User Reviews

More

User comment

2

CommentsWrite a review

2024-02-23 16:36

2024-02-23 16:36 2023-03-24 14:21

2023-03-24 14:21

Score

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.62

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Groww

Company Abbreviation

Groww

Platform registered country and region

India

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Groww Review Summary | |

| Founded | 2016 |

| Registered Country/Region | India |

| Regulation | No regulation |

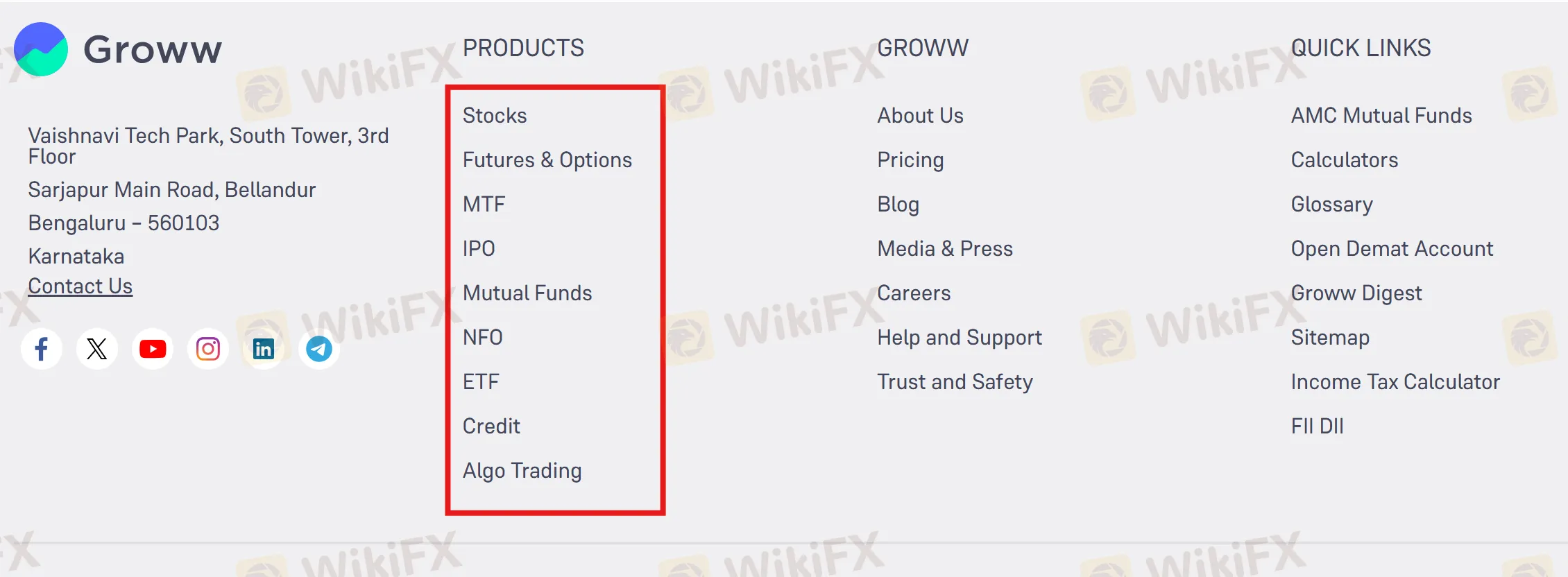

| Products | Stocks, Futures & Options, MTF, IPOs, Mutual Funds, NFOs, ETFs, Credit, and Algo Trading |

| Trading Platform | Groww |

| Minimum Deposit | / |

| Customer Support | Tel: +91 9108800000 |

| Email: support@groww.in | |

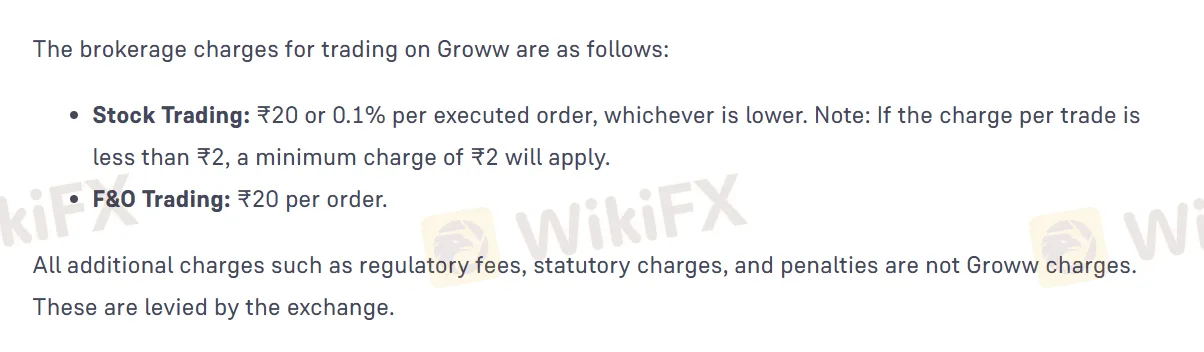

Groww is an Indian investment platform offering diverse market instruments, including Stocks, F&O, Mutual Funds, and ETFs. They offer a free Demat account with zero maintenance charges, with stock trading at ₹20 or 0.1% of order value and F&O at a flat ₹20 per executed order.

| Pros | Cons |

| Various products offered | Unregulated broker |

| Transparent and low trading fees | Trading fees applied |

Groww is an unregulated broker. Please be aware of the risk!

The WHOIS search shows the domain groww.in was registered on April 1st, 2016. Its present state is “client transfer prohibited,” which indicates the domain is locked and cannot be moved to another registrar.

Groww offers a range of products, including Stocks, Futures & Options, MTF (Margin Trading Facility), IPOs, Mutual Funds, NFOs (New Fund Offers), ETFs (Exchange Traded Funds), Credit, and Algo Trading.

Groww offers a free Demat account with zero maintenance charges, making it a trusted platform for over 50 million Indians to open and manage their investment accounts.

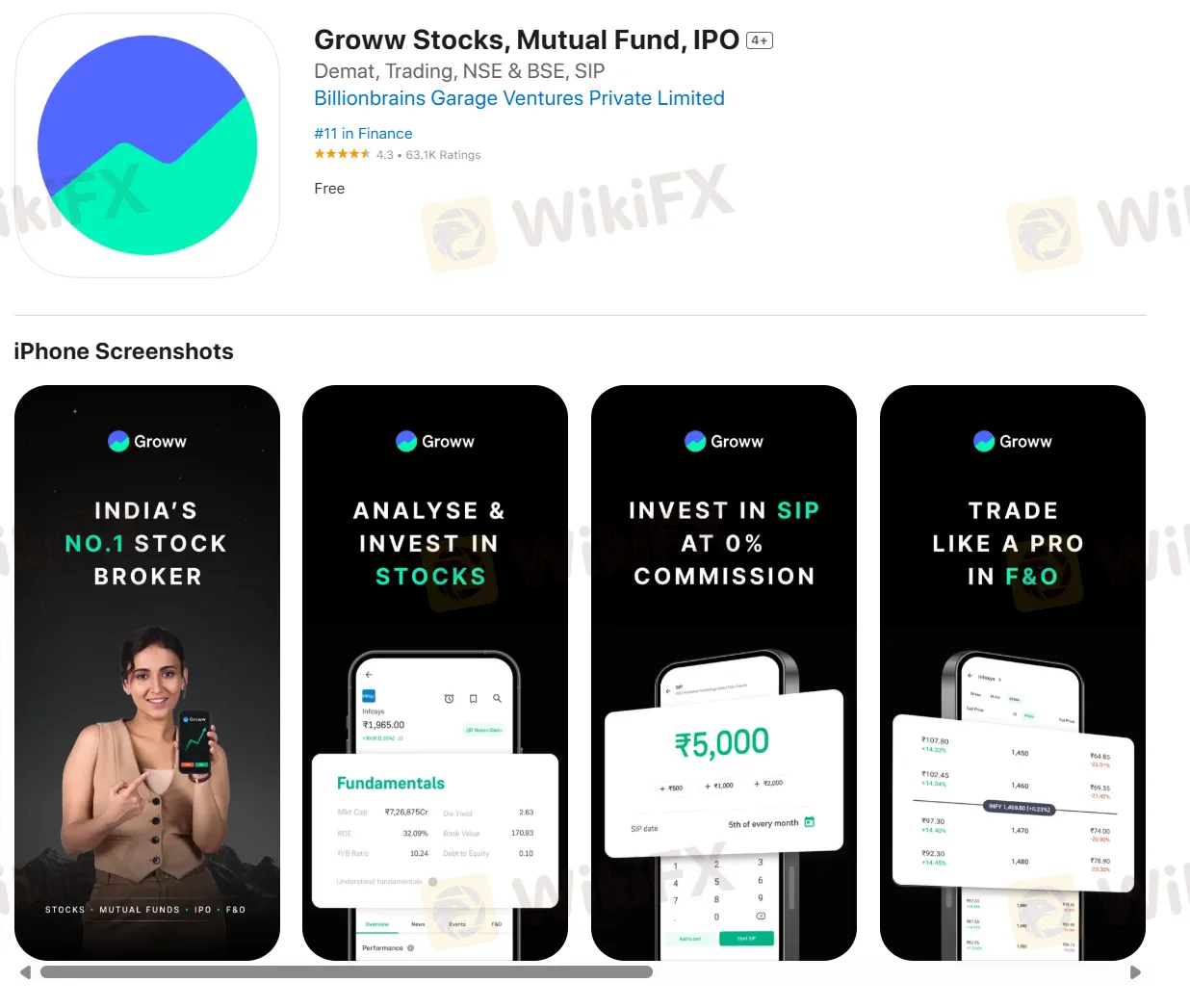

| Trading Platform | Supported | Available Devices |

| Groww | ✔ | Desktop, IOS, Android |

The forex market is increasingly prone to scams, and forex trading has become riskier due to the growing number of fraudulent forex brokers. So, how can you protect yourself and your hard-earned money? Being informed is the most powerful weapon you can use to safeguard yourself. This article aims to raise a fraud alert — read on to learn about the scam brokers you should stay away from and how to spot red flags before it's too late.

WikiFX

WikiFX

Groww is an India-based broker that is gaining popularity rapidly in the country. You will often see its ads on YouTube and other social media platforms. This broker is promoting itself aggressively. But before you invest with this broker, here are 5 red flags you should know.

WikiFX

WikiFX

Groww is an investment platform based in India that offers a variety of market instruments for investment purposes. However, it is important to note that the provided information raises concerns about Groww's legitimacy due to its lack of regulation and low score on WikiFX. Regulatory oversight provides certain protections to investors, and investing with an unregulated entity may involve higher risks.

WikiFX

WikiFX

More

User comment

2

CommentsWrite a review

2024-02-23 16:36

2024-02-23 16:36 2023-03-24 14:21

2023-03-24 14:21