User Reviews

More

User comment

2

CommentsWrite a review

2023-02-27 11:21

2023-02-27 11:21

2022-12-16 17:02

2022-12-16 17:02

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.14

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Sine Vision FX s office website cannot be opened at the moment, we could only piece together a rough picture of this brokerage house through some relevant information from some other websites.

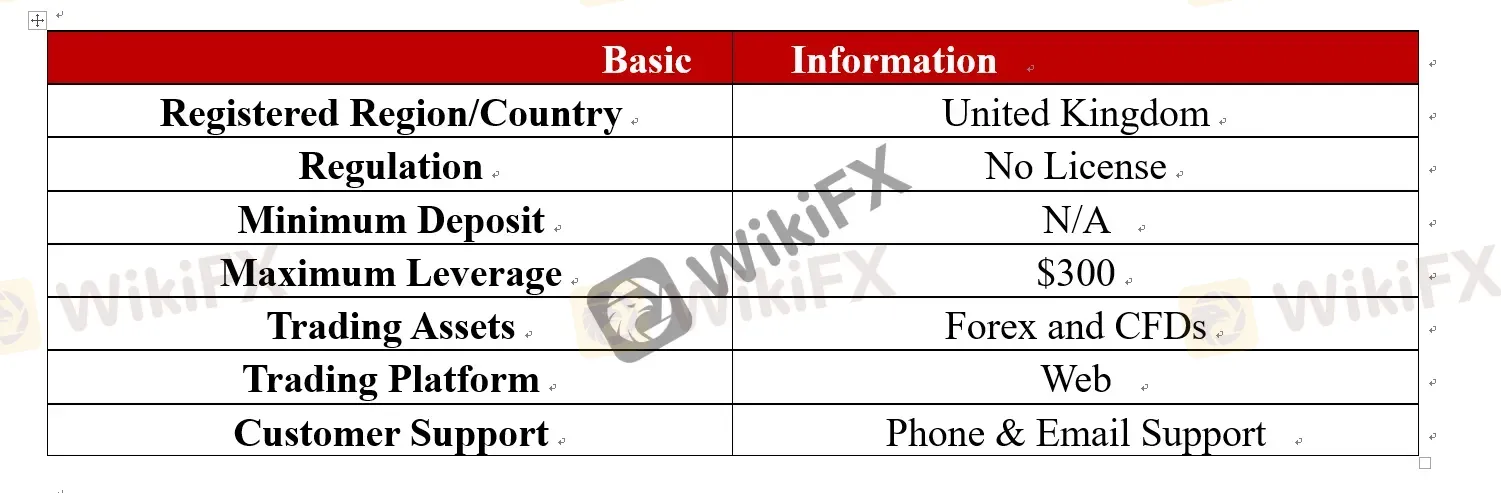

Allegedly registered in the United Kingdom, Vision FX presents itself as an online forex broker offers clients access to a series of forex-related services.

Since Vision FXs official website cannot be opened at the moment, we were unable to get further details on trading assets, leverage, spreads and commissions, and more.

When it comes to regulation, it has been verified that Vision FX is not authorized or regulated authorities. Thats why its regulatory status is marked as “No License” and receives a pretty low score of 1.33/10 on WikiFX.

Vision FX is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like Vision FX carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

Pros and Cons

Vision FX presents a mixed picture for traders. On the positive side, it offers a wide range of tradable assets, including forex, indices, cryptocurrencies, and precious metals, catering to various investment preferences. The availability of both personal and corporate trading accounts provides flexibility. Additionally, the broker's commitment to 24/7 customer support and the introduction of a portfolio diversification tool can be advantageous for traders seeking assistance and risk management. However, Vision FX's lack of regulation raises concerns about fund safety and transparency, and the absence of specific information regarding spreads, commissions, and deposit methods leaves potential clients in the dark regarding trading costs. Careful consideration of these factors is essential before choosing to trade with Vision FX.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Vision FX offers a diverse range of trading instruments to cater to different investment preferences:

FX (Forex): Forex trading with Vision FX is available 24 hours a day, providing opportunities for trading across various global currencies. This market is renowned for its liquidity, making it one of the most liquid markets worldwide.

Index CFDs: Vision FX allows investors to trade index CFDs, including popular indices like the Nikkei 225, NY Dow, and Nasdaq. Notably, Vision FX offers a substantial selection of index patterns, allowing for trading even during nighttime hours and holidays.

Crypto (Cryptocurrency): Vision FX offers cryptocurrency trading, a financial product that has gained significant attention due to its accessibility, allowing investors to start with small amounts.

Metals: Precious metals, known for their ability to retain their value, are also available for investment through Vision FX. This includes trading opportunities in metals like gold and silver.

These diverse trading instruments offer investors various avenues to diversify their portfolios and explore different market opportunities.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| Vision FX | Yes | Yes | Yes | No | Yes | No | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

The minimum deposit to trade with Vision FX is $300, slightly higher than its peers requirements.

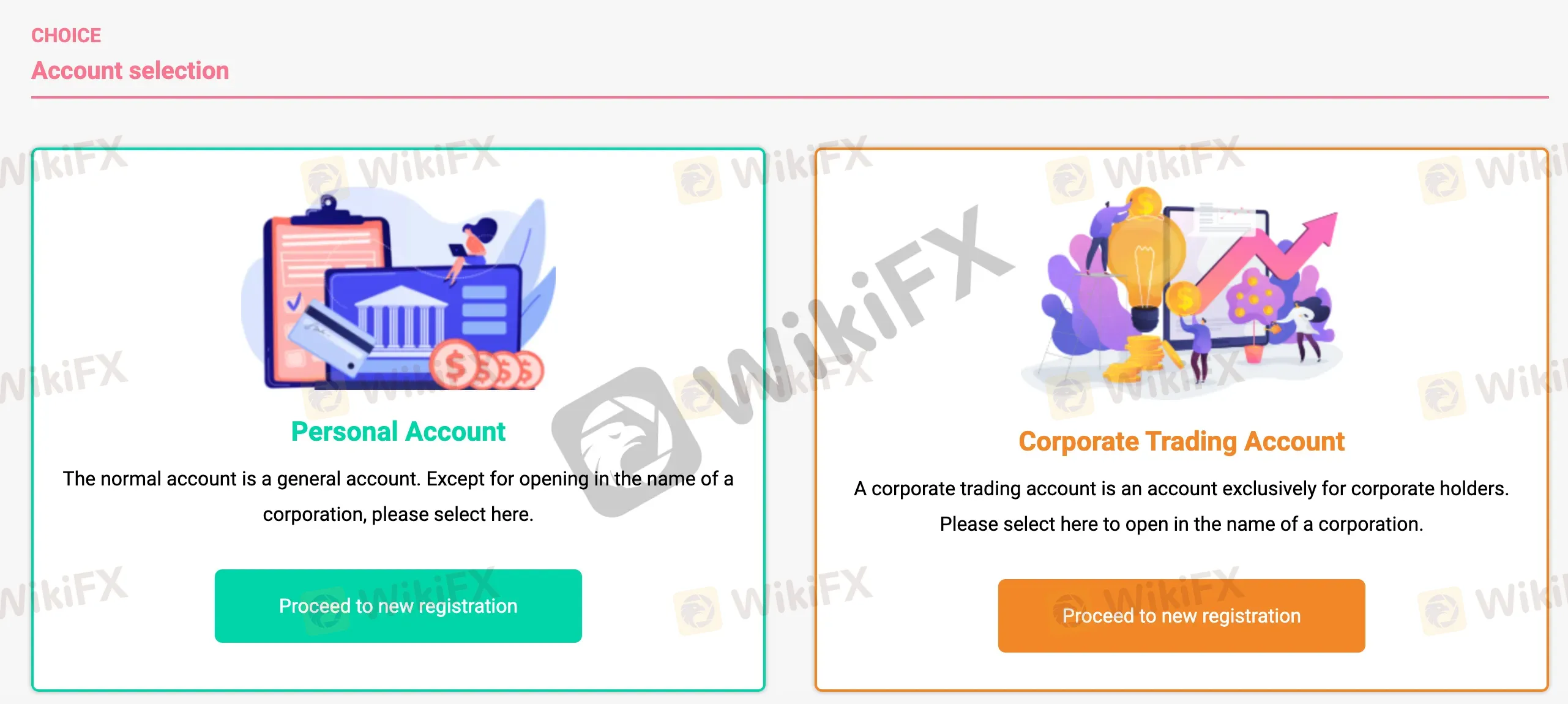

Vision FX offers two distinct account types to cater to the needs of different clients:

Personal Account: The Personal Account is a standard trading account available for individual investors. It is suitable for retail traders who wish to trade in their personal capacity. This account type is ideal for those who are not trading on behalf of a corporation or business entity.

Corporate Trading Account: The Corporate Trading Account is exclusively designed for corporate clients. This account type is intended for businesses and corporations that engage in trading activities. Corporate clients can open and operate trading accounts under the name of their corporation.

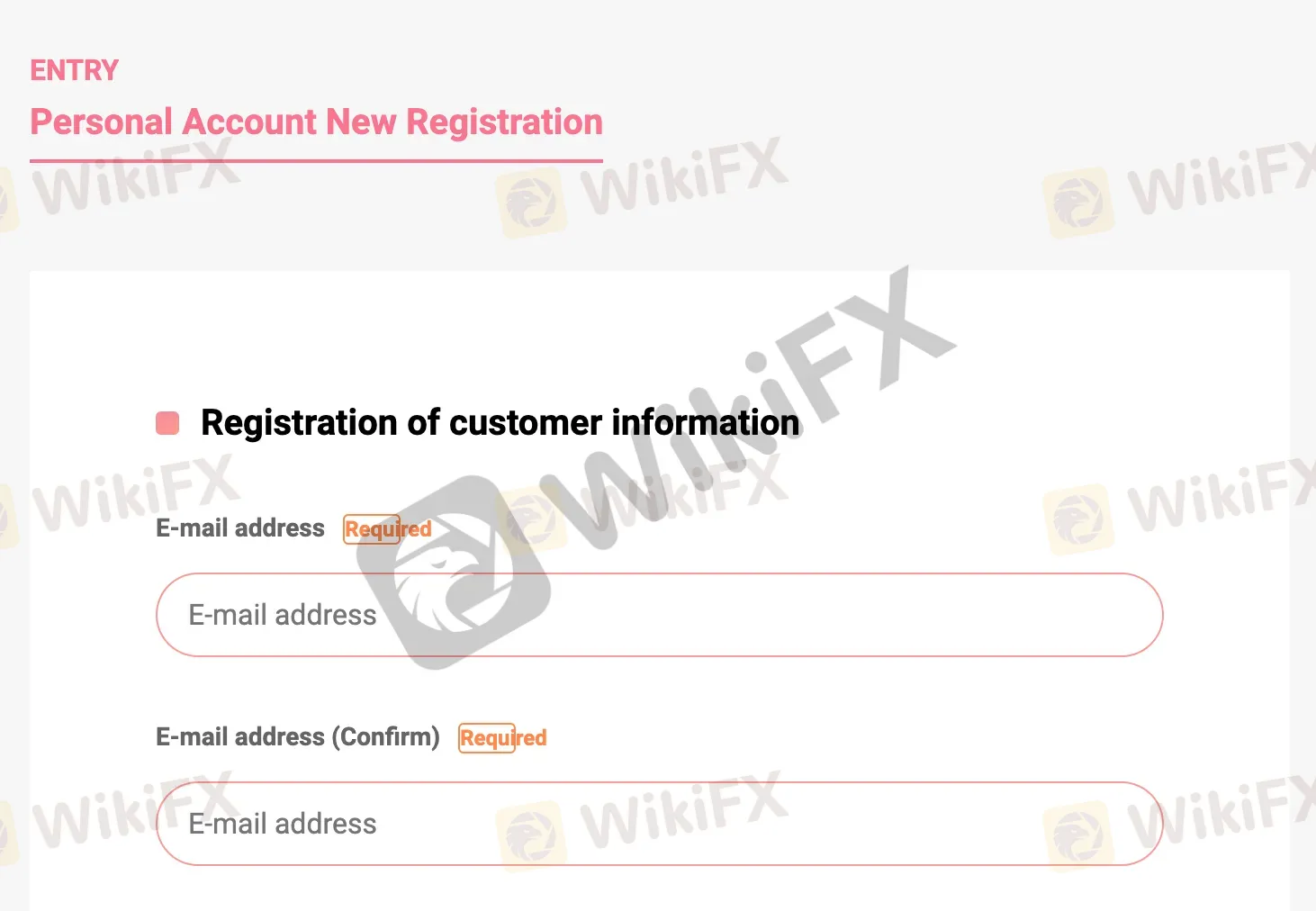

To open an account with Vision FX, follow these steps.

Visit the Vision FX website. Look for the “Open an account” button on the homepage and click on it.

2. Select account type.

3. Sign up on websites registration page.

4. Receive your personal account login from an automated email

5. Log in

6. Proceed to deposit funds to your account

7. Download the platform and start trading

Trading Platform

Vision FX provides its clients access to a simplistic-interfaced web platform where clients can buy and sell assets. Here is the screenshot of what it looks like:

Spreads and Commissions (Trading Fees)

Vision FX emphasizes minimal fees and commissions, allowing traders to potentially maximize their earnings. While the website does not provide specific details regarding spreads and commissions, it highlights the broker's commitment to providing a cost-effective trading environment. This could be particularly appealing to traders looking to minimize their trading costs, especially for long-term investments. However, it's essential for potential clients to review the broker's fee structure thoroughly and contact Vision FX directly for precise information on spreads and commissions applicable to their trading accounts.

Non-Trading Fees

Vision FX explicitly states on its website that there are no account fees or account maintenance fees. This means that traders can open and maintain their accounts without incurring additional costs beyond the usual trading expenses. The absence of these fees can be advantageous for traders who want to avoid unnecessary charges and keep their trading costs to a minimum, contributing to a more cost-effective trading experience with Vision FX.

Trading Platforms

Vision FX provides its traders with access to two powerful and widely recognized trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are available for use on PCs, mobile apps, and through the WebTrader interface.

MetaTrader 4 (MT4) is a popular and user-friendly trading platform known for its robust features and flexibility. It is widely used by traders around the world and offers advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs). Traders can install MT4 on their PCs or use the mobile app version for trading on the go.

MetaTrader 5 (MT5), also available for both PC and mobile app use, is the successor to MT4 and offers even more advanced features. It provides enhanced charting options, additional technical indicators, an economic calendar, and a broader range of trading instruments, including stock CFDs and commodities.

Additionally, Vision FX offers a web-based version of these platforms known as WebTrader, which allows traders to access their accounts and trade from any device with an internet connection, without the need for software installation.

Vision FX offers a trading tool known as “Portfolio Diversify,” which is designed to enhance the trading experience for investors. This tool allows multiple traders to invest in a single trading account, simplifying the process of diversifying portfolios. Diversification is a strategy that involves spreading investments across various assets to reduce risk. By enabling multiple traders to contribute to one account, Vision FX aims to provide investors with a convenient way to achieve portfolio diversification. This can help mitigate the impact of potential losses in any single investment, making it a valuable tool for risk management and enhancing the potential for long-term returns.

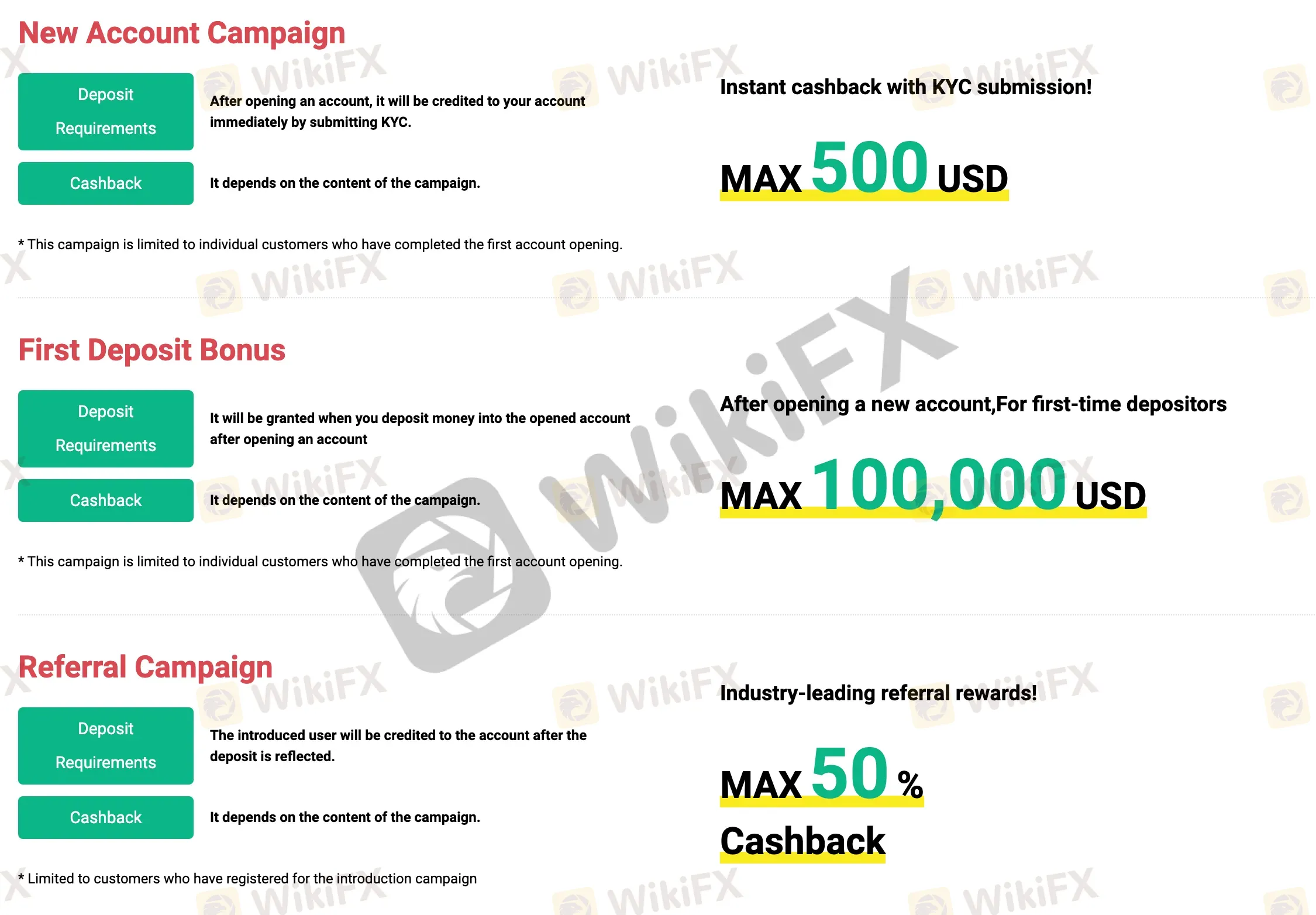

ImProForex offers several enticing bonus campaigns with varying reward amounts to enhance the trading experience for its clients:

1. New Account Campaign: Upon opening a new account and completing the KYC (Know Your Customer) verification process, traders can receive an instant cashback bonus. The specific cashback amount depends on the campaign's terms and conditions, but it's typically a welcome reward for new clients, with a maximum potential reward of up to $500 USD.

2. First Deposit Bonus: ImProForex extends a bonus for first-time depositors. After opening an account, when you make your initial deposit, you become eligible for this bonus. The cashback amount is subject to the campaign's specifics, but it offers substantial potential rewards for first-time depositors, with a maximum bonus of up to $100,000 USD.

3. Referral Campaign: ImProForex encourages clients to refer others to their platform. When introduced users make deposits and meet the campaign requirements, the referrer receives cashback rewards. The percentage of cashback can vary depending on the campaign details, with industry-leading referral rewards of up to 50% of the introduced user's deposits.

These bonus campaigns provide opportunities for traders to receive significant cashback rewards, enhancing their trading capital and potentially increasing their profits. However, it's crucial to thoroughly review the terms and conditions of each campaign, including the specific reward amounts, to understand the requirements and ensure eligibility for the bonuses. Additionally, traders should consider the impact of bonuses on their overall trading strategy and risk management.

Vision FX only accepts crypto deposits, another typical doing of scams. Crypto deposits are final and ineligible for charge back, therefore, defrauded victims have no way to get their money back once deposited if they have used crypto.

Traders with any inquiries or trading-related issues only get in touch with Vision FX through the following channels:

Telephone: (+87) 847-291-4353

Email: support@vision-forex.com

Company Address: 1010 Avenue, NY 90001, USA

Forex trading and online leveraged trading carries substantial risks and may not be appropriate for all investors. You should think long and hard about your goals, financial situation, trading ambitions, and experience level before opting to engage in any forex or CFD trading. The information presented in this article should be used only as a reference.

Q: Is Vision FX a regulated broker?

A: No, Vision FX is not regulated by any recognized financial regulatory authority.

Q: What types of trading accounts does Vision FX offer?

A: Vision FX provides two account types: Personal Accounts for individual traders and Corporate Trading Accounts for businesses.

Q: What trading instruments are available at Vision FX?

A: Vision FX offers a variety of trading instruments, including Forex, Index CFDs, cryptocurrencies, and precious metals like gold and silver.

Q: Are there any fees for opening or maintaining an account with Vision FX?

A: No, Vision FX does not charge account opening or maintenance fees.

Q: What trading platforms are available with Vision FX?

A: Vision FX offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and WebTrader as trading platforms.

More

User comment

2

CommentsWrite a review

2023-02-27 11:21

2023-02-27 11:21

2022-12-16 17:02

2022-12-16 17:02