User Reviews

More

User comment

1

CommentsWrite a review

2023-03-02 16:36

2023-03-02 16:36

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.41

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Company Name | Level Trade |

| Registered Country/Area | Montenegro |

| Years | 1-2 years |

| Regulation | Unregulated |

| Market Instruments | CFDs, Metals, Indices, Shares, and Forex |

| Minimum Deposit | $100 |

| Demo Account | Yes |

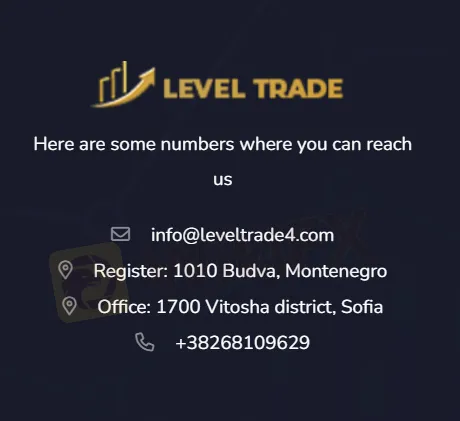

| Customer Support | Email: info@leveltrade4.com and Phone: +38268109629 |

| Educational Resources | For Beginners, Knowledge Base, Helpful Tips, and Things To Consider |

Level Trade is a trading company based in Montenegro, operating in the financial markets for approximately 1-2 years. Notably, the company operates without regulatory oversight, making it an unregulated entity. Despite its relatively short operational history and lack of regulation, Level Trade offers a range of market instruments, including CFDs, Metals, Indices, Shares, and Forex.

Traders interested in opening an account with Level Trade can start with a minimum deposit of $100. Additionally, the company provides a demo account option, allowing traders to practice their strategies and acquaint themselves with the platform before committing real funds.

For customer support inquiries, Level Trade offers two primary channels of communication: email and phone. Traders can reach out to the customer support team via email or by phone.

Recognizing the importance of education in trading, Level Trade provides various resources to support traders at different levels of expertise. The company offers a For beginners, Knowledge Base, Helpful Tips, and Things To Consider.

Level Trade operates as an unregulated trading platform. Users may not have legal recourse in case of disputes or fraudulent activities on the exchange. Without regulation, there are no mandated procedures for handling user complaints or ensuring fair trading practices.

| Pros | Cons |

| A range of market instruments | Lack of regulatory oversight |

| Low minimum deposit requirement | Limited operational history |

| Demo account option | Unregulated status poses potential risks for traders |

| Educational resources available | Limited customer support options |

| Leverage available for trading | / |

Pros:

A range of market instruments: Level Trade offers a wide selection of market instruments, including CFDs, Metals, Indices, Shares, and Forex, providing traders with opportunities for portfolio diversification and trading flexibility.

Low minimum deposit requirement: With a minimum deposit requirement of $100, Level Trade makes trading accessible to a broader range of traders, including those with limited initial capital.

Demo account option: Level Trade provides a demo account option, allowing traders to practice trading strategies and familiarize themselves with the platform's features without risking real money.

Educational resources available: Level Trade offers educational resources such as For Beginners, Knowledge Base, Helpful Tips, and Things To Consider for traders of all levels and provides valuable insights into trading practices.

Leverage available for trading: Level Trade offers leverage for trading, enabling traders to amplify their positions and potentially increase their profits (though it also increases the risk of losses).

Cons:

Lack of regulatory oversight: Level Trade operates as an unregulated platform, which means it may lack the regulatory oversight and investor protections afforded by regulated entities.

Limited operational history: With only 1-2 years of operational history, Level Trade may lack the established track record and credibility compared to more established brokers.

Unregulated status poses potential risks for traders: The absence of regulatory oversight can pose risks for traders, including concerns about fund security, fair trading practices, and dispute resolution.

Limited customer support options: Level Trade offers email and phone support, but the range of customer support options may be limited compared to brokers with more extensive support channels.

Level Trade offers an array of market instruments tailored to meet the trading preferences and strategies of its clientele. These instruments include:

CFDs (Contracts for Difference): CFDs allow traders to speculate on the price movements of various financial instruments without owning the underlying asset. This enables traders to potentially profit from both rising and falling markets, with leverage amplifying potential gains (as well as losses).

Metals: Metals, such as gold and silver, are popular commodities traded for their intrinsic value and as a hedge against inflation or economic uncertainty. Trading metal CFDs allows investors to access these markets with ease, benefiting from their liquidity and potential for diversification.

Indices: Indices represent a basket of stocks from a particular market or sector and serve as a barometer of overall market performance. Trading index CFDs enables investors to speculate on the direction of entire markets or specific sectors, providing opportunities for portfolio diversification and hedging strategies.

Shares: Shares, also known as equities, represent ownership in a company and are traded on stock exchanges. By trading share CFDs, investors can participate in the price movements of individual companies without needing to own the underlying shares outright, allowing for potential profits through capital appreciation and dividends.

Forex (Foreign Exchange): Forex trading involves the exchange of currencies in pairs, such as EUR/USD or GBP/JPY. The forex market is the largest and most liquid financial market globally, offering traders opportunities to profit from fluctuations in exchange rates through leverage, 24-hour trading, and trading strategies.

Opening an account with Level Trade is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the Level Trade website and click “Get Started.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: Level Trade offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the Level Trade trading platform and start making trades.

Customer Support at Level Trade is designed to assist traders promptly and effectively.

Email Support (info@leveltrade4.com): Level Trade offers email support through the address info@leveltrade4.com. This channel allows traders to communicate with the customer support team by sending inquiries, requests, or concerns via email. Email support provides a formal and documented means of communication, enabling traders to articulate their issues comprehensively and attach relevant documents or screenshots as needed. While response times may vary, email support ensures that traders can seek assistance and resolve inquiries at their convenience, without the need for immediate interaction.

Phone Support (+38268109629): Level Trade provides phone support via the number +38268109629, allowing traders to directly contact the customer support team for real-time assistance. This channel offers immediate access to customer support representatives, enabling traders to discuss account-related matters, seek guidance on trading inquiries, or resolve urgent issues promptly. Phone support facilitates personalized communication and provides a direct line of contact for traders who prefer verbal interaction or require immediate assistance. By offering phone support, Level Trade aims to enhance the overall customer experience and ensure that traders receive timely and effective support when needed.

Level Trade offers a comprehensive set of educational resources tailored to traders of all levels.

For beginners, these resources provide foundational knowledge and guidance to kickstart their trading journey.

The Knowledge Base serves as a repository of essential information, covering topics such as trading basics, terminology, and platform navigation.

Additionally, Helpful Tips offer practical insights and strategies to help traders improve their skills and decision-making.

Moreover, Things To Consider provides valuable guidance on risk management, market analysis, and trading psychology, empowering traders to make informed decisions in the financial markets.

In summary, Level Trade offers a wide variety of trading options and allows traders to start with a low deposit. It also provides a demo account for practice and educational resources for learning.

However, it lacks regulatory oversight, which could pose risks, especially considering its limited history. Also, customer support options are somewhat limited. While trading with leverage is possible, traders should carefully consider the potential risks involved.

Q: What is the minimum deposit required to start trading with Level Trade?

A: The minimum deposit required to open an account with Level Trade is $100.

Q: Does Level Trade offer a demo account?

A: Yes, Level Trade provides a demo account option for traders to practice trading strategies and familiarize themselves with the platform before trading with real money.

Q: How can I contact Level Trade's customer support?

A: You can contact Level Trade's customer support team via email at info@leveltrade4.com or by phone at +38268109629.

Q: What educational resources does Level Trade offer?

A: Level Trade offers educational resources for traders of all levels, including beginners. These resources include a Knowledge Base, Helpful Tips, and Things To Consider.

Q: What market instruments can I trade with Level Trade?

A: Level Trade offers trading in a variety of instruments, including CFDs, Metals, Indices, Shares, and Forex.

Q: Can I trade with leverage on Level Trade?

A: Yes, Level Trade offers trading with leverage, allowing traders to amplify their positions and potential profits (as well as losses).

More

User comment

1

CommentsWrite a review

2023-03-02 16:36

2023-03-02 16:36