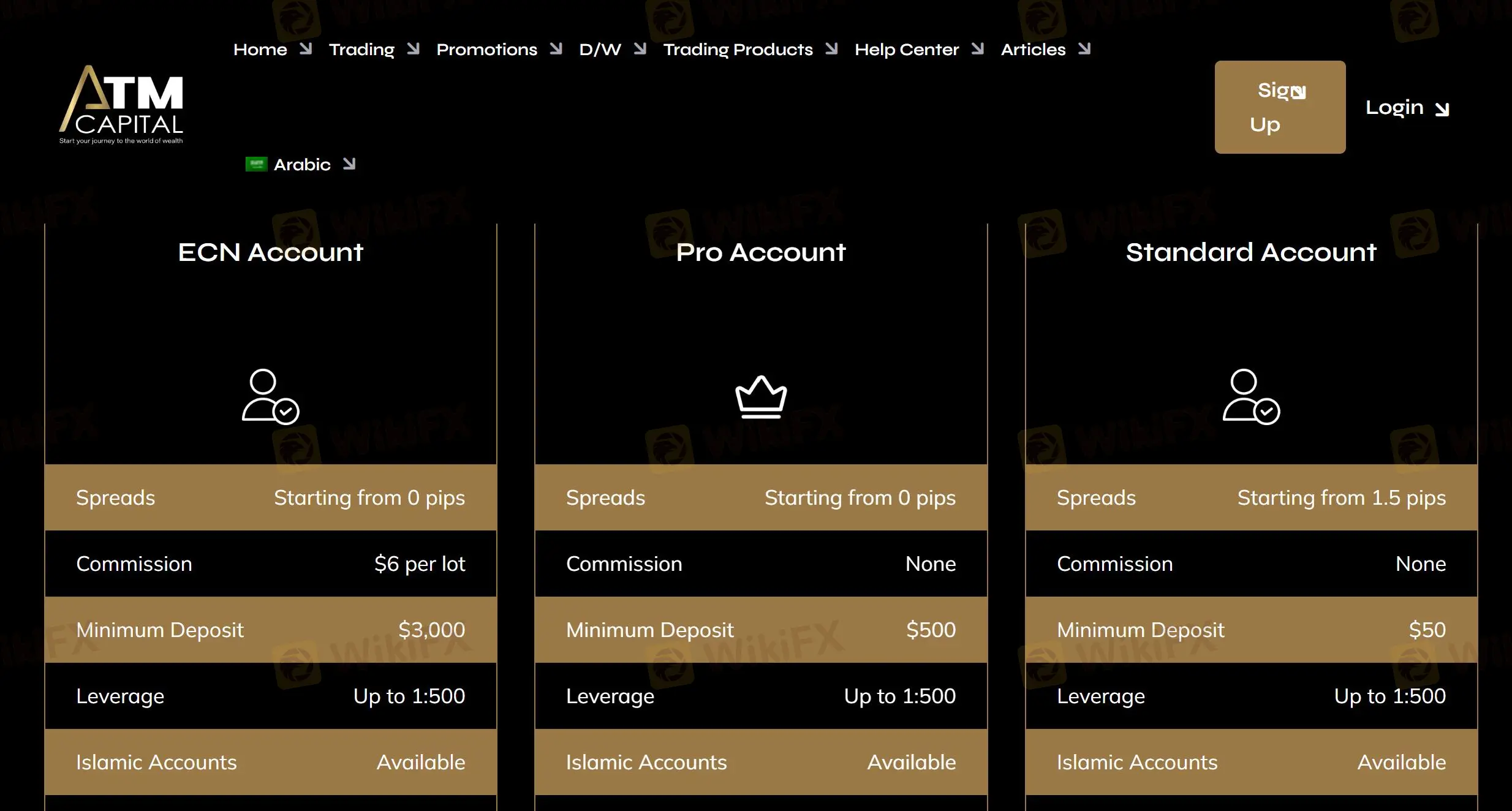

ATM Capital Pro offers 3 types of accounts, including ECN Account, Pro Account, and Standard Account. Moreover, demo accounts and Islamic accounts are also available.

| Account Type | Min Deposit | Max Leverage | Spread | Commission | Islamic Account |

| ECN | $3,000 | 1:500 | From 0 pips | $6 per lot | ✔ |

| Pro | $500 | From 0 pips | ❌ | ✔ | |

| Standard | $50 | From 1.5 pips | ❌ | ✔ |

The leverage for the three types of accounts above can be up to 1:500, which is not low. Please note the potential risks which may be brought by high leverage.

ATM Capital Pro uses MT5 and web trader as its trading platforms.

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Trader | ✔ | Web | / |

| MT5 | ✔ | Web, PC, mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

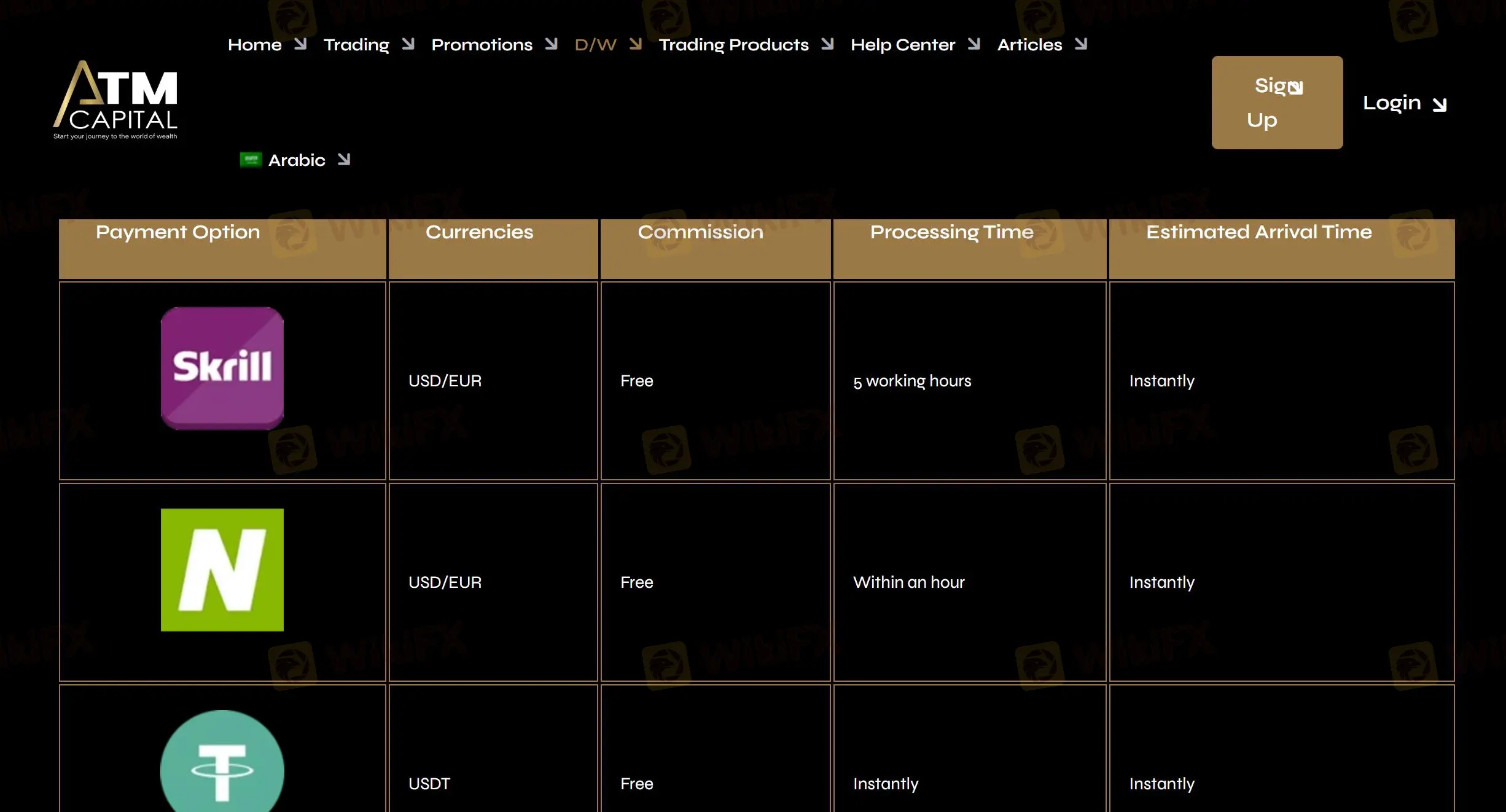

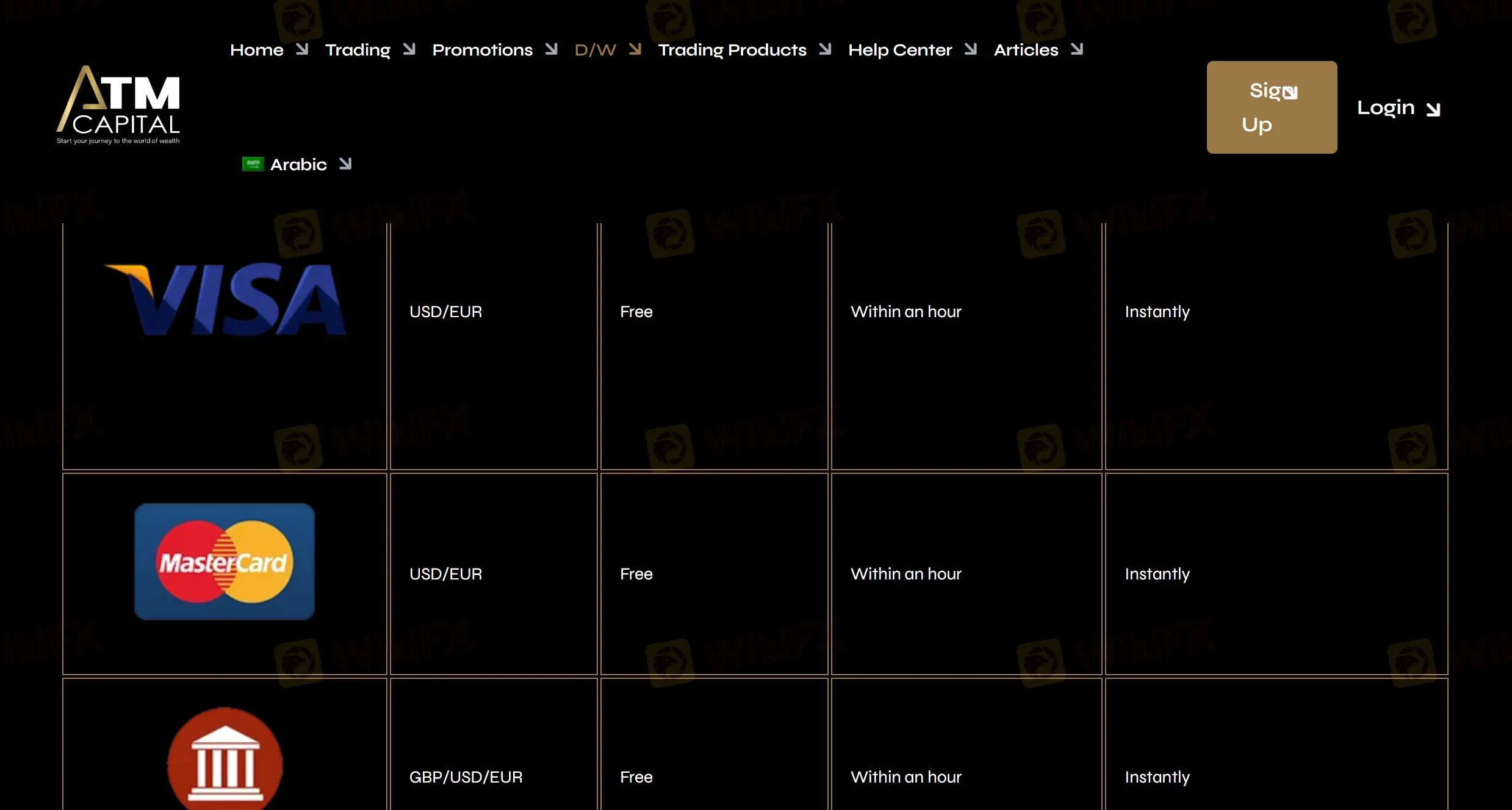

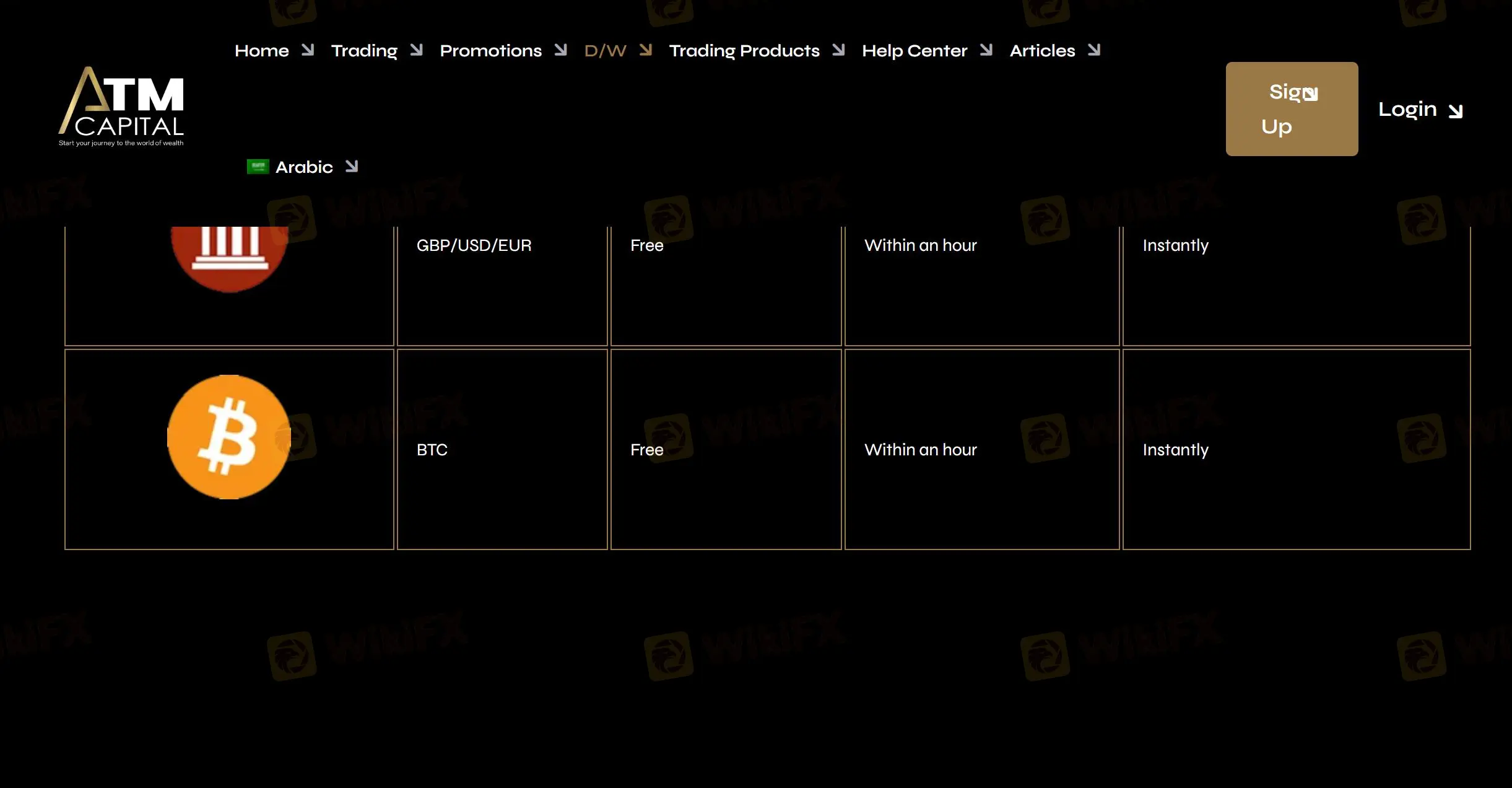

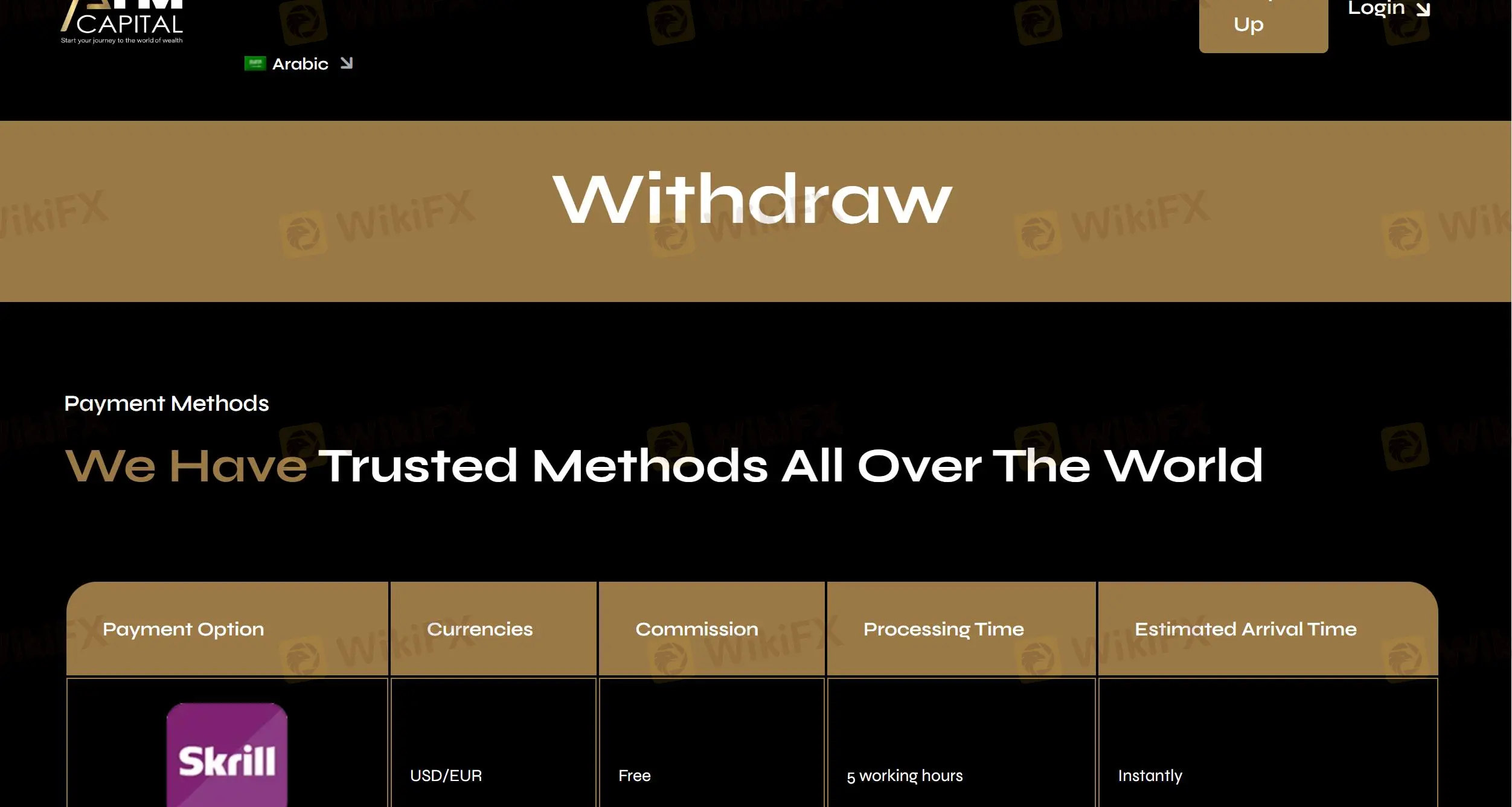

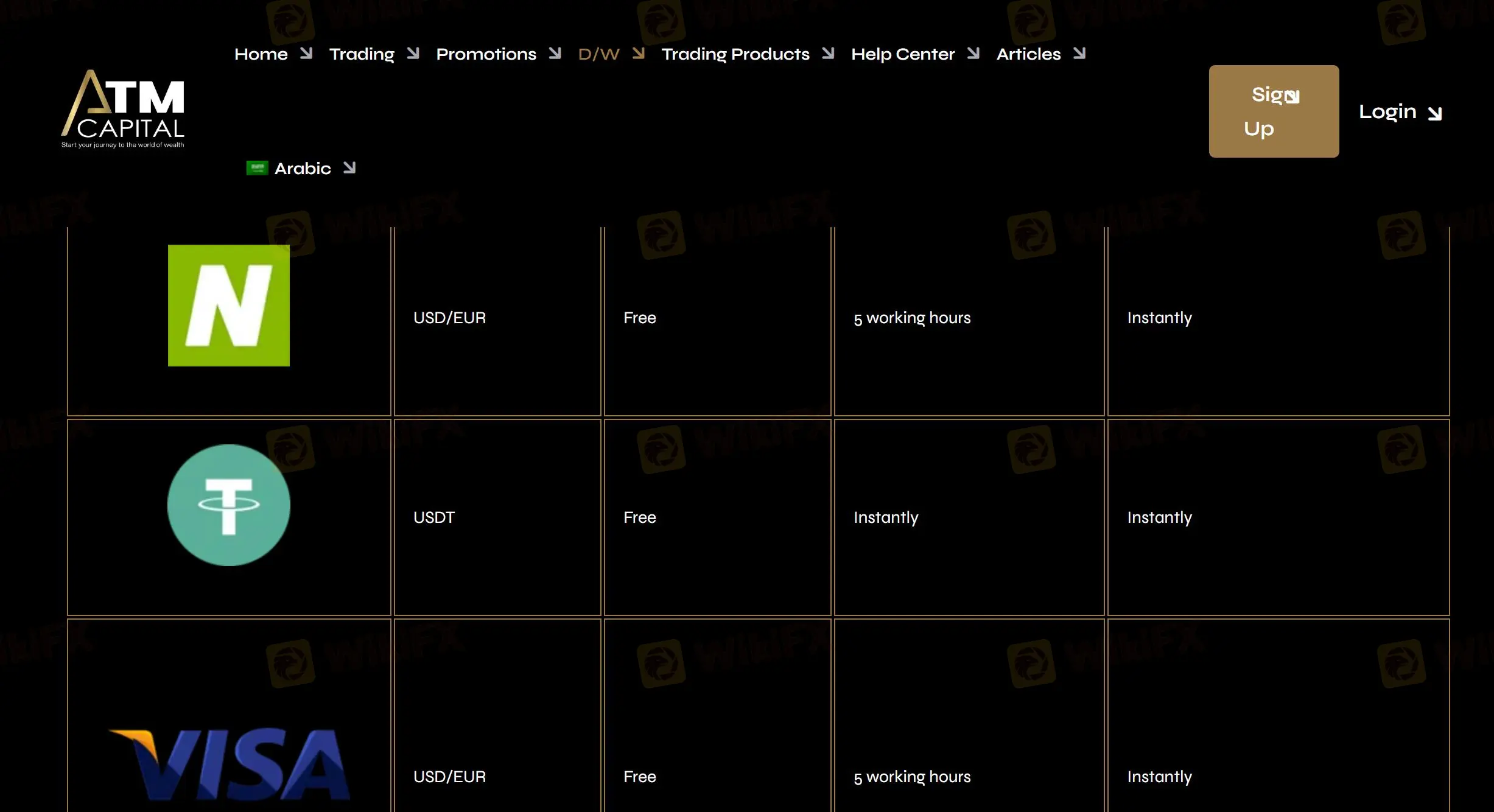

ATM Capital Pro supports several types of payment options, and it does not charge any fees for deposit and withdrawal.

| Payment Options | Accepted Currencies | Comission | Deposit Processing Time | Withdrawal Processing Time |

| Skrill | USD/EUR | ❌ | 5 working hours | 5 working hours |

| Neteller | Within an hour | |||

| Tether | USDT | Instantly | Instantly | |

| VISA | USD/EUR | Within an hour | 5 working hours | |

| MasterCard | ||||

| Bank transfer | GBP/USD/EUR | |||

| Bitcoin | BTC |

ATM Capital Pro offers copy trading services, which means customers can learn from top traders. Besides, it also provides promoting activities and bonuses.

More

User comment

7

CommentsWrite a review

2024-06-12 05:30

2024-06-12 05:30 2024-05-27 19:24

2024-05-27 19:24