User Reviews

More

User comment

4

CommentsWrite a review

2024-03-25 01:02

2024-03-25 01:02

2024-02-01 10:44

2024-02-01 10:44

Score

5-10 years

5-10 yearsSuspicious Regulatory License

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.16

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

BANKING CIRCLE

Company Abbreviation

BANKING CIRCLE

Platform registered country and region

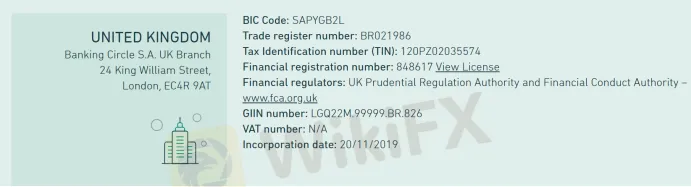

United Kingdom

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Information | Details |

| Company Name | Banking Circle |

| Founded | 2016 |

| Mission | To reduce the time and cost of cross-border transactions |

| Services | Multi-currency settlement accounts, safeguarding accounts, operational accounts, virtual accounts, payments on behalf of (POBO) & collections on behalf of (COBO), marketplace collections, local payments, cross-border payments, foreign exchange, SEPA direct debit, GBP faster payments, guaranteed FX rates, and agency banking |

| Notable Clients | Stripe, Alibaba, Paysafe, Nuvei, PPRO, Checkout.com, Paymentsense |

| Contact Information | info@bankingcircle.com |

| Registered Office | 14, Porte de France, L-4360 Esch-sur-Alzette, Luxembourg |

| Website | www.bankingcircle.com |

Banking Circle is a fully licensed Payments Bank designed to cater to the global banking and payment needs of Payment businesses, Banks, and Marketplaces. Through their API, they deliver fast, low-cost global payments and banking services by connecting to the world's clearing systems. This enables their clients to move liquidity in real-time for all major currencies securely and compliantly.

Banking Circle's solutions power the payment propositions of over 250 regulated businesses, Financial Institutions, and Marketplaces, allowing them to extend their geographic reach and access the markets their customers wish to trade in. In 2021 alone, they processed over 250 billion Euros in payment volumes, accounting for over 10% of Europe's B2C e-commerce flows.

| Year | Milestone |

| 2016 | Launch of Banking Circle |

| 2018 | Acquired by EQT VIII and EQT Ventures |

| 2021 | Processed over 250 billion Euros in payment volumes |

| 2022 | Doubled their client base to over 250 regulated businesses, Financial Institutions, and Marketplaces |

Banking Circle was acquired by EQT VIII and EQT Ventures, in partnership with Banking Circles founders, in September 2018. They have over 450 employees across four locations: Luxembourg, London, Copenhagen, and Munich.

| Location | Details |

| Luxembourg | Headquarters |

| London | Office |

| Copenhagen | Office |

| Munich | Office |

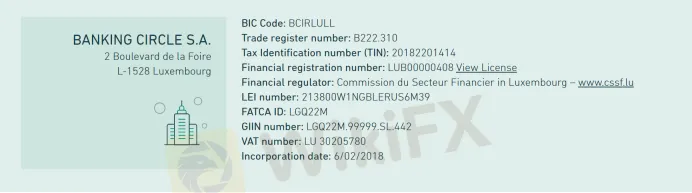

No Regulation. Although they claim the following on their official website:

Banking Circle has been granted authorization as a credit institution under point (1) of Article 4(1) of Regulation (EU) No 575/2013, (Bank number LUB00000408) and is under the supervision of the Luxembourg Commission for the Financial Sector.

The services provided by Banking Circle can be categorized as follows:

Payment Business Solutions: This includes various types of accounts (Multi-currency Settlement Accounts, Safeguarding Accounts, Operational Accounts, Virtual Accounts, Payments On Behalf Of (POBO) and Collections On Behalf Of (COBO), Marketplace Collections), payment methods (Local Payments, Cross-border Payments, Foreign Exchange, SEPA Direct Debits, GBP Faster Payments), foreign exchange services (Multi-currency Payments, FX Trading, Guaranteed FX Rates), and agency banking.

Bank Services: This includes Accounts & Virtual Solutions (Virtual Accounts for Banks, POBO & COBO, Reconciliation Solutions for Financial Markets, Settlement Accounts, Operational Accounts), Payments & Correspondent Banking (Local Collections and Payments, Cross-border Payments, SEPA Direct Debits, GBP Faster Payments, Multi-currency Payments, FX Trading), and Agency Banking for Banks.

Marketplace Solutions: This includes Collections for Sellers via Virtual Accounts, Multi-currency Settlement Accounts, and payment methods (Local Payments and Collections, Cross-border Collections, Foreign Exchange, SEPA Direct Debits).

Here is a detailed table of these services:

| Service Category | Subcategory | Service Content |

| Payment Business Solutions | Account Types | Multi-currency Settlement Accounts, Safeguarding Accounts, Operational Accounts, Virtual Accounts, Payments On Behalf Of (POBO) and Collections On Behalf Of (COBO), Marketplace Collections |

| Payment Business Solutions | Payment Methods | Local Payments, Cross-border Payments, Foreign Exchange, SEPA Direct Debits, GBP Faster Payments |

| Payment Business Solutions | Foreign Exchange Services | Multi-currency Payments, FX Trading, Guaranteed FX Rates |

| Payment Business Solutions | Agency Banking | - |

| Bank Services | Accounts & Virtual Solutions | Virtual Accounts for Banks, POBO & COBO, Reconciliation Solutions for Financial Markets, Settlement Accounts, Operational Accounts |

| Bank Services | Payments & Correspondent Banking | Local Collections and Payments, Cross-border Payments, SEPA Direct Debits, GBP Faster Payments, Multi-currency Payments, FX Trading, Agency Banking for Banks |

| Marketplace Solutions | Collections for Sellers via Virtual Accounts | - |

| Marketplace Solutions | Multi-currency Settlement Accounts | - |

| Marketplace Solutions | Payment Methods | Local Payments and Collections, Cross-border Collections, Foreign Exchange, SEPA Direct Debits |

Banking Circle's solutions power the payments propositions of more than 250 clients, enabling them to gain the geographic reach and access to the markets in which their own customers want to trade. Their clients include Payments businesses, Banks, and Marketplaces. Some of their notable clients include Ixaris, Nuvei, and Paysafe.

Jeremy Büttner, Head of Banking Partnerships, EMEA, Stripe, says, “We selected Banking Circle for their technical platform. We believe in Banking Circles vision and execution of building best-in-class financial infrastructure for service companies like Stripe.”

For more information about Banking Circle, you can visit their website at www.bankingcircle.com or contact them via email at info@bankingcircle.com. Their registered office is located at 14, Porte de France, L-4360 Esch-sur-Alzette, Luxembourg.

Banking Circle is a global B2B banking services provider that offers solutions for payments businesses, banks, and marketplaces. It aims to provide cross-border payments, access to a global network of clearing and settlement, and global payments in 24 currencies, including local clearing in 11 currencies. It offers a variety of ways to connect to its payments technology, including API, Client Portal, or SWIFT, and it is underpinned by market-leading secure and compliant AML.

On the other hand, specific cons or negative aspects about the company are not readily available from the google search results. It's recommended to look at specific user reviews or employee feedback for more detailed pros and cons.

More

User comment

4

CommentsWrite a review

2024-03-25 01:02

2024-03-25 01:02

2024-02-01 10:44

2024-02-01 10:44