User Reviews

More

User comment

2

CommentsWrite a review

2023-10-10 16:47

2023-10-10 16:47 2023-03-14 13:59

2023-03-14 13:59

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.46

Risk Management Index0.00

Software Index4.00

License Index0.00

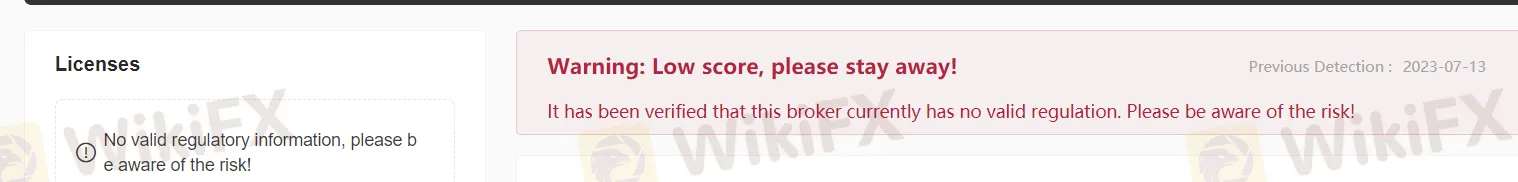

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

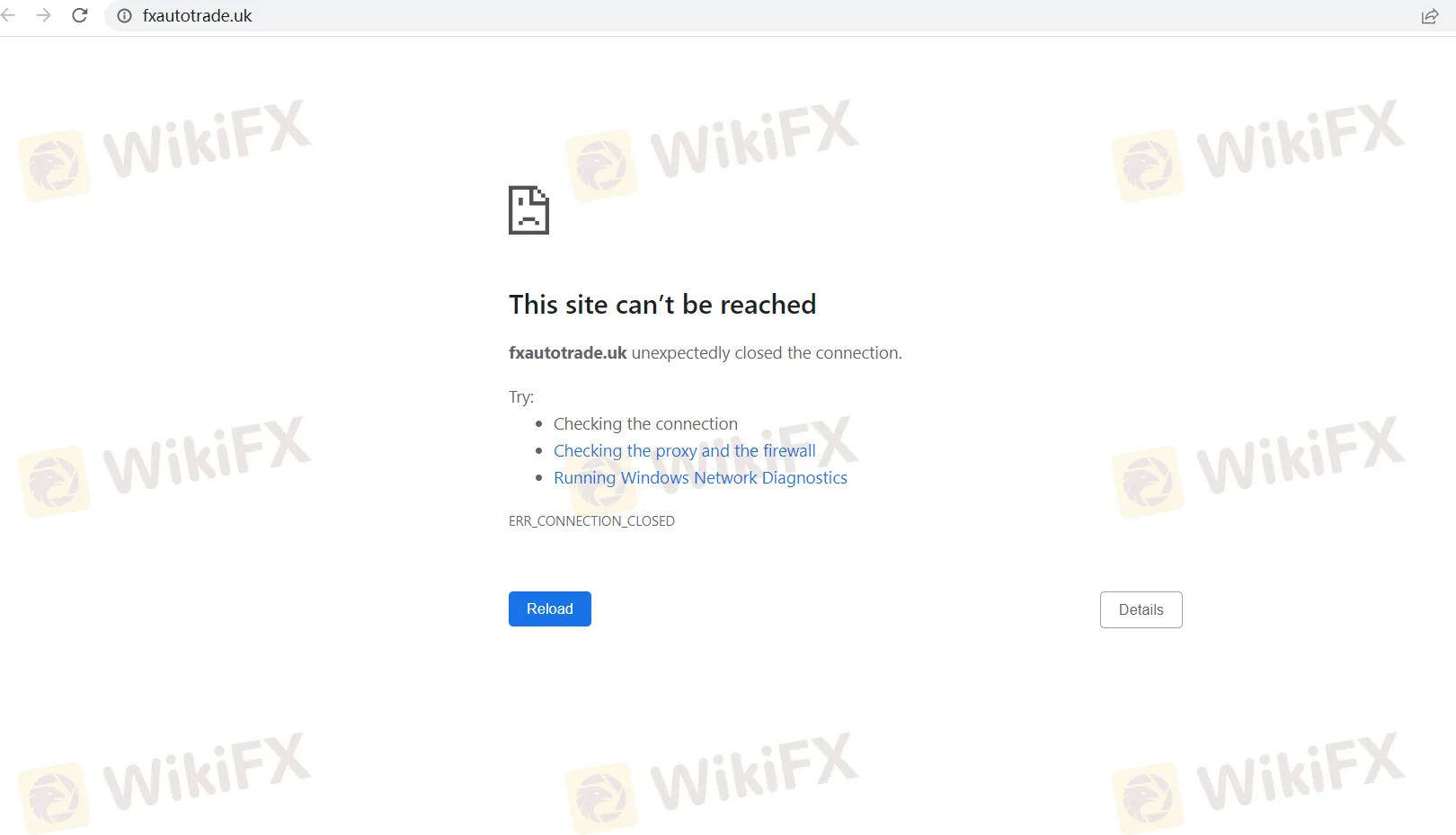

FxAutoTrade is a forex trading website that wants to simplify the trading process. The platform offers automated trading, market analysis, customizable strategies, a social trading community, and a user-friendly interface. But the official website of FxAutoTrade is currently inaccessible.

No regulation. FxAutoTrade operates as an independent forex trading platform without being subject to specific regulatory oversight. As an unregulated entity, the platform provides traders with the freedom to engage in forex trading without compliance with regulatory requirements. However, it is important to note that operating without regulation means that FxAutoTrade does not have the same level of oversight and consumer protection measures that regulated entities offer. Traders should exercise caution and conduct their own due diligence when using the platform.

Stocks: Stocks, also known as shares or equities, represent ownership in a company. Investors can buy and sell shares of publicly traded companies, allowing them to participate in the company's growth and receive dividends.

2. Bonds: Bonds are debt instruments issued by governments, municipalities, or corporations to raise capital. When investors purchase bonds, they are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

3. Commodities: Commodities are physical goods that are typically traded on exchanges. Examples include gold, silver, crude oil, agricultural products, and natural gas. Investors can trade commodities directly or invest in commodity futures contracts.

4. Foreign Exchange (Forex): Forex involves the trading of different currencies in the global foreign exchange market. Currency pairs, such as USD/EUR or GBP/JPY, are bought or sold based on the exchange rate fluctuations with the goal of profiting from the price movements.

5. Derivatives: Derivatives are financial contracts whose value is derived from an underlying asset or reference rate. This includes options, futures, forwards, and swaps. Derivatives allow investors to speculate on the future price movements of the underlying asset without directly owning it.

6. Exchange-Traded Funds (ETFs): ETFs are investment funds that are traded on stock exchanges, similar to individual stocks. They provide investors with exposure to a diversified portfolio of assets, such as stocks, bonds, or commodities, while offering liquidity and flexibility.

6. Options: Options give investors the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price within a specific time frame. Options are commonly used for hedging or speculative purposes.

Basic Account:

The Basic Account is geared towards beginners and individuals new to forex trading. It offers essential features to facilitate entry into the market. Traders with a Basic Account can access a user-friendly trading platform, basic market analysis tools, and a limited range of tradable instruments. This account type provides an opportunity for individuals to explore forex trading with a modest investment and develop a foundational understanding of the market.

Standard Account:

The Standard Account caters to intermediate-level traders who have some experience in forex trading. It offers a broader range of features compared to the Basic Account. Traders with a Standard Account can access a wider selection of tradable instruments, advanced market analysis tools, and additional trading resources. This account type is suitable for traders seeking more trading opportunities and advanced tools to refine their trading strategies.

Premium Account:

The Premium Account is designed for experienced traders and professionals who require enhanced trading capabilities. It provides access to advanced features and benefits beyond those available in the Standard Account. Traders with a Premium Account enjoy a comprehensive suite of market analysis tools, advanced charting options, priority customer support, and exclusive educational resources. This account type caters to traders seeking a higher level of service and functionality.

VIP Account:

The VIP Account is the highest-tier account intended for high-net-worth individuals and institutional traders. It offers a comprehensive set of features and benefits provided by the platform. Traders with a VIP Account receive personalized support from a dedicated account manager, access to premium research and analysis tools, exclusive trading strategies, and invitations to exclusive events and promotions. This account type is suitable for sophisticated traders who require specialized services and seek optimal trading conditions.

The maximum leverage offered by our company is 1:500. Here are the pros and cons associated with this high leverage level:

Pros:

Increased Trading Power: With a maximum leverage of 1:500, traders can control positions up to 500 times the value of their account balance. This provides enhanced trading power, allowing traders to potentially generate larger profits with a smaller initial investment.

Potential for Higher Returns: Higher leverage enables traders to amplify their potential returns. Even small market movements can result in significant gains when using high leverage, maximizing profit opportunities in favorable market conditions.

Diversification of Trading Strategies: With the ability to control larger positions, traders can diversify their trading strategies across multiple currency pairs or other financial instruments. This flexibility allows for more diversified exposure and potential for capturing various market opportunities.

Increased Market Access: High leverage allows traders to access and trade in larger and more liquid markets, providing opportunities for trading a wide range of currency pairs and other instruments.

Cons:

Higher Risk of Losses: While high leverage offers the potential for larger profits, it also increases the risk of substantial losses. Price fluctuations in the market can lead to significant drawdowns and potential account depletion, especially if risk management measures are not implemented effectively.

Margin Requirements: High leverage requires traders to maintain sufficient margin in their accounts to support their positions. Failure to meet margin requirements can lead to margin calls or automatic position closures, potentially resulting in losses.

Increased Emotional Stress: Trading with high leverage can be emotionally challenging, as the potential for large gains and losses can intensify the psychological pressure on traders. It is important for traders to maintain discipline, manage emotions, and adhere to a well-defined trading plan.

Limited Margin for Error: High leverage leaves less room for error in trading decisions. Even small market fluctuations against a trader's position can quickly erode their account balance. It requires traders to be vigilant, well-informed, and proficient in risk management strategies.

It is crucial for traders to fully understand the risks associated with high leverage and exercise caution when utilizing it. Careful risk assessment, appropriate position sizing, and implementing effective risk management techniques are essential to navigate the potential drawbacks and maximize the benefits of high leverage trading.

Basic Account:

The Basic Account features competitive spreads and transparent pricing. Traders with a Basic Account can benefit from variable spreads, starting from as low as 1.5 pips for major currency pairs. There are no additional commissions charged on trades, allowing traders to focus on executing their strategies without incurring extra costs.

Standard Account:

The Standard Account offers traders tighter spreads and a straightforward fee structure. Traders with a Standard Account can enjoy variable spreads, starting from as low as 1.0 pip for major currency pairs. A nominal commission is applied per trade, ensuring transparent pricing and minimizing trading costs. The commission is typically based on a percentage of the trade size.

Premium Account:

The Premium Account provides traders with even tighter spreads and competitive commissions. Traders with a Premium Account can access institutional-grade pricing, benefiting from spreads as low as 0.5 pips for major currency pairs. The commission charged on trades is significantly reduced compared to the Standard Account, enabling traders to optimize their trading costs.

VIP Account:

The VIP Account offers traders the most favorable trading conditions and premium pricing. Traders with a VIP Account can access the tightest spreads available, starting from as low as 0.2 pips for major currency pairs. Commissions on trades are further reduced, providing traders with highly competitive pricing. This account type is designed for high-volume traders who demand the best possible trading terms.

It's important to note that spreads and commissions may vary based on market conditions, volatility, and the specific currency pairs or financial instruments traded. Traders should refer to the platform's pricing information or contact customer support for detailed and up-to-date information regarding spreads and commissions applicable to their chosen account type.

Deposit Methods:

Bank Transfer: Traders have the option to deposit funds directly into their trading accounts through bank transfers. This method ensures secure transactions and is suitable for larger deposit amounts.

Credit/Debit Cards: The platform accepts major credit and debit cards, including Visa, Mastercard, and American Express, for instant deposits. This provides traders with a convenient and widely accepted option for funding their accounts.

3. E-Wallets: Traders can utilize popular e-wallet services such as PayPal, Neteller, or Skrill to deposit funds into their trading accounts. E-wallets offer fast and secure transactions, making them a preferred choice among traders.

Cryptocurrency: The platform supports deposits made with select cryptocurrencies such as Bitcoin or Ethereum. This option enables secure and decentralized transactions, catering to traders who prefer using digital currencies.

Withdrawal Methods:

Bank Transfer: Traders can request withdrawals through bank transfers, ensuring the secure and reliable transfer of funds from their trading accounts to their designated bank accounts.

Credit/Debit Cards: If traders initially deposited funds using a credit or debit card, they can usually request withdrawals back to the same card. This provides a convenient and seamless process for accessing their funds.

E-Wallets: Withdrawals can be processed to the same e-wallet accounts used for the deposits. This method ensures quick and efficient withdrawal processing, allowing traders to access their funds promptly.

Cryptocurrency: For traders who initially deposited funds using cryptocurrencies, withdrawals can be made in the same digital currency. This enables a direct transfer of funds to the traders' crypto wallets.

Please note that specific deposit and withdrawal methods may vary depending on the region, regulatory requirements, and platform policies. Traders are advised to refer to the platform's website or contact customer support for detailed information on available deposit and withdrawal methods, as well as any associated fees or processing times.

The MetaTrader 5 (MT5) trading platform is a powerful and widely used platform for forex and CFD trading. It offers a range of advanced features and tools that cater to the needs of traders at all levels of experience. Here is a detailed description of the key features of the MT5 trading platform:

User-Friendly Interface: The MT5 platform features a user-friendly and intuitive interface, making it easy for traders to navigate and access various functionalities. The platform offers a customizable layout, allowing traders to arrange and personalize charts, indicators, and other trading tools according to their preferences.

Multiple Asset Classes: MT5 supports trading in various asset classes, including forex currency pairs, stocks, indices, commodities, and cryptocurrencies. Traders can access a diverse range of markets and instruments from a single platform, enabling them to diversify their trading portfolio.

Advanced Charting and Analysis: MT5 provides a comprehensive set of charting tools and technical indicators for in-depth market analysis. Traders can choose from a wide range of chart types, timeframes, and drawing tools to analyze price movements, identify patterns, and develop trading strategies. The platform also supports the use of custom indicators and automated trading systems.

Order Execution Options: MT5 offers flexible order execution options to suit different trading styles. Traders can execute trades using various order types, including market orders, limit orders, stop orders, and trailing stops. The platform supports one-click trading, allowing for quick and efficient order placement.

Algorithmic Trading: MT5 is well-known for its advanced algorithmic trading capabilities. Traders can develop and deploy automated trading strategies using the built-in MetaEditor tool and MQL5 programming language. The platform supports the use of Expert Advisors (EAs), which are automated trading systems that can analyze the market, place trades, and manage positions automatically.

Economic Calendar and News: MT5 features an integrated economic calendar that provides traders with real-time updates on economic events and announcements that can impact the markets. Traders can also access live news feeds and market analysis directly within the platform, helping them stay informed about market developments and make informed trading decisions.

Risk Management Tools: The platform includes various risk management tools to help traders manage their positions effectively. Traders can set stop-loss and take-profit levels, apply trailing stops, and monitor their account equity and margin requirements in real-time.

Mobile Trading: MT5 is available as a mobile application for iOS and Android devices, allowing traders to trade and monitor their positions on the go. The mobile app provides full access to trading accounts, real-time quotes, interactive charts, and account management features.

Backtesting and Strategy Optimization: Traders can backtest and optimize their trading strategies using historical market data within the MT5 platform. This feature allows traders to evaluate the performance of their strategies and make necessary adjustments before deploying them in live trading.

Community and Marketplace: MT5 has a vibrant trading community where traders can share ideas, indicators, and strategies. Traders can also access the MetaTrader Market, a built-in marketplace within the platform, where they can purchase or rent trading tools, indicators, and Expert Advisors developed by other traders.

The customer support team at FxAutoTrade may have certain limitations that need to be considered. Traders can connect with the support team through the following channels:

Phone Support: While there is a phone support option available, reaching the customer support team at +44 07588 854651 may not always guarantee immediate assistance. Response times and the quality of support provided can vary, which may lead to frustration for traders seeking prompt resolutions.

Email Support: Traders can contact customer support via email at support@fxautotrade.uk. However, it's important to note that response times may be delayed, and the team's ability to address inquiries effectively might be limited. This could result in extended waiting periods and potential frustration for traders seeking timely assistance.

Additionally, it is essential to mention that the customer support team's knowledge and expertise may not always meet the specific needs or expectations of traders. They may lack in-depth understanding of complex trading issues, leading to inadequate or incomplete solutions.

It is important to be aware that the customer support provided by FxAutoTrade may have certain drawbacks. Traders may experience delays in response times, limited effectiveness in addressing inquiries, and potential gaps in knowledge and expertise. These factors can contribute to a less than satisfactory experience for traders seeking prompt and comprehensive support.

FxAutoTrade is a forex trading website that operates without regulatory oversight, which raises concerns about the level of consumer protection and accountability. Traders should approach the platform with caution, as the lack of regulation means that there is no guarantee of fair practices or transparency. Additionally, the customer support provided by the company is unreliable, with long response times and limited effectiveness in addressing inquiries. Traders may face frustration and difficulties in obtaining timely assistance or finding satisfactory solutions to their issues. It is important for traders to carefully evaluate the risks associated with trading on an unregulated platform and to consider alternative options that offer greater protection and reliable support.

Q: Is FxAutoTrade regulated?

A: No, FxAutoTrade operates without regulatory oversight.

Q: What risks are associated with unregulated platforms?

A: Unregulated platforms may lack investor protection and transparency, and fraudulent practices can occur.

Q: How reliable is FxAutoTrade's customer support?

A: FxAutoTrade's customer support has limitations, including delays and ineffective assistance.

Q: Are there regulated alternatives to FxAutoTrade?

A: Yes, there are regulated platforms that offer enhanced consumer protection and reliable support.

Q: What factors should I consider when choosing a trading platform?

A: Consider regulatory compliance, reputation, customer reviews, available instruments, fees, and quality of customer support.

More

User comment

2

CommentsWrite a review

2023-10-10 16:47

2023-10-10 16:47 2023-03-14 13:59

2023-03-14 13:59